Currently only an existing investor with Quantum Mutual Fund can invest in SWP through our online SWP option.

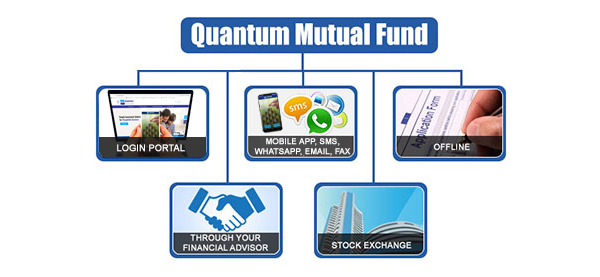

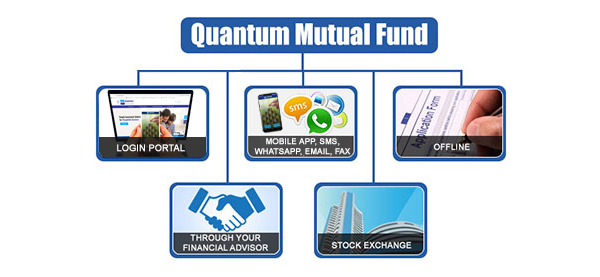

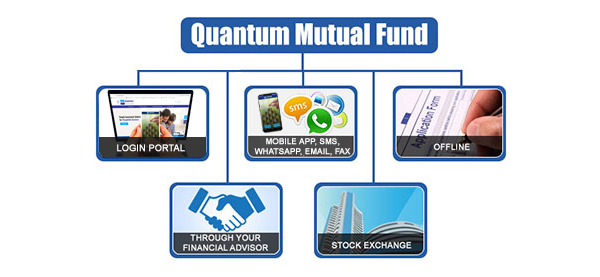

- Visit www.QuantumAMC.com.

- Click on Invest Online section and log in using your User id/PAN and Password/OTP.

- Under ‘Transact’ click on "SWP"

- Click on ‘New SWP Registration’

- Click on ‘Register SWP’ for the respective source scheme

- Fill up the Online SWP registration form

- Click on ‘Submit’ and confirm the SWP registration request by clicking on ‘Confirm’ option

0.005% of the net investment value i.e., gross investment amount less any other deduction like transaction charge.

Stamp duty applicability will be on Purchases (including triggers from past SIP registrations), Switch-in (including triggers from past STP registrations) and Dividend reinvestment transactions. The same is applicable for both physical and demat. Transfer of Units from one demat account to another including market / off-market transfers attract stamp duty.

Pursuant to Notification No. S.O. 1226(E) and G.S.R. 226(E) dated March 30, 2020 issued by Department of Revenue, Ministry of Finance, Government of India, read with Part I of Chapter IV of Notification dated February 21, 2019 issued by Legislative Department, Ministry of Law and Justice, Government of India on the Finance Act, 2019, stamp duty will be levied on mutual fund transaction, with effect from July 1, 2020, as per the rates provided in the table below :-

| S. No. | Description | Applicable new rate |

|---|---|---|

| 1 | Issue of security | 0.01% |

| 2 | Transfer of security | 0.02% |

NAV Applicability

If the valid application received up to 3.00 p.m. on a Business Day at the official point (s) of acceptance and funds for the entire amount of subscription/ purchase (including switch-in) as per the application are credited to the bank account of the respective Scheme and are available for utilization before the cut-off time (3.00 p.m.)- the closing NAV of the day shall be applicable. If the valid application received after 3.00 p.m. on a Business Day at the official point (s) of acceptance and funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the respective Scheme on same day or before the cut - off time of the subsequent Business Day i.e. funds are available for utilization before the cut-off time of subsequent Business Day- the closing NAV of the subsequent Business Day shall be applicable;

Irrespective of the time of receipt of application at the official point(s) of acceptance, where the funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the respective Schemes on or before the cut - off time of the subsequent Business Day i.e. funds are available for utilization before the cut-off time of subsequent Business Day - the closing NAV of such subsequent Business Day shall be applicable;

For Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), Dividend Transfer Facility:

The units will be allotted based on which the funds are available for utilization by the respective schemes / target schemes irrespective of the installment date of the SIP, STP or record date of dividend declarations. It may also be noted that allotment of units in the normal course will be based on realization of amount of subscription or the date of receipt of application or the date of instalment (in case of SIP) whichever is later if both realization and application dates are different.

Further, if the time of realization of funds can’t be ascertained then the allotment of units will be as per the day and date of realization of amount of subscription.

- Change or Updating of Mobile No / Residence No / Office No / Fax No

- Updating of IFSC / MICR No / Bank Address

- Change / Updating for Date of Birth

- Change of E-mail ID

- SOA Request

- FATCA updation

- Aadhar Number Updation

Investors with short indicative investment horizon of less than 30 days will get impacted more because the stamp duty is being charged as a onetime charge. Please refer below table for illustration purpose. Impact gets reduced as the holding period increases.

| Stamp Duty | No. of Days | Impact in % terms (Absolute/day) | Impact in % terms (Annualised) |

|---|---|---|---|

| 0.005% | 1 | 0.0050% | 1.825000% |

| 2 | 0.0025% | 0.912500% | |

| 3 | 0.0017% | 0.608333% | |

| 4 | 0.0013% | 0.456250% | |

| 5 | 0.0010% | 0.365000% | |

| 6 | 0.0008% | 0.304167% | |

| 7 | 0.0007% | 0.260714% | |

| 30 | 0.0002% | 0.060833% | |

| 60 | 0.0001% | 0.030417% | |

| 90 | 0.0001% | 0.020278% | |

| 180 | 0.0000% | 0.010139% | |

| 270 | 0.0000% | 0.006758% | |

| 365 | 0.0000% | 0.005000% |

Quantum Mutual Fund does not deduct Transaction Charges and shall continue not to deduct Transaction Charges as allowed under SEBI Circular No. Cir / IMD / DF/13/2011 dated August 22, 2011.

The processing of transactions will be done as per applicable NAV in accordance with SEBI Mutual Fund Regulations i.e to consider cut off timing and availability of funds for utilization for determining the applicable NAV the provisions of the respective Scheme Information Documents of the Scheme will be considered.

In case of transaction submission through OTP option:

The transaction is deemed to be completed and processed subject to backend based additional validations.

Incase of transaction submission without OTP :

For the purpose of determining the applicable NAV in accordance with SEBI Mutual Fund Regulations, the system recorded date and time at the end of the verification / confirmation call will be considered. The transaction shall then be processed afterwards subject to further validity of request.

Note : There may be delay in delivery / difference in the date and time of the website request received at the server of the AMC and the date and time of the server through which you have sent the message and also the AMC server may not receive / reject the message sent by the you.

For units issued in demat or non-demat form – purchase, dividend reinvestment, switch – stamp duty will be deducted from the net investment amount i.e., gross investment amount less any other deduction like transaction charge. Units will be created only for the balance amount (Net investment amount – stamp duty deducted). Stamp duty will be computed @0.005% on an inclusive method using the formula - ((Investment amount – transaction charge/TDS if any) / 100.005) * 0.005.

Illustration:

Transaction Amount: Rs. 1,00,100

Transaction Charges:/TDS applicable if any: Rs.100

Stamp Duty charged : Rs. 5 ((Transaction Amount - Transaction Charges/TDS applicable if any) * 0.005%

NAV: Rs.10 per unit

Units allotted : 9,999.50

Units value : Rs. 99995.00

Yes, These new cadre of distributors are required to complete a simplified form of National Institute of Securities Market (NISM) certification. The NISM has launched the Continuing Professional Education (CPE) and Test programme for the new cadre of Distributors and

registration for the same commenced from January 14, 2013.

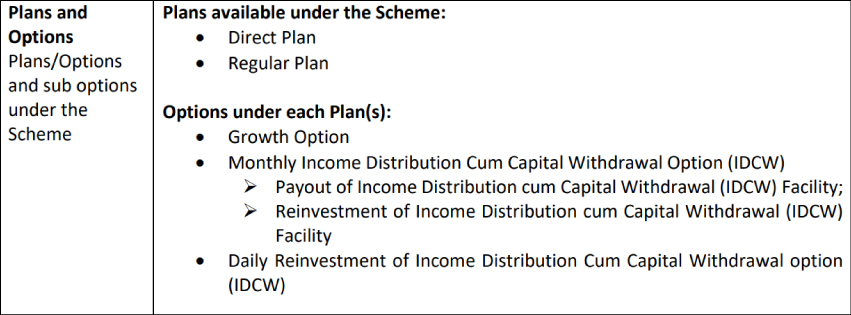

Direct Plan:

The expense ratio of the Direct Plan of the Quantum ESG Best In Class Strategy Fund is 0.85% p.a. with effect from August 1, 2023 (Post GST).

