How 2020 Taught Us the Importance of Asset Allocation

Posted On Wednesday, Dec 16, 2020

The year 2020 ends soon. But is this the end of uncertainties it brought along, no one knows! The outbreak of Covid-19 saw a global meltdown in financial markets. Throughout the year, the Index and various asset classes saw multiple ups and downs. Needless to say, financial health took a set-back for many of us across the world. Investments took a huge hit. But the most affected investors were among the ones who disregarded the importance of asset allocation, who ignored diversification.

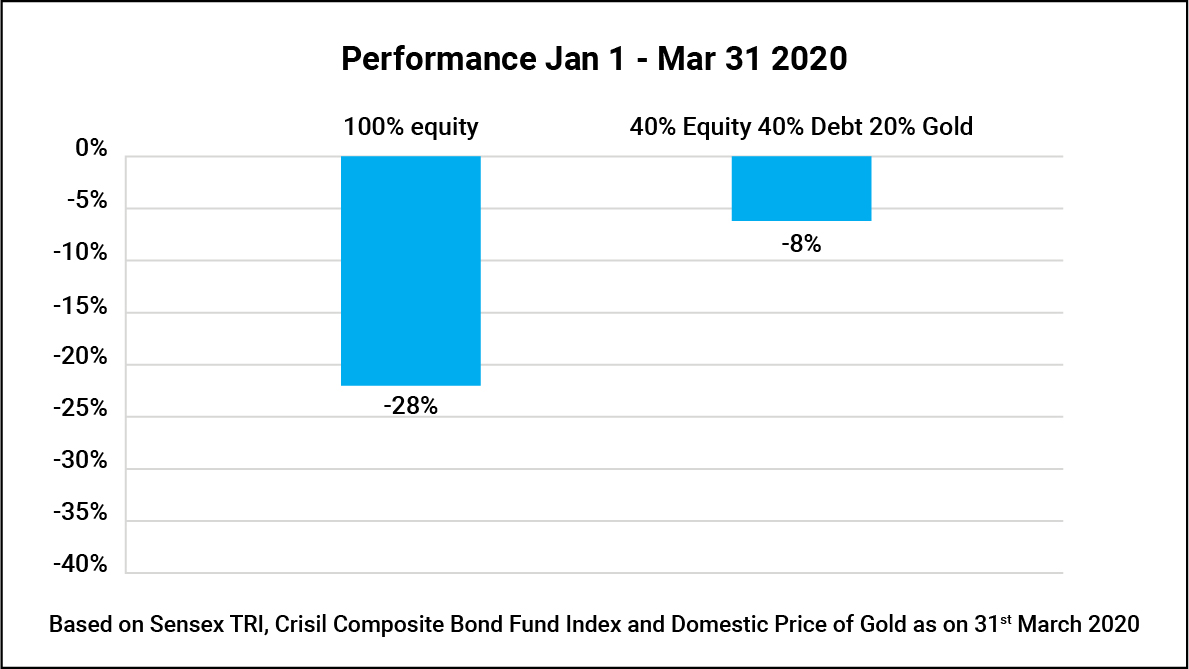

How asset allocation could have protected investors in the Covid-19 sell off in March (India)

What is Asset Allocation? Asset allocation simply means dividing up your assets in the right proportions among equities, debt, bonds, and gold to maximize your chance of achieving your financial goals while also trying to control investment risk. |

But, not to worry. It’s never too late.

It might be a good idea to relook at your portfolio allocation based on your risk appetite and ask yourself these questions to help decide your asset allocation strategy.

1. Is my investment portfolio concentrating on one asset class?

Investing in just one asset class could hamper your financial goals. By strategically diversifying assets across asset classes, you are minimizing risk of a bad outcome. Rebalancing your portfolio will help you eliminate the need to predict the near-term future of the financial markets. It reduces dependency on a single asset class to generate returns.

