Decoding the apparent disconnect between physical and derivative gold markets

Posted On Friday, May 22, 2020

India, despite being one of the largest consumers of gold, is a price taker. What we mean by a price taker is that the prevailing International gold price is used to set gold price in India. The International gold price is used as a base price and converted to Indian rupees using the Dollar/ Rupee rate and we add to it various Indian duties and levies to arrive at the Indian gold price. We call this as the benchmark gold price or also known as the theoretical gold rate.

With that background, we are trying to explain gold market behavior over the last couple of months due to the lock down. Most investors track the prices that they see on TV channels, newspapers, web portals. Most of these showcase MCX gold prices. MCX is a derivative exchange and reflects futures prices. As a result, many Gold ETF investors are concerned about the apparent price disconnect between physical and derivative gold markets. Earlier we had physical gold-backed Gold ETF prices seemingly increasing faster than MCX prices and now the Gold ETF prices seem to be tapering off and MCX prices are seen catching up.

As we have gone through phases of lock down, there was an apparent disconnect between physical and the derivative gold markets.

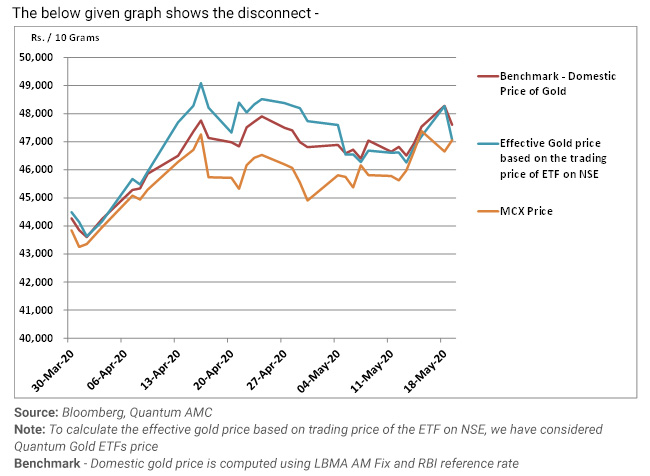

In early April, when the existing inventory of gold started reducing and no new gold imports could arrive due to flights not operating, increasing demand led to a buildup of premium for the physical supplies in the Indian markets. This premium is seen in the differential between the red and blue line wherein the red line reflects the benchmark / theoretical Indian gold price. We have used the Quantum Gold ETF traded prices on NSE (blue line) as a proxy and equated to a converted 10 gram gold price reflective of the actual physical gold market prices.

As import of some gold was possible post mid-April, the premiums have decreased as seen in the chart below. As a matter of fact, mines and refineries were also impacted due to lockdowns globally; such premium build up was not unique to India but also seen in global markets like London and US.

However, if you see the orange line, the MCX gold prices that most of the investors track, were trading at a discount to the benchmark gold prices. The spread between the spot price of gold and the futures price is typically fairly efficient. That is to say, the two prices are normally within a few Rupees. However, that same spread (often referred to by traders as the EFP, or Exchange-for-Physical) has been wider than usual over the last 2 months with physical gold trading at premiums and futures contracts trading at discounts to the benchmark price.

The MCX gold contract prices which have been trading at a discount to the benchmark prices now seem to be rebounding to the benchmark price levels to reflect their underlying - physical gold prices - as the expiry date nears.

In the graph, we see that the physical gold price has been trading at a premium to the benchmark price and the MCX futures contract price has been trading at a discount. Both are now merely returning to benchmark levels and thus appear to be moving in opposite directions, warranting investor concerns. In summary, there is no anomaly with Gold ETF pricing and returns, it was just the market dynamics at play that led to short term jump in premiums on account of import stoppage and has been corrected now.

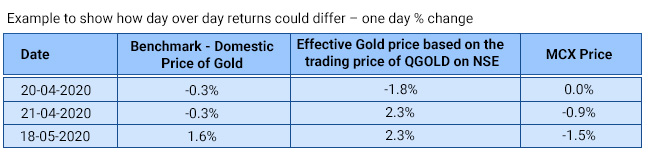

Also, investors should note that the one day return changes that they see in various prices could significantly differ on account of sheer differences in timing when the closing prices of each are determined. Gold ETF closes at 03:30 pm and the closing price is the weighted average price of the last half hour of trade. Whereas, MCX closing price is arrived at using the weighted average of last hour trade which ends at 11:30 pm (reduced to 5pm now due to lockdown). Given the volatility in gold markets, these closing prices could significantly differ and therefore the one day change that you see for both these products could be very different at times.

Hope that eases your worry on the price changes you see. In fact, if you think of it, despite India being a price taker we still don't have a standardized gold price. From a price standpoint, Gold ETFs are highly price efficient, regulated vehicles to invest in 24 karat real physical gold, so build your portfolio allocation through Gold ETF now.

You can invest online in Quantum Gold Savings Fund which invests in units of Quantum Gold Fund - Exchange Traded Fund.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for March 2026

Posted On Sunday, Mar 01, 2026

Gold entered February 2026 consolidating around $4,800, after a steep fall from its late-January peak of $5,598

Read More -

Looking Beyond the 10-Year Benchmark: Decoding India’s Bond Market Signals

Posted On Thursday, Feb 26, 2026

If you glance at India’s financial headlines today, the tone feels reassuring.

Read More -

From Storage to Circulation

Posted On Thursday, Feb 26, 2026

From Storage to Circulation: Can Total Return Swaps Transform India’s Corporate Bond Market?

Read More