Build a Weatherproof Portfolio Passively - With Our Upcoming NFO

Posted On Thursday, Jul 14, 2022

Has the recent decline in the stock markets resulted in losses in your mutual fund portfolio or sleepless nights?

Perhaps you did not diversify your investments across many asset classes and across many kinds of equity funds. Investing in equity mutual funds has proven to be a wonderful way to build long term wealth – perhaps the problem was that you did not have someone to guide you on which asset classes to invest and how much to invest in each asset class.

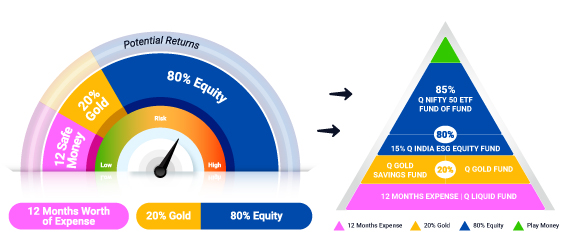

In our continuous endeavour to simply investing for you, our 12:20:80 Asset Allocation Strategy - that you can modify to suit your specific, individual needs- is that simple guide that has stood the test of time.

Quantum has been meticulously adding funds over the years across the asset classes of Equity, Debt and Gold to create a one stop shop for all your mutual fund investment needs and objectives. Each fund that we have launched forms a building block in our well thought-out and time-tested 12-20-80 Asset Allocation strategy.

The Quantum Nifty 50 ETF Fund of Fund – NFO July 18, 2022 – August 1, 2022 is a critical block in our suite of products to offer a complete solution for investors who prefer to diversify their investments in passive funds.

#Please note the above is a suggested fund allocation only and not as an investment advice / recommendation.

Introducing - the Quantum. Nifty 50 ETF Fund of Fund - NFO Opens July 18, 2022

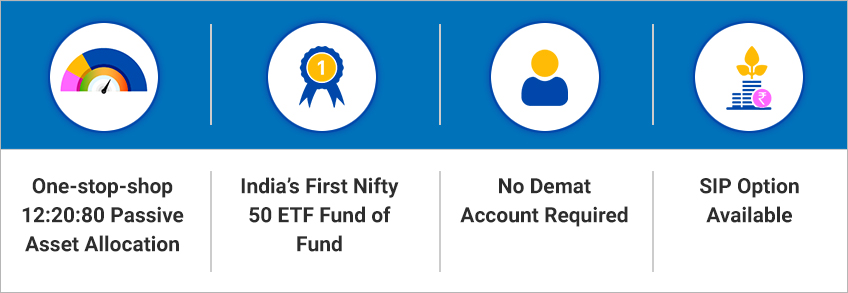

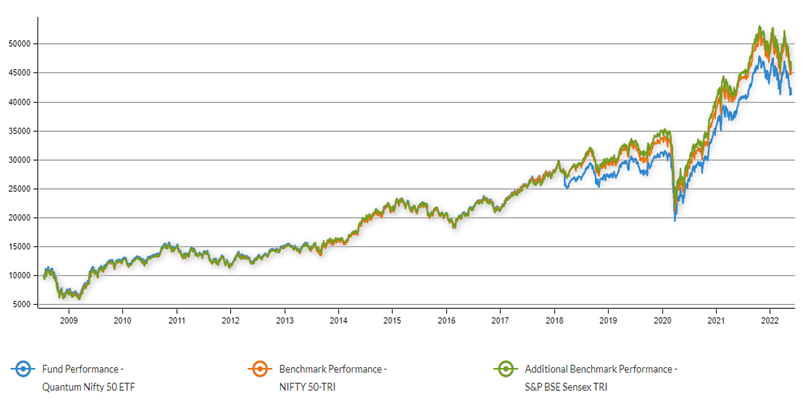

Quantum brings to you an easy way to ride India’s growth story with a fund that provides exposure to the Nifty 50 Index. It is a first of its kind wrapper fund that invests in units of the Quantum Nifty 50 ETF, offering the efficiency of an ETF with the convenience of an Index Fund. The underlying Quantum Nifty 50 ETF tracks/ replicates India’s Nifty 50 companies and has a proven track record of 14 years and counting.

