FDs Feel Safe. But Are They Silently Falling Behind?

Posted On Monday, Jun 30, 2025

Rising Global Concerns. Uneven Markets.

Cautious RBI approach. Uncertain Geopolitics.

In 2025, uncertainty isn’t just local —it’s global. From energy and commodities to currencies and interest rates, market signals are increasingly hard to read. As caution sets in, many investors are retreating into what's familiar — Fixed Deposits (FDs). They feel safe and risk-free.

But here’s the point to consider: in a world that’s changing fast, being static may cost more than you think. FDs will keep your capital safe and secure, but they don’t help it grow meaningfully — especially when taxes and inflation take their share.

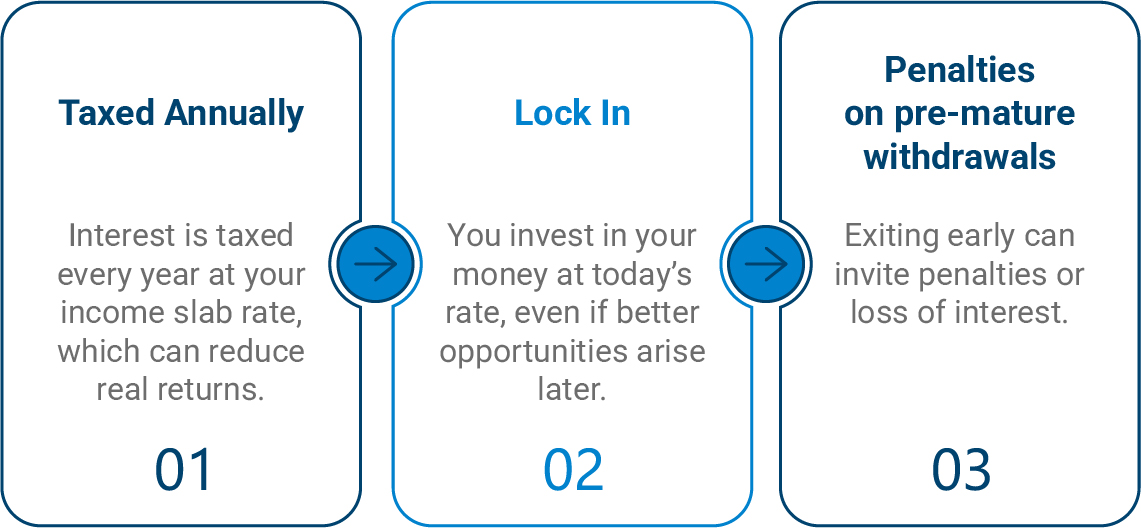

FDs May Feel Simple — But They Come with Certain Limitations

While FDs seem straightforward, they come with their limitations few talk about:

What Happens When Interest Rates Fall?

RBI has cut interest rates by 100bps (1%) in the last few months; banks have reacted by cutting loan interest rates and FD/Saving rates by 25-50bps. Can the interest rate fall further?

If you’re investing into a long-term FD now, you may be settling for lower real returns — returns that shrink further once you factor in inflation and tax.

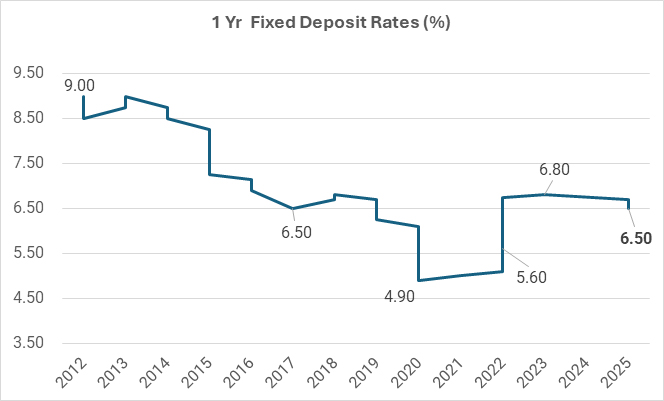

FD Returns Are Reducing

FD rates have steadily declined over the past decade — from a high of 9.0% in 2012-13 to 6.5% in 2024-25 (after briefly peaking at 6.8% last year). That’s a long-term drop in nominal returns, reflecting a downward interest rate trend. And this is before accounting for inflation or taxes — which can further erode real returns.

Source: SBI’s 1-year FD Interest Rates for explanation, Data as on 30th June, 2025.

Quantum Multi Asset Fund of Fund (QMAFOF) invest across 3 asset class - equity, debt, and gold. Designed to stay conservative yet responsive, QMAFOF captures opportunity while managing risk — helping your money move with changing times.

