Investment Outlook 2021: Q&A with Arvind Chari, CIO

Posted On Tuesday, Jan 05, 2021

An exclusive Q&A with Arvind Chari - Chief Investment Officer, at our Sponsor Company, Quantum Advisors. Arvind's vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking the domestic and global economy, he is Quantum's thought leader and we have got him to get his insights on the investing themes and trends in 2021.

1. What are your views on the year 2020 with regards to its impact on Investments and Wealth Creation?

We all wanted the year 2020 to end and look forward to new beginnings in 2021. Any adjective, positive or negative, anyone uses to describe their experience in 2020 is most likely to be true. It was such a year. However, I see 2020 as a year of learning - as an individual, as a member of a family or workplace, as a part of society and as an Investor.

It has been a year of facing, learning and adapting to the Unknown. It was the same with the markets and investments. People would have learnt a lot about their behavioral aspects in investing. How they reacted to the market crash in March; the steps they took to protect their portfolio and whether and how they participated in the ensuing rally across Equity, Fixed Income, Gold and Real Estate.

The one takeaway though remains the good old simple but disciplined asset allocation. Investors who followed Quantum's 24-80-20 Rule, would have had a pleasant and rewarding investment experience. The emergency corpus of up to 24 months of expenses in safe, liquid investments would have provided mental cushion to deal with any income or job loss. The 20% in Gold would have buffered the equity portfolio shock in March. Re-allocating the equity component back to 80% would have ensured greater participation in the recovery. Today, mutual funds allow you to carry out all of these at a click of a few buttons! It is indeed this simple.

2. Do you see emergence of any investing theme or trend which will drive markets in 2021?

As 2020 showed us yet again, it is difficult to predict short-term market movements. However, markets tend to move on particular themes. The consensus-investing theme globally seems to be on:

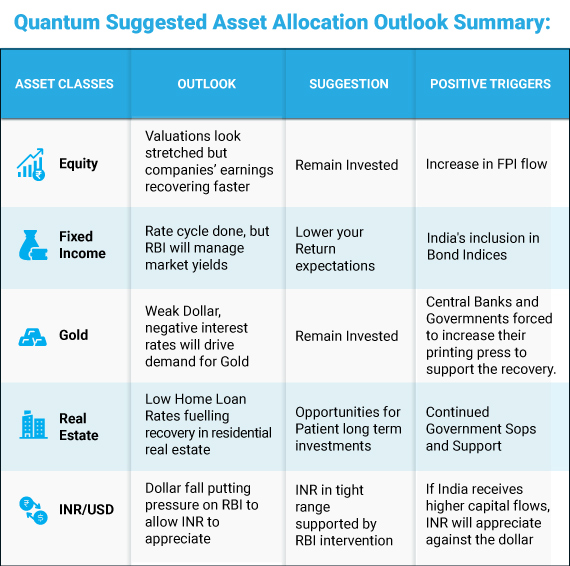

a) Global interest rates will remain low for long and global liquidity will remain in surplus

b) The US dollar will continue to depreciate

These two trends seen together could mean that global investors will seek higher return destinations and will try to diversify their investments to non-dollar assets. If so, this trend should be positive for local investments made in emerging economies. When seen from the geo-political angle of investors moving away from China, India being the only other large emerging Asian economy comparable in size, we seem well placed yet again as a potential recipient of these large flows.

An internal scenario exercise on what happens even if India attracts an excess of only USD 100 billion per year of the global stash of trillions of dollars was revealing. Despite the size and depth of the Indian Bonds, Equity and Real Estate markets, excess inflows of such order will have its impact on market valuations. We may have seen the first wave of such flows in the Indian equity markets over the past 4 months. If India is indeed able to attract such large excess inflows over the year, we expect the Indian rupee to remain strong, interest rates to remain low, liquidity to remain comfortable and equity valuations to remain high.

This is not a prediction but is an 'If so, then what' kind of scenario analysis. It may or may not happen, however portfolio managers will bear this in mind while investing.

3. In a normal scenario, what are your views on the outlook and movement of the three asset classes of Equity, Gold & Debt?

Pankaj Pathak - Fund Manager, Fixed Income at Quantum AMC, believes that the best may be over for capital gains out of Fixed Income and that investors should lower their return expectations (Read our Fixed Income outlook by Pankaj). He expects the RBI to begin a slow normalizing of monetary policy in the second half that may improve returns from liquid funds and short-term fixed deposits. However, interest rates will remain low when compared to our historical averages.

The decade low home loan interest rates and some government sops have brought back smiles in the Real Estate team. Quantum's associate, Primary Real Estate, has seen record sales of residential properties in their projects in the last 3 months and are hoping the momentum continues. Residential Real Estate seems to have turned the corner.

Gold did, what it was supposed to this year. It gained in prices in all currencies living up to its function of a store of value.

Many are enamored with Bitcoin as an alternative to Gold and a hedge against central bank stupidity. I am not sure if it is yet legal to buy Bitcoins in India. Also, investors would need more conviction to treat Bitcoin as a medium of exchange and a store of value. Gold will remain the 'real' asset choice for many. (Read our Gold outlook by Chirag Mehta)

The Quantum Value Equity team heaved a huge sigh of relief this year as markets finally found 'value' in value stocks. Their discipline and process meant they deployed capital in March and benefitted out of the rally. The better than expected rebound in economic activity, low interest rates and cost reductions has meant that earnings estimates are being revised upwards allowing some more time for stocks to remain in the portfolio. Also, the concentrated nature of the market movements has meant that despite markets at record peak, some stocks yet offer value. (Read our Equity outlook by Nilesh Shetty)

Quantum's more than 5 year-long effort on developing a proprietary ESG investment process paved way to the launch of the ESG Equity Fund. The initial signs are rewarding with the fund posting significant returns since its inception in July 2019. ESG at Quantum is not only a fund offering but a philosophy and we believe globally ESG investing will get integrated in most investment portfolios.

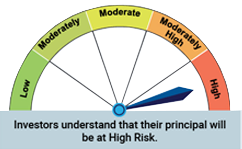

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years | |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold | |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

The Monetary Transition

Posted On Wednesday, Nov 24, 2021

Inflation has been one of the biggest talking points globally in 2021.

Read More -

सौरभ गुप्ता द्वारा मन्थ्ली इक्विटी देखें

Posted On Friday, Sep 17, 2021

एसएंडपी बीएसई सेंसेक्स अगस्त-21 के महीने में कुल रिटर्न के आधार पर 9.4% बढ़ा।

Read More -

निश्चित आय मासिक कमेंट्री - सितंबर 2021

Posted On Friday, Sep 17, 2021

बॉन्ड मार्केट के लिए अगस्त एक सकारात्मक महीना था। मैच्योरिटी कर्व के दौरान बांड यील्ड नीचे आया।

Read More