5 Reasons to Stay Invested for the Long Term

Posted On Thursday, Apr 01, 2021

The secret to building wealth and achieving your goals is to play the long game. Whether you want to invest for your dream home, child’s education, their marriage or your retirement plan, long term investing demands a lot of patience and a horizon of five years or more.

Let's understand the five reasons why stay invested for the long term:

1. Overcome recency bias

You might be on the lookout for the best equity mutual funds to invest or which mutual fund gave top returns. Instead of chasing that one mutual fund that gives high returns that may or may not be sustainable in the long run, you need to overcome recency bias from a fund performance perspective. You need to look at the long term returns over a period of atleast 3 years or more. The mutual fund must have completed at least one market cycle. If the mutual fund managed to exceed benchmark performance even during market downsides, you can get an idea about the capacity of the scheme to manage the investment across market cycles.

2. Redemption should be tied to the big picture not market performance

Unless you are nearing your financial goals, it is suggested that you should not redeem your investments. Timing the market to make a quick buck can be detrimental to your wealth creation journey. Rather than worrying over an investment’s short-term movements, it’s better to track its big-picture growth trajectory.

Remain focused on the end goal of wealth accumulation and accomplishing financial goals using a financial plan. Be cognizant of your risk profile, investment objective and the time in hand to achieve the envisioned financial goals. It is like following a roadmap that will prevent you from going off track.

Usually, equity mutual funds experience a lot of fluctuations during the short-run. However, equity has potential to provide long term risk adjusted returns.

3. Overcome style bias with diversified equity allocation

When building your equity portfolio, it is found that different investment styles perform differently depending on the macro & market environment.

Thus, it becomes imperative to diversify across Equity Funds to prevent style bias and lower return deviation.

A portfolio with a mix of diversified equity funds varying in investment styles, market capitalization and sectors could have the potential to generate risk-adjusted returns over the long term.

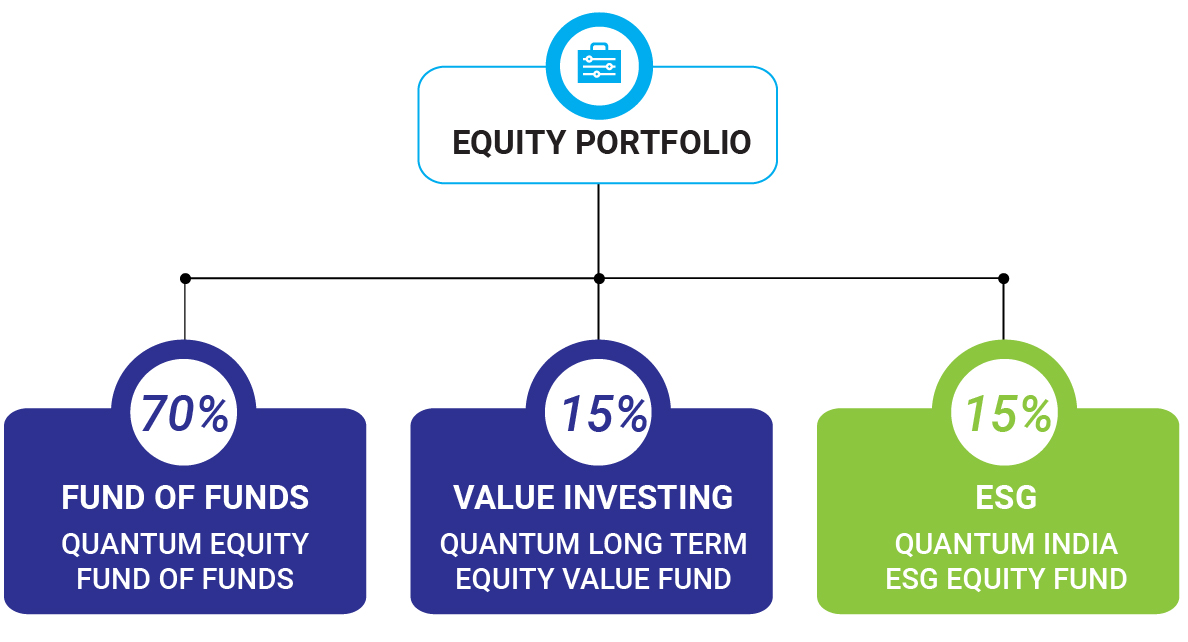

At Quantum, we suggest you diversify your equity portfolio in 70-15-15* ratio across different styles and themes as detailed below:

70% of your EQUITY portfolio can be invested in Quantum Equity Fund of Funds.

By investing in this single fund, your money is diversified across 5-10 third party equity mutual fund schemes across varying market capitalization and diverse sectors chosen based on extensive qualitative-quantitative research and a minimum of 3-year track record.

15% of your EQUITY portfolio can be invested in Quantum Long Term Equity Value Fund.

This is Quantum’s flagship fund since 2006. It follows the Value investing strategy that involves buying companies at discounts to their long-term intrinsic value and focused on the long term potential of business.

15% of your EQUITY portfolio can be invested in Quantum India ESG Equity Fund.

ESG investing considers environmental, social and corporate governance criteria to generate risk adjusted long-term returns and positive societal impact. Quantum India Equity ESG Fund (QESG) is one of the pioneering ESG themed schemes investing in Indian companies.

4. Focus on India’s long term growth story

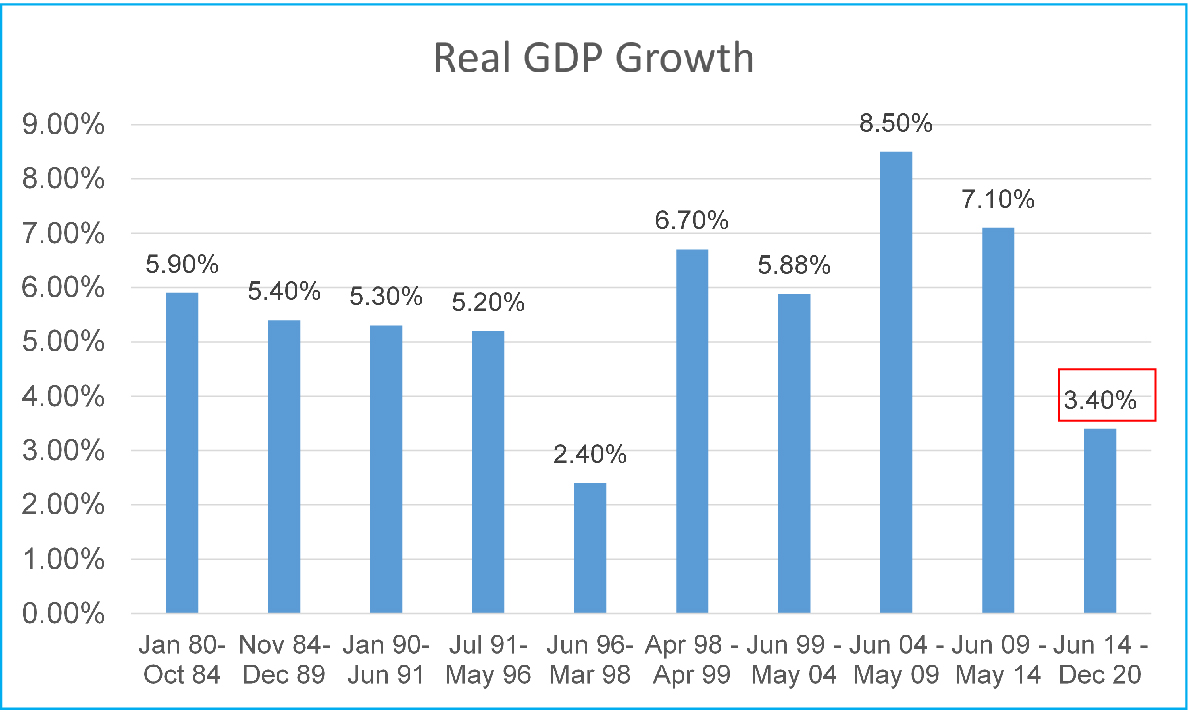

After a record GDP contraction of -24.4% in FY 21 Q1, it is only after two successive quarters, that the economy finally grew to 0.4% in FY 21 Q3 as a result of the rebound in economic activity,

Note: The number in red rectangle is from a changed data series starting Jan 2015.

With the Government’s fiscal expansionary move, calibrated fiscal support, and increased infrastructure spends coupled with RBI’s liquidity enhancing measures is likely to increase employment, & expedite the business cycle to revive corporate earnings over the long term. This in turn may give a boost to equity markets. As historical data shows in the past 39 years, we believe 6.5% Real GDP growth is a realistic long term assumption.

