heading

About The Fund

The Quantum Multi Asset Allocation Fund aims to diversify your portfolio across three major asset classes i.e. Equity, Debt and Gold to reduce dependence on a single asset class & deliver better risk-adjusted returns over the long run. While Equity investments have the potential to generate capital appreciation over time, Debt investments add stability to your portfolio & Gold plays the role of a strategic diversifier as it generally has an inverse correlation with Equities. This Fund helps combine the benefits of 3 asset classes with 1 single investment to achieve your long-term goals with peace of mind.

Enjoy the benefits of having a Fund Manager who periodically rebalances the portfolio to capitalize on opportunities across market cycles. Investors who do not have the time or the expertise to manage a diversified portfolio on their own can take advantage of this actively managed fund.

5 Reasons to Invest in Quantum Multi Asset Allocation Fund

-

1. Dynamic research backed asset allocation.

-

2. Smarter option to a Bank Fixed Deposit.

-

3. Periodic rebalancing to buy low and sell high.

-

4. Tax efficient rebalancing and indexation benefits.

-

5. Potential for good risk adjusted returns.

To know more about the Post Budget Tax Implications on this fund - Click Here

Fund Features

-

Investment Objective

The investment objective of the Scheme is to generate long term capital appreciation/income by investing in a diversified portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments.

-

Benchmark

Tier I: NIFTY 50 TRI (40%) + CRISIL Short Term Bond Fund AII Index (45%) + Domestic Price of Gold (15%)

-

Type of Scheme

An Open-Ended Scheme Investing in Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments

-

Plans Available

The Scheme offers two Plans - Direct Plan & Regular Plan – Investment Through Distributor. Each plan offers – Growth Option

-

Minimum Application Amount

500 / SIP - 100 (Daily) & 500 (Weekly, Fortnightly, Monthly & Quarterly)

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

Funds Managed:

Qualification:

- B.Com Degree, CA Inter, Pursuing CFA

Qualification:

- B.Com Degree, CA (Institute of Chartered Accountants of India)

Portfolio

Product Label

-

Name of the Scheme and Benchmark

Quantum Multi Asset Allocation Fund

(An Open-Ended Scheme Investing in Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments)

Tier I Benchmark: NIFTY 50 TRI (40%) + CRISIL Short Term Bond Fund All Index (45%) + Domestic Price of Gold (15%) -

This product is suitable for investors who are seeking*

• Long term capital appreciation and current income

• Investment in a Diversified Portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments

-

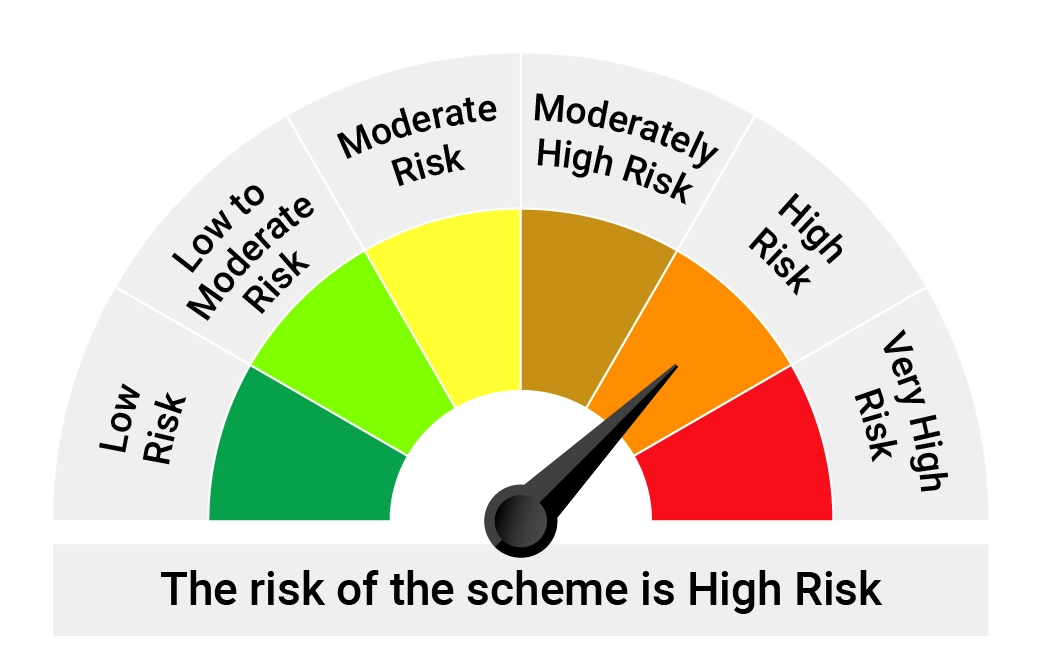

Risk-o-meter of Scheme

-

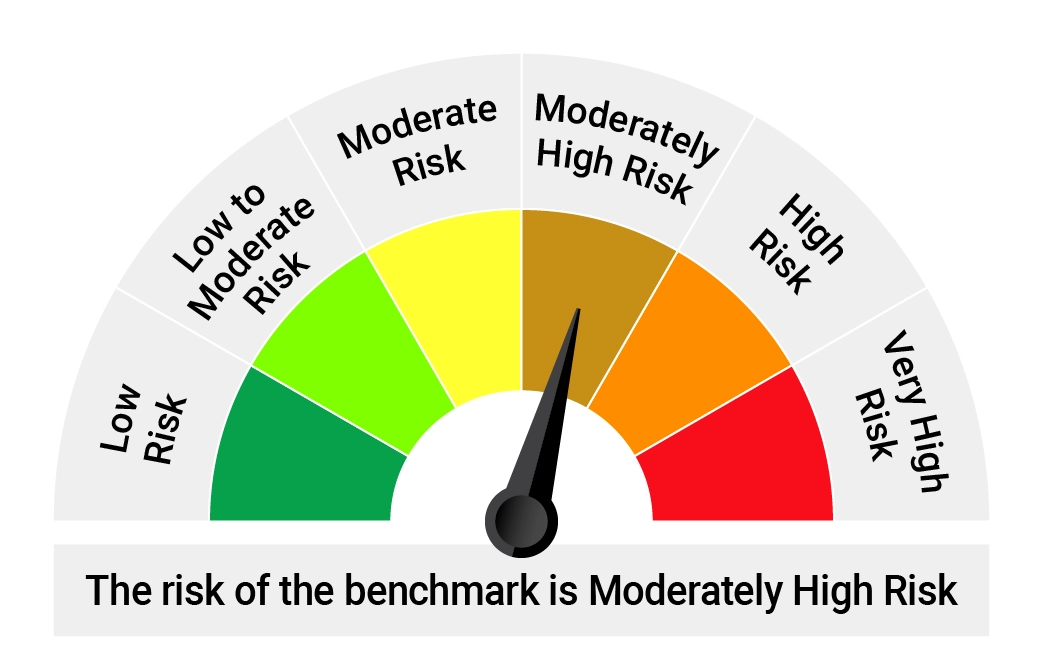

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.