heading

About The Fund

Given the multitude of equity funds available today, choosing the right funds can be confusing and tricky. The Quantum Diversified Equity All Cap Active FOF can simplify and optimize your equity investing journey by investing in good quality, diversified equity schemes on your behalf, across all Market Caps, after extensive qualitative and quantitative research. The fund also reduces the hassles of making and tracking multiple investments. A single NAV is all you need to know how your investments are faring.

5 Reasons to invest in the Quantum Diversified Equity All Cap Active FOF

1. Basket of 5-10 well researched diversified equity schemes.

2. Only one NAV to track.

3. Diversification with limited capital.

4. Efficient rebalancing between schemes.

5. Provides an option to hold units in Demat mode.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

-

Funds Managed:

Qualification:

- B.Com Degree (IGNOU) and CIPM (CFA Institute, USA)

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Diversified Equity All Cap Active FOF

(An Open-Ended Fund of Funds Scheme investing in diversified Equity Schemes across All Market Caps of Mutual Funds)Tier I Benchmark : BSE 500 TRI

-

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Investments in portfolio of diversified Equity Schemes across All Market Caps of Mutual Funds -

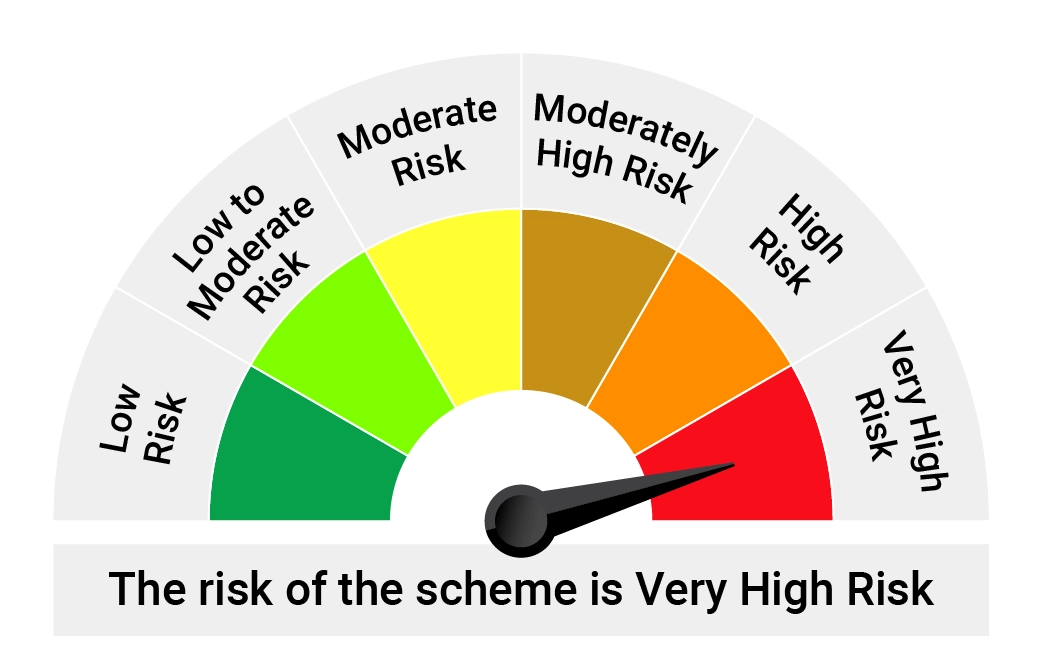

Risk-o-meter of Scheme

-

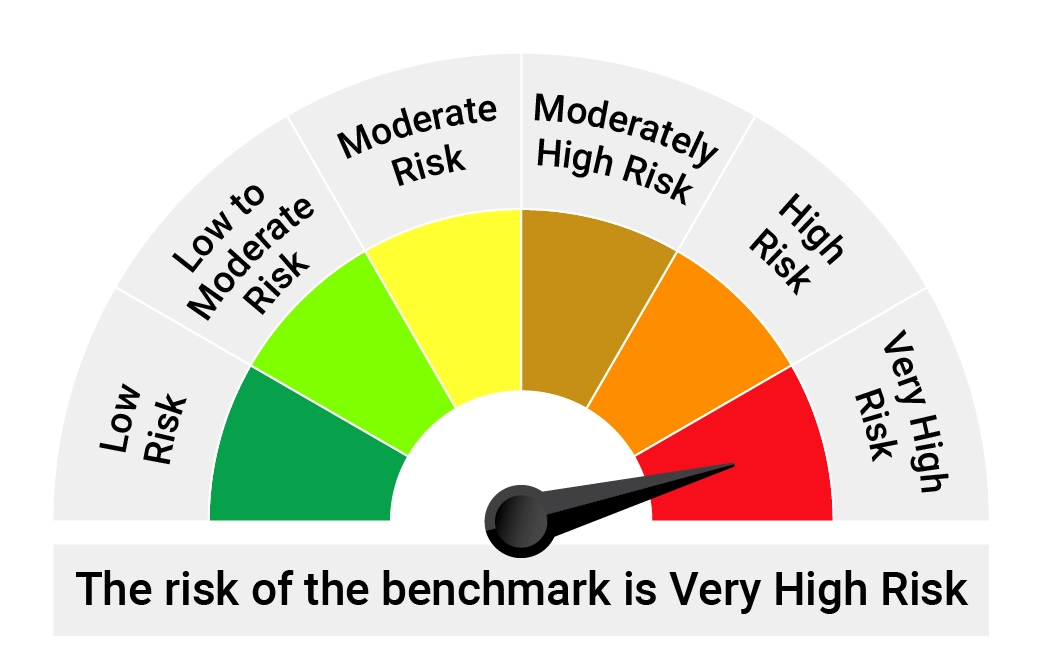

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

*Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes in which this Scheme makes investment.