Regular Plan:

The expense ratio of the Regular Plan of the Quantum ESG Best In Class Strategy Fund is 2.10% p.a. with effect from August 1, 2023 (Post GST).

Investing through an SIP offers several key benefits:

- Discipline in Investing: SIP encourages regular, systematic investment, which fosters disciplined saving and investing habits over time.

- Rupee Cost Averaging: With SIP, you invest a fixed amount regardless of the market’s performance, buying more units when prices are low and fewer when prices are high. This helps average out the cost of investment over period of time.

- Compounding: Investing regularly through SIP allows your money to grow over period of time through compounding,helping your investment grow faster.

- Affordability: SIPs allow you to start with as low as Rs. 100/- (depending on scheme and frequency), making it accessible even for those with a limited budget.

- Flexibility: SIPs offer flexibility in terms of the amount, tenure and frequency of investment. You can increase, decrease, or pause your SIP depending on your financial situation.

- Long-Term Wealth Creation: SIP is ideal for long-term investing, as it helps investors ride out market volatility and generate wealth over period of time through the power of compounding.

- No Timing the Market: SIP removes the need to time the market, as you're investing consistently, which means you don't have to worry about whether it's a good or bad time to invest.

- Risk Diversification: Small amount of investment through SIPs in different asset type of mutual fund schemes, which helps spread risk across different assets, potentially reducing the impact of market fluctuations.

- Achieving Financial Goals Through SIP: SIP helps fulfil your dreams by allowing you to make small, fixed tenure investments over period of time to build a corpus for financial goals like buying a house, children's education, or marriage. Since these objectives require large sums, SIP enables wealth creation through consistent contributions, making it easier to reach these aspirations.

Overall, SIP is an efficient way to build wealth gradually, especially for those who may not have large sums to invest initially or prefer a less hands-on approach to investing.

Here is an example to help you understand the working of SIP.

THE POWER OF RUPEE COST AVERAGING | |||||

|

| Lump-Sum Investor | Regular SIP Investor | ||

Month | Unit Price | Amount Invested in Rs. | Units Bought | Amount Invested in Rs. | Units Bought |

1 | 20 | 60,000 | 3000 | 10,000 | 500 |

2 | 18 | -- | -- | 10,000 | 556 |

3 | 13 | -- | -- | 10,000 | 769 |

4 | 22 | -- | -- | 10,000 | 455 |

5 | 21 | -- | -- | 10,000 | 476 |

6 | 20 | -- | -- | 10,000 | 500 |

Total Amount Invested | Rs. 60,000 | Rs. 60,000 | |||

Average price paid | Rs. 20 | Rs. 19 | |||

Current NAV | Rs. 20 | Rs. 20 | |||

Total units bought | 3000 | 3256 | |||

Value of investment after six months | Rs. 60,000 | Rs. 65,120 | |||

This table demonstrates that, although the invested amount is the same in both cases, the returns from the SIP investment mode are comparatively higher.

Choti SIP is a small-ticket Systematic Investment Plan (SIP) that allows individual investors to start investing with just Rs. 250 per month in select mutual fund schemes.

The AMC will first process the instant redemption request and later action on any other request.

The AMC reserves right to reject any redemption / switch out / systematic withdrawal or transfer request received through any other mode for any Calendar Day if an Instant Redemption request has been received subsequently and such instant redemption is pending for processing.

Following is the procedure for Instant redemption.

| 1. | Visit www.QuantumAMC.com and click on 'Login' |

| 2. | Login with your User id/PAN and Password/OTP |

| 3. | Click on ‘Insta Redemption’ under the Transact tab |

| 4. | Select the transaction type as 'Instant Redemption' and enter your transaction PIN |

| 5. | Select the scheme & Enter the amount (which should not be more than the amount specified in the ‘Eligible Amount’ column) |

| 6. | Select the bank (in which redemption is required) |

| 7. | Click on Submit |

The Instant Redemption transaction will be processed by applying lower of Previous Day NAV or Prospective NAV.

- (a) When the application is received up to 3.00 pm – the lower of (i) NAV of previous Calendar Day and (ii) NAV of Calendar Day on which application is received; will be considered.

- (b) When the application is received after 3.00 pm – the lower of (i) NAV of the Calendar Day on which such application is received, and (ii) NAV of the next Calendar Day will be considered.

The minimum amount for the instant redemption per day per PAN, is Rs. 500/- and multiple of Rs.1/ - thereafter.

With effect from 01st March, 2019 the maximum redemption amount shall be Rs. 50,000 or 90% of latest value of investment (as per last available NAV on records) in the scheme, whichever is lower. This limit shall be applicable per calendar day, per scheme, per investor.

2. Only Resident Individuals and Resident Minor investors except Non Resident Individual can avail this facility.

3. Investor’s IFSC code and the core banking account number should be registered in the folio

4. Investor’s bank account should be IMPS (Immediate Payment Service) enabled

5. The instant redemption can be done only in terms of ‘amount’ only and not in ‘units’

An investor can register a maximum of three Choti SIPs, one in each of up to three Asset Management Companies (AMCs).

For Monthly SIP, you can choose a Top-Up frequency of either Half-Yearly or Yearly. And for Quarterly SIP, the Top-Up frequency is available only on a Yearly basis. If no frequency is selected, the default Top-Up frequency will be Yearly for both Monthly and Quarterly SIP.

Yes, you can set a Top-Up Cap either on the Amount or the Period.

- Top-Up Cap on Amount: Investor can place maximum cap on amount. Once the SIP amount reaches the selected Top-Up Cap amount, the SIP instalment amount will be freezed till end of the SIP tenure. This ensures that no further increases will occur once the cap is reached.

- Top-Up Cap on Period: Investor can place maximum cap on period (month and year). Once the SIP reaches the selected Top-Up Cap period, the SIP amount will remain constant from that point forward until the end of the SIP tenure, regardless of any additional Top-Ups.

If neither a Top-Up Cap Amount nor a Top-Up Cap Period is selected, a default Cap Amount of Rs. 10 Lakhs will be applied. This means that once the Top-Up reaches Rs. 10 Lakhs, the SIP amount will remain constant for the rest of the SIP tenure.

Once the SIP is enrolled with the Top-Up facility, the details cannot be modified. To make any changes, you will need to cancel the existing SIP and enrol for a new SIP with the updated Top-Up options.

SIP (Systematic Investment Plan) is a method of investing pre-determined fixed amount of money in regular intervals like weekly, fortnight and monthly etc into a Mutual Fund scheme. It allows investors to buy units at different NAV, which helps to average out the cost and reduce the impact of market volatility over time. SIP encourages disciplined investing and can be a good option for long-term wealth creation, especially for individuals who may not have a lump sum amount to invest upfront.

No. The SIP Top-up facility is not available under Choti SIP.

Investing through an SIP offers several key benefits:

- Discipline in Investing: SIP encourages regular, systematic investment, which fosters disciplined saving and investing habits over time.

- Rupee Cost Averaging: With SIP, you invest a fixed amount regardless of the market’s performance, buying more units when prices are low and fewer when prices are high. This helps average out the cost of investment over period of time.

- Compounding: Investing regularly through SIP allows your money to grow over period of time through compounding,helping your investment grow faster.

- Affordability: SIPs allow you to start with as low as Rs. 100/- (depending on scheme and frequency), making it accessible even for those with a limited budget.

- Flexibility: SIPs offer flexibility in terms of the amount, tenure and frequency of investment. You can increase, decrease, or pause your SIP depending on your financial situation.

- Long-Term Wealth Creation: SIP is ideal for long-term investing, as it helps investors ride out market volatility and generate wealth over period of time through the power of compounding.

- No Timing the Market: SIP removes the need to time the market, as you're investing consistently, which means you don't have to worry about whether it's a good or bad time to invest.

- Risk Diversification: Small amount of investment through SIPs in different asset type of mutual fund schemes, which helps spread risk across different assets, potentially reducing the impact of market fluctuations.

- Achieving Financial Goals Through SIP: SIP helps fulfil your dreams by allowing you to make small, fixed tenure investments over period of time to build a corpus for financial goals like buying a house, children's education, or marriage. Since these objectives require large sums, SIP enables wealth creation through consistent contributions, making it easier to reach these aspirations.

Overall, SIP is an efficient way to build wealth gradually, especially for those who may not have large sums to invest initially or prefer a less hands-on approach to investing.

Here is an example to help you understand the working of SIP.