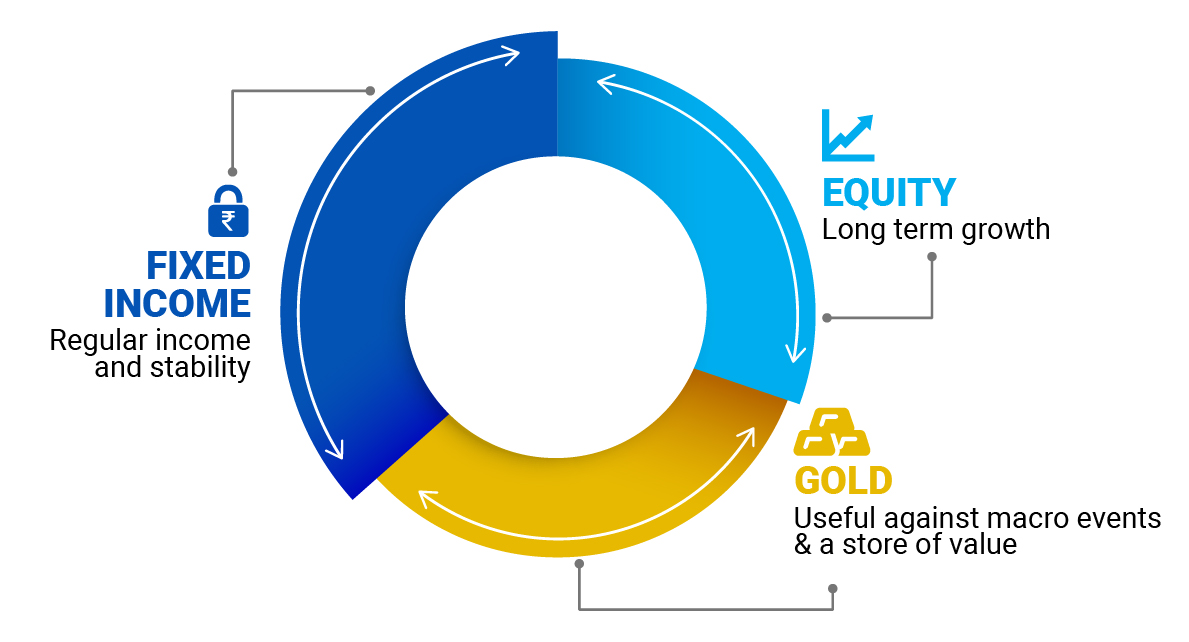

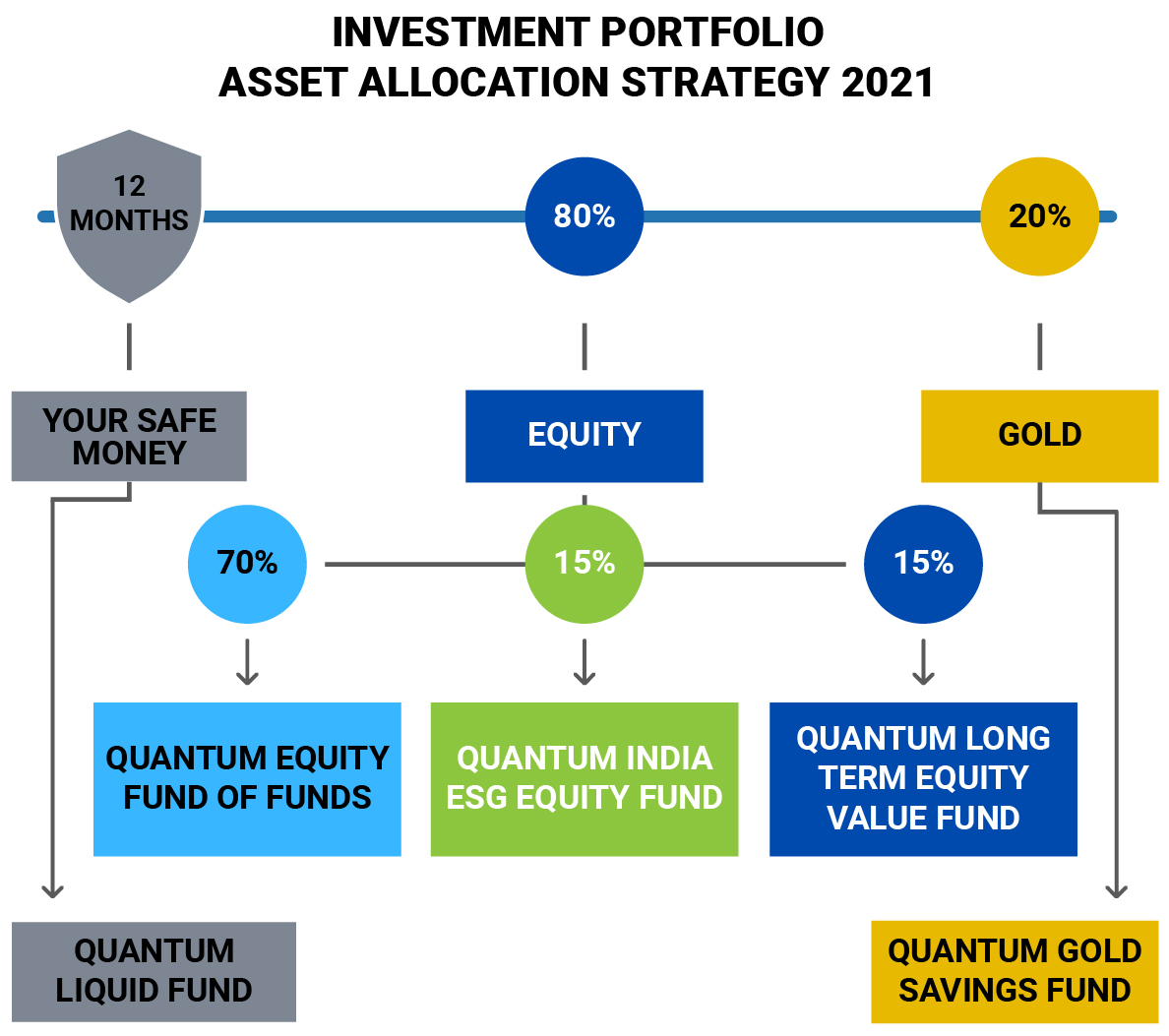

As you see in the chart above, it is suggested to have a safe money in the form of liquid assets such as Liquid Mutual Funds at the heart of your portfolio. These liquid funds help to meet short term cash and contingency needs and at the same time may help earn slight higher returns than those offered by savings bank accounts. You can then have Equity and commodities like Gold in your portfolio. The advantage of diversifying your investments is to reduce dependency on a single asset class to