What is Fund of Funds?

Posted On Friday, Oct 01, 2021

Fund of Funds - A World of Diversification

| Table of Contents | |

| Sr no | Header |

1 | What is Fund of Funds & Its Types |

2 | What are the benefits of Fund of Funds |

3 | Fund of Fund Taxation |

4 | Fund of Funds in India |

As an investor, Fund of Funds is something you should definitely know about.

So, before we go ahead with telling you more about Fund of Funds, it is very important that you know fund of funds meaning.

What is Fund of Funds?

In the simplest of words, a “Fund of Funds” is nothing but a mutual fund scheme that invests in other mutual fund schemes.

Just like a mutual fund invests in shares of companies, a Fund of Funds invests in different mutual funds with the aim of best possible returns.

The fund manager of a Fund of Funds creates a portfolio that consists of other mutual funds rather than equities or bonds. He/she designs this portfolio as per the mutual fund scheme objectives.

The fund manager may choose to invest in a scheme of the same fund house or another fund house.

This way of investing in numerous fund categories allows investors to benefit from the resulting diversification.

The Fund of Funds schemes can be a foreign Fund of funds or a domestic Fund of Funds scheme.

For a foreign Fund of Funds, the fund manager invests in units of mutual fund schemes that are offshore, while ensuring that the investment philosophy and risk profile of funds based on such scheme investment objectives.

But be it domestic or foreign, it can help investors in wealth creation in the long run.

Having said that, let us learn more about the types of Fund of Funds.

There are various types of Fund of Funds like:

- Asset Allocation Funds - A very diverse asset pool, comprising of Equity, Debt, Gold.

- Gold Funds - These invest in different mutual funds that majorly invest in gold ETF

- International Fund of Funds - These invest in mutual funds operating in countries other than India.

- Multimanager Fund of Funds - Invests in multiple professionally managed funds and usually have multiple portfolio managers, each dealing with a specific asset from the mutual fund.

So, you now know what is Fund of Funds meaning and its types.

Let us know something about Fund of Funds Benefits.

Following are the Fund of Funds Benefits

1. Tax Friendly: Since Fund of Funds is basically investment in different funds. There might be times you want to rebalance your assets and for which you may end up paying short or long term capital gain. But in a Fund of Funds scheme, Fund manager rebalances the portfolio of the scheme to maintain scheme allocation between debt and equity as per SID, there are no taxes on the capital gains coming out of that transaction.

2. Simple to Handle: You just have to track and follow one single NAV & one single portfolio. The low number of funds that require managing, makes Fund of funds easy to handle.

3. Professional Fund Management: Investing in a fund of funds allows you to get a taste of investing in professionally managed funds before committing to individual investments.

4. Start with Limited Capital: Investors with a limited amount of money can participate in various assets through a Fund of Funds. These assets would ordinarily be difficult for such investors to get on their own.

These were Fund of Funds benefits, which we are well aware of now.

Now moving on to telling you about one of the most important aspects to know if you wish to invest in Fund of Funds.

Fund of Funds Taxation:

If you plan to invest in any Fund of Funds, it is imperative that you should also know about Fund of Funds Taxation.

An investor must pay the tax on a fund of funds only when the principal amount is redeemed.

If sold before 36 months, the investor will be subject to short-term capital gain tax based on his or her income tax bracket.

And in case the units are sold after 36 months, a long-term capital gain tax of 20% with indexation is applicable.

Now that you know about Fund of Funds Taxation, lets move on to find out more about Fund of Funds in India.

There are various options if an investor wants to invest in Fund of Funds in India and one such example is the Quantum Equity Fund of Funds (QEFOF).

As of data as per AMFI as of Aug 31, you see, there are over 350 Equity funds out there. Which one should you invest in?

How about you don’t worry about that and just invest in one fund, which in turn will pick the Equity funds to put your hard earned money into?

The Quantum Equity Fund of Funds (QEFOF) does just that.

This fund of fund is an equity fund of funds that invests in 5-10 diversified equity schemes of third party mutual funds, shortlisted after extensive research.

The investment objective of the scheme is to generate long-term capital appreciation by investing in a portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI.

Here is a look at the performance of the Quantum Equity Fund of Funds:

| Performance of the Scheme | Direct Plan | |||||

| Quantum Equity Fund of Funds - Direct Plan - Growth Option | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Benchmark | Additional Benchmark | Benchmark | Additional Benchmark | |||

| Period | Scheme Returns (%) | S&P BSE 200 TRI Returns (%) | S&P BSE Sensex TRI Returns (%) | Scheme (₹) | S&P BSE 200 TRI (₹) | S&P BSE Sensex TRI (₹) |

| Since Inception (20th Jul 2009) | 14.75% | 13.64% | 13.16% | 53,044 | 47,127 | 44,766 |

| August 30, 2011 to August 31, 2021 (10 years) | 15.21% | 15.15% | 14.72% | 41,267 | 41,064 | 39,529 |

| August 28, 2014 to August 31, 2021 (7 years) | 13.49% | 13.93% | 13.00% | 24,293 | 24,953 | 23,572 |

| August 31, 2016 to August 31, 2021 (5 years) | 13.52% | 15.82% | 16.48% | 18,855 | 20,853 | 21,451 |

| August 31, 2018 to August 31, 2021 (3 years) | 13.31% | 14.96% | 15.49% | 14,553 | 15,198 | 15,412 |

| August 31, 2020 to August 31, 2021 (1 year) | 51.85% | 55.45% | 50.55% | 15,185 | 15,545 | 15,055 |

Data as on Aug 31, 2021

Past Performance may or may not sustained in future

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The fund is managed by Mr. Chirag Mehta, since Nov 2013. For performance of other schemes managed by Mr. Chirag Mehta please click here.

Now you know more about Fund of funds in general.

We told you about Fund of funds meaning, Fund of funds taxation, Fund of funds in India, Fund of funds benefits and more.

So, if you want to start investing in the Quantum Equity Fund of Funds, you can start right here.

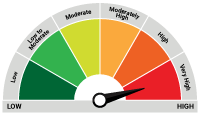

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on August 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Be Good. Do Good: The Quantum Way

Posted On Tuesday, Jul 30, 2024

In the business environment, good corporate governance is paramount to the success and sustainability of organisations.

Read More -

What is Fund of Funds?

Posted On Friday, Oct 01, 2021

As an investor, Fund of Funds is something you should definitely know about.

Read More -

Equity Mutual Funds – Are They For You?

Posted On Friday, Oct 01, 2021

Every investor at one point in time has wondered or looked up for what is Equity Mutual Fund meaning.

Read More