THE POWER OF RUPEE COST AVERAGING | |||||

|

| Lump-Sum Investor | Regular SIP Investor | ||

Month | Unit Price | Amount Invested in Rs. | Units Bought | Amount Invested in Rs. | Units Bought |

1 | 20 | 60,000 | 3000 | 10,000 | 500 |

2 | 18 | -- | -- | 10,000 | 556 |

3 | 13 | -- | -- | 10,000 | 769 |

4 | 22 | -- | -- | 10,000 | 455 |

5 | 21 | -- | -- | 10,000 | 476 |

6 | 20 | -- | -- | 10,000 | 500 |

Total Amount Invested | Rs. 60,000 | Rs. 60,000 | |||

Average price paid | Rs. 20 | Rs. 19 | |||

Current NAV | Rs. 20 | Rs. 20 | |||

Total units bought | 3000 | 3256 | |||

Value of investment after six months | Rs. 60,000 | Rs. 65,120 | |||

This table demonstrates that, although the invested amount is the same in both cases, the returns from the SIP investment mode are comparatively higher.

You can start Online and Offline SWP, through Direct and Regular Plans for the following schemes:

| • | Quantum Long Term Equity Value Fund |

| • | Quantum Liquid Fund |

| • | Quantum ELSS Tax Saver Fund |

| • | Quantum Equity Fund of Funds |

| • | Quantum Gold Savings Fund |

| • | Quantum Multi Asset Fund of Funds |

| • | Quantum Dynamic Bond Fund |

| • | Quantum ESG Best in Class Stratergy Fund |

| • | Quantum Nifty 50 ETF Fund of Fund |

| • | Quantum Smallcap Fund |

| • | Quantum Multi Asset Allocation Fund |

| • | Quantum Ethical Fund |

Under the Instant Redemption (Access) Facility (“Instant Redemption”), the Fund shall endeavor to send the redemption proceeds to the selected registered bank account of the investor, instantly from the receipt of Instant Redemption Request using Immediate Payment Services (IMPS) provided by various banks in accordance with SEBI Circular No. SEBI / HO/ IMD/ DF2/ CIR/P/2017/ 39 dated May 8, 2017. Instant redemption is a type of redemption wherein the investor can get the redemption proceeds instantly i.e. he will get his redemption amount into his account within 30 minutes from the time of the redemption.

Please Click Here for the list of IMPS enabled banks for instant redemption facility.

Systematic withdrawal plans are used by investors to create a regular flow of income from their investments. Investors looking for income at periodic intervals for e.g. funding a travel plan during the children’s summer vacations, also set up their withdrawals in such a way that the cash is available when most required.

For an STP you can invest a lump sum amount in one scheme and regularly withdraw a pre-defined amount into another scheme.

Let us assume you have 5,000 units in a Mutual Fund scheme. You have given instructions to the fund house that you want to withdraw Rs. 8,000 every month through SWP.

Now let''s assume that on 1 December, the Net Asset Value (NAV) of the scheme is Rs. 20.

Equivalent number of MF units = Rs. 8,000 / Rs. 20 = 400 units

400 units would be redeemed from your MF holdings, and Rs. 8,000 would be given to you.

Your remaining units = 5,000 - 400 = 4600 units

Now let''''s assume that on 1 January, the NAV is Rs. 16.

Equivalent number of units = Rs. 8,000 / Rs. 16 = 500 units

500 units would be redeemed from your MF holdings, and Rs. 8,000 would be given to you.

Your remaining units = 4600 - 500 = 4100 units

This way, units from your mutual fund holdings are redeemed in a systematic way to provide you with continuous income. You can start offline SIP, through Direct & Regular Plans for the following schemes:

| • | Quantum Long Term Equity Value Fund |

| • | Quantum Liquid Fund |

| • | Quantum ELSS Tax Saver Fund |

| • | Quantum Equity Fund of Funds |

| • | Quantum Gold Savings Fund |

| • | Quantum Multi Asset Fund of Funds |

| • | Quantum Dynamic Bond Fund |

| • | Quantum ESG Best in Class Stratergy Fund |

| • | Quantum Nifty 50 ETF Fund of Fund |

| • | Quantum Smallcap Fund |

| • | Quantum Multi Asset Allocation Fund |

| • | Quantum Ethical Fund |

You will receive a confirmation email/SMS with the details of your Online SWP after successfully completing the registration process on our website.

You can also check the status of your registration under the section '' Transact > SWP > Registered SWP ''.

| • | You can invest lump sum and get a fixed payout at fixed intervals which works like monthly income i.e. it allows the account holders to access their money at regular intervals. |

| • | SWP is tax efficient for an investor who likes to save on dividend distribution tax. |

| • | Convenience and Liquidity |

SWP is redemption from a scheme, so tax provisions apply accordingly.

No, there are no additional charges for availing the SIP facility. However, some banks may charge mandate registration fees for physical mandate registrations. We recommend checking with your bank for any such charges.

Yes, the ongoing SIP will be terminated after 3 consecutive reversals except quarterly frequency SIPs, for quarterly will be terminated after 2 consecutive reversals due to any reason.

For further queries please do not hesitate to get in touch with us on [email protected] or on 1800-22-3863 or 1800-209-3863.

Investors can opt in for the online Modify SIP facility where the existing SIP will be cancelled and a fresh SIP with top up will be registered.

In case your Email Id is registered in our records, you will receive a confirmation email at your registered email address. In case your Email Id is not registered with us, you will receive a physical statement of account at your registered mailing address on a quarterly basis.

In case your Email address is registered in our records, you will receive a confirmation email at your registered email address or physical statement of account will be sent to registered mailing address on monthly basis .

If you are holding Mutual Fund Units in the physical form, which are represented by a Statement of Account, you can convert these units into dematerialised form in your demat account with any Depository Participant (DP) of NSDL or CDSL. DPs have enabled holding of mutual fund units [represented by Statement of Account] in dematerialised form. You can use your existing demat accounts for converting your mutual fund units in dematerialised form.

Please note that once your mutual funds are in demat form, you can sell them either via a stock broker through the Exchange platform (BSE Star & NSE MFSS) or through the off-market mode i.e. by selling/redeeming it through your Depository Participant.

Note: The investors who hold their units with the CDSL can redeem the units directly with the AMC without converting their units in physical mode (except units of Quantum Liquid Fund, Quantum Dynamic Bond Fund and ETF Funds)

| • | You can invest lump sum and get a fixed payout at fixed intervals which works like monthly income i.e. it allows the account holders to access their money at regular intervals. |

| • | SWP is tax efficient for an investor who likes to save on dividend distribution tax. |

| • | Convenience and Liquidity |

SWP is redemption from a scheme, so tax provisions apply accordingly.

The Online SWP facility is available at NO CHARGE.

A Systematic Withdrawal Plan (SWP) is a facility that allows an investor to withdraw money from an existing mutual fund at predetermined intervals. The money withdrawn through a systematic withdrawal plan can be reinvested in another fund or retained by the investor in cash.

Following is the procedure for Instant redemption.

| 1. | Visit www.QuantumAMC.com and click on 'Login' |

| 2. | Login with your User id/PAN and Password/OTP |

| 3. | Click on ‘Insta Redemption’ under the Transact tab |

| 4. | Select the transaction type as 'Instant Redemption' and enter your transaction PIN |

| 5. | Select the scheme & Enter the amount (which should not be more than the amount specified in the ‘Eligible Amount’ column) |

| 6. | Select the bank (in which redemption is required) |

| 7. | Click on Submit |

1. Helps Combat Inflation

With the average annual inflation rate in India hovering around 7.5%, your purchasing power is likely to decrease over time if your investments don’t keep pace with rising costs. By increasing your SIP contribution by a percentage equivalent to or greater than the inflation rate, you can ensure that your investments grow in line with inflation. This way, you preserve the real value of your investments and ensure that your financial goals remain achievable despite rising expenses.

2. Aligns with Your Income Growth

As your income grows, it makes sense to increase your savings accordingly. By setting up SIP top-ups that match your income growth, you can continue to invest without straining your finances. This strategy allows you to save more over time without altering the percentage of your income allocated to investments, helping you build wealth in tandem with your increasing earnings.

3. Achieve Financial Goals More Quickly

Increasing your SIP contributions through top-ups can accelerate the growth of your investment corpus. Since you're consistently increasing your investment amount, you may reach your financial targets sooner than initially expected. This strategy helps you accumulate the necessary funds faster, reducing the time it takes to achieve your long-term financial objectives and enhancing the potential for higher returns.

4. Operational Ease

One of the key advantages of SIP Top-Ups is the ease with which they can be implemented. Once you set up your SIP top-up option, the increments are automatically applied at the specified intervals, whether monthly or annually. This eliminates the need for manual adjustments and ensures that your investments continue to grow without any extra effort. It offers a seamless and hassle-free way to enhance your investment plan without worrying about remembering to increase your contributions. This level of automation provides both convenience and consistency, making it easier to stay on track with your long-term financial goals.

Currently, the SIP Top-Up facility is applicable only to new SIP enrolments.