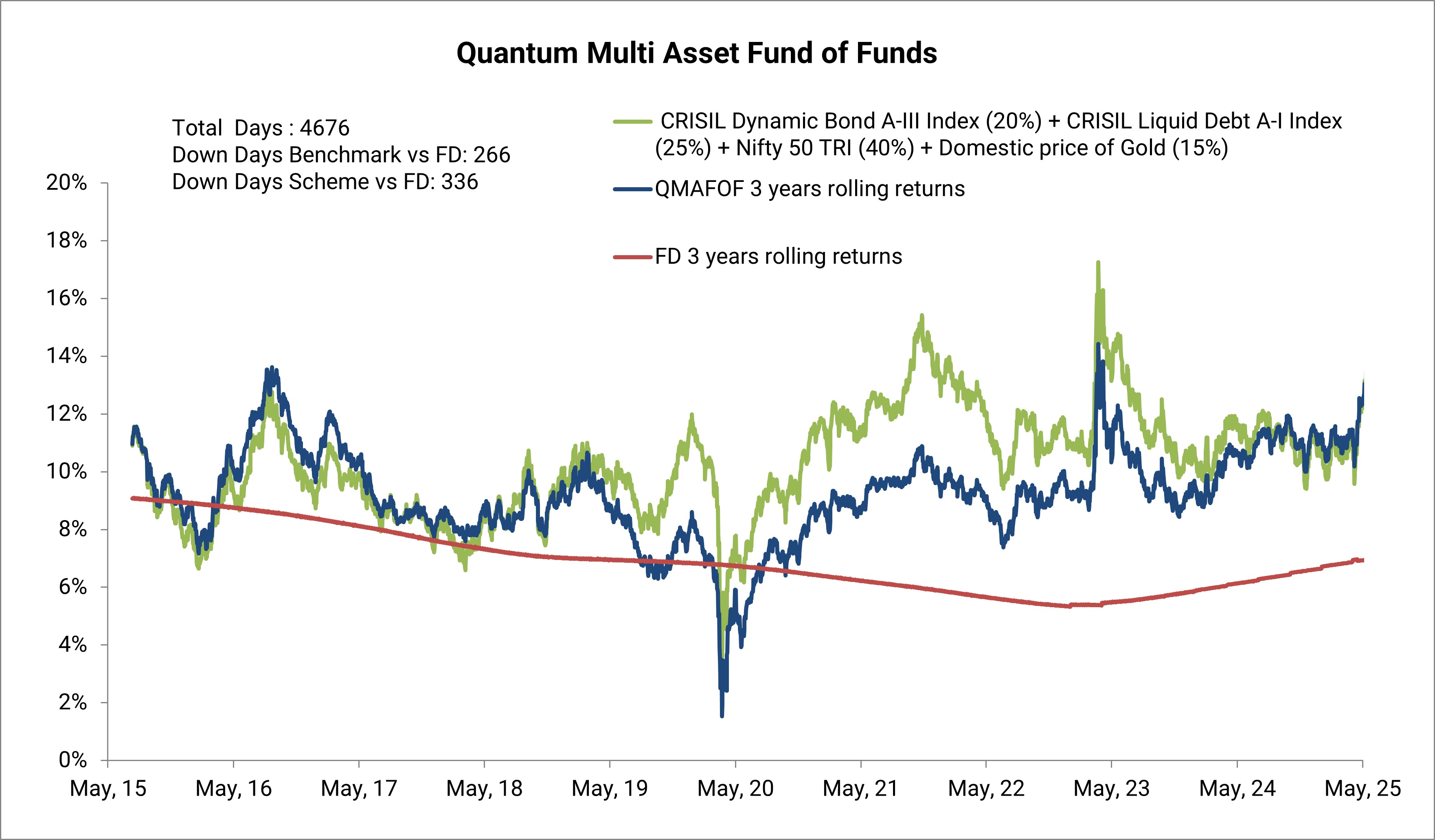

Rolling Returns Reveal the Real Story

Point-to-point returns only tell you what happened between two dates. But investors come in at all times — that’s why rolling returns matter more.

| Total days | Down days vs Fixed Deposit | % of outperformance |

| 4676 | 336 | 92.1 |

The table above indicates total number of days, number of days QMAFOF has underperformed compared to an FD and percentage of outperformance. Note: The graph above has to be read in conjunction with performance of the scheme provided below. Data Source: SBI FD 3-year rolling returns of 1-year FD Rates considered for explanation , Data as on 30th June, 2025.

