FATCA obliges such foreign (for US) banks and financial institutions (also Mutual Fund – Quantum MF) to report information about US persons having accounts with them. It is a financial reporting of assets owned by “United States Persons” to the “United States Tax Authorities”.

The data collected of U.S. Reportable Account will be reported to US Internal Revenue Service (IRS) or the Indian Tax Authorities for onwards submission to IRS. We would like to inform you that as per the FATCA, Quantum Mutual Fund is required to undertake due diligence process of all the investors including Indian investors.

You can generate a new TPIN. Please refer the flow chart to generate a new TPIN.

Note: The old TPIN will be deactivated once you generate a new TPIN.

Click here to know more about KYC.

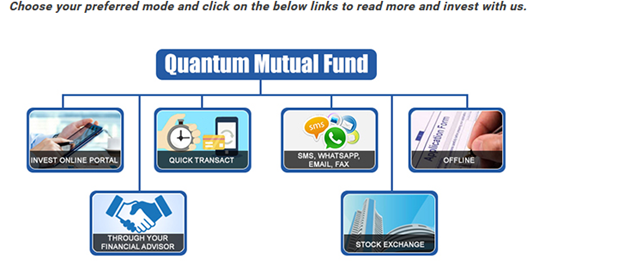

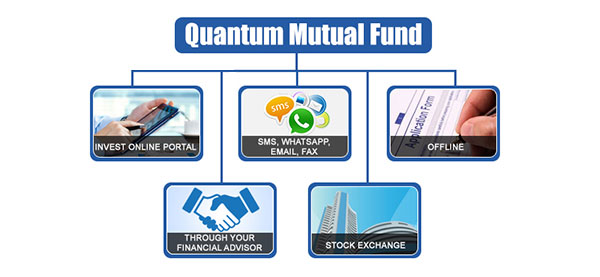

You can invest in our Schemes through the following modes:

| 1. | Through our Invest Online portal |

| 2. | By submitting physical transaction requests offline |

| 3. | Through your mobile phone/computer using SMS, WhatsApp, Email, Fax |

| 4. | Through the stock exchange platform |

| 5. | Mutual Fund Utility Platform |

Please note that for ETF schemes i.e. QGF and QIF you will have to read the respective SID of the schemes.

• Additional Purchase (Subscription)

• Redemption

• Switch in / Switch-out

Investors with short indicative investment horizon of less than 30 days will get impacted more because the stamp duty is being charged as a onetime charge. Please refer below table for illustration purpose. Impact gets reduced as the holding period increases.

| Stamp Duty | No. of Days | Impact in % terms (Absolute/day) | Impact in % terms (Annualised) |

|---|---|---|---|

| 0.005% | 1 | 0.0050% | 1.825000% |

| 2 | 0.0025% | 0.912500% | |

| 3 | 0.0017% | 0.608333% | |

| 4 | 0.0013% | 0.456250% | |

| 5 | 0.0010% | 0.365000% | |

| 6 | 0.0008% | 0.304167% | |

| 7 | 0.0007% | 0.260714% | |

| 30 | 0.0002% | 0.060833% | |

| 60 | 0.0001% | 0.030417% | |

| 90 | 0.0001% | 0.020278% | |

| 180 | 0.0000% | 0.010139% | |

| 270 | 0.0000% | 0.006758% | |

| 365 | 0.0000% | 0.005000% |

CKYC is effective from 1 February 2017. You need to note the following:

a) New investors (investors for whom no record exists in any of the KRAs) will have to mandatorily submit the CKYC form along with the investment application. If the investor has filled the KRA application form in lieu of CKYC form, he will have to additionally submit the Supplementary CKYC form along with the KRA application form.

b) Existing investors (investors for whom a record exists in any of the KRAs, regardless of the KYC status) can continue making investments without any additional requirements. In case any modification is required to be done in the KYC status, then only KRA forms are to be used.

SWP instructions will take a minimum of 5 business days for registration with the registrar. The first transfer will be carried out only after the registration. Therefore, the date and months in which your SWP commences and ends may change depending on the date of its registration.

To check the performance of the Quantum Dynamic Bond Fund you will have to go through the current factsheets.

Click here for detailed Scheme Factsheet.

Only Resident Individuals (RIs) are eligible to complete Online KYC. At present, other categories of investors, including NRIs and PIOs, are not permitted to use the Online KYC process.

Yes. If the units are being transferred to a different holder(s), an OTP confirmation is mandatory from both the Transferor and the Transferee. The OTP must be authenticated within the stipulated timeline to validate and process the request.

No, Quantum Mutual fund does not deduct any Transaction Charges and shall continue not to deduct Transaction Charges as allowed under SEBI Circular No. Cir / IMD / DF/13/2011 dated August 22, 2011

Note: Minimum balance to start SWP: Rs.5000/-

| Scheme Name | SWP Options | Weekly | Fortnightly | Monthly | Quarterly |

| Quantum Long Term Equity Value Fund / Quantum ESG Best In Class Strategy Fund / Quantum Equity Fund of Funds / Quantum Gold Savings Fund / Quantum Multi Asset Fund of Funds / Quantum Dynamic Bond Fund / Quantum Nifty 50 ETF Fund of Fund / Quantum ELSS Tax Saver Fund / Quantum Small Cap Fund / Quantum Liquid Fund / Quantum Multi Asset Allocation Fund / Quantum Ethical Fund | Eligible Dates | Any day of the Week | Any day of Alternative Week | Any Date | |

| Minimum SWP amount | ₹500/- and in multiples of ₹1/- thereafter | ||||

| Minimum SWP Installments | 10 | ||||

Convenience and Accessibility: Online KYC allows customers to complete the verification process from anywhere with internet access, providing the convenience of doing it at any time. Unlike physical KYC, which requires visiting a branch during business hours, online KYC is available 24/7, offering round-the-clock accessibility.

Speed and Efficiency: Online KYC allows for faster processing by eliminating manual paperwork and physical document verification, often enabling real-time customer verification. Additionally, it reduces waiting time, as customers no longer need to wait in long queues or schedule appointments to complete the process.

Better Security and Reduced Risk of Fraud: Online KYC uses advanced authentication methods like facial recognition, biometrics, and secure document uploads, reducing the risk of fraud. Additionally, digital data is encrypted and securely transmitted, minimizing the chances of documents being lost, tampered with, or stolen during verification.

Environmental Impact: Online KYC is a paperless process that eliminates the need for physical forms and documents, making it environmentally friendly by reducing paper waste and resource consumption.

Improved Customer Experience: Online KYC enables faster onboarding, allowing customers to start using services almost immediately. It's also less invasive, as many customers prefer simple document uploads or biometric verification over in-person meetings.

Overall, online KYC is a modern, efficient, and secure alternative to traditional physical verification, offering both businesses and customers substantial benefits in terms of time, cost, and security.

Officially Valid Documents (OVDs) are government issued documents that can be accepted as identity and address proof and defined as per Rule2(d) of PML Rules.

Investors whose KYC records have been validated by the KRAs do not need to undergo the KYC process again when approaching another intermediary in Mutual Funds. This is known as the portability of KYC records, and the new intermediary can retrieve the validated records from the KRA.

Central KYC Records Registry (CKYCR) is an initiative of the Government of India, which act as centralized repository of KYC records of all entities in the financial sector with uniform KYC norms and inter-usability of the KYC records across the sector. Once the KYC form is submitted, a unique KYC Identification Number (also known as CKYC Number) is generated and communicated to the investors by SMS/Email.

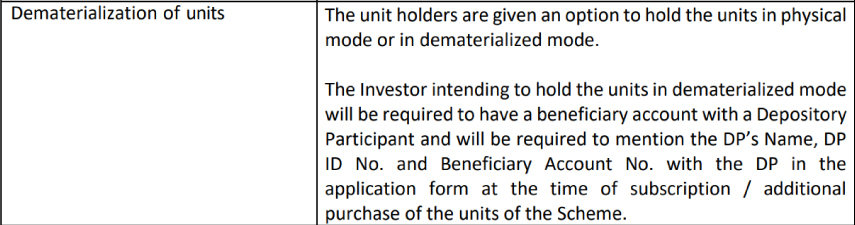

The unit holders are given an option to hold the units in physical mode or in dematerialized mode.

The Investor intending to hold the units in dematerialized mode will be required to have a beneficiary account with a Depository Participant and will be required to mention the DP’s Name, DP ID No. and Beneficiary Account No. with the DP in the application form at the time of subscription / additional purchase of the units of the Scheme.

It may be noted that the facilities viz. Switch in and out/ Systematic Withdrawal Plan (SWP) / Systematic Transfer Plan (STP) are currently not available in the dematerialized mode.

Yes. You can select different transaction type for each scheme as per your desire. However only one common transaction reference number will be generated for all the transactions submittedand shared with investor.