Investments can be made only through NACH (National Automated Clearing House).

| Frequency of STP | Eligible dates for effect | Minimum amount per Instalment | Minimum term/duration applicable |

| Daily | All Business days | ₹100 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 30 Business days |

| Weekly | Any day of the week | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 10 instalments |

| Fortnightly | Any day of alternative Week | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 10 instalments |

| Monthly | Any date (except 29, 30, 31st) | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 12 instalments |

| Quarterly | Any date (except 29, 30, 31st) | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 12 instalments |

| Minimum Balance to start STP : ₹5000/- | |||

SWP instructions will take 5 business days for registration with the registrar. The first withdrawal will be carried out only after the registration.

Yes. Investors must provide a mobile number to the AMC to receive statutory disclosures and updates.

The instant redemption amount will be credited to investor’s account (incase all pre-requisites are fulfilled). Also we endeavor to credit the amount into investor’s account within 30 minutes from the transaction time. Incase of any failure of instant redemption payment (due to any bank issue etc), the amount will be credited to investor’s account as per existing SEBI guidelines.

The redemption proceeds will be credited into the bank account selected while placing the instant redemption.

Note: The selected bank account should be IMPS enabled.

No. Instant redemption facility is not available for the demat investors.

The minimum amount for the instant redemption per day per PAN, is Rs. 500/- and multiple of Rs.1/ - thereafter.

With effect from 01st March, 2019 the maximum redemption amount shall be Rs. 50,000 or 50% of latest value of investment (as per last available NAV on records) in the scheme, whichever is lower. This limit shall be applicable per calendar day, per scheme, per investor.

The Instant Redemption transaction will be processed by applying lower of Previous Day NAV or Prospective NAV.

- (a) When the application is received up to 3.00 pm – the lower of (i) NAV of previous Calendar Day and (ii) NAV of Calendar Day on which application is received; will be considered.

- (b) When the application is received after 3.00 pm – the lower of (i) NAV of the Calendar Day on which such application is received, and (ii) NAV of the next Calendar Day will be considered.

As your income grows year after year – whether through a new job or your business reaching new milestones – it's important to remember that expenses are also on the rise. They don’t stay stagnant; they tend to increase as well. This is where SIP Top-Ups come into play. They allow you to gradually increase your SIP investments, giving your portfolio a much-needed boost. Think of it as a workout for your investments: the more you contribute, the stronger they become. The key factor here is compounding. By utilizing SIP Top-Ups, you harness the power of compounding over the long term, helping you work towards building substantial wealth.

If the investor is ineligible, the SIP will still be processed but will be treated as a regular SIP, not a Choti SIP.

Yes, to start Online SWP you must have a minimum balance of Rs.5,000/- in the scheme you wish to invest from.

SWP instructions will take a minimum of 5 business days for registration with the registrar. The first transfer will be carried out only after the registration. Therefore, the date and months in which your SWP commences and ends may change depending on the date of its registration.

Note: Minimum balance to start SWP: Rs.5000/-

| Scheme Name | SWP Options | Weekly | Fortnightly | Monthly | Quarterly |

| Quantum Long Term Equity Value Fund / Quantum ESG Best In Class Strategy Fund / Quantum Equity Fund of Funds / Quantum Gold Savings Fund / Quantum Multi Asset Fund of Funds / Quantum Dynamic Bond Fund / Quantum Nifty 50 ETF Fund of Fund / Quantum ELSS Tax Saver Fund / Quantum Small Cap Fund / Quantum Liquid Fund / Quantum Multi Asset Allocation Fund / Quantum Ethical Fund | Eligible Dates | Any day of the Week | Any day of Alternative Week | Any Date | |

| Minimum SWP amount | ₹500/- and in multiples of ₹1/- thereafter | ||||

| Minimum SWP Installments | 10 | ||||

For New Investors:

Fill all the required information and attach the below mentioned documents as supporting.

| 1 | Main application form along with the SYSTEMATIC TRANSACTION FORM |

| 2 | Current dated at par cheque in favor of ‘Quantum ______________ scheme – your PAN number’ |

| 3 | A cancelled copy of cheque |

| 4 | A self-attested copy of PAN of the unit holder(s) |

| 5 | KYC acknowledgement copy of the unit holder(s) |

For Existing Investors

Fill all the required information and attach the below mentioned documents as supporting.

Duly filled and signed Systematic Transaction Form

Submission of the Form

You can submit your physical applications along with all required supporting documents at the addresses mentioned below:

| 1 | Quantum Asset Management Company Private Limited: 1st floor, Apeejay House, 3 Dinshaw Vachha Road, Backbay Reclamation, Churchgate, Mumbai - 400 020, |

| 2 | K Fintech Technologies Limited - K Fintech Technologies Limited is our Registrar and Transfer Agent having many offices across India. Click Here for all the locations available over India. |

STP is an effective tool when you need to rebalance your portfolio, saving you from the operational complexities of manually transferring funds into equity schemes.

When market conditions suggest potential growth in equities, STP allows you to strategically shift your portfolio towards equity for better returns.

o Invest in Debt Funds & Transfer to Equity: You can invest in debt funds and then initiate an STP to an equity fund, making it similar to a Systematic Investment Plan (SIP).

o Works Like an SWP: STP can also function like a Systematic Withdrawal Plan (SWP). By transferring from equity funds to debt funds, you can protect your portfolio when markets are volatile, similar to how an SWP works.

o Liquidity: Typically, STP is used to transfer from debt funds to equity funds. Since your money is initially invested in debt funds, you have the flexibility to liquidate it at any time, making it an effective emergency fund option.

o Growth Potential: While your funds are invested in debt schemes, they continue to grow at the prevailing debt returns, contributing to your overall wealth accumulation.

The AMC will first process the instant redemption request and later action on any other request.

The AMC reserves right to reject any redemption / switch out / systematic withdrawal or transfer request received through any other mode for any Calendar Day if an Instant Redemption request has been received subsequently and such instant redemption is pending for processing.

No. Currently you can apply for the instant redemption only via web transactions.

No. Currently there are no additional charges for instant redemption facility.

Note: The selected bank account should be IMPS enabled.

STP facility is available free of charge.

1. The instant redemption facility is available for the growth option of Quantum Liquid Fund only

2. Only Resident Individuals and Resident Minor investors except Non Resident Individual can avail this facility.

3. Investor’s IFSC code and the core banking account number should be registered in the folio

4. Investor’s bank account should be IMPS (Immediate Payment Service) enabled

5. The instant redemption can be done only in terms of ‘amount’ only and not in ‘units’

Yes, you can!

For SIP registered through physical mode:

To cancel your existing SIP with Quantum Mutual Fund, submit the SIP cancellation form or a written request with your folio number, scheme name, SIP date, and amount to our registered office or nearest POS . Your SIP will be cancelled within T+2 working days. If an installment is due within 10 days, it will be processed and debited from your account.

To modify your SIP amount or frequency, submit a cancellation request, followed by a fresh SIP registration request.

To pause your SIP, email us from your registered ID at [email protected]. The pause will be processed within 10 calendar days, after a verification call to your registered contact number.

For SIP registered through Online mode:

If you wish to modify/pause/cancel the existing ISIP registered with us, you can do so by following the below mentioned procedures:

| ISIP Modification | ISIP Cancellation | ISIP Pause |

1 | Visit https://secure.quantumamc.com/ | Visit https://secure.quantumamc.com/ | Visit https://secure.quantumamc.com/ |

2 | Enter Primary holder’s PAN / User ID, select Folio from menu | Enter Primary holder’s PAN / User ID, select Folio from menu | Enter Primary holder’s PAN / User ID, select Folio from menu |

3 | Login Using Password & OTP, confirm the declaration and click on ‘Submit’ | Login Using Password & OTP, confirm the declaration and click on ‘Submit’ | Login Using Password & OTP, confirm the declaration and click on ‘Submit’ |

4 | Visit Transact->SIP->Registered SIP | Visit Transact->SIP->Registered SIP | Visit Transact->SIP->Registered SIP |

6 | Click on ‘Modify’ for the respective SIP | Click on ‘Cancel’ for the respective SIP | Click on ‘Pause’ for the respective SIP |

7 | Modify the SIP frequency, SIP Start Date, SIP End Date & Amount of SIP | Click on 'Confirm' | Select the Pause Period |

8 | Click on 'Submit' and confirm the modification |

| Click on 'Submit' and confirm the pause details |

| Note: | Note: | Note: |

a | Only online registered SIPs can be modified through this module. Changes can be made to the SIP amount, start and end dates, and frequency. | SIP will be cancelled within Transaction (T) + 2 working days. If an SIP installment is due within 10 days of cancellation, it will be processed, and your bank account will be debited. Units will be allotted subject to fund realization and utilization. | SIP will be paused within 10 days. If an SIP installment is due within 10 days of the pause, it will be processed, and your bank account will be debited. Units will be allotted subject to fund realization and utilization. |

b | Modification requests must be submitted 21 days before the next scheduled SIP date. If a modification involves changing the SIP amount and the next installment is due within 21 days, the installment will be processed at the original amount before the change. |

|

|

Frequency of SIP | Eligible dates for effect | Minimum Amount per Instalment | Minimum term /duration applicable |

Daily | All Business Days | ₹100 and in multiple of ₹1 thereafter (for ELSS minimum ₹500 and multiple of ₹500) | 30 Business days |

Weekly | Any day of the week | ₹500 and in multiple of ₹1 thereafter (for ELSS multiple of ₹500) | 10 instalments |

Fortnightly | Any day of alternative week | ₹500 and in multiple of ₹1 thereafter (for ELSS multiple of ₹500) | 10 instalments |

Monthly | Any date (except 29, 30, 31st) | ₹500 and in multiple of ₹1 thereafter (for ELSS multiple of ₹500) | 12 instalments |

Quarterly | Any date (except 29, 30, 31st) | ₹500 and in multiple of ₹1 thereafter (for ELSS multiple of ₹500) | 12 instalments |

Yes, you can modify / pause / cancel your STP.