The comparison with Fixed Deposits has been given for the purpose of the explanation only and not a recommendation to invest. Investments in Quantum Multi Asset Fund of Funds / Mutual Funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in Quantum Multi Asset Fund of Funds / Mutual Funds investment. Investment in Quantum Multi Asset Fund of Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisors.

And here’s the insight:

QMAFOF constructed dynamically — taps into equity growth, debt stability, and gold’s diversification.

On a 3-year rollin g return basis, QMAFOF outperformed Fixed Deposits 92.1% of the time. Let that sink in. 9 times out of 10, QMAFOF gave better 3-year rolling returns than a FD. And over time, this makes a difference— not just in returns, but in the experience of investing.

Don’t Just Diversify. Rebalance.

Diversification is only half the battle.

What matters more is how and when you rebalance.

QMAFOF follows dynamic rebalancing model that helps align the portfolio based on market conditions. If equity overheats, it pulls back. If gold dips, it leans in.

This system:

• Removes emotional decision-making

• Helps avoid chasing trends

• Manages volatility over time

The Tax Edge You May Be Missing

Interest of FDs is taxed every year at your income slab — up to 30%, even if you’re money is invested.

But QMAFOF offers better tax efficiency:

• Held for over 2 years? You pay a 12.5% tax on gains Held for less than 2 years? Gains are taxed as per your income slab (Applicable for investments made on or after April 1, 2023)

• Real return improves for long-term investors

In 2025, Play Safe — But Don’t Sit Still

FDs offer comfort. But in today's markets, comfort comes at a cost.

We’re in a phase of global uncertainty — shifting interest rate cycles, volatile equity markets, and unpredictable macro triggers. Investing your money into a static product might feel safe, but it limits your potential.

QMAFOF is designed for exactly this scenario:

• Conservative in risk

• Dynamic in execution

• Balanced across market cycles

Before you invest in that FD, ask yourself: Is your money growing?

Explore QMAFOF — and make a smarter, more flexible start.

|

Mr. Chirag Mehta is managing the scheme since July 11, 2012.

Ms. Sneha Pandey is managing the scheme since April 01, 2025.

Ms. Mansi Vasa is managing the scheme since April 01, 2025.

| Performance of the Scheme | as on May 31, 2025 | |||||

| Quantum Multi Asset Fund of Funds - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (July 11, 2012) | 10.8% | 10.85% | 14.14% | 34,489 | 37,712 | 55,023 |

| 10 years | 9.68% | 10.66% | 12.74% | 25,217 | 27,574 | 33,226 |

| 7 years | 10.33% | 11.76% | 14.03% | 19,902 | 21,786 | 25,074 |

| 5 years | 12.75% | 14.03% | 21.66% | 18,232 | 19,290 | 26,686 |

| 3 years | 13.31% | 13.34% | 14.95% | 14,549 | 14,559 | 15,189 |

| 1 year | 13.38% | 13.40% | 11.36% | 11,334 | 11,336 | 11,133 |

#CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%). .It is a customized index and it is rebalanced daily. ##BSE Sensex TRI Data as on May 31, 2025. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Click here for other schemes managed by the Fund Managers.

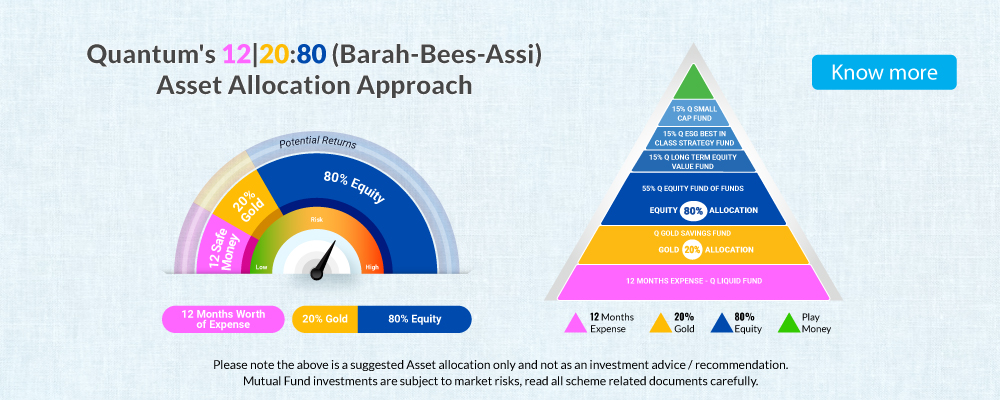

If you prefer a DIY (Do-It-Yourself) approach:

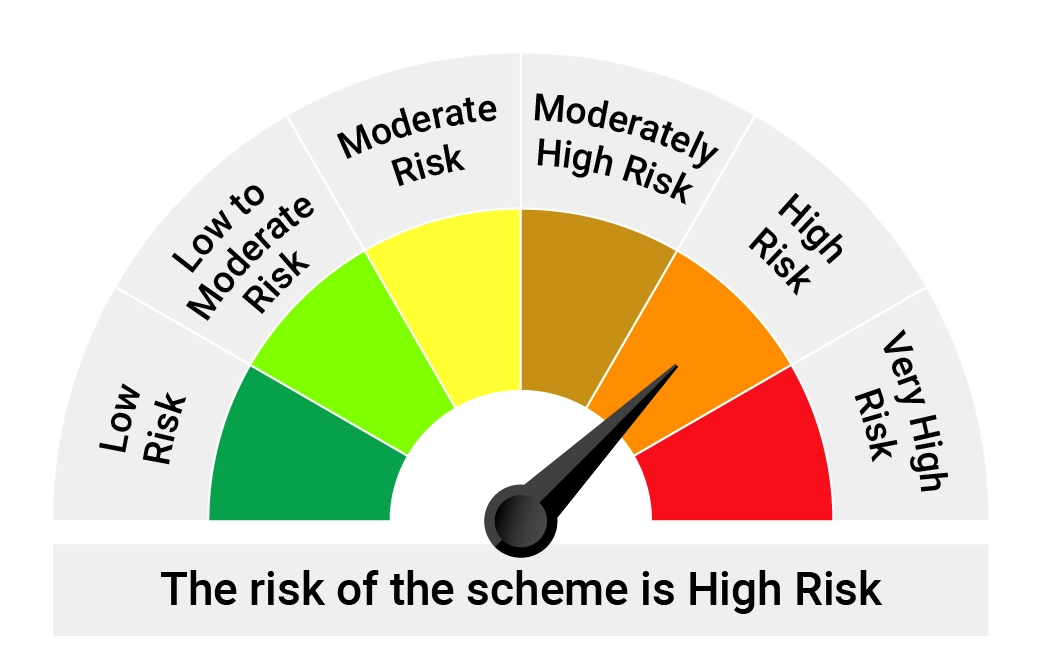

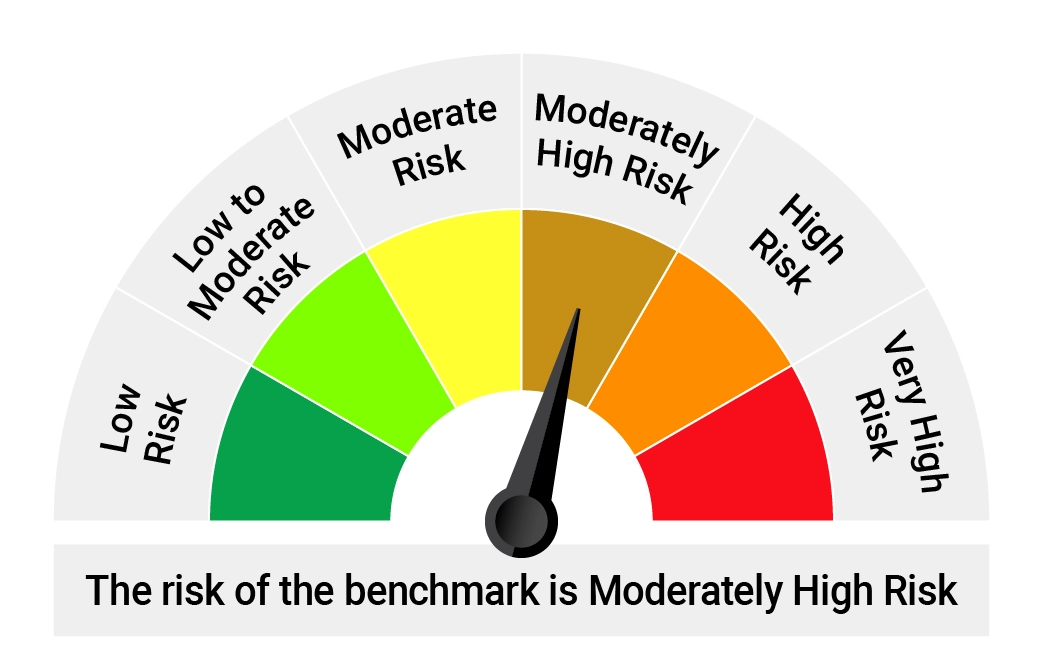

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-I Benchmark |

Quantum Multi Asset Fund of Funds** An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund Tier I Benchmark : CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

**Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More