Note: One Inhouse reference number (IH number) will be generated for each scheme transaction for processing.

The Investment Objective of the scheme is to achieve long-term capital appreciation by investing in share of companies identified based on the Environment, Social and Governance (ESG) theme following Best in Class Strategy. There is no assurance that the Investment Objective of the Scheme will be achieved.

Please refer below table for the minimum amount required to invest or redeem in the Quantum ESG Best In Class Strategy Fund.

| Minimum Amount | Amount in Rs. |

|---|---|

| Initial Investment | Rs. 500/- and multiples of Re. 1/- thereafter |

| Additional Investment | Rs. 500/- and multiples of Re. 1/- thereafter / 50 units |

| Minimum Redemption/ Switch Out Amount | NIL |

Below are the folio-based Services Requests which can be requested using TPIN on IVR:

- Statement of Account (Both Email & Physical)

- Unlock User Id / PIN

- Reset Password

- Change Mobile Number

After appropriate selection of above-mentioned service request on IVR, a Service Request Id will be generated and sent on the registered 10 digit Mobile Number of the respective Folio Number.

Our server time at the instance of confirmation of the transaction will be considered as the final time to determine transaction time, cut-off time and consequentapplicable NAV.Also the NAV applicability will be basis scheme features and latest SEBI guidelines.

Yes. On acceptance of the application for subscription, an allotment confirmation along with the account statement (password protected) specifying the number of units alloted by way of email/or SMS (if the mobile number is not registered under the Do Not Call Registry) within 5 business days from the date of receipt of transaction request is triggered to the investor. The password to open transactional statements is Primary holder’s / Guardian PAN in capital letter

Note: For G-mail users here are the below steps to open the PDF statement:

- Click on the PDF attachment and enter the password

- Click on ‘Open With’

- Select ‘DocHub or Lumin PDF’

- Please enter your Password and click on create document

- After clicking on Create document it will open the document.

Thereafter, a CAS for each calendar month shall be sent by mail/email on or before 10th of the succeeding month to the unitholders.

Also you can generate the Statement of Account via login using password at our Invest Online Portal /Mail Back Facility.

Note: The password to open the statement generated via Login using password/Login using OTP/Mail Back facility will be the first holder / guardian PAN (in capital). For example, if the PAN is ABCDE1000F, then the correct password will be ABCDE1000F and not abcde1000f.

PAN Exempt Investor : Please enter the reference number provided by KRA (in capital) to open the attachment.

Please follow the below process for TPIN generation:

- Dial our toll-free number and press 3 from Main Menu

- Enter and confirm the folio number

- From the list of service options prompted in the next menu on the IVR [i.e – (1) Generate a new TPIN, (2) Enter TPIN and (3) Change TPIN], press 1 to select the Generate a new TPIN option

- A 5-digit TPIN will be sent to the Mobile Number registered with us under the respective folio number

Note: TPIN is triggered and sent only to the 10-digit Mobile Number registered with us in our records under respective folio number and it should not be prefixed with 0, 91, +91, 091, or +091 to enable them to receive TPIN through SMS. Currently, TPIN will not be triggered to the Overseas Mobile Number registered in the folio.

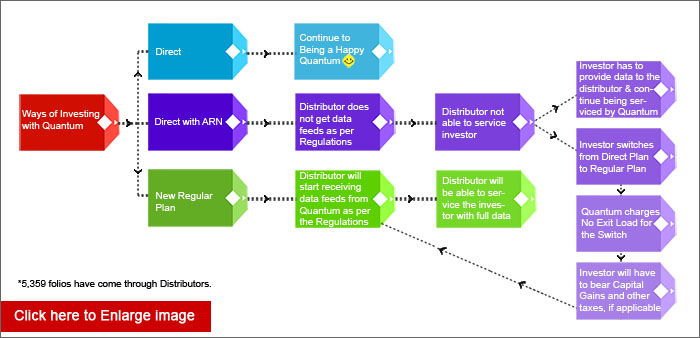

The chart below will explain what you need to do as an investor. In a nutshell, if you are a Direct investor with us, you need to simply sit back and relax as there’s nothing you need to do! ☺ - however if you have an ARN number along with your investment then the chart below will help you know the next steps

Quantum Mutual Fund does not deduct Transaction Charges and shall continue not to deduct Transaction Charges as allowed under SEBI Circular No. Cir / IMD / DF/13/2011 dated August 22, 2011.

You will get the email and SMS transaction confirmation after the successful processing of the transaction.

Only one common folio will be generated after the successful processing of multiple scheme transaction.

Note: The mode of payment viz, UPI and IMPS will be disabled if the total amount of purchase exceeds Rs. 100,000/-

If your already have an OTM/NACH registered in the respective folio, then you may either select OTM/NACH for making the payment or you may opt for NEFT / RTGS payment mode whereby you will be required to first transfer the payment to anyone of our Collection Bank Accounts (NEFT/RTGS Bank Detail); after transferring the investment amount, you may then initiate an additional purchase transaction on IVRS as per steps mentioned above and during this session, you will be prompted to enter the last 4 numeric digits of the NEFT/RTGS Bank Reference Number to complete the transaction request and further identification and tracking of funds.

If you do not have an OTM/NACH registered in the folio, we suggest you to register using Online / Offline Procedure. Please visit our FAQ section ‘One Time Mandate NACH’ for more information on the same. However, you may still use NEFT / RTGS payment mode as mentioned above.

Yes, to start Online SWP you must have a minimum balance of Rs.5,000/- in the scheme you wish to invest from.

The Quantum Ethical Fund is an open-ended equity scheme that invests in companies following ethical set of principles. The Fund uses a proprietary integrity framework to select businesses that align with values which is high on Ethics and Integrity. The Framework will exclude sectors such as alcohol, gaming, tobacco, vulgar entertainment, animation content provider, exhibition of films, media-broadcasting, media-content, production & distribution of films, mainstream/conventional financial services, leather, narcotics substance or anything largely harmful to society.

For NRI / PIO, copy of Passport / Persons of Indian Origin (PIO) Card / Overseas Citizenship of India (OCI) Card and Overseas Address proof in English language are required.

According to the Income Tax Department notification, NRIs without an Aadhaar number are exempted from linking their PAN with Aadhaar, provided they update their residential status as Non-Resident in the Income Tax records. However, NRIs who hold an Aadhaar number are advised to link their PAN with Aadhaar.

PLEASE NOTE THAT YOU NEED TO BE KYC COMPLIANT TO INVEST WITH US.

Click here to know more about KYC.

You can invest in our Schemes through the following three modes:| 1. | Through our Login portal |

| 2. | By submitting physical transaction requests offline |

| 3. | Through your mobile phone/computer using Mobile App, SMS, WhatsApp, Email. |

| 4. | Through the stock exchange platform |

| 5. | Through your financial advisor |

Please note that for ETF schemes i.e. Quantum Gold Fund ETF and Quantum Nifty 50 ETF you will have to read the respective SID of the schemes.

The returns from Multi-Asset Allocation fund can vary depending on factors such as the fund's investment strategy, market conditions, Asset Allocation. Generally, this fund aims to provide a balance between risk and return, seeking to deliver competitive returns over the long term while managing volatility.

Historically, Multi-Asset Allocation have offered returns that are typically higher than those of conservative investments like fixed deposit but lower than those of pure equity allocation. The actual returns can vary widely, ranging from moderate to potentially significant, depending on the fund's investment approach and the performance of the underlying assets.

The processing of transactions will be done as per applicable NAV in accordance with SEBI Mutual Fund Regulations i.e to consider cut off timing and availability of funds for utilization for determining the applicable NAV the provisions of the respective Scheme Information Documents of the Scheme will be considered.

In case of transaction submission through OTP option:

The transaction is deemed to be completed and processed subject to backend based additional validations.

Incase of transaction submission without OTP :

For the purpose of determining the applicable NAV in accordance with SEBI Mutual Fund Regulations, the system recorded date and time at the end of the verification / confirmation call will be considered. The transaction shall then be processed afterwards subject to further validity of request.

Note : There may be delay in delivery / difference in the date and time of the website request received at the server of the AMC and the date and time of the server through which you have sent the message and also the AMC server may not receive / reject the message sent by the you.

Currently the investors can do only new purchase transactions viz,

a. Only lumpsumb. Lumpsum with SIP

c. Only SIP

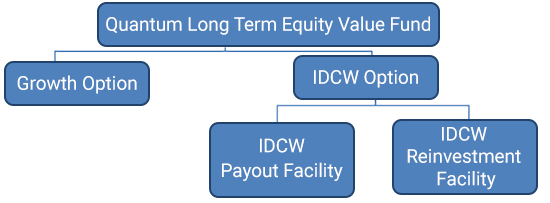

Investor subscribing under Direct Plan of a scheme will have to indicate ‘Direct Plan’ against the scheme name in the application form e.g. “Quantum Long Term Equity Value Fund – Direct Plan” and under ‘regular Plan’ “Quantum Long Term Equity Value Fund – Regular Plan”.

