- Why Quantum

-

Investment Solutions

- Product Suite

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Active FOF

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Allocation Fund

- Partner Corner

- Learning Lab

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Allocation Fund

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Active FOF

Notice

Dear Investor,

Pursuant to SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings, irrespective of the amount of investment, under all mutual fund schemes.

1) To know more about payment modes available :

• Lump Sum Investments and their efficiency in the hierarchy of best to worst Click Here

• SIP Investments and their efficiency in the hierarchy of best to worst Click Here

2) Bank efficiencies in terms of providing credit to mutual funds on the same day before cut-off timings on which investors’ account is debited

i. NPCI (National Payments Corporation of India) Click Here

ii. Payment Aggregators (for e.g. Google Pay, Amazon Pay, PayTM)

We request Investors who have not submitted their PAN details and/or are Non KYC compliant to submit their PAN details & fulfill their KYC at the earliest. You may contact our [email protected] or call our toll free number 1800 - 209 - 3863 / 1800 - 22- 3863 for any queries or assistance.

Liquidity Window - Quantum Gold Fund (ETF): The Liquidity Window under Quantum Gold Fund is Open. Investors of Quantum Gold Fund can submit their redemption request upto Rs.25 Crores at the Official Point of Acceptance of the AMC. You may also redeem by sending the application via email from your registered Email Id to our Transact Id - [email protected].

SEBI’s Important Update on Folios without PAN / PEKRN: Click here for PAN / PEKRN related intimation.

Important Update on PAN & Aadhaar Seeding: As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 30th June 2023 failing which the unlinked PAN shall become inoperative. Please visit https://www.incometax.gov.in/iec/foportal/ and click on ‘Link Aadhaar option’ under the ‘Quick Links’ section to link your PAN with Aadhaar.

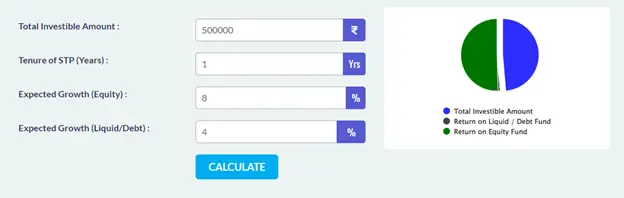

STP Calculator Online

If you have a lump sum amount and want to transfer that amount over a period of time to Equity Funds, Systematic Transfer Plan (STP) is the most suitable option for you. Under a mutual fund Systematic Transfer Plan (STP), a lump sum amount you invested in one scheme can be transferred at regular intervals systematically in a piecemeal manner into another mutual fund scheme (as desired by you) of the same mutual fund house. Most fund houses have a daily, monthly, weekly, and quarterly option to transfer money. But not all offer the weekly option – only a handful of them do. Moreover, different fund houses have different requirements for the minimum amount invested through STP.

Total Investible Amount :

STP Per Month :

Total Future Value :

*past performance may or may not be sustained in future and is not a guarantee of any future returns.

STP Calculator

Are you planning to invest in the capital markets but worried about the volatility? Well, you have a way to out. Instead of investing all your investible surplus at one go, particularly in a high-risk equity mutual fund scheme, you could consider opting for the Systematic Transfer Plan or STP.

What is a Systematic Transfer Plan or STP?

STP (like SIP) is a mode of investing in mutual funds, wherein you gradually shift your investments from one mutual fund scheme to another within the same fund house (typically from a liquid or a debt fund into an equity fund) over a period, called the STP tenure (which could be 6 months, 1 year, 2 years, etc.), by making systematic transfers at a regular frequency (weekly, monthly, quarterly, etc) over the STP tenure.

Types of STPs:

1. Fixed STP – Here the total amount to be transferred and the frequency remains fixed. As an investor, you can decide the amount and period of transfer as per their financial goals.

2. Flexible STP -It offers you, the investor the flexibility to transfer funds flexibly as you deem fit. Depending upon the market volatility, you could flexibly transfer a higher share of the source scheme or vice versa.

3. Capital Appreciation STP – Here, only the capital appreciation amount or gains are transferred to another fund of your choice. The capital in the source scheme remains intact.

How does STP work?

Say, you have Rs 5 lakh as investible surplus or earned a windfall income and want to deploy it in a worthy equity mutual fund scheme so that it multiplies wealth, you could first consider parking the money in a Liquid Fund -- akin to parking money in the savings bank -- and then via the STP, to mitigate the risk, transfer the money from into the desired equity mutual fund scheme, i.e. the target mutual fund scheme of your choice over the STP tenure.

