Equity Portfolio Allocation With Growing Indian Economy

Posted On Tuesday, Feb 16, 2021

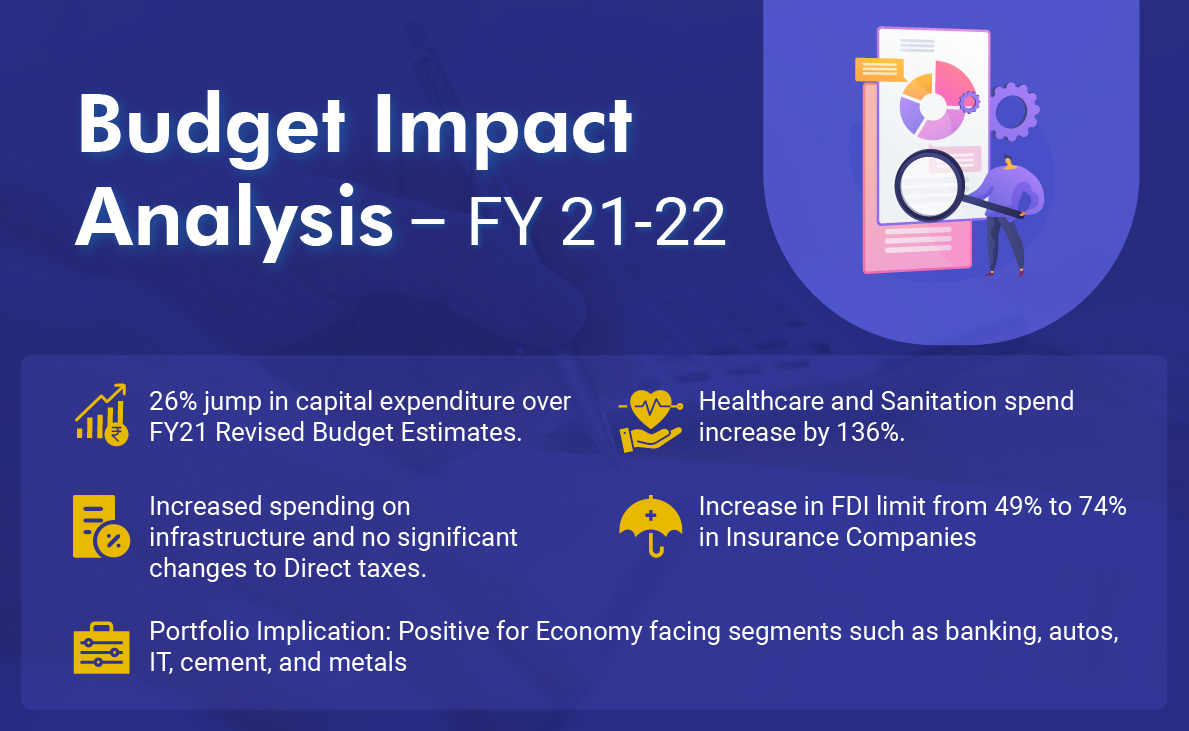

India’s Union Budget 2021 is pro-growth and lays the foundation for accelerated future growth.

It comes up with a stimulus for the economy with increased spending on infrastructure and healthcare.

The increase in spending would revive corporate earnings and may in turn give a boost to equity markets.

On the other hand, increased government spending for extended period and introduction of new cess & import duties on various products could also cause inflation to rise. In this case, you need to invest in turnkey equity solutions to beat inflation.

Read Union Budget 2021: A Quantum Perspective

Indian equities thereby remain an attractive asset class and is expected to do well over the long term.