In case of valid application received without indicating any choice of plan then the application will be processed for plan as under:

| Scenario | Broker Code Mentioned by the investor | Plan mentioned by the investor | Default Plan to be captured |

| 1 | Not mentioned | Not mentioned | Direct Plan |

| 2 | Not mentioned | Direct | Direct Plan |

| 3 | Not mentioned | Regular | Direct Plan |

| 4 | Mentioned | Direct | Direct Plan |

| 5 | Direct | Not mentioned | Direct Plan |

| 6 | Direct | Regular | Direct Plan |

| 7 | Mentioned | Regular | Regular Plan |

| 8 | Mentioned | Not mentioned | Regular Plan |

In case of wrong/ invalid/ incomplete ARN codes mentioned on the application form, the application shall be processed under the Regular Plan. The AMC shall contact and obtain the correct ARN within 30 calendar days of the receipt of the application form from the investor/ distributor. In case, the correct code is not received within 30 calendar days, the AMC shall reprocess the transaction under Direct Plan from the date of application.

NAV (Net Asset Value) Applicability for Purchase:

For Liquid Funds: Where the application is received up to 1.30 p.m. on a Business Day at the official point(s) of acceptance and funds for the entire amount of subscription/ purchase (including switch in) as per the application are credited to the bank account of the Scheme and are available for utilization before the cut-off time (1.30 p.m.) - the Closing NAV of the day immediately preceding the day of receipt of application.

In respect of valid application received after 1.30 p.m. on a Business Day at the official point(s) of acceptance and funds for the entire amount of subscription / purchase (including switch in) as per the application are credited to the bank account of the Scheme on the same day or before the cut-off time of the next business day i.e. funds are available for utilization before the cut-off time (1.30 p.m.) of the next Business Day, the closing NAV of the day immediately preceding the next Business Days ;

For Non-Liquid Funds - Where the application is received up to 3.00 p.m. on a Business Day at the official point(s) of Acceptance and funds for the entire amount of subscription/ purchase (Including switch-in) as per the application are credited to the bank account of the Scheme and are available for utilization before the cut-off time (3.00 p.m.), the closing NAV of the day shall be applicable.

In respect of valid application received after 3.00 p.m. on a Business Day at the official Point(s) of acceptance and funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the Scheme on same day or before the cut-off time of the next business day i.e. funds are available for utilization before the cut-off time of next Business Daythe closing NAV of the next Business Day shall be applicable

NAV (Net Asset Value) Applicability for Redemption:

For Liquid Funds:Where the application is received up to 3 p.m. on a Business Day - the closing NAV of the day immediately preceding the next Business Day, shall be applicable.n respect of valid applications received after 3 p.m. on a Business Day - the closing NAV of the next Business Day shall be applicable.

For Non-Liquid Funds - IWhere the application is received up to 3 p.m. on a Business Day, the closing NAV of the day of receipt of application shall be

applicable.In respect of valid applications received after 3 p.m. on a Business Day, the closing NAV of the next Business Day shall be applicable.

NAV (Net Asset Value) Applicability for Switch:

Please refer our link https://invest.quantumamc.com/onlinenew/Switch%20Matrix.pdf on Switch Matrix for detailed information on NAV Applicable for switch transactions

The instant redemption amount will be credited to investor’s account (incase all pre-requisites are fulfilled). Also we endeavor to credit the amount into investor’s account within 30 minutes from the transaction time. Incase of any failure of instant redemption payment (due to any bank issue etc), the amount will be credited to investor’s account as per existing SEBI guidelines.

The redemption proceeds will be credited into the bank account selected while placing the instant redemption.

Note: The selected bank account should be IMPS enabled.

No. Instant redemption facility is not available for the demat investors.

The investment policies of the Scheme shall be as per SEBI (Mutual Funds) Regulations, 1996, and within the following guideline. The asset allocation under the Scheme, under normal circumstances, will be as follows:

| Instruments | Indicative Allocation (% of Net Assets) | |

| Minimum | Maximum | |

| Equity & Equity Related Instruments of Companies identified based on ESG theme folloiwng Best in Class Stratergy | 80 | 100 |

| Money Market Instruments and Liquid Schemes of Mutual Fund | 0 | 20 |

The proportion of the scheme portfolio invested in each sector will vary to track sector weights that of a broad well-diversified indices to ensure portfolio diversification. The proportion of the scheme portfolio invested in each type of security within the sector will vary depending upon a comprehensive analysis of the company based on the Environmental, Social and Governance factors impacting the company and their peer group within its sector of operations.

The above asset allocation is only indicative and may change from time to time, keeping in view the market conditions and applicable rules and regulations.

View the current portfolio,select the scheme name along with the year and month that you wish to view.

Click here to view the entire list of who cannot invest?

The Investment Objective of the scheme is to achieve long-term capital appreciation by investing in Equity & Equity Related Instruments of companies following an Ethical Set of Principles. There is no assurance that the investment objective of the scheme will be achieved.

NAV Applicability

If the valid application received up to 3.00 p.m. on a Business Day at the official point (s) of acceptance and funds for the entire amount of subscription/ purchase (including switch-in) as per the application are credited to the bank account of the respective Scheme and are available for utilization before the cut-off time (3.00 p.m.)- the closing NAV of the day shall be applicable. If the valid application received after 3.00 p.m. on a Business Day at the official point (s) of acceptance and funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the respective Scheme on same day or before the cut - off time of the subsequent Business Day i.e. funds are available for utilization before the cut-off time of subsequent Business Day- the closing NAV of the subsequent Business Day shall be applicable;

Irrespective of the time of receipt of application at the official point(s) of acceptance, where the funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the respective Schemes on or before the cut - off time of the subsequent Business Day i.e. funds are available for utilization before the cut-off time of subsequent Business Day - the closing NAV of such subsequent Business Day shall be applicable;

For Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), Dividend Transfer Facility:

The units will be allotted based on which the funds are available for utilization by the respective schemes / target schemes irrespective of the installment date of the SIP, STP or record date of dividend declarations. It may also be noted that allotment of units in the normal course will be based on realization of amount of subscription or the date of receipt of application or the date of instalment (in case of SIP) whichever is later if both realization and application dates are different.

Further, if the time of realization of funds can’t be ascertained then the allotment of units will be as per the day and date of realization of amount of subscription.

The minimum amount for the instant redemption per day per PAN, is Rs. 500/- and multiple of Rs.1/ - thereafter.

With effect from 01st March, 2019 the maximum redemption amount shall be Rs. 50,000 or 50% of latest value of investment (as per last available NAV on records) in the scheme, whichever is lower. This limit shall be applicable per calendar day, per scheme, per investor.

The Instant Redemption transaction will be processed by applying lower of Previous Day NAV or Prospective NAV.

- (a) When the application is received up to 3.00 pm – the lower of (i) NAV of previous Calendar Day and (ii) NAV of Calendar Day on which application is received; will be considered.

- (b) When the application is received after 3.00 pm – the lower of (i) NAV of the Calendar Day on which such application is received, and (ii) NAV of the next Calendar Day will be considered.

For units issued in demat or non-demat form – purchase, dividend reinvestment, switch – stamp duty will be deducted from the net investment amount i.e., gross investment amount less any other deduction like transaction charge. Units will be created only for the balance amount (Net investment amount – stamp duty deducted). Stamp duty will be computed @0.005% on an inclusive method using the formula - ((Investment amount – transaction charge/TDS if any) / 100.005) * 0.005.

Illustration:

Transaction Amount: Rs. 1,00,100

Transaction Charges:/TDS applicable if any: Rs.100

Stamp Duty charged : Rs. 5 ((Transaction Amount - Transaction Charges/TDS applicable if any) * 0.005%

NAV: Rs.10 per unit

Units allotted : 9,999.50

Units value : Rs. 99995.00

The following features are available in the scheme during ongoing period:

Systematic Investment Plan (SIP): This feature enables investors to save and invest periodically over a long period of time.Click here to know more about SIP in detail.

Systematic Withdrawal Plan (SWP): This feature enables an investor to withdraw amount/units from their holdings in the Scheme at periodic intervals through a one-time request. Click here to know more about SWP in detail

Systematic Transfer Plan (STP): This feature enables an investor to transfer fixed amounts from their accounts in the Scheme to another scheme within a folio from time to time.Click here to know more about STP in detail.

Switch options: Click here to view switch matrix for the applicable NAV.

