Debt Monthly for July 2025

Posted On Monday, Jul 07, 2025

Key highlights of the month: |

|

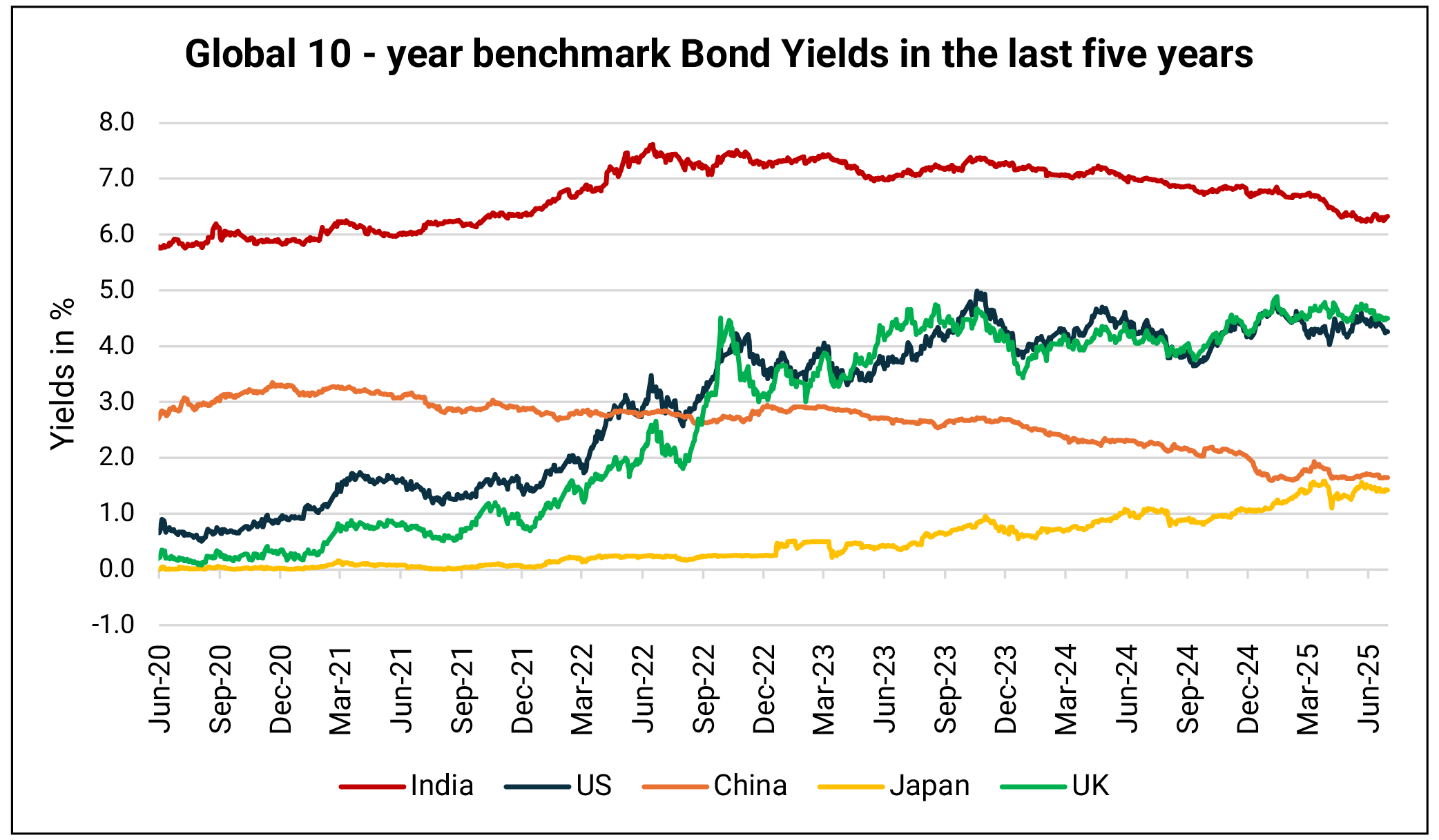

Chart I: Tracking India’s 10-Year Bond Yields Against Major Global Economies

Source: Bloomberg. Data as of June 30, 2025.