Physical:

To cancel your STP request, please submit a written request signed by unit holder(s) as per the mode of holding. The request should include your folio number, the STP amount, the STP date, and the name of the scheme from which you wish to cancel the STP.

You can modify or pause the offline STP via online mode. Please Click Here to modify or pause your STP.

Digital: you wish to modify / pause / cancel your existing STP registered with us via our website or mobile application, you can do so by following the steps outlined below:

Modification of the STP | Pause of the STP | Cancellation of the STP |

2. Click on ‘Login’ section and log in using your User Id/PAN with Password and OTP. | 2. Click on ‘Login’ section and log in using your User Id/PAN with Password and OTP. | 2. Click on ‘Login’ section and log in using your User Id/PAN with Password and OTP. |

3. Under ‘Transact’ click on 'STP' | 3. Under ‘Transact’ click on 'STP' | 3. Under ‘Transact’ click on 'STP' |

4. Click on ‘Modify’ for the respective STP | 4. Click on ‘Pause’ for the respective STP | 4. Click on ‘Cancel’ for the respective STP |

5. Modify the required details | 5. Select Pause period | 5. Click on ‘Confirm’ |

6. Click on ‘Submit’ option | 6. Click on ‘Submit’ option | 6. Click on send OTP, once OTP received on registered Email-id/Mobile Number, kindly enter the same |

7. Click on send OTP, once OTP received on registered Email-id/Mobile Number, kindly enter the same | 7. Click on send OTP, once OTP received on registered Email-id/Mobile Number, kindly enter the same | 7. Confirm the STP Cancellation details by clicking on ‘Confirm’ |

8. Confirm the STP Modification details by clicking on ‘Confirm’ | 8. Confirm the STP Pause details by clicking on ‘Confirm’ |

|

Note:

- In case the modification request received involves change in the STP amount and if any STP installment is due within 5 business days from the date of modification request received, the said installment will be processed as per the amount of the STP registered before modification.

- Your request for STP cancellation / modification / pause needs to be submitted 5 working days prior the STP date.

- The online modification of STP can only be done in the STP amount and the STP end period.

SIP will be registered for all banks offering NACH facility.Kindly refer the list of Live Banks offering NACH facility. The list of participating banks may be updated, modified, or removed at any time at the sole discretion of the National Payments Corporation of India (NPCI), without prior notice or reason. Standing instructions for investors with these banks may be discontinued, and we will notify you of such discontinuation.

ISIP registration (only online) below banks providing ISIP registration facility.

List of the banks | |||

1 | Axis Bank Limited | 21 | Karnataka Bank Ltd |

2 | Bandhan Bank | 22 | Karur Vysya Bank Limited |

3 | Bank Of Baroda | 23 | Kotak Mahindra Bank |

4 | Bank Of Maharashtra | 24 | Maharashtra Gramin Bank |

5 | Catholic Syrian Bank | 25 | NKGSB Bank |

6 | CITI BANK | 26 | Punjab National Bank |

7 | City Union Bank | 27 | RBL Bank |

8 | Cosmos Bank | 28 | Samurao Vittal Co-oprative Bank |

9 | DCB Bank | 29 | Saraswat Bank |

10 | Development Bank Of Singapore | 30 | South Indian Bank |

11 | Dhanlaxmi Bank | 31 | Standard Chartered Bank |

12 | Federal Bank | 32 | State Bank Of India |

13 | HDFC Bank | 33 | Survoday Small Finance Bank |

14 | HSBC Bank | 34 | Tamilnad Mercantile Bank Ltd |

15 | ICICI Bank Ltd | 35 | The Surat People's Co-Op Bank Ltd |

16 | IDBI Bank Ltd | 36 | UCO BanK Ltd |

17 | IDFC Bank Ltd | 37 | Ujjivan Small Finance Bank |

18 | India Post Payments Bank | 38 | Union Bank Of India |

19 | Indian Bank | 39 | Yes Bank |

20 | Indusind Bank Ltd |

|

|

Note: For ISIP registration multiple modes are available

Auto Pay - Auto pay option will enable automatic debit of the SIP amount from the bank account without any manual intervention from the Investor..

View & Pay - View & Pay is an option to manually authorize the payment (in investor’s bank login)

Fixed amount and maximum amount -Investor can select appropriate option.

You can start STP, through Direct & Regular Plans for the following schemes:

| • | Quantum Long Term Equity Value Fund |

| • | Quantum Liquid Fund |

| • | Quantum ELSS Tax Saver Fund |

| • | Quantum Equity Fund of Funds |

| • | Quantum Gold Savings Fund |

| • | Quantum Multi Asset Fund of Funds |

| • | Quantum Dynamic Bond Fund |

| • | Quantum ESG Best in Class Stratergy Fund |

| • | Quantum Nifty 50 ETF Fund of Fund |

| • | Quantum Smallcap Fund |

| • | Quantum Multi Asset Allocation Fund |

| • | Quantum Ethical Fund |

Systematic Transfer Plan (STP) allows you to invest a lump sum in one mutual fund scheme and systematically transfer a fixed amount at regular intervals into another scheme. Typically, investors park their money in a debt fund and gradually move it into an equity-oriented fund. This strategy works similarly to a Systematic Investment Plan (SIP), but instead of transferring money from your bank account, the funds are moved internally between schemes.

STPs help reduce the risk of timing the market when investing a large sum by spreading the investment over time. This also offers the benefit of rupee cost averaging. You can choose the transfer frequency—daily, weekly, fortnightly, monthly, or quarterly—based on your investment goals and preferences.

To set up an STP, you need to choose:

- The source fund (Transferor scheme) from which the money will be withdrawn.

- The destination fund (Transferee scheme) where the money will be invested.

Transfers are made in terms of units. Based on the Net Asset Value (NAV) of the source fund on the transfer date, units are redeemed, and the corresponding amount is used to buy units of the destination fund at its prevailing NAV.

For example, if you want to invest in Fund ‘B’ through an STP, you first invest a lump sum in Fund ‘A’ that supports STP. Then, you set up a schedule to gradually transfer a chosen amount into Fund ‘B’ over your selected time frame. This approach lets you tailor your investment to your risk tolerance.

STPs can be a useful way to manage market volatility and protect your investments from sudden downturns.

Systematic Withdrawal Plans are used by investors to create a regular flow of income from their investments. Investors looking for income at periodic intervals for e.g. funding a travel plan during the children’s summer vacations, also set up their withdrawals in such a way that the cash is available when most required.

For an SWP you can invest a lump sum amount in one scheme and regularly withdraw a pre-defined amount into another scheme.

Let us assume you have 5,000 units in a Mutual Fund scheme. You have given instructions to the fund house that you want to withdraw Rs. 8,000 every month through SWP.

Now let''''s assume that on 1 December, the Net Asset Value (NAV) of the scheme is Rs. 20.

Equivalent number of MF units = Rs. 8,000 / Rs. 20 = 400 units

400 units would be redeemed from your MF holdings, and Rs. 8,000 would be given to you.

Your remaining units = 5,000 - 400 = 4600 units

Now let''''s assume that on 1 January, the NAV is Rs. 16.

Equivalent number of units = Rs. 8,000 / Rs. 16 = 500 units

500 units would be redeemed from your MF holdings, and Rs. 8,000 would be given to you.

Your remaining units = 4600 - 500 = 4100 units

This way, units from your mutual fund holdings are redeemed in a systematic way to provide you with continuous income.

Yes, you can!

To cancel your SWP request, kindly submit to us a duly signed written request by all the unit holder(s) according to the mode of holding. In the written request, kindly mention your folio number, the SWP amount, SWP date, the scheme name in which you wish to cancel the SWP.

You can modify or pause the offline SWP via online mode. Please Click Here to modify or pause your SWP.

Note:

Your request for SWP cancellation / modification / pause needs to be submitted 5 working days prior the SWP date.

The online modification of SWP can only be done in the SWP amount and the SWP end period.

Yes, you can cancel, pause and modify your online SWP.

If you wish to modify/pause/cancel the existing SWP registered with us through Quantum's Website or Mobile Application, you can do so by following the below mentioned procedures:

| Modification of the SWP | Pause of the SWP | Cancellation of the SWP |

| 1. Visit www.QuantumAMC.com. | 1. Visit www.QuantumAMC.com. | 1. Visit www.QuantumAMC.com. |

| 2. Click on Login section and log in using your PAN / User Idwith Password and OTP. | 2. Click on Login section and log in using your PAN / User Idwith Password and OTP. | 2. Click on Login section and log in using your PAN / User Idwith Password and OTP. |

| 3. Under ‘Transact’ click on "SWP" | 3. Under ‘Transact’ click on "SWP" | 3. Under ‘Transact’ click on "SWP" |

| 4. Click on ‘Modify’ for the respective SWP | 4. Click on ‘Pause’ for the respective SWP | 4. Click on ‘Cancel’ for the respective SWP |

| 5. Modify the required details | 5. Select Pause period | 5. Click on send OTP, once OTP received on registered Email-id/Mobile Number, kindly enter the same |

| 6. Click on ‘Submit’ option | 6. Click on ‘Submit’ option | 6. Click on ‘Confirm’ |

| 7. Click on send OTP, once OTP received on registered Email-id/Mobile Number, kindly enter the same | 7. Click on send OTP, once OTP received on registered Email-id/Mobile Number, kindly enter the same | |

| 8. Confirm the SWP modification request be clicking on ‘Confirm’ | 8. Click on ‘Confirm’ |

Notes:

- The online SWP modification/cancellation/pause request needs to be submitted 5 business days prior to the next STP date opted by you online.

- In case the modification request received involves change in the SWP amount and if any SWP installment is due within 5 business days from the date of modification request received, the said installment will be processed as per the amount of the SWP registered before modification

- Modification can only be done in the SWP amount and SWP end period.

You can start offline and online SIP in Direct and Regular Plans in the following schemes:

| • | Quantum Value Fund |

| • | Quantum Liquid Fund |

| • | Quantum ELSS Tax Saver Fund |

| • | Quantum Equity Fund of Funds |

| • | Quantum Gold Savings Fund |

| • | Quantum Multi Asset Fund of Funds |

| • | Quantum Dynamic Bond Fund |

| • | Quantum ESG Best in Class Stratergy Fund |

| • | Quantum Nifty 50 ETF Fund of Fund |

| • | Quantum Smallcap Fund |

| • | Quantum Multi Asset Allocation Fund |

| • | Quantum Ethical Fund |

A. Physical Mode:

The mandate registration in physical for SIP can be submitted at any of the Point of Services (POS):- click here for our branch address or nearest Kfin Technologies Ltd Collection Centres

Investors/Unitholders needs to submit an original cancelled cheque (or a copy) with the name and account number pre-printed, or a bank account verification letter, to register the mandate.The unitholder’s cheque/bank account details will be subject to third-party verification.

Investor opting for this facility must be KYC complied.

For New investors: - New investors need to submit the dully filled and signed Common Application Form along with SIP & One Time Mandate Form to any of our point of services

For Existing Investors: Existing investors can submit the dully filled and signed SIP & One Time Mandate Form to any of the point of services.

Digital Mode: Please refer below steps for New & Existing Investor:

| New Investor | Existing Investor |

1 | ||

2 | Click on 'Open An Account' | Enter Primary holder’s PAN / User ID, select Folio from menu |

3 | Enter the required details | Login Using Password & OTP, confirm the declaration and click on ‘Submit’ |

4 | Under ‘Investment Details’ tab select any of the below options: | Visit Transact->SIP->New SIP Registration |

5 | i) Lumpsum with SIP – To do a purchase along with SIP registration or | Select Register SIP Through - existing OTM or eNACH |

6 | ii) Only SIP - To register only an SIP | Fill the form and follow further instructions |

7 | Fill the entire form and click on 'Save & Proceed' | Confirm ‘Declaration’, enter OTP and click on ‘Submit’ |

8 | If you have opted for ‘Lumpsum with SIP’, you will receive an on-screen confirmation to click on ‘Make Payment’ for payment towards lumpsum purchase | Confirm the SIP details and click on ‘Confirm’ |

9 | SIP will be registered within 21 days post the successful registration confirmation received by your Bank. | For eNACH registration, you will be redirected to your bank’s net-banking portal for mandate authentication and registration. Once completed successfully, your SIP through eNACH will be registered within the defined timelines. If you receive a failure message, please retry the registration process. |

10 | For Lumpsum with SIP, a Unique Registration Number (URN) will be generated and emailed. You need to add the URN in your banks bill payment section and select ‘Quantum Mutual Fund’ as a biller while adding in your banks’ net banking / mobile banking module. | Online SIP instructions will take a minimum of 21 days for activation. The first auto debit will be carried out only after the registration is completed by the Registrar and the Bank. You can check the status of your SIP under Transact->SIP->Registered SIP in your online login portal. |

11 | For Only SIP, the registration will be through eNACH and you will be redirected to your bank’s net-banking portal for mandate authentication and registration. Once completed successfully, your SIP through eNACH will be registered within the defined timelines. If you receive a failure message, please retry the registration process. |

A Systematic Transfer Plan (STP) allows an investor to invest a lump sum amount in one scheme and periodically transfer (or switch) a predetermined sum to another scheme. Depending on the selected frequency, the chosen amount is transferred on a specified date from the initial scheme to another scheme of the investor’s preference.

An existing investor can register SWP through our website.

Minimum conditions

- To register SWP the minimum balance should be more than ₹ 5000

- This facility is not available for folios in demat mode

- Visit WWW.QuantumAMC.Com

- Click on Login, and login by using credentials.

- Under ‘Transact’ click on "SWP"

- Click on ‘New SWP Registration’

- Click on ‘Register SWP’ for the respective source scheme

- Fill up the Online SWP registration form

- Click on "Order Review"

- After review Click on “Send OTP”

- After entering the “OTP” Click on ‘Submit’ to SWP registration.

Physical Mode:

For New investors: - New investors need to submit the dully filled and signed Common Application Form along with SIP & One Time Mandate Form to any of our point of services

For Existing Investors: Existing investors can submit the dully filled and signed SIP & One Time Mandate Form to any of the point of services.

Online Mode:

| New Investor | Existing Investor |

1 | ||

2 | Click on 'Open An Account' | Enter Primary holder’s PAN / User ID, select Folio from menu |

3 | Enter the required details | Login Using Password & OTP, confirm the declaration and click on ‘Submit’ |

4 | Under ‘Investment Details’ tab select ‘Only SIP’ - To register only an SIP with Top-Up | Visit Transact->SIP->New SIP Registration |

5 | Enable SIP Top-Up button and fill top up details | Select Register SIP Through - existing OTM or eNACH |

6 | Fill the entire form and click on 'Save & Proceed' | Fill the form and enable SIP Top-Up button to fill the top up details |

7 | SIP with Top-Up facility will be registered within 21 days post the successful registration confirmation received by your Bank. | Confirm ‘Declaration’, enter OTP and click on ‘Submit’ |

8 | For Only SIP, the registration will be through eNACH and you will be redirected to your bank’s net-banking portal for mandate authentication and registration. Once completed successfully, your SIP through eNACH will be registered within the defined timelines. If you receive a failure message, please retry the registration process. | Confirm the SIP with Top-Up details and click on ‘Confirm’ |

9 |

| For eNACH registration, you will be redirected to your bank’s net-banking portal for mandate authentication and registration. Once completed successfully, your SIP through eNACH will be registered within the defined timelines. If you receive a failure message, please retry the registration process. |

10 |

| Online SIP with Top-Up registration will take a minimum of 21 days for activation. The first auto debit will be carried out only after the registration is completed by the Registrar and the Bank. You can check the status of your SIP under Transact->SIP->Registered SIP in your online login portal. |

Let’s consider an example where an investor opts for a Monthly SIP with the SIP Top-Up facility:

Investor Details:

- SIP Amount: Rs. 5,000 per month

- SIP Frequency: Monthly

- SIP tenure Dec 2050 (25 years)

- Top-Up Amount: Rs. 500

- Top-Up Frequency: Yearly

- Cap Amount: Rs. 10,000

- Top-Up Start Date: January 1, 2025

Month /Year | Top-Up Amount | Monthly SIP Amount | Remarks |

Jan 2025 to Dec 2025 | Rs. 0 | Rs. 5,000 | Initial SIP amount. |

Jan 2026 to Dec 2026 | Rs. 500 | Rs. 5,500 |

|

Jan 2027 to Dec 2027 | Rs. 500 | Rs. 6,000 |

|

Jan 2028 to Dec 2028 | Rs. 500 | Rs. 6,500 |

|

Jan 2029 to Dec 2029 | Rs. 500 | Rs. 7,000 |

|

Jan 2030 to Dec 2030 | Rs. 500 | Rs. 7,500 |

|

Jan 2031 to Dec 2031 | Rs. 500 | Rs. 8,000 |

|

Jan 2032 to Dec 2032 | Rs. 500 | Rs. 8,500 |

|

Jan 2033 to Dec 2033 | Rs. 500 | Rs. 9,000 |

|

Jan 2034 to Dec 2034 | Rs. 500 | Rs. 9,500 | |

Jan 2035 to Dec 2035 | Rs. 500 | Rs. 10,000 | Cap Amount reached; SIP amount frozen. |

Jan 2035 to Dec 2050 | NIL | Rs. 10,000 | No top-up/increase |

Note:

- The SIP Amount starts at Rs. 5,000 and increases by Rs. 500 each year.