Triggers:

A trigger is facility that allows you to specify an exit target (linked to value or time) or to receive an update when the desired levels are reached. The moment this target is achieved, the trigger gets activated. There can be Alert triggers or Action trigger. Click here to view the FAQ on Trigger Facility

It can be obtained from any of the Local Operating Units (LOUs) accredited by the Global Legal Entity Identifier Foundation (GLEIF), the body tasked to support the implementation and use of LEI. In India, LEI can be obtained from Legal Entity Identifier India Ltd. (LEIL) (https://www.ccilindia-lei.co.in), which is also recognised as an issuer of LEI by the Reserve Bank.

Yes. As per RBI circular (RBI/2020-21/82 DPSS.CO.OD No.901/06.24.001/2020-21) 20-digit LEI code of remitter and beneficiary (non-individuals) are mandatory w.e.f. 1.4.2021 for NEFT/RTGS transactions amounting to Rs. 50 crores and above.

| Scheme Name | Direct Plan | Regular Plan |

Quantum Long Term Equity Value Fund | 1.10% | 2.00% |

Quantum ELSS Tax Saver Fund | 0.90% | 2.00% |

Quantum Liquid Fund | 0.15% | 0.25% |

Quantum Dynamic Bond Fund | 0.51% | 0.96% |

Quantum Equity Fund of Funds | 0.51% | 0.75% |

Quantum Gold Savings Fund | 0.06% | 0.21% |

Quantum Multi Asset Fund of Funds | 0.10% | 0.47% |

Quantum India ESG Equity Fund | 0.83% | 2.08% |

Expense ratio for Quantum NIFTY 50 ETF is 0.094%

The KIN will be allotted by CERSAI within 4 – 5 working days.

· Dedicated Relationship Manager

· Online E-KYC for your investors

· Investor Awareness Programs for your investors

· Path to Partnerships An exclusive Awareness & Education initiative for Partners to provide them with a broad perspective on the Mutual Fund industry and tips to upscale their advisory growth journey

· Regular market & investment updates

· ARN EMBEDDED URL - which allows partners to forward and garner transactions

Yes, subject to RBI and FEMA guidelines.

The Scheme will invest in the units of Quantum Nifty 50 ETF (Q Nifty), a mutual fund scheme Replicating / Tracking Nifty 50 Index - in the form of an Exchange Traded Fund.View the current portfolio,select the scheme name along with the year and month that you wish to view.

As your income grows year after year – whether through a new job or your business reaching new milestones – it's important to remember that expenses are also on the rise. They don’t stay stagnant; they tend to increase as well. This is where SIP Top-Ups come into play. They allow you to gradually increase your SIP investments, giving your portfolio a much-needed boost. Think of it as a workout for your investments: the more you contribute, the stronger they become. The key factor here is compounding. By utilizing SIP Top-Ups, you harness the power of compounding over the long term, helping you work towards building substantial wealth.

Yes, for financial and non-financial transactions made via Email, SMS, or WhatsApp, the AMC will make a verification call.

Upon emailing a transaction request, the investor will receive an automated acknowledgment of receipt. This does not indicate acceptance of the request. The AMC will contact the investor on their registered number via a recorded call for verification of transaction, even if the number is on the Do Not Disturb (DND) list. If confirmation cannot be completed, the request will be rejected.

Following successful verification, the AMC will send an email confirming acceptance or rejection of the transaction. This email will serve as the official response and determine further processing, subject to the validity of the request and due diligence.

If the investor is ineligible, the SIP will still be processed but will be treated as a regular SIP, not a Choti SIP.

To modify, send a revised email before the cut-off time. Changes cannot be made once the AMC has initiated the confirmation or verification call.

To cancel a transaction, send a cancellation request via email before the transaction date’s cut-off time.

No modification/cancellation requests received after the cut-off time will be processed.

Income from mutual funds is either:

A) Capital Gains – Capital Gain means appreciation in the value of investment over the period of time; in simple terms it is profit earned on sell of your investment for example if you buy something for Rs. 1 Lakh & sell it for Rs. 1.5 Lakh, you have made a Capital Gain of Rs. 50,000. Capital Gains are further divided into short-term & long-term depending on their investment horizon.

B) IDCW (Income Distribution cum Capital Withdrawal)- It refers to a payout option where investors receive a portion of the fund’s income and capital gains in the form of regular payouts. These payments can be made daily, monthly, quarterly, half-yearly, or annually, depending on the terms of the fund.

No. Tax is applicable only when you redeem, switch, or withdraw from your mutual fund. Merely holding the investment does not trigger any tax liability.

Investments can be made only through NACH (National Automated Clearing House).

Requests for financial transactions may be submitted via email from the official email ID of an authorized official. This request must include a completed application form, signed either with a wet signature or through a valid digital method—such as a Digital Signature Certificate (DSC) or an Aadhaar-based e-signature—by the authorized signatory.

Such email requests will be accepted even if they are not sent from the registered email ID of the authorized official.

In addition, below conditions are required to be fulfilled :

- The sender’s email domain matches the official domain of the entity.

- The attached application form is properly signed by the authorized signatory(ies).

- The registered email ID of an authorized official or signatory is included in the CC field of the email.

Yes, it is taxable and added to your total income

INVESTOR | INCOME TAX RATE |

Resident Individuals / HUF /Domestic Company | Applicable Slab rates + Surcharge as applicable + 4 % Health & Education Cess |

Non-Resident | 20% plus Surcharge as applicable + 4% Health & Education Cess |

INVESTOR | INCOME TAX RATE |

Resident Individuals / HUF /Domestic Company | 10% (If income distributed is more than Rs.10,000 during Financial Year) |

Non-Resident | 20% plus Surcharge as applicable + 4% Health & Education Cess |

Like any other equity mutual fund scheme, capital gains are taxed based on the holding period.

• Long-term Capital Gains (Holding period more than 12 months): Gains exceeding Rs 1,25,000/- in a year are taxable at 12.5% without indexation.

• Short-term Capital Gains (Holding period less than 12 months): Taxable at 20%.

For further details, please refer to the SID (Scheme Information Document) (NFO)

SWP instructions will take 5 business days for registration with the registrar. The first withdrawal will be carried out only after the registration.

The Quantum Ethical Fund is for investors seeking long-term growth while adhering to value-based ethical standards. The fund invests in businesses that prioritize social good, ethical governance and not harmful to society.

Please Click here for detailed FAQ on the revised KYC norms.

| Frequency of STP | Eligible dates for effect | Minimum amount per Instalment | Minimum term/duration applicable |

| Daily | All Business days | ₹100 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 30 Business days |

| Weekly | Any day of the week | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 10 instalments |

| Fortnightly | Any day of alternative Week | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 10 instalments |

| Monthly | Any date (except 29, 30, 31st) | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 12 instalments |

| Quarterly | Any date (except 29, 30, 31st) | ₹500 and in multiple of ₹1 thereafter (for ELSS ₹ 500 and in multiples of ₹ 500) | 12 instalments |

| Minimum Balance to start STP : ₹5000/- | |||

We are tied up with Shariahcap Advisors for being Shariah compliant.The Shariah Compliance certificate for the scheme shall be uploaded on our website on every half yearly basis viz. by 31st March and 30th September every year, respectively.

Central KYC Registry is a centralized repository of KYC records of customers in the financial sector with uniform KYC norms and inter-usability of the KYC records across the sector with an objective to reduce the burden of producing KYC documents and getting those verified every time when the customer creates a new relationship with a financial entity. Once the CKYC is complete for an Investor, he / she is allotted a 14-digit unique KIN (KYC Identification Number) which needs to be quoted by the investor while doing any transaction.

Central Registry of Securitization Asset Reconstruction and Security Interest (CERSAI) is acting as Central KYC Registry (CKYCR). CERSAI is a central online security interest registry of India authorized by the Government of India to act as and to perform the functions of the Central KYC Records Registry under the PMLA (Prevention of Money-Laundering) rules 2005, including receiving, storing, safeguarding and retrieving the KYC records in the digital form for a client. CERSAI will act as central repository of KYC records of investors in the financial services sector with uniform KYC norms.

You need to submit the following documents:

a) Duly filled and signed CKYC application form OR KRA application form + Supplementary CKYC form

b) One proof of Identity (self-attested copy)

c) One proof of Address (self-attested copy)

d) One photograph

Central KYC Registry has the below salient features:

I. Facilitates uniformity & inter-usability of KYC records & process across the financial sector.

II. Unique KYC identifier linked with independent ID proofs.

III. Substantial cost reduction by avoiding multiplicity of registration and data upkeep.

IV. KYC data and documents stored in a digitally secure electronic format.

V. Facilitates KYC Search, Upload, Download, Update.

VI. Secure and advanced user authentication mechanisms for system access

VII. Data de-duplication to ensure single KYC identifier per applicant.

VIII. Real time notification to institutions on updation in KYC details.

IX. Seamless file exchange processes without the need for manual intervention.

X. API’s for search and download allow for real time account opening for CKYC compliant customers.

As per the PML Rules, registered intermediaries are required to capture KYC information and share it with the Central KYC Records Registry in accordance with the PML Rules and the KYC template finalized by CERSAI.