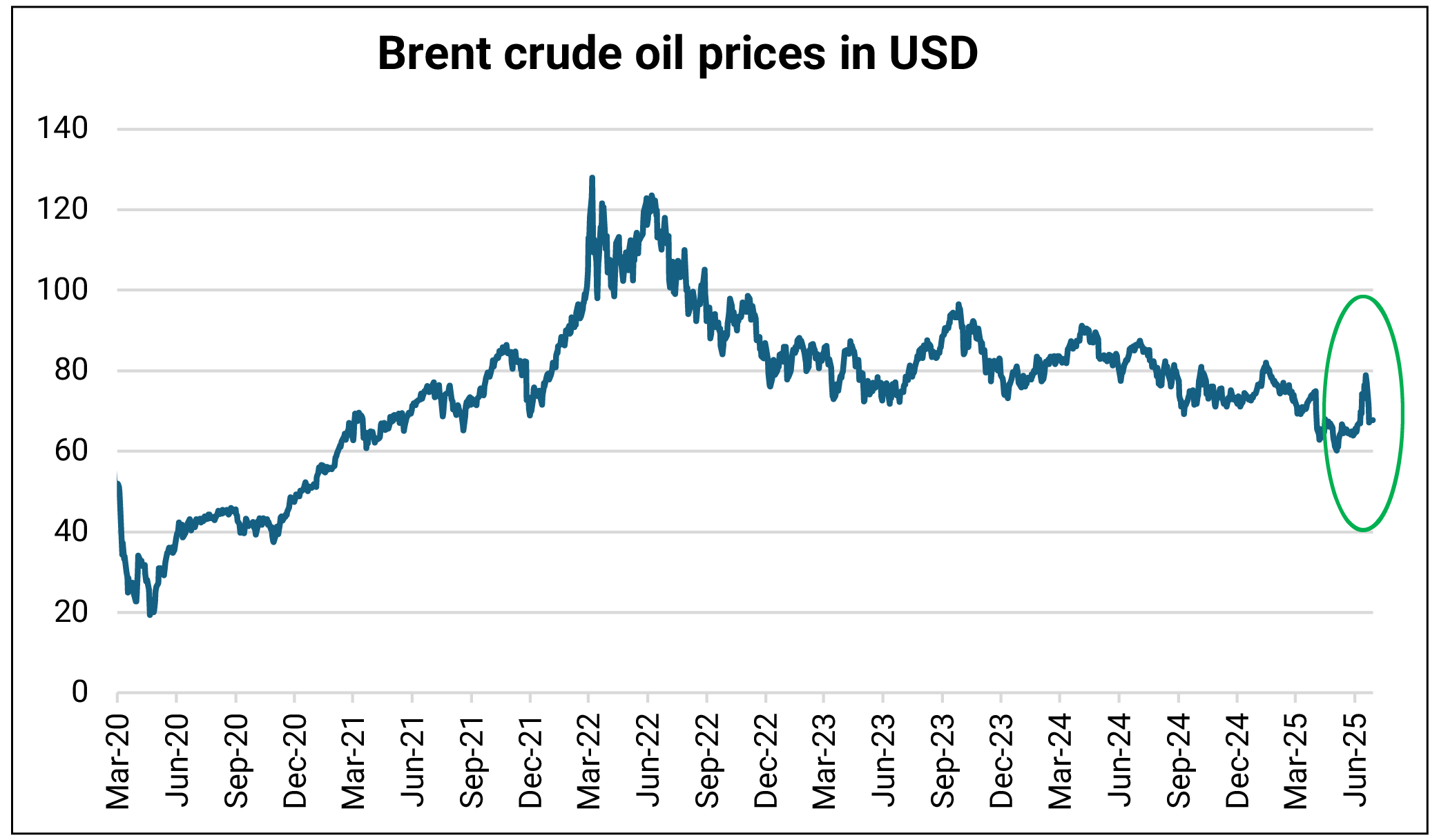

Flashpoint Middle East: War, Oil, and the Strait of Hormuz Risk: In June 2025, the Israel-Iran conflict erupted into full-scale war, sparking widespread geopolitical instability. Rooted in Iran’s nuclear ambitions and Israel’s security concerns, the war quickly expanded through military strikes and proxy warfare. Regional powers were drawn in as Israel’s airstrikes on Iranian nuclear sites triggered retaliatory attacks, escalating tensions across neighboring countries.

This conflict sent shockwaves through global markets, particularly crude oil prices. While not officially at war, the ongoing violence, cyberattacks, and military posturing fueled fears of oil supply disruptions. Iran, a major oil producer, posed a serious risk to global supply chains, especially if exports were hit by military action or sanctions. With the Strait of Hormuz, through which 20% of the world’s oil passes, at risk, oil markets remained volatile, pushing prices higher amid mounting geopolitical uncertainty.

Chart II: War and Black Gold: The conflict in Middle East Shook the Oil Markets

Source: Bloomberg. The above data is for 5 years up to June 30, 2025.