- The Top-Up frequency is yearly.

- The Cap Amount of Rs. 10,000 is reached by the 10th year.

- After the Cap Amount is reached, the SIP amount will stay fixed at Rs. 10,000 for the remaining of the SIP tenure.

For SIP Registered through Physical Mode: To change bank details for an existing SIP, you must first cancel your current SIP, which will be processed within two working days (T+2). If an installment is due within 10 days, it will be processed and debited from your account. After cancellation, submit the SIP & One Time Mandate Form with a cancelled cheque of your new bank account. The new mandate will be registered within 21 calendar days. Additionally, may submit Multiple Bank Account Registration Form , along with a cancelled cheque or an attested bank statement/passbook. Your new bank details will be updated within 10 working days.

For SIP Registered through Online Mode: There is no option to change the bank for an online SIP. You will need to cancel the current SIP and register a new one with the new bank account.

You will receive an update once your request is processed.

Physical - For New Investors: Please enclose duly filled and signed STP Form along with Common Application Form and requisite documents as per checklist mentioned therein.

For Existing Investors: Kindly submit duly filled and signed STP Form at the address mentioned below:

Quantum Asset Management Company Private Limited: 1st floor, Apeejay House, 3 Dinshaw Vachha Road, Backbay Reclamation, Churchgate, Mumbai - 400 020

K Fintech Technologies Limited - K Fintech Technologies Limited is our Registrar and Transfer Agent having many offices across India. Click Here for all the locations available over India

Digital: Currently only an existing investor with Quantum Mutual Fund can register online STP. Follow a simple registration process as mentioned below to start an Online STP.

1. Visit www.QuantumAMC.com

2. Click on ‘Login’ section and log in using your User Id/PAN with Password and OTP

3. Under ‘Transact’ click on ''STP''

4. Click on ‘New STP Registration’

5. Click on ‘Register STP’ against the respective source scheme

6. Fill up the Online STP registration form

7. Click on "Send OTP." Once you receive the OTP on your registered email ID or mobile number, please enter it.

8. Click on "Submit" and confirm your STP registration by selecting the "Confirm" option.

Note: The application for start of STP should be submitted at least 5 business days before the date of commencement/start date of STP. You will receive an intimation on successful registration of STP in the Folio.

- Only individual investors (excluding minors) can apply.

- The mode of holding must be single.

- Investors must not have any existing investments (SIP or lump sum) in any mutual fund scheme outside of this Choti SIP facility.

Choti SIP is available under the Growth Option of the following Quantum Mutual Fund schemes:

- Quantum Value Fund

- Quantum Multi Asset Allocation Fund

- Quantum Gold Saving Fund

- Quantum Equity Fund of Fund

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Multi Asset Fund of Fund

- Minimum amount: Rs. 250/- per month (in multiples of Re. 1 thereafter).

- Minimum commitment: 60 monthly instalments.

(Note: Early withdrawal is allowed but may attract Exit Load as per the Scheme Information Document (SID).)

- Frequency: Monthly only

- SIP Date: Any date between the 1st and 28th of each month.

| • | Nomination is mandatory in a folio. |

| • | If existing investments are without a nomination, a request to register a nominee shall be sent to investors through various modes i.e. letters, emails or sms. The statement of account will highlight the need to nominate. |

Process:

| 1. | Addition or change in nominee: Multiple Nominee Registration Form duly filled and signed by all unit holders irrespective of the mode of holding. |

| 2. | Cancellation of nominee: A duly signed written request for cancellation of nominee signed by all holders irrespective of the mode of holding. |

Note:

| • | All unit holders must sign the request for nomination/cancellation even if the mode of holding is not “joint”. |

| • | Nomination form cannot be signed by Power of attorney (POA) holders. |

| • | Every new nomination for a folio/account will overwrite the existing nomination. |

| • | Nomination is not allowed in a folio held on behalf of a minor. |

Kindly refer to FAQs on nomination on the same for additional details.

If you have invested in multiple schemes of the same fund house with different folios or invested in same scheme with multiple folios, you can combine/merge all these folios into one consolidated folio instead of keeping track of each scheme/each folio separately in a scheme or across multiple schemes. This process is called consolidation of folios.

Most investors fill in a fresh application form even while investing in the same Mutual Fund or investors tend to invest in same scheme with different folio in case he wants to invest with different holding pattern. This leads to creation of multiple folios (accounts) and investors may find it difficult to maintain and keep records. Mutual Funds and Registrars have given investors the option to CONSOLIDATE all their folios in the same Mutual Funds into one single folio. Consolidation is the merger of two or more folios into one single folio however subject to some parameters/conditions/criteria.

Consolidating folios into one would give you the benefit of having to track and transact in one folio and allow you a single view of your investments in the Fund - all investments in a Fund would reflect in a single statement under one folio.

Process:

Offline: A duly filled and signed Folio Consolidation Form by the unit holders (according to mode of holding).

Online:

- Visit www.QuantumAMC.com

- Login with your user id/PAN and password/OTP (The source and target folio must be mapped with the same user id)

- Click on ‘Folio Consolidation’ under the Manage Account

- Enter the PIN and click on ‘Submit’

- Enter the source and target folio (If the mode of holding in the target folio is ‘Single’ and no nominee is registered, you will get a pop –up message to register a nominee or select another folio. Nominee can be registered online under Non-Commercial Transactions > Nominee Updation option)

- Click on Submit

- An acknowledgement of consolidation message will display on-screen. Also it will be triggered on the email id and mobile number (registered in the target folio).

To know more about the consolidation please Click Here

1. Letter specifying name, folio number, duly signed by all unit holders (if mode of holding joint) or authorized signatories in case of corporate entities.

2. KYC Acknowledgement with new name

3. Bank's Cheque copy with new name

4. If signature change - banker attestation of new signature

Additional below documents if:

Change in Name due to Marriage – Notarized copy of Marriage Certificate

Change in Name due to Divorce –

- Divorce Declaration form duly witnessed

- Attested copy of the Court order stamped by Executive Magistrate or Judicial Magistrate apart from having Court stamp

Change in Name due to adoption – Attested copy of Court order duly stamped and also attested by Executive Magistrate/Judicial Magistrate/Notary.

Change in Name for other reasons - Notarized copy of Judgment/Gazette Notification

Change in Name for Corporate Investors -

- Attested copy of Certificate of Incorporation at Registrar of Companies (ROC)

- Memorandum of Articles & Articles of Association

- List of Authorized Signatories, Board Resolution

Note - If any Signature Change due to Marriage/Divorce - old and new signature to be

provided (old signature should be tallied with our records)

The investor can change his/her existing bank details under the folio. You can also add or register up to 5 bank accounts in the folio.

Online Process:

Please click here to know more about online process.

Offline Process:

| 1. | Multiple Bank Registration Form should be submitted to the AMC/ along with the supporting documents. |

| 2. | Cancelled Original Bank Cheque or attested copy of Bank statement/ Certificate / Bank Pass Book. |

Note:

| • | Redemption amount will be credited in default bank. |

| • | The requests for addition/change/deletion/modification in the registered bank account(s) should be submitted using the designated application form only. Requests received on a plain paper are liable to be rejected. |

The investor can change his/her Email-id and Contact number under the folio.

Process:

Online - You can change your Email Id and contact details through "Manage Account>Modify Contact Details/Modify Email id" option under Login. Please note that PIN is required for change of each criteria.

Offline - You can update your email id/ contact number by any of the following way.

1. Request Letter - A duly signed letter/Transaction Slip mentioning the Email Id, Mobile Number and any other contact details can be submitted to AMC branch / any of the KFin Technologies Limited.