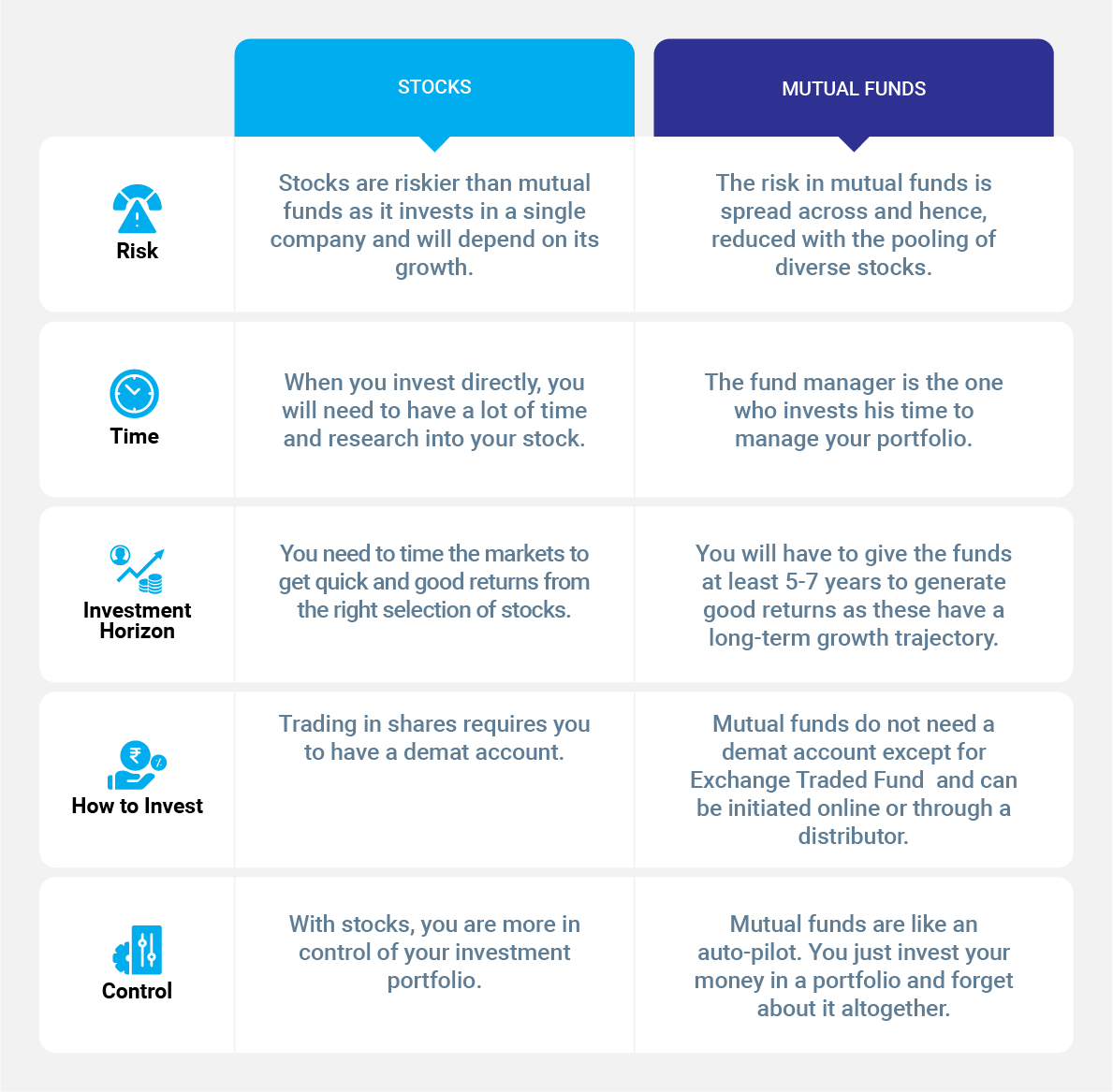

Which leaves us the question of whether to invest in the equity markets through stocks or mutual funds. Let’s see the differences between the two:

Whether you should invest in mutual funds or shares depends on your knowledge and experience of the market and the amount of time you have. We believe mutual funds are a great investing instrument if your aim is a long term growth of wealth. Now, you may ask how should one select the best mutual fund out of over 350 Equity mutual funds out there?

A simple solution could be to invest in one fund, which in turn picks the Equity funds you should put your hard earned money in.

QEFOF offers a unique portfolio of diversified equity funds encompassed in one fund to simplify their need of diversifying their equity portfolio.

What is the QEFOF investing strategy?

1. Fund selection:

• Only those funds are considered which have a 3-year track record.

• Ranks the funds based on their performance across time frames.

• Removes funds which hold a concentrated stock portfolio and which are not categorized as diversified equity funds (such as sector, thematic and global funds) from the above list.

• Shortlisted funds are evaluated based on qualitative criteria such as investment systems and processes, consistency in characteristics of its portfolio.

2. Portfolio Construction:

• The portfolio will have 5 to 10 open-ended diversified equity mutual fund schemes.

• The Scheme shall not invest more than 20% of its assets in a single scheme with a 3-year track record.

• The overall exposure in the schemes with a 3-year track record shall not exceed 40% of the Portfolio.