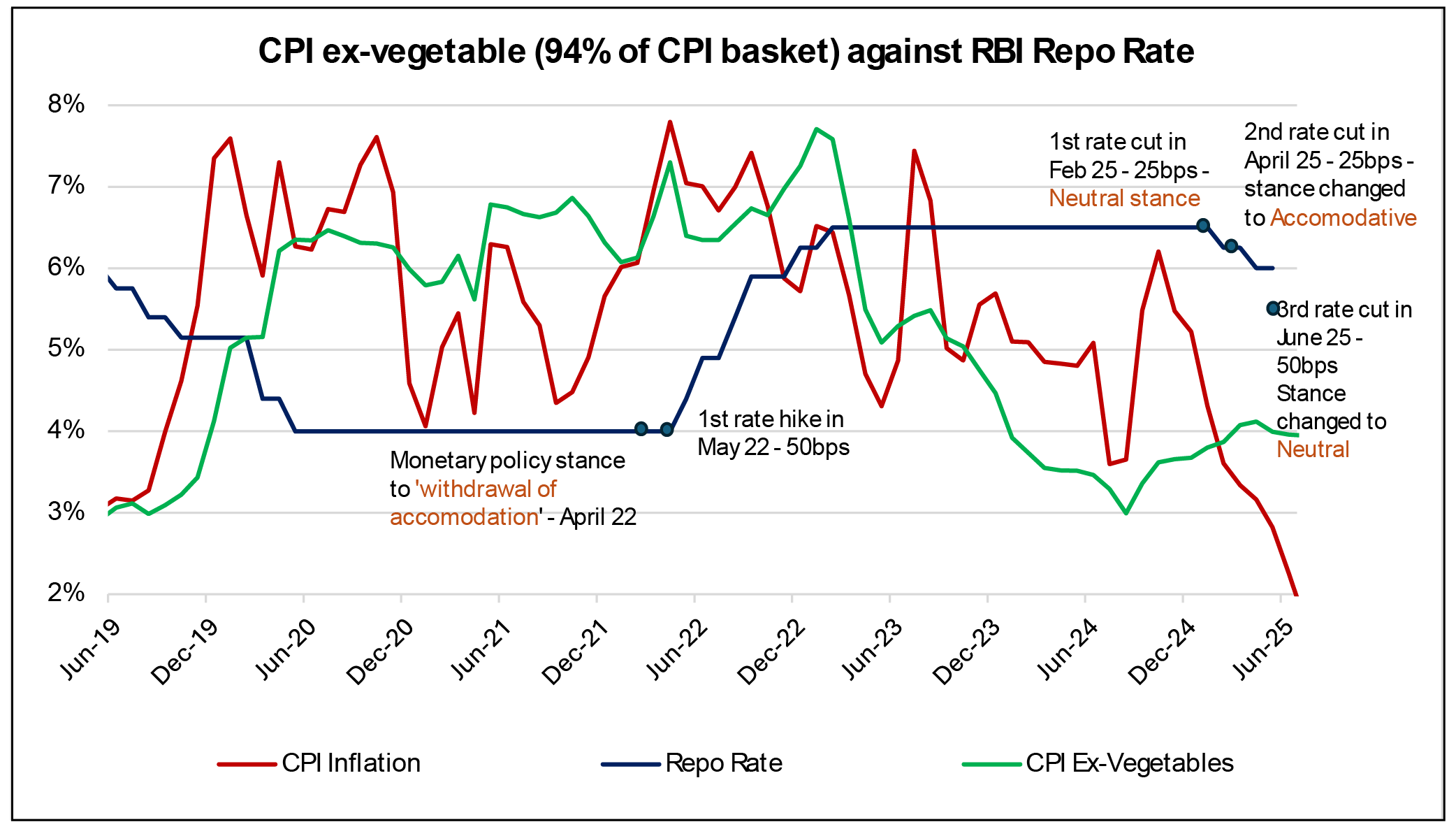

On the domestic front, in a surprise June 2025 move, the RBI frontloaded easing with a 50bps repo rate cut (5.5%, 5-1 vote) and shifted its stance to ‘neutral’. It also announced a 100bps phased Cash Reserve Ratio (CRR) cut (September – December 2025), set to inject ~₹2.5 trillion in liquidity—aimed at accelerating transmission amid soft inflation and stable macro conditions.

The early CRR cut helps offset liquidity pressures from Forex forward unwinding. While ₹2.4 trillion has already been infused via Open Market Operations (OMOs) in FY26, the RBI is likely to add more liquidity in order to maintain the liquidity in the surplus zone targeting ~1% of NDTL (Net Demand and Time Liabilities)—a key condition for effective rate cut transmission.

The RBI now pegs FY26 inflation at 3.7% (vs 4% earlier), suggesting in confidence that “the war on inflation has been won—for now.” Growth is projected at 6.5%, though downside risks from weak consumption and global headwinds remain. We maintain our FY26 GDP growth estimate at 6.5%.

The RBI is clearly prioritizing growth support while keeping inflation risks in check. Based on our internal estimates, with CPI likely easing toward 3%, we expect one more 25bps cut by end of Q3FY26, bringing the terminal rate to 5.25%. But for now, a cautious pause seems likely in the August monetary policy review.