2. Email/SMS -

a. Email - The investor can send an email from the registered email id to update the email id/contact number (mobile/ residential/office number) at [email protected]

b. SMS -The email id/mobile number can also be updated by sending an SMS from the registered mobile number on 9243223863.

Note: The folio number and the new contact details have to be mentioned in the request submitted.

For the latest updates please Click Here

One can hold his/her investments either solely or with an additional holder.

Three types of holdings can be availed by an investor which Single, Joint or Anyone or Survivor(s). You can only change your mode of holding from Joint to Anyone or Survivor(s) or vice versa.

Process:

| • | A duly signed written request from both the holders registered under the folio should be submitted to the AMC. |

Investors must first remediate the reason of the initial fund returned by the bank as communicated by the AMC. If this requires change in bank, please submit a duly filled and signed Multiple Bank Accounts Registration Form along with original cancelled cheque leaf / copy of the Bank Statement showing A/c holder Name and A/c No. duly attested by the relevant Bank Manager / copy of Pass book showing A/c holder Name and A/c No. duly attested by the relevant Bank Manager. This will enable us to update the correct bank mandate in the folio. Once the necessary remediation is completed, Investor may submit the duly filled and signed Additional Transaction or Service Request Slip for claiming Unclaimed Redemption/Dividend Amount.

The request can be submitted at any of the AMC Investor Service Centre or at any KFin Tech Service Centre. This request need to be duly signed as per the mode of holding.

The investor can change his/her signature under the folio.

Process:

| 1. | Letter in writing with the new signature should be submitted to AMC / KFin Technologies Limited with supporting documents. |

| 2. | The signature must be attested by the bank manager of unitholder’s registered bank. |

| 3. | Any other document evidencing the signature. |

Offline Process:

Submit a request for change in details/tax status and FATCA form by submitting a duly filled and signed KYC Application Form with supporting documents for change in status from NRI to RI or vice versa.

After receipt of acknowledgement from the KRA, you need to submit a duly signed Tax Status Change Request Form to this effect mentioning the new bank account details with an original cancelled cheque having name and account number preprinted/ Bank Statement/ Certified copy of the Passbook to the AMC.

Online Process after change of Tax Status in KYC:

- Login to https://secure.quantumamc.com

- Visit Manage Account > Modify Resident Status

- A pop-up message will be displayed requesting to submit a change in resident status request to the KRA > Click on ‘OK’

- Enter the required details and upload the documents as per the instructions provided and click on submit

- An on-screen message will be displayed for the receipt of the request. An email and SMS will be triggered to the registered email id and mobile number respectively.

NOTE: If a photocopy of any document is submitted, it should be certified by the bank or investors must produce an original for verification for offline process. In case of change of tax status from RI to NRI, the bank account type should be a NRO Bank Account (Non- Resident Ordinary) only as the investment amount earlier was on non-repatriation basis. In case of change of tax status from NRI to RI, the bank account type should be Savings Bank Account only.[DP1] [RD2]

If your already have an OTM/NACH registered in the respective folio, then you may either select OTM/NACH for making the payment or you may opt for NEFT / RTGS payment mode whereby you will be required to first transfer the payment to anyone of our Collection Bank Accounts (NEFT/RTGS Bank Detail); after transferring the investment amount, you may then initiate an additional purchase transaction on IVRS as per steps mentioned above and during this session, you will be prompted to enter the last 4 numeric digits of the NEFT/RTGS Bank Reference Number to complete the transaction request and further identification and tracking of funds.

If you do not have an OTM/NACH registered in the folio, we suggest you to register using Online / Offline Procedure. Please visit our FAQ section ‘One Time Mandate NACH’ for more information on the same. However, you may still use NEFT / RTGS payment mode as mentioned above.

NAV (Net Asset Value) Applicability for Purchase:

For Liquid Funds: Where the application is received up to 1.30 p.m. on a Business Day at the official point(s) of acceptance and funds for the entire amount of subscription/ purchase (including switch in) as per the application are credited to the bank account of the Scheme and are available for utilization before the cut-off time (1.30 p.m.) - the Closing NAV of the day immediately preceding the day of receipt of application.

In respect of valid application received after 1.30 p.m. on a Business Day at the official point(s) of acceptance and funds for the entire amount of subscription / purchase (including switch in) as per the application are credited to the bank account of the Scheme on the same day or before the cut-off time of the next business day i.e. funds are available for utilization before the cut-off time (1.30 p.m.) of the next Business Day, the closing NAV of the day immediately preceding the next Business Days ;

For Non-Liquid Funds - Where the application is received up to 3.00 p.m. on a Business Day at the official point(s) of Acceptance and funds for the entire amount of subscription/ purchase (Including switch-in) as per the application are credited to the bank account of the Scheme and are available for utilization before the cut-off time (3.00 p.m.), the closing NAV of the day shall be applicable.

In respect of valid application received after 3.00 p.m. on a Business Day at the official Point(s) of acceptance and funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the Scheme on same day or before the cut-off time of the next business day i.e. funds are available for utilization before the cut-off time of next Business Daythe closing NAV of the next Business Day shall be applicable

NAV (Net Asset Value) Applicability for Redemption:

For Liquid Funds:Where the application is received up to 3 p.m. on a Business Day - the closing NAV of the day immediately preceding the next Business Day, shall be applicable.n respect of valid applications received after 3 p.m. on a Business Day - the closing NAV of the next Business Day shall be applicable.

For Non-Liquid Funds - IWhere the application is received up to 3 p.m. on a Business Day, the closing NAV of the day of receipt of application shall be

applicable.In respect of valid applications received after 3 p.m. on a Business Day, the closing NAV of the next Business Day shall be applicable.

NAV (Net Asset Value) Applicability for Switch:

Please refer our link https://invest.quantumamc.com/onlinenew/Switch%20Matrix.pdf on Switch Matrix for detailed information on NAV Applicable for switch transactions

Transmission of units is done in the event of the death of the first unit holder wherein only the transfer of units will take place from the unit holder’s name to the claimant’s name.

Process:

| 1. | Applicants/Claimants should submit the prescribed documents as per situation as specified in the AMFI Circular. |

| 2. | The transmission process is specific to mode of holding. Kindly click here for the list of documents & annexures to be submitted for transmission of units. |

Note:

| i. | The redemption request given with transmission will not be processed and the claimant will have to submit a redemption request after the transmission is completed. |

| ii. | A new folio will be created for all transmission cases. |

| iii. | For Death Certificate (DC) issued outside India, the DC should be attested by Indian Embassy located in the country issuing the DC or embassy of the country issuing DC located in India. |

Kindly refer to AMFI guidelines on the same for additional details.

Note :

a. The ongoing systematic transactions (SIP/STP/SWP) will be terminated post the transfer of units into the new folio.

Post the transfer of units, the claimant has to provide the new folio number allotted to him for any financial/non-financial transaction.

b. As per the ELSS, in the event of the death of the 'Assessee', the nominee or legal heir as the case may be shall be able to withdraw the investment only after the completion of1 (one) year from the date of allotment of the Units to the 'Assessee'. Accordingly, transfer of Units (allotted to 'Assessee' as defined under the ELSS) to nominees as mentioned above will be carried out only after the completion of 1 (one) year from the date of its allotment. The restriction of 3 (three) year shall apply to units allotted to investors other than the deceased 'Assesses' referred to above.

Power of Attorney is to have the authority to act for another person in legal or financial matters.

Process:

| 1. | A duly signed written request from the investor |

| 2. | Notarized POA document |

| 3. | KYC copy of the POA holder |

| 4. | List of authorized signatories (Incase the POA is a non – individual) |

The investor can change his tax status from Resident Individual to Non-Resident Individual and vice versa. Please refer the below offline and online procedures.

Offline Process:

1. | Submit a request for change in details/tax status to your respective KRA (KYC Registration Agency) (through whom your initial KYC was done) by submitting a duly filled and signed KYC Application Form with supporting documents for change in status from RI to NRI and vice versa. |

2. | After receipt of acknowledgement from the KRA, you need to submit a duly signed written request to this effect mentioning the NRO (Non-Resident Ordinary) bank account details with a cancelled cheque with name and account number preprinted/ Bank Statement/ Certified copy of the Pass Book to the AMC. |

Online Process:

1 | Visit www.QuantumAMC.com and click on “Login” |

2 | Login with your user id and password/OTP |

3 | Click on Manage Account > Modify Resident Status |

4 | A pop up message will be displayed requesting to submit a change in resident status request to the KRA > Click on ‘OK’ |

5 | Enter the required details and upload the documents as per the instructions provided |

6 | Click on “Submit” |

7 | An on-screen message will be displayed for the receipt of the request. Also an email and SMS will be triggered to the registered email id and mobile number respectively. |