5 Ways to Invest during Uncertain Times

Posted On Thursday, Dec 09, 2021

It is natural to be anxious about your investments as markets are getting unpredictable and have been experiencing wide market swings. Unfortunately, this can often lead many to making haphazard decisions, exposing their portfolio to downside risks.

However, as thoughtful investors, amidst all this uncertainty, you need not worry, but know the right steps to respond to market movements and try to lower the impact of underlying risks to your portfolio.

The risks currently impacting the market sentiment:

• Lofty valuations

• Higher global inflation

• Anticipation of liquidity normalization and rate hikes

• Emergence of Omicron as a new variant of Covid -19

• Resurgence of Covid-19 cases in the US and parts of Europe

How can you ride the market swings?

While it may seem that the Bears have taken over Dalal Street as benchmark indices have declined by over 9% to 56,747.14 as of Dec 06, 2021, from their record high levels of 62,245.43 in Oct 10, 2021, consider the following parameters to help you ride the market swings with ease.

5 ways to consider in response to the market swings:

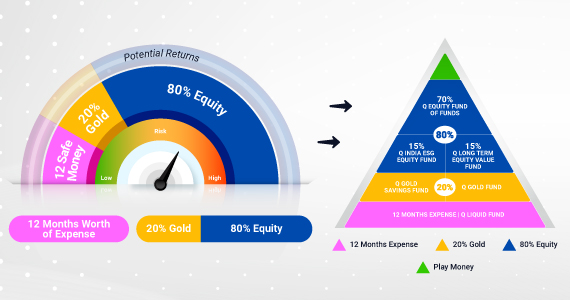

**Please note the above is suggested fund allocation only and not an investment advice / recommendation.

There are three crucial building blocks within this strategy with underlying assets in Equity, Debt and Gold which helps to achieve your long-term goals and ride the market swings with peace of mind. When you combine the assets, you get the potential for risk-adjusted returns over the long term.

The Safety Block: Avoid redeeming from your mutual funds meant for long-term goals and set aside money to meet unforeseen expenses such as medical emergencies, unexpected travel, etc. As a general guideline, you should set aside around 12 months of your monthly expenses in savings bank account or liquid scheme such as the Quantum Liquid fund. This fund gives you an insta-redemption option of up to Rs.50,000 and the flexibility to redeem anytime. It is an open-ended liquid fund that follows the SLR (Safety, Liquidity, Returns) principle and prioritizes safety and liquidity over returns by investing in G-secs and AAA-rated PSU debt securities.

The Gold Block: As an asset class, Gold generally has a negative correlation to equity and generally tends to perform better during periods of volatility. With high inflation rates, gold is likely to benefit and will continue to play a risk-reducing, portfolio diversifying role in the long run. You can consider investing up to 20% of your portfolio to price-efficient and liquid options such as the Quantum Gold Fund ETF and Quantum Gold Savings Fund.

The Equity block: Diversify across market caps and styles by investing 70% in Quantum Equity Fund of Funds which invests in well-researched equity mutual funds with a proven track record. By investing in this one fund, you get exposure to a truly diversified fund and avoid the hassle of tracking multiple funds in the market.

| Fund Name | Category | Suggested Allocation |

| Quantum Equity Fund of Funds | Fund of Funds | 70% |

| Quantum Long Term Equity Value Fund | Value Fund | 15% |

| Quantum India ESG Equity Fund | Thematic Fund (ESG) | 15% |

**Please note the above is suggested fund allocation only and not an investment advice / recommendation.

Resort to a sensibly valued fund by allocating 15% to the Quantum Long Term Equity Value Fund. Though valuations look expensive, markets are generally heterogenous and our fund managers look for pockets of value in the large, listed space. This fund incorporates margin of safety approach to their portfolio building and have potential to limit the risk of downside during market swings.

Look beyond PE levels by allocating 15% to the Quantum India ESG Equity Fund. This fund goes beyond traditional valuation metrics and looks to shortlist companies based on environmental, social and governance parameters. Though these are non-financial parameters, they can have a material impact on the firm’s earnings and valuation.

Your One Stop Solution to meet all your Asset Allocation Needs

With Quantum Mutual Fund, you have access to simple products that can be used as building blocks to create the perfect Asset Allocation Strategy that meets your needs. You can use 12-20-80 as a base and adjust this based on your individual needs.

If you do not have the time to track multiple funds in DIY asset allocation, we also have the Quantum Multi-Asset Fund of Funds. Here our fund manager does the work for you – by following a regular rebalancing approach within each asset class of equity, debt and gold.

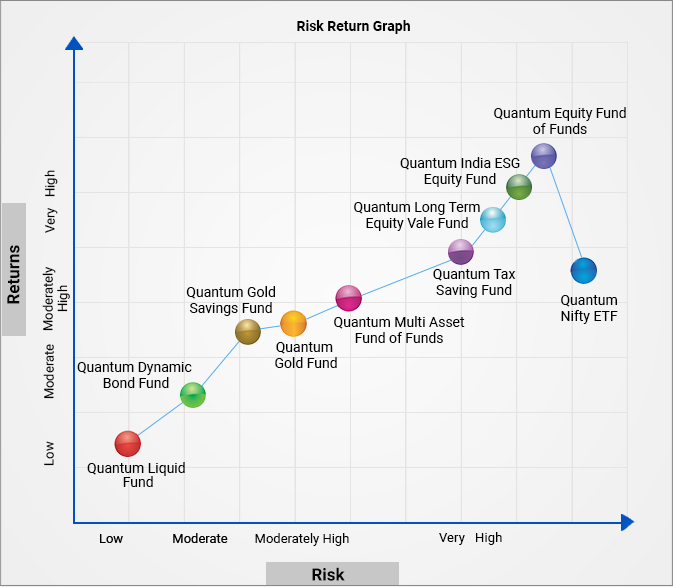

Illustrative Views of Risk Returns Graph of Quantum Mutual Fund Schemes

The above graph is for illustrative purpose to explain the concept of Risk and Returns in Quantum Mutual Fund schemes. Please review the actual returns and risk-o-meter of the respective schemes independently to make informed investment decision.

Switch off from the market noise, ride the market cycles by diversifying your investments with the Quantum 12-20-80 Asset Allocation Strategy.

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Nifty ETF An Open Ended Scheme Replicating / Tracking Nifty 50 Index | • Long term capital appreciation • Investments in equity and equity related securities of companies in Nifty 50 Index |  Investors understand that their principal will be at Very High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on November 30, 2021.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More