Chart III: Inflation at a 5-Year Low, Monsoon Fuels Kharif Momentum

Source: MOSPI, RBI. CPI data is for the month of May 2025, Repo Rates are as of June 30, 2025.

Headline Consumer Price Index (CPI) fell to 2.8% YoY in May 2025, down from 3.2% in April 2025 —the lowest since March 2019. Food inflation dropped to a 43-month low of 1%, helped by a favorable base.

CPI excluding vegetables eased to 4%, while core CPI (ex-food, fuel) inched up to 4.3%. Core CPI (ex-gold, gasoline) softened to 3.4%. Meanwhile, Wholesale Price Index (WPI) slipped to 0.4%, a 14-month low, from 0.9% in April 2025.

India's monsoon picked up pace in late June, pushing cumulative rainfall 7% above normal. While rainfall distribution is uneven, the overall outlook is encouraging for kharif sowing.

As of June 20, 2025, kharif acreage is up 10% YoY (the fastest growth in four years). Rice, cereals, and pulses led the charge. Cotton and sugarcane saw moderate gains compared to the Long Period Average (LPA).

Some key positives are playing well for inflation outlook: Reservoir levels are ~38% above normal, providing strong water availability to support the next crop season. 7% surplus rainfall supports timely sowing across regions. Neutral ENSO conditions (no El Niño/La Niña) point to a stable, less erratic monsoon season.

On the macro front: Rural wage growth improved to 3.2% YoY in March 2025 (vs. flat in October 2024), aided by easing rural inflation. While vegetable and fuel prices jumped in June 2025, headline CPI is expected to ease to 2.3% YoY, down from 2.8% in May 2025, owing to a high base and limited fuel pass-through.