A beneficial owner is the natural person or persons who ultimately own, control, or influence an investor and/or the individuals on whose behalf a transaction is conducted. It also includes those who exercise ultimate effective control over a legal entity or arrangement.

KYC – is the known and regular process in the Mutual Fund industry whereby the identity of an investor is verified based on written details submitted by him / her on a form, supplemented by an In Person Verification (IPV) process. Once the verification is done successfully, the relevant investor data is entered into the KRA Registration Agency (KRA) system and subsequently uploaded to their database.

eKYC – is KYC done with the help of a investor’s Aadhaar number. While completing the eKYC, the authentication of the investor’s identity can be done:

(a) Via One Time Password (Limits investments to Rs 50,000 per year per mutual funds and mandates investments via the online electronic mode)

(b) Via Biometrics (No limits on the investment amount here unless those specifically imposed by the scheme / Fund House)

This data is uploaded into the records of the KRA.

CKYC – is an initiative of the Government of India where the aim is to have a structure in place which allows investors to do their KYC only once. CKYC compliance will allow an investor to transact / deal with all entities governed / regulated by Government of India / Regulator (RBI, SEBI, IRDA and PFRDA) without the need to complete multiple KYC formalities which is an inconvenience / hindrance as of now. It will allow for larger market participation by investors, easing their journey on the financial highway. The CKYC processing is handled by CERSAI.

In terms of section 56(2)(x) of the Act, any property (other than immovable property) transferred without consideration or for an inadequate consideration (as provided in section 56(2)(x)(c) of the Act) will be taxable in the hands of recipient assessee. The term “property” includes shares and securities. Units of a mutual fund could fall within the purview of the term “securities”.

Yes. Investors must provide a mobile number to the AMC to receive statutory disclosures and updates.

Currently CKYC is applicable to Individuals only (Resident Individuals & Non-Resident Indian). Any individual customer who has never done KYC with KYC Registration Agency (KRA) and whose KYC is not registered in the KRA as well as CKYC system is required to complete the CKYC process.

Existing investors who are registered or verified in the KRA system can continue making investments without any additional documentation. However, for any modification to their existing records, they need to fill up the CKYC form.

In the digital KYC process, the investor’s photograph is captured, and the acceptance of officially valid documents is facilitated through technology-assisted methods such as DigiLocker, online/offline biometric Aadhaar, live video capturing, time stamping, and geo-location tagging to verify that the physical location is within India. A live face verification is also conducted. In the online KYC mode, the documents, along with the wet or cropped signature, are e-signed.

Income Tax Slab for FY 2025-26 (AY 2026-27) is as follows

Income Tax Slab Rate for New Tax Regime

The following tables show the Revised Income Tax Slabs. The table for the new tax regime slabs-

Net Taxable Income | New Tax Regime - F. Y. 2025-26 (A.Y. 2026-27) |

Rs. 0 to Rs. 4,00,000 | NIL |

Rs. 4,00,001 to Rs. 8,00,000 | 5% |

Rs. 8,00,001 to Rs. 12,00,000 | 10% |

Rs. 12,00,001 to Rs. 16,00,000 | 15% |

Rs. 16,00,001 to Rs. 20,00,000 | 20% |

Rs. 20,00,001 to Rs. 24,00,000 | 25% |

More than Rs. 24,00,000 | 30% |

Income Tax Slab Rate for Old Tax Regime

The table for the old tax regime slabs-

Net Taxable Income | Old Tax Regime - F. Y. 2025-26 (A.Y. 2026-27) |

Rs. 0 to Rs. 2,50,000 | NIL |

Rs. 2,50,001 to Rs. 5,00,000 | 5% |

Rs. 5,00,001 to Rs. 10,00,000 | 20% |

More than Rs. 10,00,000 | 30% |

Income Tax Slab for People Between 60 to 80 Years

Net Taxable Income | Rates |

Rs. 3 lakhs | NIL |

Rs. 3 lakhs - Rs. 5 lakhs | 5% |

Rs. 5 lakhs - Rs. 10 lakhs | 20% |

Rs. 10 lakhs and more | 30% |

Income Tax Slab for People More than 80 Years

Net Taxable Income | Rates |

Rs. 0 - Rs. 5 lakhs | NIL |

Rs. 5 lakhs - Rs. 10 lakhs | 20% |

Above Rs. 10 lakhs | 30% |

Transfer requests are processed within T+2 working days, where T refers to the date of submission of the request.

No. CKYC requires additional information (for e.g. – investor’s maiden name, mother’s name, FATCA information etc) to be collected and submitted to CERSAI for completion of the CKYC formalities of an investor. Date of Birth is a mandatory information under CKYC. All required documentation including proof of identity and proof of address are mentioned in the CKYC form.

e-Sign Electronic Signature Services is an innovative initiative that enables easy, efficient, and secure signing of electronic documents by authenticating the signer through Aadhaar e-KYC services. This service allows any Aadhaar holder to digitally sign electronic documents without the need for a physical digital signature dongle. Electronic signatures facilitated through e-Sign Online Electronic Signature Services are legally valid.

Money laundering has become a big problem worldwide threatening the stability of various regions by actively supporting and strengthening terrorist networks and criminal organizations. The links between money laundering, organized crime, drug trafficking and terrorism pose a risk to all financial institutions. This means that we need to know and understand our investors in a much better manner that ever before.

With this in mind, the Government / Regulatory Bodies are introducing new and novel ways, enabling people to complete their KYC formalities in a quick and convenient manner. The targeted aim is to ensure that an investor does his / her KYC formalities only once, post which the focus for the investor can subsequently shift towards the actual dealing with the financial institutions.

Yes, an investor can provide written authorization stating their relationship with the third party to use the third party's address as the correspondence address, provided that all the prescribed 'Know Your Investors' (KYC) norms for the third party are also fulfilled.

Yes. Investors are required to update KYC records as and when there is any change/modification in the KYC information submitted.

PAN is not required to be mandatorily mentioned by the applicant on the CKYC application form provided by CERSAI. This form will be used by institutions which do not require PAN to be provided mandatorily for account opening / transaction purposes.

However, from the securities markets perspective, PAN is a mandatory requirement and therefore the said CERSAI form has been modified at our end and investors approaching us for completing CKYC have to mandatorily provide us with their PAN. The KYC type has to be selected as ‘Normal’ on the CKYC application forms and in case any investor does not have a PAN, the KYC type should be selected as ‘PAN Exempt Investors’.

If correspondence and permanent address are different, then proof for both is to be provided. However, if an investor has provided Aadhaar / Aadhaar number for identification and wants to provide a current address, which is different from the address indicated in the Aadhaar, the investors may give a self-declaration to that effect to the respective intermediary.

You need to submit both proofs of identity as well as address.

For identity proof, you may submit any one document - PAN/ passport / voter ID/ driving license / Aadhaar card / NREGA job card / any other document notified by central government.

For address proof, you may use the same proofs as submitted as identity proof (except the PAN, since that does not specify the address). If your permanent address is different from the correspondence address, then you need to submit proof for both the addresses.

Copies of all documents that are submitted need to be compulsorily self-attested by the applicant and accompanied by originals for verification. In case the original of any document is not produced for verification, then the copies should be properly attested by entities authorized for attesting the documents. For more details, please refer to the “instructions / guidelines” over-leaf on CKYC / Supplementary CKYC form.

Yes, investors are required to change their name in KYC by submitting a modification form along with a self-attested copy of the documentary proof showing the new name.

KRA validation refers to the process of verifying and validating the KYC attributes of KYC records stored in the KRA.

For completing the CKYC process, the customer is required to visit the nearest Point of Service /Point of Acceptance and furnish the duly filled in CKYC form, all the required documents (duly attested) as prescribed under CKYC.

Further, if any prospective investor uses the old KYC form, which does not have all information needed for registration with CKYC, such customer should either be requested to provide additional/missing information using a supplementary CKYC form or fill the new CKYC form.

In the case of multiple Partners registered under a folio, each Partner will only be able to view the transactions for which they are the distributor.

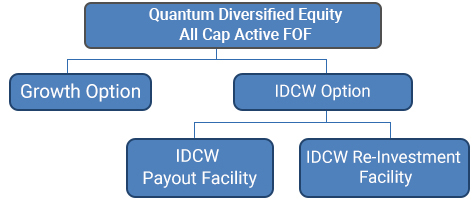

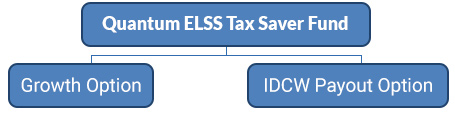

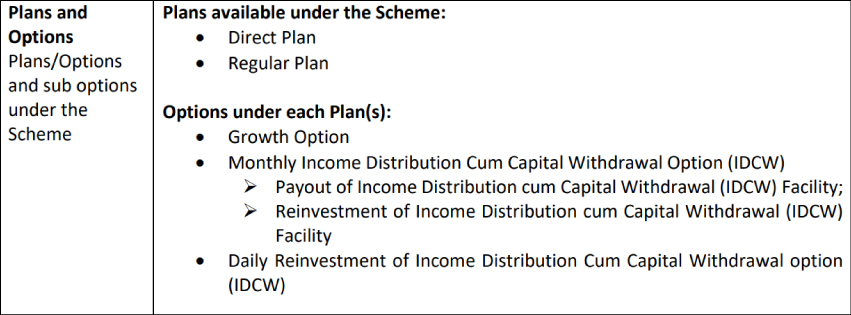

Plans available under the Scheme:

• Direct Plan

• Regular Plan

Options under each Plan(s):

Growth Option - The income attributable to Units under this Option will continue to remain invested and will be reflected in the Net Asset Value of Units under this Option.

Please refer this link https://www.ckycindia.in/ckyc/assets/images/CKYCvideoforReportingEntities.mp4

As per the SEBI Circular no. CIR/IMD/DF/21/2012 dated September 13, 2012, a new cadre of distributors are categorized such as postal agents, retired government and semi-government officials (class III and above or equivalent), retired teachers and retired bank officers with a

service of at least 10 years, and other similar persons (such as Bank correspondents) as may be notified by AMFI/ AMC from time to time, has been allowed to sell units of simple and performing mutual fund schemes.

Subsequent to SEBIs circular, AMFI included the following persons under the new cadre:

1) Intermediaries/ Agents engaged in distribution of financial products e.g. insurance agent, FD agent, National Savings Scheme products, PPF, etc. registered with any other Financial Services Regulator.

2) Business correspondents appointed by Banks.

Simple and performing mutual fund schemes shall comprise of diversified equity schemes, fixed maturity plans (FMPs) and index schemes and should have returns equal to or better than their scheme benchmark returns during each of the last three years.

Yes, These new cadre of distributors are required to complete a simplified form of National Institute of Securities Market (NISM) certification. The NISM has launched the Continuing Professional Education (CPE) and Test programme for the new cadre of Distributors and

registration for the same commenced from January 14, 2013.

KIN is being allotted by CERSAI to investors whose CKYC application is found to be valid. An SMS / email will be sent by CERSAI to the registered mobile number of the investor as soon as the KIN is generated at their end. Since CERSAI will not be sending any physical intimation, applicants should ideally provide their mobile number and/or email ID in the CKYC application form.

For the commission structure, empanelled distributors can reach out to their relationship manager or email us with their ARN details at [email protected]

Any AMFI/NISM Certified Intermediaries involved in marketing and selling Mutual Fund schemes must be registered with AMFI after passing the AMFI/NISM Certification Test and obtaining an ARN. Valid ARN cardholders are eligible to empanel with Quantum Mutual Fund. The following entities can partner with us: individuals, sole proprietorships, partnership firms, companies, societies, banks, trusts, and others.

Investors who are already allotted a KIN are considered as CKYC compliant. Such investors do not need to submit any more documents for CKYC compliance. However, please ensure to keep the KIN details readily available as it needs to be mentioned on the application form at the time of investing.

Online: Upon successful submission, individual distributors will receive empanelment confirmation in real-time. For non-individual distributors, empanelment confirmation will be sent via email within 3 business days, subject to document verification.

Offline: For physical form submissions, MFDs will receive empanelment confirmation via email within 10 business days.

Yes, investors can switch from the Direct Plan to the Regular Plan. However, for the switch to be processed in a Regular Plan, the ARN mentioned or provided in the request must first be empanelled with Quantum Mutual Fund. This switch will not incur any exit load.

1. Helps Combat Inflation

With the average annual inflation rate in India hovering around 7.5%, your purchasing power is likely to decrease over time if your investments don’t keep pace with rising costs. By increasing your SIP contribution by a percentage equivalent to or greater than the inflation rate, you can ensure that your investments grow in line with inflation. This way, you preserve the real value of your investments and ensure that your financial goals remain achievable despite rising expenses.

2. Aligns with Your Income Growth

As your income grows, it makes sense to increase your savings accordingly. By setting up SIP top-ups that match your income growth, you can continue to invest without straining your finances. This strategy allows you to save more over time without altering the percentage of your income allocated to investments, helping you build wealth in tandem with your increasing earnings.

3. Achieve Financial Goals More Quickly

Increasing your SIP contributions through top-ups can accelerate the growth of your investment corpus. Since you're consistently increasing your investment amount, you may reach your financial targets sooner than initially expected. This strategy helps you accumulate the necessary funds faster, reducing the time it takes to achieve your long-term financial objectives and enhancing the potential for higher returns.

4. Operational Ease

One of the key advantages of SIP Top-Ups is the ease with which they can be implemented. Once you set up your SIP top-up option, the increments are automatically applied at the specified intervals, whether monthly or annually. This eliminates the need for manual adjustments and ensures that your investments continue to grow without any extra effort. It offers a seamless and hassle-free way to enhance your investment plan without worrying about remembering to increase your contributions. This level of automation provides both convenience and consistency, making it easier to stay on track with your long-term financial goals.

Non-financial transaction requests should be sent to:

- Email: [email protected]

- SMS / WhatsApp: +91-9243223863

Requests sent to other email IDs or mobile numbers will not be accepted.

The email must include a scanned, signed transaction form, which can bear:

- Wet (physical) signature

- Digital Signature Certificate (DSC)

- Aadhaar-based e-signature

Yes. Here's how NAV is determined:

Event | Time |

Transaction sent by investor | 3:00 PM |

Received by sender’s service provider | 3:05 PM |

Received by AMC/Registrar | 3:10 PM |

Verification call made by AMC | 4:00 PM |

Verification call completed | 4:04 PM |

Applicable NAV | 4:04 PM, if funds are received in time |

Yes, investors who have invested through the channel partner mode may also execute transactions via email, provided that the required channel partner details (such as ARN code and EUIN code) are clearly mentioned in the email

For folios in demat mode for non-ETF schemes, only additional purchase transactions will be allowed.

No. To open a new folio, please apply through:

- The official Quantum AMC website, or

- Submit a physical application.

A) Growth plans: In Growth Plan, profits and incomes are reinvested back in the scheme, and tax arises only at the time of redemption of such units as capital gains.

B) IDCW plans: In IDCW Plans, tax is applicable only at the time of each distribution, and the entire IDCW amount is added to your income and taxed as per your slab. TDS is deducted by mutual fund as per the applicable TDS rates.

No. Taxation rules are same for both sip and lumpsum investments. However, each SIP instalments is treated as a separate investment for capital gains calculation. So, the holding period and tax computation is done for each SIP separately.

Exit Load is a fee charged by the AMC when you redeem or switch out of a mutual fund before a *pre-defined period. in simple terms think of exit load like a small fine if you take out your money too soon, it’s like when you break a FD early and bank charges small penalty for it.

Note :* pre-defined period differs from scheme to schemes.

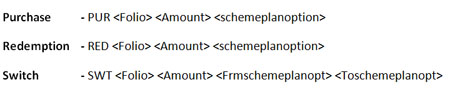

The following details are mandatory:

• Folio Number

• Scheme Name

• Transaction Type (Purchase, Redemption, Switch, etc.)

• Amount or units

• Mode of payment

• Funds Transfer Reference Number

Please ensure that all the above details are mentioned by you in your email to us for a transaction.

Transmission of units is done in the event of the death of the first unit holder wherein only the transfer of units will take place from the unit holder’s name to the claimant’s name.

Process:

| 1. | Applicants/Claimants should submit the prescribed documents as per situation as specified in the AMFI Circular. |

| 2. | The transmission process is specific to mode of holding. Kindly click here for the list of documents & annexures to be submitted for transmission of units. |

Note:

| i. | The redemption request given with transmission will not be processed and the claimant will have to submit a redemption request after the transmission is completed. |

| ii. | A new folio will be created for all transmission cases. |

| iii. | For Death Certificate (DC) issued outside India, the DC should be attested by Indian Embassy located in the country issuing the DC or embassy of the country issuing DC located in India. |

Kindly refer to AMFI guidelines on the same for additional details.

Note :

a. The ongoing systematic transactions (SIP/STP/SWP) will be terminated post the transfer of units into the new folio.