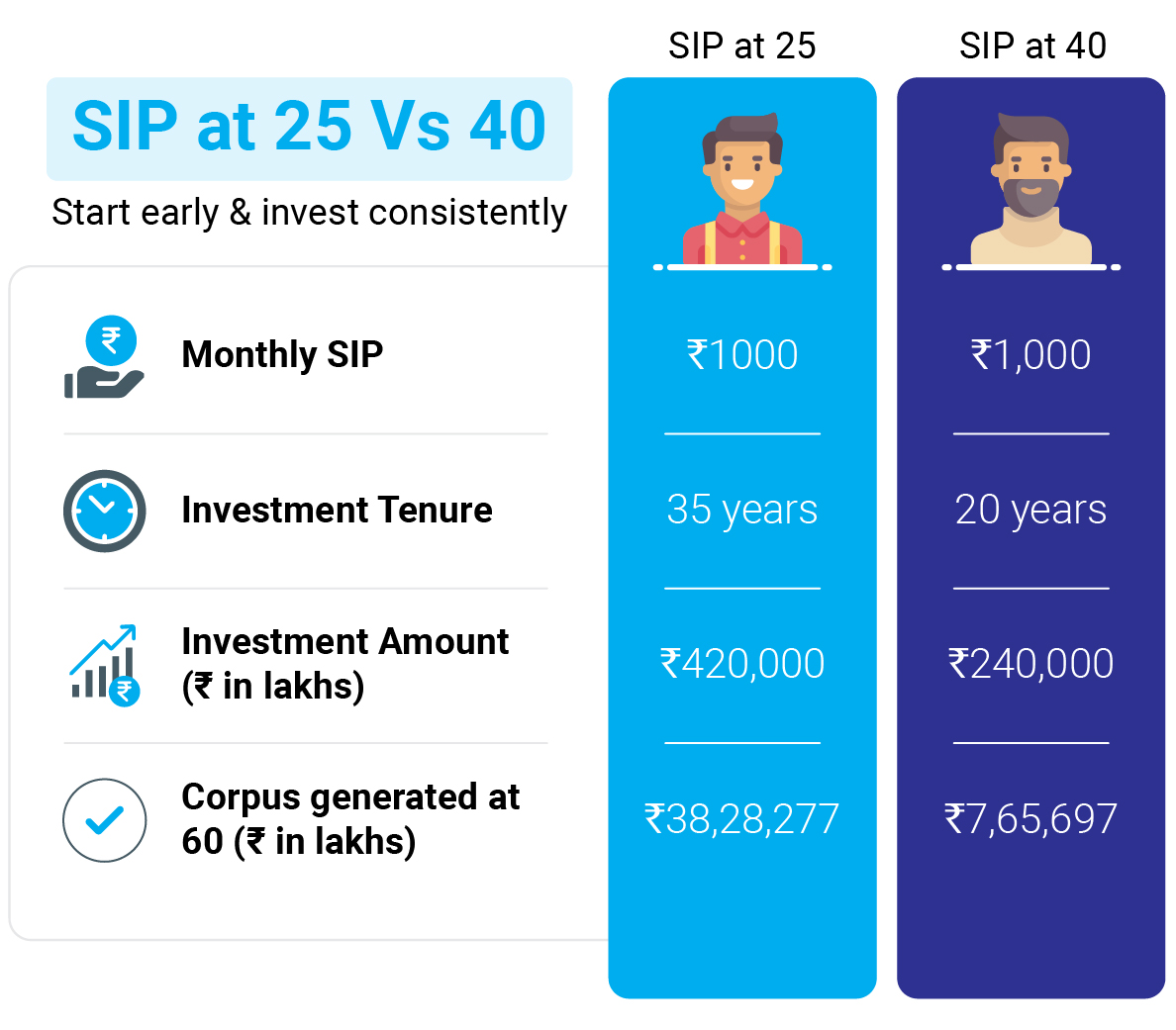

5. Start early and invest consistently with an SIP to unlock the power of compounding

The ideal time to begin investing is at the start of one’s working life, no matter how small the amount is. Let’s understand how investment through systematic investment plan (SIP) of Rs. 1,000 invested per month @ 10% pa till the age of 60. By investing just Rs.1.8 Lakhs extra, the investor who started early and invested consistently has earned a higher corpus of over Rs. 38 lakhs vis-à-vis an investor aged 40.

To summarize the key takeaways from this email, evaluate mutual funds’ performance across market cycles, avoid timing the market, diversify your equity allocation across investment styles, leverage India’s growth story and invest consistently using the SIP mode to unlock the power of compounding.

Stay focused on the future and keep a long-term perspective to achieve your goals.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More