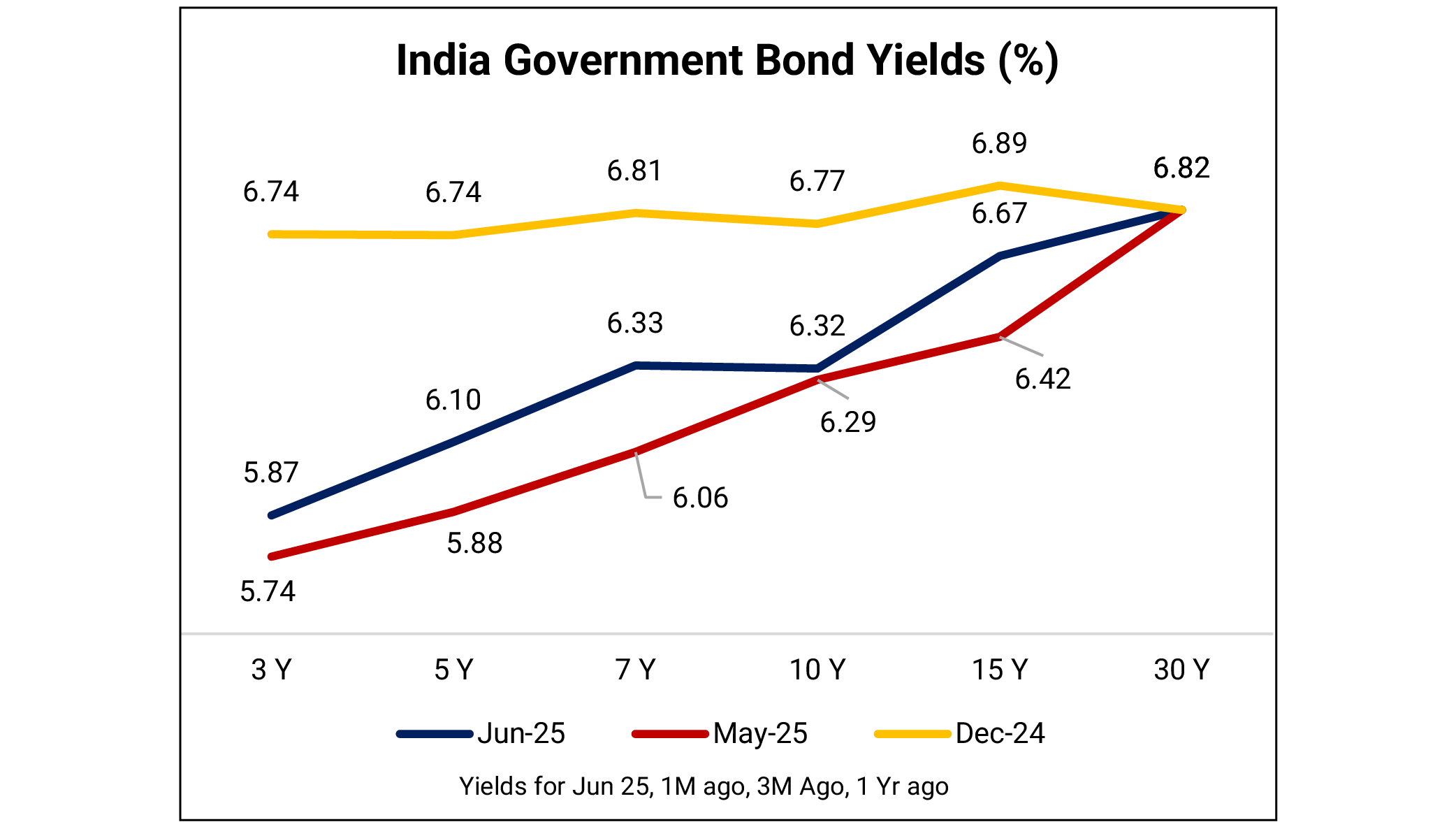

Indian Bond Yields Climb as Policy Shifts and Oil Spikes Shake Markets:

Indian bond yields rose sharply in June 2025, driven by two key developments: the RBI’s shift back to a ‘Neutral’ stance—signaling a potential end to the rate-cutting cycle—and escalating Middle East tensions that pushed crude oil prices higher.

Why oil matters:

Inflation: Every $10/bbl rise adds 25–35 bps to CPI.

Growth: GDP could dip by 20–30 bps.

External Balance: CAD may widen by ~$3 billion (0.1–0.2% of GDP).

Global pressures persisted too. U.S. 10-year Treasury yields remained volatile, ranging between 4.26% and 4.5%. Meanwhile, India’s 10-year G-sec yield edged up 4 bps to 6.32%. The India–U.S. yield spread narrowed to below 200 bps, well below its 20-year average of 450+ bps.

Chart IV: G-sec yield curve remains steep, but the yield curve has shifted upward with yields rising amid geopolitical tensions and crude oil pressures.

Source: Bloomberg. Above data is for the month ended June 2025, May 2025 (1 month ago) and December 2025 (6 months ago).

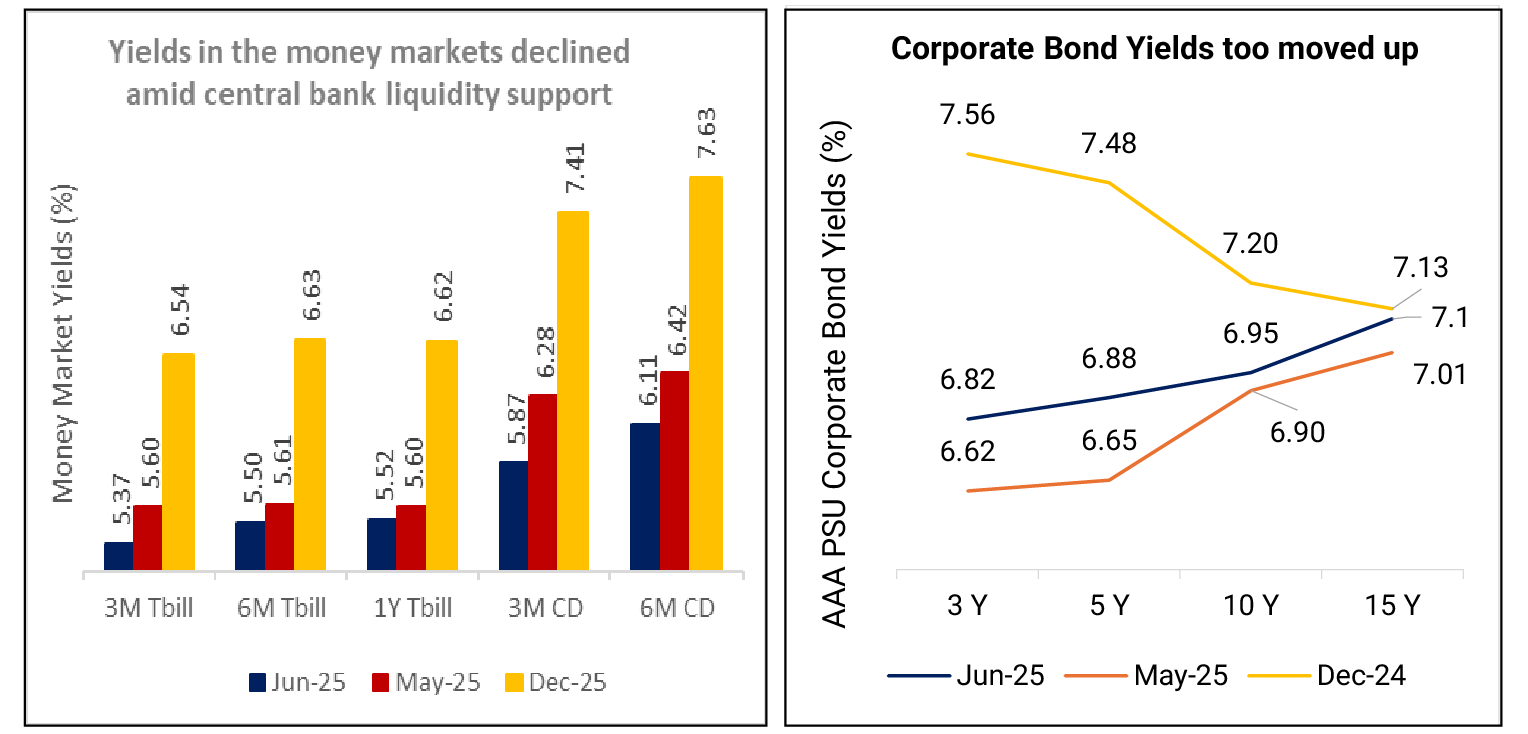

Money Market yields in India softened on the back of liquidity support by the RBI. T-bill rates for the 3-month segment plunged post easing in liquidity conditions. Meanwhile, the 3-month AAA PSU CP/CD rates too moved in tandem to the 5.8%- 6.1% range against the 6.2% - 6.4% band on a closing basis.

Chart V: Money Market Rates eased on the back of liquidity flux; Corporate bond yields inched up across the curve broadly tracing the up move in G-sec yields

Source: Bloomberg. Above data is for the month ended June 2025, May 2025 (1 month ago) and December 2025 (6 months ago). Data on corporate bond yields is for AAA PSU Corporate Bonds.

The corporate bond yield curve has also moved up in line with the up move in the G-sec yields, with the spread tightening across the curve. By end-June 2025, the spread between 10-year corporate bonds and G-secs remained more or less the same at 63 bps, while the 15-year spread compressed to 42 bps, down from 53 bps in May 2025. Demand for corporate bonds remains strong, supported by a steady supply pipeline.

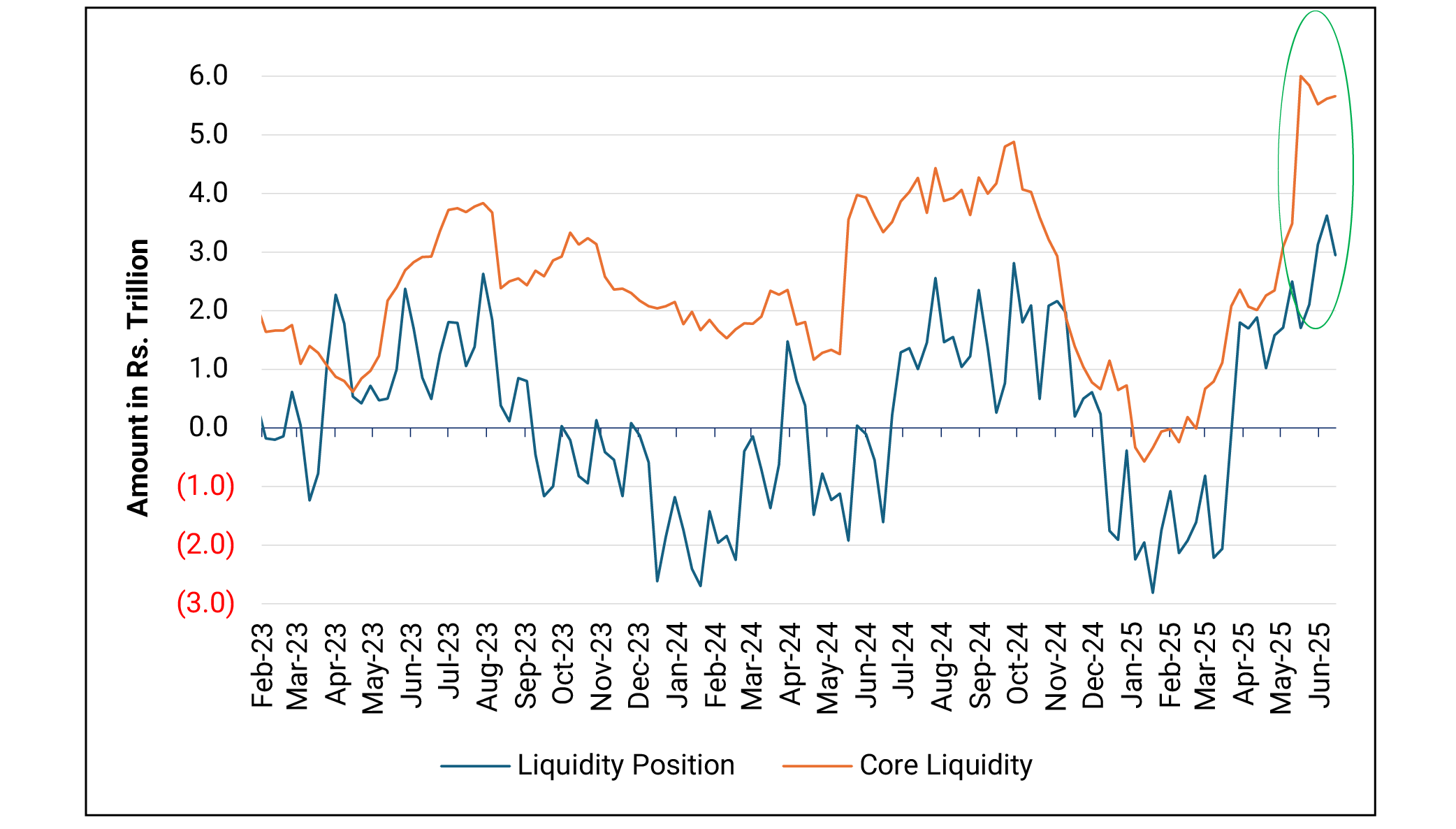

Liquidity management has been focused on enhancing transmission of the rate cuts with RBI infusing substantial durable liquidity since December 2024. Infusion has been made via Cash Reserve Ratio (CRR) cut, OMO purchase, USD INR buy-sell swaps and buy backs.

As of June 30, 2025, system liquidity closed at a surplus of INR 2.6tn (~1.2% of NDTL), bringing overnight rates closer to SDF (Standing Deposit Facility) levels. Core Liquidity as of June 20, 2025, stood at Rs 5.6 trillion.

Initially, the surplus narrowed due to GST outflows, but FPI inflows and month-end government spending widened it again. The RBI announced a VRRR (Variable Reverse Repo Rate) auction of Rs 1 trillion for 7 days. While the amount was not large and it seems they did this VRRR to put a floor on money market rates which were beginning to fall below the SDF rate.

However, we do not see this as a signal towards the end of the rate cut cycle or liquidity tightening but just a hint that the bar for further rate cuts is very high - with further rate cuts possible if growth underperforms or inflation falls below the RBI’s forecast.

Liquidity is expected to remain comfortable at the start of the month due to government spending, benefiting overnight rates. However, currency demand and seasonal government balance changes could tighten conditions later.

Chart VI: Banking system liquidity in surplus; Core liquidity too in a surplus ~ 5.6 trillion

Source: RBI. Data up to the week ended June 20, 2025.

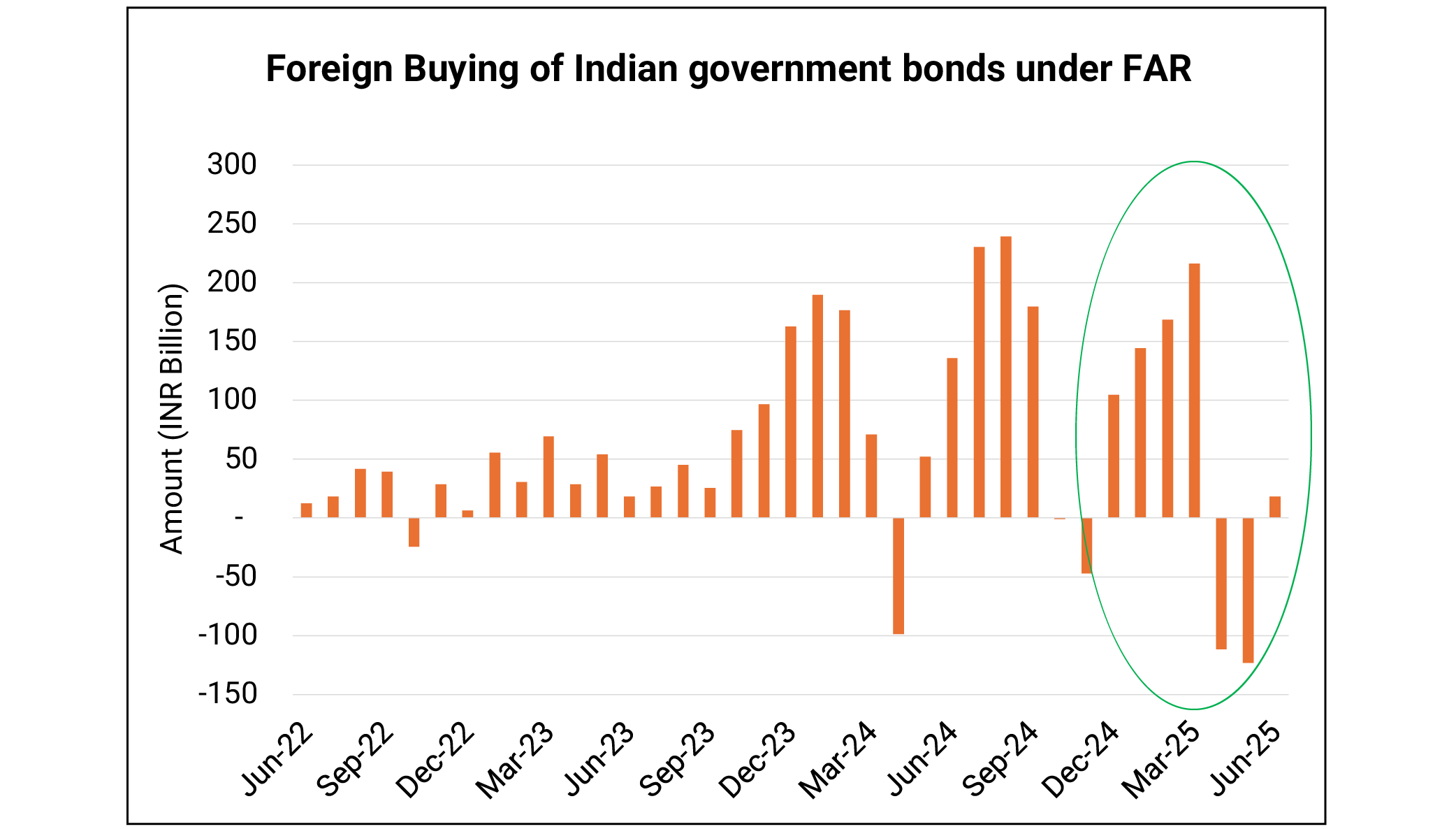

Foreign investments in IGBs (Indian Government Bonds) saw notable growth in March 2025 alone, with the Fully Accessible Route (FAR) segment receiving an influx of Rs 227 billion during the month alone. However, this momentum reversed in April and May 2025, as global trade tensions under the Trump administration, rising crude oil prices, and concerns over a potential pause in the RBI’s rate-cut cycle led to heightened caution and net outflows.

Encouragingly, June 2025 marked a rebound in foreign interest as global volatility eased, the RBI maintained a neutral stance, but its liquidity action was more or less accommodative, and attractive yield differentials renewed investor appetite for Indian debt in the month of June 2025.

Chart VII: Global Jitters Drive Foreign Outflows from Indian Bonds; June Marks a Modest Rebound

Source: CCIL. Data up to the month ended June 2025.

In the medium term, global financial markets are expected to experience reduced volatility. The USD is likely to stabilize within its current range, potentially leading to a reversal of the safe-haven trade, which may result in increased capital flows into Emerging Markets (EMs) like India.

Outlook

Following the 50 bps rate cut and a shift to a ‘neutral’ stance, we believe the RBI now has limited room for further easing. If inflation continues to trend lower, there may be space for one final 25 bps cut later this year to support transmission. However, we expect the RBI to adopt a wait-and-watch approach in the coming policy meetings to assess the full impact of its recent actions. Credit growth remains subdued, and with no immediate risks to economic growth, there's little reason to pursue aggressive rate cuts from here.

As borrowing costs fall and liquidity improves, the focus shifts to monetary transmission and a revival in credit demand. Fiscal measures and structural reforms will also need to play a stronger role in supporting growth. That said, global uncertainties—including U.S. tariffs, recession risks, and geopolitical tensions—could limit further downside in yields.

Despite short-term market volatility, our medium-term outlook on bonds remains constructive, supported by:

• A decline in net G-sec supply,

• Consistent demand from long-term domestic investors,

• India’s inclusion in global bond indices, and

• Potential for further RBI open market operations (OMOs).

In line with this view and given limited scope for further rate cuts, we are reducing portfolio duration, shifting toward shorter-term bonds to prioritize capital preservation and manage risks in a flattening yield curve environment.

What should investors consider?

Given the current environment, bond yields are likely to either decline or remain range-bound. In such a volatile interest rate landscape, investors with a medium to long-term horizon may consider dynamic bond funds. These funds offer flexibility to actively manage portfolio duration, allowing adjustments in response to evolving market conditions—making them well-suited for staying invested over longer periods.

For those with shorter investment horizons or a lower risk appetite, liquid funds continue to be a more appropriate choice, offering stability and easy access to funds.

Source: Reserve Bank of India (RBI), Ministry of Statistics & Program Implementation (MOSPI), Bloomberg.

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More -

Debt Monthly for October 2025

Posted On Friday, Oct 03, 2025

September was a pivotal month for fixed income markets, both globally and domestically.

Read More