Particularly in volatile market conditions, the five key benefits that STP adduces are:

1) Helps spreads your investments in the specific equity scheme 2) Facilitates rupee-cost averaging 3) Provides a means of tactical asset allocation and rebalancing 4) Makes it possible to take advantage of the market scenario 5) And kind of lower the risk and optimise the returns

The virtues of using the STP Calculator

Using the STP calculator thoughtfully provides insight as to how the money would be transferred to another scheme within the fund house.

All you got to do is enter the investible amount, the STP tenure, and expected growth from the Equity Fund and the Liquid Fund prudently to get the answer in a few seconds.

Assuming you are transferring a sum of Rs 5 lakh over the next 12 months from a Liquid Fund to an Equity Fund, and expect equities to yield you a return of 8% p.a. while a Liquid Fund at the rate of 4% p.a. on an average; here’s how the money will be systematically transferred from the Liquid Fund to the Equity Fund of the fund house via STP…

Based on the return expectation you enter in the online calculator, it gives you the return you can make from the Liquid Fund, and the Equity Fund, and tells you indicatively the future value of your investment.

The 5 key benefits of using the STP calculator are:

1) Simple 2) Convenient 3) Helps plan your investments better 4) Save you the trouble of manually performing complex and lengthy calculations 5) Provides a means of tactical asset allocation and rebalancingv

Tax Implication of STP

STP is considered as an exit or redemption (from the source scheme) to simultaneously purchase units in the transferee/target scheme. Thus, the capital earned out of the units of the source scheme at the time of transfer will be subject to Short Term Capital Gains (STCG) or Long Term Capital Gain (LTCG) tax as the case may be, i.e. depending on the holding period and type scheme type (equity-oriented or debt-oriented).

| Equity-oriented mutual fund scheme | Debt-oriented mutual fund scheme | |

|---|---|---|

| Redemption < 1 year | STCG tax at 15% | Tax as per the income tax slab of the investor |

| Redemption > 1 year | LTCG tax at 10% for gains over Rs 1 lac in a financial year | |

Who should consider STP?

STP serves as a useful investment strategy for, both novice and seasoned investors who wish to stay invested at all times. It instils the necessary investment disciple and facilitates portfolio rebalancing with systematic transfers.

That said, as an investor, you ought to thoughtfully choose the source and transferee/target scheme depending on the market conditions.

Furthermore, consider your risk profile, investment objective, the financial goals being addressed, the time in hand to achieve the envisioned goals, and make sure that your STP tenure is reasonable, particularly when you are deploying money from a low-risk fund to a high-risk fund.

Frequently Asked Questions (FAQs)

What is the minimum amount for STP?

According to SEBI regulations, there is no minimum investment requirement for STP in mutual funds. However, most fund houses insist on a minimum investment amount in the source scheme to start an STP. Investors must commit at least 6 transfers from the transferor scheme to the transferee/target scheme while applying for the STP transaction.

How to start or set up an STP?

Starting an STP can be done offline by reaching out to your mutual fund distributor or the relationship manager at the fund house. You need to physically fill up the hardcopy of the STP enrolment form [indicating the source scheme name, the transferee/target scheme name, the STP variant name, the amount to be transferred (in case of fixed STP), the period of STP and the frequency] when doing it offline. Alternatively, an STP can also be set up online on the website of the fund house or a fintech mutual fund investment platform.

Are Systematic Transfers to another scheme within the fund house free?

No. Your redemptions from the source scheme for transfer to another within the fund house may be subject to the exit load as applicable. Besides, there are expense ratios applicable to the source scheme and transferee/target scheme.

STP be done if the units of the source scheme are pledged?

No. If the units of the source scheme are pledged, doing an STP is not possible.

When does the STP stop?

Your STP may stop when the balance units in the source scheme reduce to an amount less than the minimum STP value.

What is the difference between STP and SIP?

Under the STP you transfer the amount invested in one mutual fund scheme (known as the source scheme) to another scheme (known as the transferee/target scheme) of the same fund house. Thus, STP allows you to stay invested at all times but tactically shift money from one type of scheme to another.

Whereas in the case of SIP, you are investing a fresh sum of money systematically at regular intervals ––weekly, monthly, quarterly, etc.––into the

mutual fund scheme of your choice; there is no inter-fund transfer. That being said, both SIP and STP enable rupee-cost averaging while you endeavour to compound wealth.

Add To Cart

| Total of Lumpsum Amount |

|---|

Broker Details

-

ARN CodeARN -

-

Sub Broker Code

-

EUIN CodeE -

-

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker.