World Health Day 2023: Assess Impact on your Financial Health

Posted On Thursday, Apr 06, 2023

World Health Day 2023: Assess Impact on your Financial Health

This World Health Day, it’s time to prioritize not just your physical and mental health but also your financial health. April is the start of the financial year and is also a good opportunity to review your portfolio and explore how to strengthen it to safeguard your future.

There may be some questions that you may have regarding the current challenges that confront your investing journey.

• How has the last financial year fared across asset classes?

• How to safeguard your portfolio for the future?

• How is it going to impact your investments?

Get answers to all your questions through this article.

A Lookback at the Challenges in FY 22-23

Over the past financial year 2023, we saw several macroeconomic challenges -SVB Banking Collapse, rising inflation & subsequent interest rate hikes, ongoing geopolitical tensions between Russia and Ukraine and a looming global recession. This led to wide fluctuations in the financial markets across asset classes.

How Asset Classes Fared in FY 2023

| Nifty | -1.76% |

| Gold | 15% |

| Nifty 10 Year G-Sec | 3.17% |

Source – Bloomberg Data as of Mar 31, 2023. Past performance may or may not be sustained in the future

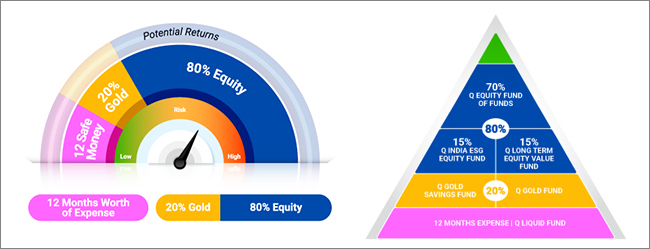

Given the decline in equities, rally in gold and muted returns in debt, FY 22-23 laid focus on the importance of prudent Asset Allocation. This new financial year, take the opportunity to balance your portfolio using Quantum’s tried and tested 12| 20:80 Asset Allocation Strategy (Barah Bees Aur Assi) and safeguard your portfolio these uncertain times.

Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

To go about this allocation, you can use Quantum’s handy Asset Allocation Calculator to easily allocate your investments. This tool allows you to create a diversified investment basket across three asset classes of Equity, Debt and Gold in just a few clicks! Find out how each of the building blocks of this 12|20:80 portfolio would have helped you stay ahead of global recessionary pressures and safeguard your portfolio.

1. 12 Months of Safe Money – Take Opportunity of interest rate hikes with Debt funds to create your Emergency Reserves As part of our 12|20:80 strategy, we suggest investors allocate 12 months of monthly expenses to create their emergency reserves in a liquid fund scheme such as Quantum Liquid Fund. This comes to your aid during medical emergencies or any unforeseen circumstances. Investing in liquid funds looked even more attractive for your surplus funds this last financial year as repricing of interest rates was captured effectively. Since May 2022, RBI has hiked interest rates 6 times or 250 basis points. Therefore, investing in a liquid fund offered you better return potential than a conventional bank savings account.

2. 80% of your investable surplus fin the growth block - Navigate equity market swings with a Diversified Equity Portfolio: Investing in equities gives you better potential to cope with inflation as opposed to other asset classes, but you must be ready to stomach the downturns. The performance of equity markets took a decline past financial year after offering superior returns the previous two consecutive financial years. Nifty 50 Index declined by 1.76% while S&P BSE Sensex declined by 0.48% due to global pressures.

Growth is likely to be constrained going forward due to slower consumption owing to higher borrowing costs and challenging global conditions. Despite signs of moderation in the near term, the long-term growth trajectory continues to be resilient given India’s strong fundamentals. India’s Real GDP growth average at over 6% over the last 40 years is a testament to this fact. To ease the investment ride, you can diversify your equity portfolio across market-caps and investment styles for best possible outcomes across market cycles.

3. Safeguard your portfolio with Gold: Gold most often doesn’t go hand-in-hand with equity, and this is probably one of the best reasons why adding gold to your portfolio becomes imperative. Investors who invested in Gold were rewarded as Gold prices recorded double digit growth and surged at 15% in FY23. It acted as a portfolio diversifier, and will continue balancing your portfolio during periods of macroeconomic stress.

Take the opportunity of this World Health Day to review the health of your portfolio over the last financial year and re-evaluate your goals for the future. No better time than now to balance your portfolio as per Quantum’s 12|20:80 Asset Allocation Strategy.

|

|

Related Articles

Gudipadwa - Herald the New Year with a Sound Investment Strategy

How to Structure Your Portfolio Given an Imminent Global Economic Slowdown

Multi Asset Strategy to Save Your King (Portfolio)

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More