The returns of Quantum Nifty 50 ETF will be similar to the returns of Nifty 50 Index (subject to the tracking error), as the Quantum Nifty 50 ETF tracks / replicates the Nifty 50 Index while investing. This will keep your cost of investing low and offer you liquidity. Quantum Nifty 50 ETF Fund of Fund as the name suggests, benchmarks its performance against the Nifty-50 Total Return Index

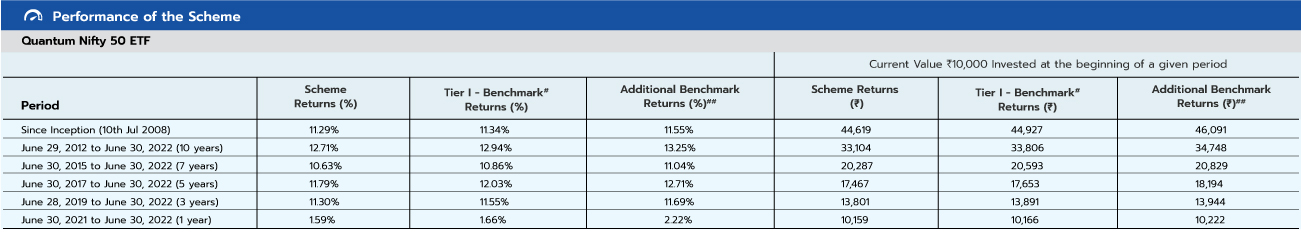

Data as of June 30, 2022

Base value Rs 10,000

Past performance may or may not be sustained in the future. The above performance to be seen in conjunction with the complete performance as given below.

Since its inception in July 10, 2008, the Quantum Nifty 50 ETF has generated CAGR of 11.29% (as of June 30, 2022).

Build a Weatherproof Portfolio with 12:20:80

While it is a good time to invest in equity and balance/ rebalance your portfolio, do not forget the importance of asset allocation in building a weather-proof portfolio.

✔ Emergency Block: Before you start investing, set aside at least 12 months of your monthly expenses for emergencies or other unknown expenses in a bank savings account or a liquid fund such as the Quantum Liquid Fund.

✔ Portfolio Diversifying Block: Allocate 20% to the pure and portfolio diversifying asset of Gold that generally has a negative correlation with equities and generally performs better during periods of macroeconomic stress. Allocate with newer and efficient forms of this investment option such as Quantum Gold Fund ETF and Quantum Gold Savings Fund.

✔ Growth Block: Finally, ensure that 80% of your mutual fund portfolio is invested in a diversified equity portfolio, that is free from style or market cap bias.

If you choose to build a passive allocation, allocate 85% in the NFO - the Quantum Nifty 50 ETF Fund of Fund and initiate an SIP (Systematic Investment Plan) or lumpsum during the NFO period, and the balance of 15% in Quantum India ESG Equity Fund. The Quantum Nifty 50 ETF Fund of Fund gives you exposure to India’s top^ 50 companies across diverse sectors.

For those interested in actively managed funds, you can Invest 70% of your equity bucket to Quantum Equity Fund of Funds. 15% of your portfolio can be allocated to Quantum India ESG Equity Fund. Invest the final 15% of your equity portfolio in the Quantum Long Term Equity Value Fund.

Experience the magic and simplicity of the 12:80:20 allocation strategy through the asset allocation solution to simplify your portfolio allocation needs. Visit the website or log in to your portfolio and experience the 12:20:80 calculator for yourself.

If you choose to build or add to your portfolio using passive funds, do not miss out subscribing to our upcoming NFO starting July 18, 2022, and closing on Aug 1, 2022.

Take the opportunity to combine the efficiency of the Nifty 50 ETF with the convenience and flexibility of an index fund. It is a simple and straightforward way to build a weather-proof portfolio passively without having to stress about timing markets or worry about unforeseen circumstances.

|

|

#Nifty 50 Total Return Index, ##S&P BSE Sensex TRI.

Data as of June 30, 2022.

Past performance may or may not be sustained in the future. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The Scheme being Exchange Traded Fund has one plan to invest through stock exchange and having a single expense structure.

Income Distribution of Rs. 80 was declared on 9 March 2018. Scheme return calculated above is inclusive of Income Distribution amount.

The scheme is managed by Mr. Hitendra Parekh. Mr. Hitendra Parekh is the Fund Manager managing the scheme since July 10, 2008.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Nifty 50 ETF Fund of Fund** An Open-ended fund of fund investing in units of Quantum Nifty 50 ETF | • Long term capital appreciation • Investments in units of Quantum Nifty 50 ETF – Exchange Traded Fund |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

**The product labelling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio the same may vary post NFO when the actual investments are made. For latest riskometer, investors may have to refer to the Monthly Portfolios disclosed on the website of the fund www.QuantumAmc.com/ www.QuantumMF.com

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

^Top 50 Companies based on Free Float Market Capitalization

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on June 30, 2022.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on June 30, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark |

Quantum Nifty 50 ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |  |

The Risk Level of the Tier I Benchmark Index in the Risk O Meter is basis it's constituents as on June 30, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Overcome Market Uncertainties: The Power of Multi-Asset Investing

Posted On Tuesday, Sep 03, 2024

As we step into September, Indian stock markets may face increased fluctuations, influenced by global and domestic factors.

Read More -

Getting Financial Freedom on Track

Posted On Friday, Aug 26, 2022

On Aug 15, 2022, India celebrated 75 years of independence. As in the past, India has displayed resilience and the potential to overcome challenges..

Read More