heading

About The Fund

The Quantum ESG Best In Class Strategy Fund invests in companies that are focused on conserving the environment, on positively impacting communities that they operate in, and conducting business ethically. These sustainable businesses are not only environmentally and socially responsible but also make great sense as investments as you look to build wealth over the long term.

5 Reasons to invest in the Quantum ESG Best In Class Strategy Fund

1. Offers a solution for investing in businesses where sustainable practices drive long term performance.

2. Invests after comprehensive research on Environmental, Social and Governance or ESG factors.

3. Provides exposure to good quality sustainable companies with low volatility and downside risk.

4. Well diversified portfolio that follows a disciplined investment process.

5. Follows risk and liquidity controls on investing.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

Funds Managed:

Qualification:

- BBA.LLB (Hons.)

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum ESG Best In Class Strategy Fund

(An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy)

Tier I Benchmark : NIFTY100 ESG TRI -

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy -

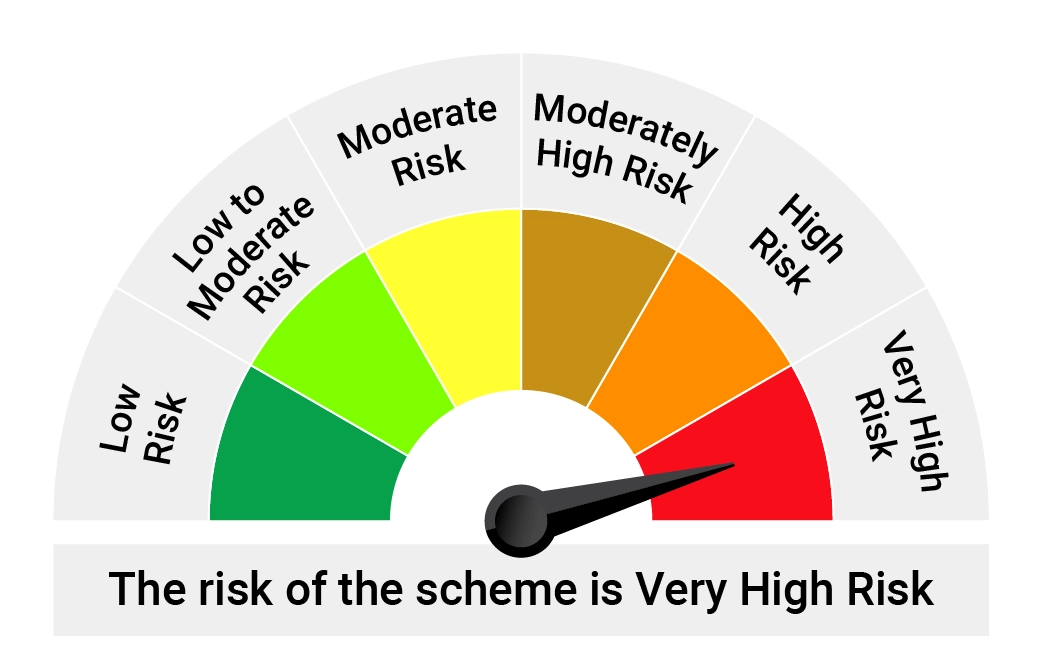

Risk-o-meter of Scheme

-

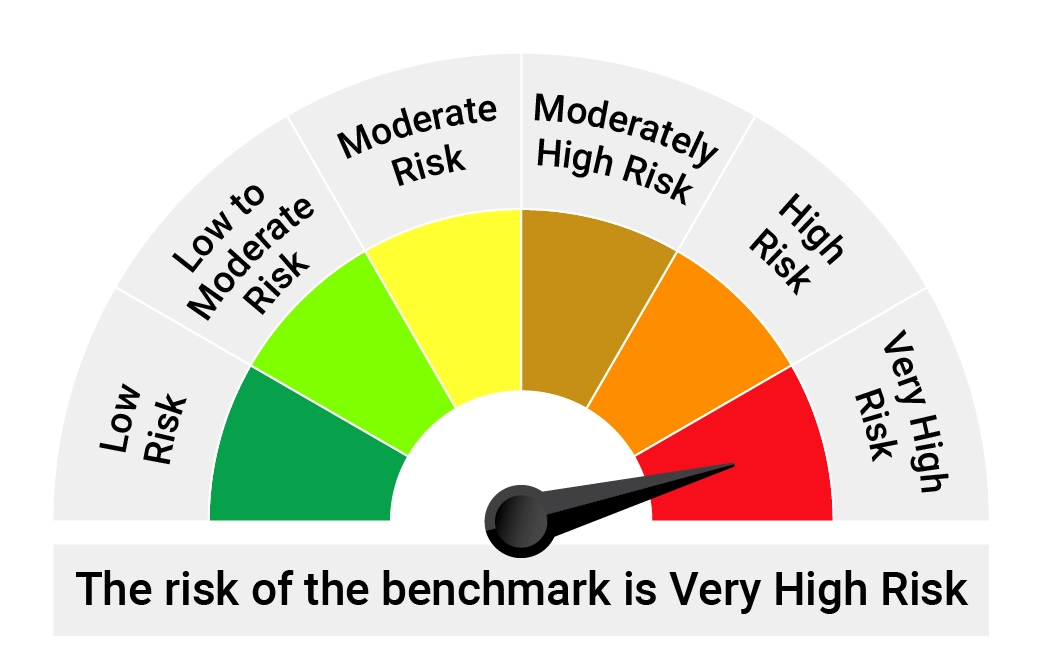

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Jan 31, 2026

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on Jan 31, 2026

Frequently Asked Questions

ESG Equity Funds are diversified equity funds that are thematic. They use three pillars - environmental, social and corporate governance criteria to screen companies and provide exposure to businesses that are sustainable. It is also called responsible or sustainable investing.

ESG investing aims for the triple bottom line that is good for 3Ps - people, planet and profits. Investors increasingly are becoming aware of the significance of weighing investments beyond financial parameters and seek the presence of certain values or ethics that they identify with. They are cognizant of the fact that a lack of sustainability parameters eventually translates into lower profitability over the long term.

When selecting ESG funds to invest, select a true-to-label funds. To verify ESG credentials, we believe it still warrants a detective’s lens and you cannot rely solely on BRSR reports (Business Responsibility & Sustainability Report). ESG screening of companies is not about excluding those companies in chemicals, refining or thermal power business etc., but to assess whether it is done responsibly. Quantum’s proprietary ESG scoring methodology evaluates over 200 parameters across the Environment, Social and Governance spectrum, backed by quantitative and qualitative data. We move beyond desk research and depend on groundwork and industry checks.

While computing the ESG score, 50% weightage is assigned to the Governance aspect, while the rest 50% to the Environmental and Social aspects. As a matter of fact, integrity filter is something that we follow at the group level since 1996. We believe poor governance also reflect poor performance on the social and environmental fronts, making it a good proxy for inherent risks.

Another important parameter to consider is that companies that have low ESG scores could lose prominence in the investment landscape, despite generating higher profits.

ESG investing may be underestimated due to their focus on non-financial parameters. However, there are studies that validate that a business which has good ESG practices has potential to deliver good risk adjusted returns arising out of lower cost of capital and improved operational performance. This eventually leads to higher profitability.