Post the transfer of units, the claimant has to provide the new folio number allotted to him for any financial/non-financial transaction.

b. As per the ELSS, in the event of the death of the 'Assessee', the nominee or legal heir as the case may be shall be able to withdraw the investment only after the completion of1 (one) year from the date of allotment of the Units to the 'Assessee'. Accordingly, transfer of Units (allotted to 'Assessee' as defined under the ELSS) to nominees as mentioned above will be carried out only after the completion of 1 (one) year from the date of its allotment. The restriction of 3 (three) year shall apply to units allotted to investors other than the deceased 'Assesses' referred to above.

Currently, the SIP Top-Up facility is applicable only to new SIP enrolments.

Yes. Investors may transfer funds before or during the submission of their transaction request, using their registered bank account.

To know more about online investing please Click Here.

Quantum Mutual Fund has aimed at making the email transaction process as safe and secure as possible for our investors. The email transaction is validated only after fulfilling these two criteria.

• The email is sent from the registered email id.

• The email transaction is authenticated by the investor through a call made to their registered contact number.

In case of any of the above criteria is not fulfilled, the transaction will be considered as void and rejected with confirmation to the Unitholder.

The Entity must submit a Board Resolution or Authority Letter on its letterhead authorizing specific officials to transact. This must include:

- Names, designations, and official email IDs of the authorized officials.

- An undertaking that email instructions from these officials will be binding on the Entity as if signed physically.

All financial transaction requests must be emailed to:

Emails sent to other addresses will not be accepted.

Securities Transaction Tax or STT, is a type of direct tax levied by the Government of India on the sale or purchase of securities. Generally, the STT is associated with stock investments. Still, it also applies to equity-oriented mutual funds when investors sell their units.

Only equity-oriented mutual funds attract STT. No STT is applicable on the sale and purchase of debt-oriented funds. When an investor sells their units on a stock exchange or redeems them by selling them back to the fund house, STT is charged at 0.001% of the total value at which the units are sold.

The STT in mutual fund transactions is always borne by the seller of the units whether they sell their units on the stock exchange or redeem them through the fund house. In the case of units that can be traded on the market, like exchange-traded funds or closed-ended funds, the seller pays 0.001% STT on the sale price.

Investor need to fill the application form available on Link ETF Transaction Slip and submit at the Official Point of Acceptance of the AMC.

A. Investors can directly approach the AMC for redemption of units of ETFs, for transaction of upto INR 25 Cr. without any exit load, in case of the following scenarios:

i. Traded price (closing price) of the ETF units is at discount of more than 1% to the day end NAV for 7 continuous trading days, or

ii. No quotes for such ETFs are available on stock exchange(s) for 3 consecutive trading days, or

iii. Total bid size on the exchange is less than half of creation units size daily, averaged over a period of 7 consecutive trading days.

B. In case of the above scenarios, applications received from investors for redemption up to 3.00 p.m. on any trading day, shall be processed by the AMC at the closing NAV of the day.

C. The above instances shall be tracked by the AMC on a continuous basis and in case if any of the above mentioned scenario arises, the same shall be disclosed on the website of AMC under respective Scheme Product page.

Investors need to submit the off-market “Delivery Chalan” to transfer the units from their DP account to scheme’s DP account. This Delivery Challan need to be submitted to your DP and acknowledgement to be attached with our transaction slip. Please click here to download the ETF Transaction Slip.

Above application can be submitted to our AMC branch or Kfintech Collection Center nearest to you. Please click here to locate the address closest to you.

Alternatively, you can also email us the above applications from your registered Email Id to our Transact Id – [email protected].

AMC will make the payment in your bank account linked with demat account within T+2 working days, T being the date of transaction.

The redemption request received from investors during the liquidity window upto 3.00 pm. on any trading day, shall be processed by the AMC at the closing NAV of the day.

Investor need to fill the application form available on Link ETF Transaction Slip and submit at the Official Point of Acceptance of the AMC.

Investors need to submit the off-market “Delivery Chalan” to transfer the units from their DP account to scheme’s DP account. This Delivery Challan need to be submitted to your DP and acknowledgement to be attached with our transaction slip. Please click here to download the ETF Transaction Slip.

Above application can be submitted to our AMC branch or Kfintech Collection Center nearest to you. Please click here to locate the address closest to you.

Alternatively, you can also email us the above applications from your registered Email Id to our Transact Id – [email protected].

A. Investors can directly approach the AMC for redemption of units of ETFs, for transaction of upto INR 25 Cr. without any exit load, in case of the following scenarios:

i. Traded price (closing price) of the ETF units is at discount of more than 1% to the day end NAV for 7 continuous trading days, or

ii. No quotes for such ETFs are available on stock exchange(s) for 3 consecutive trading days, or

iii. Total bid size on the exchange is less than half of creation units size daily, averaged over a period of 7 consecutive trading days.

B. In case of the above scenarios, applications received from investors for redemption up to 3.00 p.m. on any trading day, shall be processed by the AMC at the closing NAV of the day.

C. The above instances shall be tracked by the AMC on a continuous basis and in case if any of the above mentioned scenario arises, the same shall be disclosed on the website of AMC under respective Scheme Product page.

Investor can submit the request either to their Depository Participant (DP) / AMC branch / Kfintech Collection Centers.

Changes must be submitted through:

Must be supported by a Board Resolution or Authority Letter (Any change in the List of Authorised Signatories shall be submitted to the AMC along with a copy of the Board Resolution or on the Entity’s letter head).

The physical letter (including of scan copy thereof) shall be required to send to [email protected] / [email protected].

Yes, provided that:

- A completed application form signed either with a wet signature or through a valid digital method—such as a Digital Signature Certificate (DSC) or an Aadhaar-based e-signature—by the authorized signatory is provided.

- An authorization letter from the non-individual unitholder must be submitted, permitting the MFD or authorized representative to send scanned, signed transaction forms or request letters on behalf of the Entity.

- The registered email ID of the non-individual unitholder must be included in the CC field of the email sent by the MFD/authorized representative.

Yes. The Entity must register a designated bank account. Funds can be transferred prior to sending the transaction email.

The NAV is based on:

- The timestamp recorded on the AMC’s or Registrar’s email server.

- The transaction amount must be credited and available in the scheme’s bank account before cut-off time.

Indexation is a process of adjusting the purchase price of an investment to reflect the effect of inflation on it. It allows the taxpayer to take in to account the impact of inflation on cost of acquisition, which can reduce the amount of capital gains that would be taxed.

From 23rd July 2024, indexation is no longer available for any investor. Gains from debt mutual funds are taxed at slab rate, even for long-term holdings.

Systematic withdrawal plans (SWPs) is a facility offered by the Mutual fund that allows investors to withdraw fixed amounts of money at regular intervals (Monthly, Quarterly, etc..) from their existing investment in the mutual fund scheme.

Each withdrawal under SWP is taxed based on the holding of period of the units sold. The gain is calculated using FIFO (First-In-First-Out) method and capital gain will be applicable which may LTCG or STCG depend upon the period of holding.

Yes. For only for resident individuals under section 112A of income Tax Act 1961, LTCG from units of equity-oriented mutual funds is exempt up to ₹1.25 lakh per financial year. Gains beyond ₹1.25 lakh are taxed at 12.5%. without indexation.

Physical Mode:

For New investors: - New investors need to submit the dully filled and signed Common Application Form along with SIP & One Time Mandate Form to any of our point of services

For Existing Investors: Existing investors can submit the dully filled and signed SIP & One Time Mandate Form to any of the point of services.

Online Mode:

| New Investor | Existing Investor |

1 | ||

2 | Click on 'Open An Account' | Enter Primary holder’s PAN / User ID, select Folio from menu |

3 | Enter the required details | Login Using Password & OTP, confirm the declaration and click on ‘Submit’ |

4 | Under ‘Investment Details’ tab select ‘Only SIP’ - To register only an SIP with Top-Up | Visit Transact->SIP->New SIP Registration |

5 | Enable SIP Top-Up button and fill top up details | Select Register SIP Through - existing OTM or eNACH |

6 | Fill the entire form and click on 'Save & Proceed' | Fill the form and enable SIP Top-Up button to fill the top up details |

7 | SIP with Top-Up facility will be registered within 21 days post the successful registration confirmation received by your Bank. | Confirm ‘Declaration’, enter OTP and click on ‘Submit’ |

8 | For Only SIP, the registration will be through eNACH and you will be redirected to your bank’s net-banking portal for mandate authentication and registration. Once completed successfully, your SIP through eNACH will be registered within the defined timelines. If you receive a failure message, please retry the registration process. | Confirm the SIP with Top-Up details and click on ‘Confirm’ |

9 |

| For eNACH registration, you will be redirected to your bank’s net-banking portal for mandate authentication and registration. Once completed successfully, your SIP through eNACH will be registered within the defined timelines. If you receive a failure message, please retry the registration process. |