• The Scheme shall not invest more than 25% of its assets in a single scheme with a 5 years track record.

• Quantum schemes will not be chosen!

3. Periodic Rebalancing:

The fund manager continues to review chosen funds based on portfolio characteristics and quantitative performance ranking and qualitative criteria.

Watch our webinar video Equity investing simplified to understand how we pick equity mutual funds under the Quantum Equity Fund of Funds.

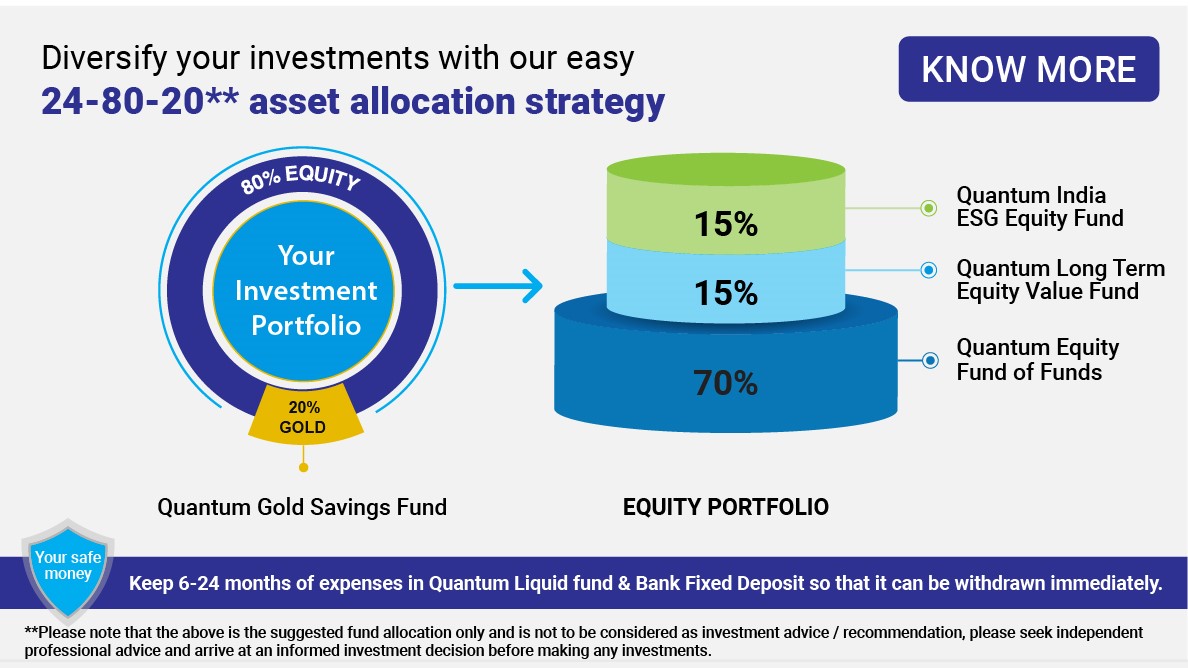

How much to allocate?

Even in the most conservative portfolio, a major portion of your allocation should be in equity mutual funds for growing your investment over the long term.

We would suggest you to go one step further and build a robust equity portfolio that can mitigate downside risk during market uncertainty and perform on the rebound.

At Quantum, we suggest you consider an Asset Allocation plan* that has a potential to help you reach your financial goals. It is suggested you need to have a contingency fund reserve in the form of liquid assets such as Liquid Mutual Funds at the heart of your portfolio. These liquid funds help to meet short term cash and contingency needs and at the same time has potential to earn slight higher returns than those offered by savings bank accounts.

You can then have allocation to Equity and Gold in your portfolio.

You can invest 70% of your equity portfolio to Quantum Equity Fund of Funds.

Invest 15% in Value Investing with Quantum Long Term Value Fund: Our strategy is to identify good companies and try and buy them at a discount to their fair value. This fund primarily helps investors give their investment an equity exposure with the potential to achieve long-term capital appreciation. Watch how to Ride India’s Economic Recovery.

Invest the final 15% responsibly with Quantum India ESG Fund:

This is a portfolio of 40-50 companies that meet and exceed cut-off of our ESG (Environment, Social & Environment) score screened after quantitative and qualitative research across over 200 parameters. Read how to unlock India’s Equity Opportunity 2021 with ESG investing.

Get ready to participate in India’s growth story with equity mutual funds.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies | |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. | |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on January 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More