generate risk adjusted returns. This introduces other dimensions of the market that are imperfectly correlated and are expected to respond differently to the ever-evolving economic situation. A well-diversified portfolio can help mitigate downside risk of your investments while growing it.

2. Does it bring a good mix to my portfolio?

All asset classes generally don’t move at the same pace or in the same direction and that’s why having the right mix is important.

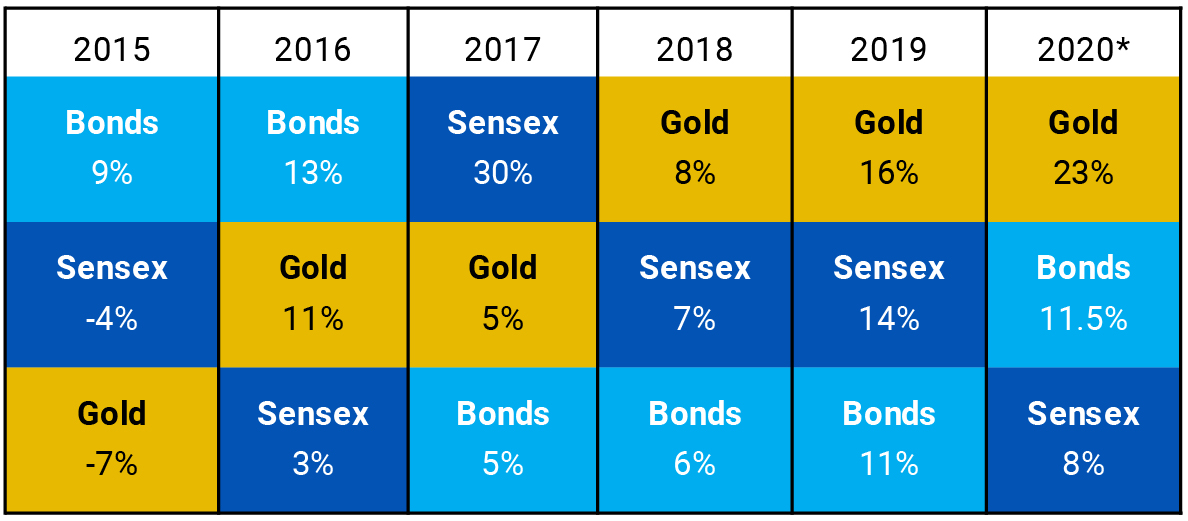

The chart below shows how asset classes react to different market cycles.

*YTD - January to November 30, 2020

The chart ranks the best to worst performing indexes per calendar year from top to bottom.

Indices Used: S&P BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

Past performance may or may not sustained in future

There have been years when equity markets had a dream run. Debt have seen times when they were touted as the most dependable of assets. At times it’s Gold that has shined the brightest. When equities are witnessing a correction, the presence of other asset classes in your portfolio could help you garner net positive returns. The chart shows how imperative it is to have Gold as a part of your portfolio to diversify risk.

3. Does it match my risk profile?

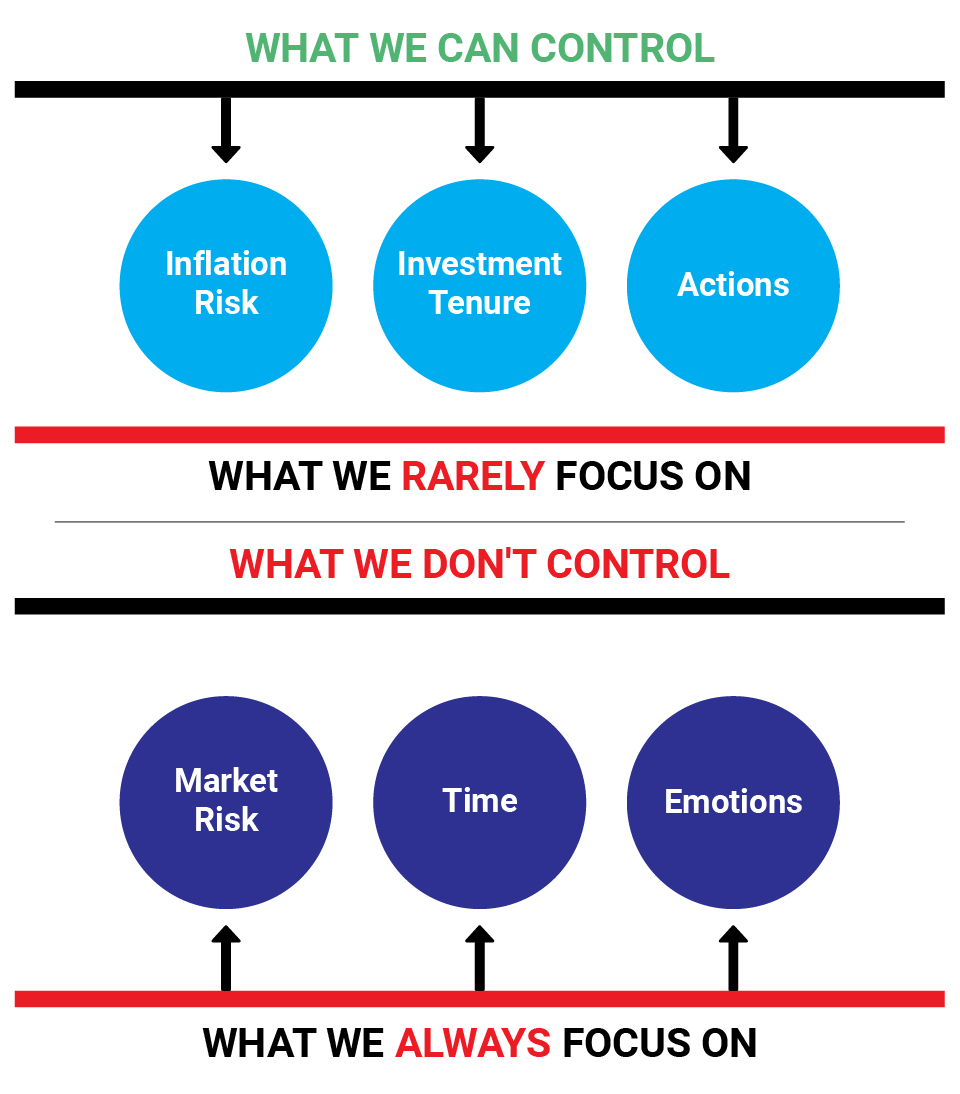

The key for building a successful investment portfolio is to focus on the risk you can control (inflation) and reduce the risk you can’t (market risk). See the infographic below, generally our focus is on things that we don’t control (Market Risk, Time, and Emotions) while we rarely focus on factors we can control (Inflation, Investment Tenure, and Actions).

Even in the most conservative investment portfolio, it is suggested to allocate a portion of assets to equities to diversify your portfolio from inflation risks.

4. Does the asset mix have the potential to help me reach my goals?

The first step in determining your asset mix in relation to your investment goal is to think whether your portfolio can fulfill your goals. Consider your investment horizon carefully during this exercise.

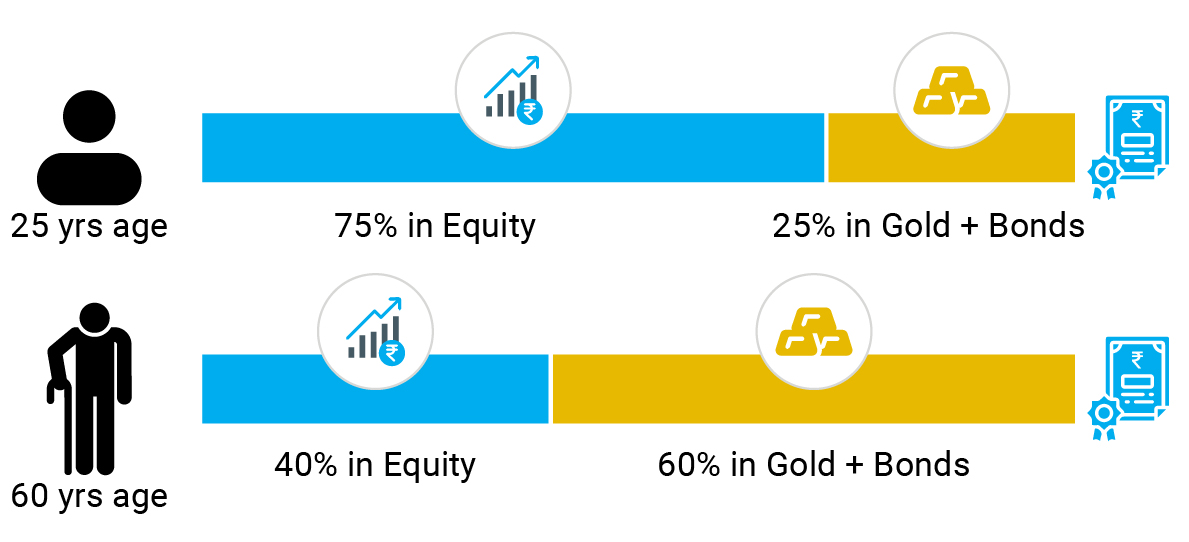

The old thumb rule of subtracting your age from 100 works fine in most cases.

See infographic below:

The above chart is for illustrative purpose only.

At Quantum, we suggest you consider an Asset Allocation plan that has a potential to help you reach your financial goals. Try this simple and hassle-free 12-80-20** portfolio.

5. Are the assets relevant to the emerging themes?

The Year 2020 has been ground-breaking for Gold and ESG funds globally.

Take advantage of emerging investment trends to enable your portfolio to capture maximum benefits from the market cycles.

Key takeaways are:

1. Investing in just one asset class could hamper your financial goals.

2. All asset classes don’t move at the same pace or in the same direction and that’s why having a right mix is important.

3. The key to building a successful investment portfolio is to eliminate the risk you can control (inflation) and reduce the risk you can’t (market risk).

4. Tailoring your asset allocation to your investment tenure improves your chances of achieving your financial goals.

5. Take advantage of emerging investment trends to enable your portfolio allocation to capture maximum benefits from the market cycles.

Conclusion

Markets are volatile by their very nature, they can plunge or rise like a phoenix at any time. Therefore, avoid taking short term measures which can harm your investments in the long run. Hold on to your investments for a long term. Let your SIP continue until you reach your financial goal, no matter what. Spread your investments across asset classes. Park your money in various assets of equity, debt or gold and let your investments grow over the time.

This new-year get a head start to strengthen your asset allocation strategy.

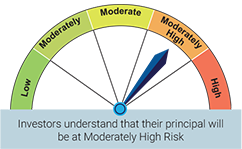

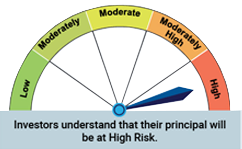

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies | |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold | |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More