10 |

| Online SIP with Top-Up registration will take a minimum of 21 days for activation. The first auto debit will be carried out only after the registration is completed by the Registrar and the Bank. You can check the status of your SIP under Transact->SIP->Registered SIP in your online login portal. |

Let’s consider an example where an investor opts for a Monthly SIP with the SIP Top-Up facility:

Investor Details:

- SIP Amount: Rs. 5,000 per month

- SIP Frequency: Monthly

- SIP tenure Dec 2050 (25 years)

- Top-Up Amount: Rs. 500

- Top-Up Frequency: Yearly

- Cap Amount: Rs. 10,000

- Top-Up Start Date: January 1, 2025

Month /Year | Top-Up Amount | Monthly SIP Amount | Remarks |

Jan 2025 to Dec 2025 | Rs. 0 | Rs. 5,000 | Initial SIP amount. |

Jan 2026 to Dec 2026 | Rs. 500 | Rs. 5,500 |

|

Jan 2027 to Dec 2027 | Rs. 500 | Rs. 6,000 |

|

Jan 2028 to Dec 2028 | Rs. 500 | Rs. 6,500 |

|

Jan 2029 to Dec 2029 | Rs. 500 | Rs. 7,000 |

|

Jan 2030 to Dec 2030 | Rs. 500 | Rs. 7,500 |

|

Jan 2031 to Dec 2031 | Rs. 500 | Rs. 8,000 |

|

Jan 2032 to Dec 2032 | Rs. 500 | Rs. 8,500 |

|

Jan 2033 to Dec 2033 | Rs. 500 | Rs. 9,000 |

|

Jan 2034 to Dec 2034 | Rs. 500 | Rs. 9,500 | |

Jan 2035 to Dec 2035 | Rs. 500 | Rs. 10,000 | Cap Amount reached; SIP amount frozen. |

Jan 2035 to Dec 2050 | NIL | Rs. 10,000 | No top-up/increase |

Note:

- The SIP Amount starts at Rs. 5,000 and increases by Rs. 500 each year.

- The Top-Up frequency is yearly.

- The Cap Amount of Rs. 10,000 is reached by the 10th year.

- After the Cap Amount is reached, the SIP amount will stay fixed at Rs. 10,000 for the remaining of the SIP tenure.

The distributor can empanel with us through either offline or online mode.

Online:

- Visit our website at www.QuantumAMC.com and click on the "Partner Corner" tab > "Get Empanelled."

- Enter the ARN code (e.g., if the ARN code is ARN-12345, enter “12345”), accept the terms and conditions, and click "Continue."

- If the distributor is not yet empanelled, there will be an option to provide the PAN (which will be matched with AMFI data).

- The system will redirect to the next screen for OTP verification. After OTP validation, click "Submit."

- Enter the bank details and nomination (for individuals), or upload the required documents for non-individuals to complete the process.

Offline: Mutual Fund Distributors (ARN holders) can submit the Distributor Empanelment form along with supporting documents to the nearest AMC/R&T office. To download the form, visit our Quick Downloads > Partner Form section.

| Name of Vendor (As per legal Document) | QUANTUM MUTUAL FUND |

| GST Registration Status | MIGRATED |

| Address of Head / Corporate Office. | 1st Floor, Apeejay House, 3 Dinshaw Vachha Road, Backbay Reclamation, Churchgate |

| Town/City | Mumbai |

| State | Maharashtra |

| Pin Code | 400020 |

| Country | India |

| Constitution of Business | Society/ Club/ Trust/ AOP |

| Telephone No./Mobile No. | 022-61447800 |

| Email Id - (Invoice to be sent to) | [email protected] |

| PAN No | AAATQ0088J |

| GSTIN/Unique ID | 27AAATQ0088J1ZC |

| Principle Place Of Business (State) | Maharashtra |

| Description for Invoice | Distribution Commission for sale of Mutual Fund products |

| Website | www.QuantumAMC.com |

Transactions received in the Regular Plan with an invalid ARN will be processed in the Direct Plan or rejected. For more details Click here to view the AMFI circular.

Investments mobilized by distributors before 1st April 2017 will remain in the Direct Plan until an investor switches from the Direct Plan to the Regular Plan.

The conditions to be fulfilled are:

i) Senior Citizens are Individuals who qualify under the criteria stipulated by SEBI i.e. a person who has attained age of 50 years as on May 31, 2010 (OR) has at least 10 years experience in the securities market OR/ AND in distribution in Mutual Fund products as on May 31, 2010.

ii) New cadre of Distributors should be compliant with the criteria mentioned in the SEBI Circular dated September 13, 2012.

iii) Individuals, Sr. Citizens and new cadre of Distributors should have valid Certificate for passing NISM Examination/ attending CPE Programme.

Iv) ARN Card issued shall be valid upto 3 years from the date of passing the date of NISM Examination / attending CPE Programme. However, renewal of ARN after 3 years shall be subject to payment of prescribed fees, as applicable at the time of renewal.

v) The application made for registration under this scheme (waiver of fees) should be accompanied with all other stipulated documents specified in the ARN Registration Form.

Quantum Mutual Fund does not levy any transaction charges.

AMFI Circular No. 119/2025-26, dated May 8, 2025, introduces Phase II of the transfer process for units held in Non-Demat (SoA) mode. It extends the facility to all individual investors for cases such as transfers to siblings, gifting, third-party transfers, and addition/deletion of unitholders. This builds on Phase I (effective Nov 14, 2024), which covered only transmission and minor-to-major cases. Phase II is effective from May 19, 2025.

| Phase I (Effective Nov 14, 2024) | Phase II (Effective May 19, 2025) |

| Transfers allowed only in special cases: | Extends facility to all individual unitholders (resident & non-resident) for: |

| · Surviving joint holder adding new joint holder(s) after a death. | · Transfers to siblings (Stamp Duty Applicable) |

| · Nominee transferring to legal heirs after transmission. | · Gifting units to Father / Mother / Son / Daughter / Spouse (Stamp Duty Not Applicable) |

| · Minor unitholder turning major and adding joint holder(s). | · Transfers to third parties (Stamp Duty Applicable) |

| · Addition/Deletion of unitholders (Stamp Duty Not Applicable) |

Before initiating a transfer, please ensure:

• The unitholder has completed transmission (in case of death) or minor-to-major status update.

• The unitholder has completed transmission (in case of death) or minor-to-major status update.

• Units are free from lien, freeze, or lock-in.

• The transferee must:

o Be an individual.

o Hold or open a valid folio in the same mutual fund scheme (zero-balance folio allowed).

o Be KYC-validated and have a PAN, valid bank account, email, mobile number, and nomination (or opt-out declaration).

• Transfers are allowed only through online mode (RTA portal or MF Central). No physical/paper requests are accepted.

• Stamp duty, if applicable, is payable by the transferor and calculated using the last available NAV.

Follow these steps:

1. Log in to the RTA or MF Central portal.

2. Select the folio and number of units to be transferred.

3. Enter the transferee’s folio number and reason for transfer.

4. Complete OTP verification (sent to registered email & mobile).

5. Pay stamp duty online (if applicable) from your registered bank account.

6. Once payment is confirmed, the RTA will process the transfer within 2 working days and issue updated SoAs to both parties.

Yes. Partial transfers are permitted — you may transfer any number of units available in your SoA, subject to scheme eligibility and free balance.

Yes, but the minor must be accompanied by a guardian or parent as joint holder. If the minor has turned major (18 years or older), they must first update their status to “major” before initiating the transfer.

Yes, transfer requests can be made on any date. However, if the request is lodged on a record date for IDCW payout/reinvestment, the IDCW will be paid to the transferor, not the transferee.

• Stamp duty, if applicable, is payable by the transferor

• It is computed based on the last available NAV, irrespective of any consideration value entered.

• Example:

o If the request is made before NAV declaration, the previous day’s NAV applies.

o If made on a holiday, the previous business day’s NAV applies.

• Payment is made online through the registered bank account.

• The RTA verifies the eligibility of both transferor and transferee (KYC, PAN, compliance checks).

• If valid, OTP verification is completed, and stamp duty is paid.

• The RTA then transfers the units within 2 working days and issues updated Statements of Account (SoA) to both parties.

• Units transferred are subject to a 10-day restriction on redemption.

Your request may be rejected if:

• KYC is not validated,

• Units are under lien/freeze/lock-in,

• The transferee does not meet eligibility criteria.

In such cases, you will receive an email/SMS notification of rejection with the reason

Transferred units cannot be redeemed for 10 days from the transfer date. This safeguard allows time to detect and reverse any fraudulent transfers.

Yes. Tax treatment depends on the nature of transfer:

Scenario | Tax Impact | Cost & Holding Period |

Survivor adds joint holder (post-death) | Not taxable | Remains unchanged |