World Health Day: Build a Healthier Portfolio with Quantum ESG Best-in Class Strategy Fund

Posted On Friday, Apr 05, 2024

As we celebrate World Health Day on April 7th, it's a timely reminder of the importance of wellness in all spheres of our lives. As you know, this year's theme for World Health Day is "Health for All. Everywhere." This theme emphasises the need to ensure everyone has access to the resources they need to live a healthy life. It serves as a reminder for individuals and communities to prioritize their physical, mental, and emotional well-being. However, beyond just focusing on our physical health, it's essential to recognize the importance of financial health as well. Much like maintaining a healthy body, managing one's financial portfolio requires attention, care, and regular check-ups. A strong financial portfolio not only ensures stability and security for individuals and families but also contributes to overall well-being and quality of all stakeholders.

Enhance Financial Wellness with a Right Equity Investment

It is important to assess the health of your investment portfolio that will eventually determine your financial wellness and achievement of your future goals. The disruptions brought by the pandemic, war, climate change, and pollution, are a wake-up call to adopt a more thoughtful approach.

More and more investors are increasingly becoming aware of the significance of weighing investments beyond financial parameters which will eventually impact future returns.

A better way to achieve your goals while doing good for the planet is choosing the ESG approach for equity investing.

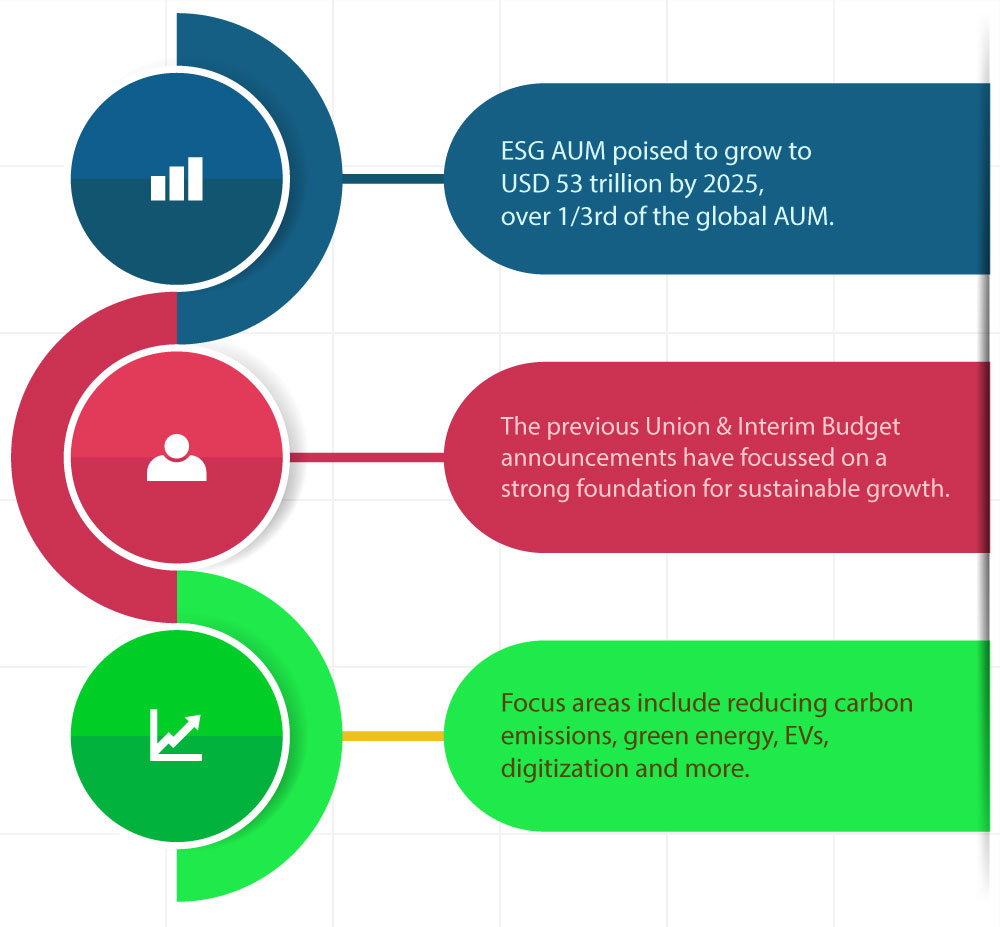

Why ESG Investing is Gaining Importance?

Source: Bloomberg Intelligence, Union Budget

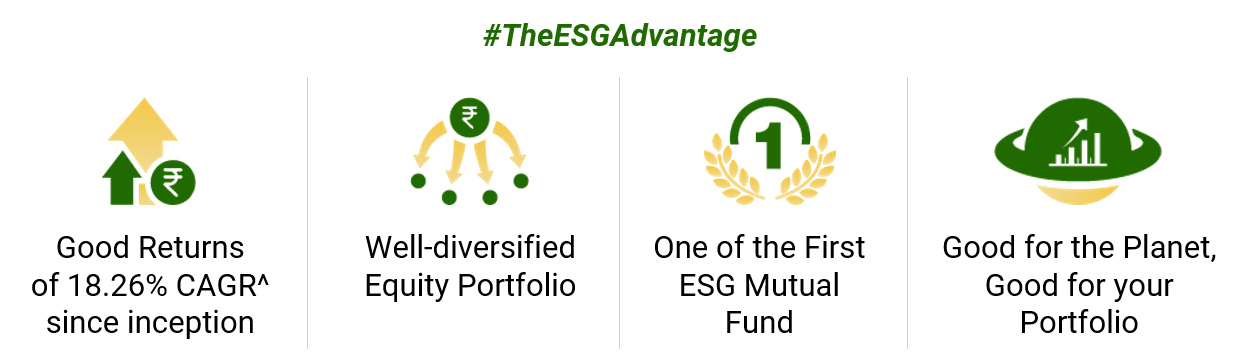

At Quantum Mutual Fund, we believe that a combination of equity investing following environmental, social, and governance (ESG) principles can be a powerful way for enhancing the health of your portfolio while targeting potential growth.

What's Unique about Quantum ESG Best-in-Class Strategy Fund?

The scheme banks on a strong in-house proprietary research team, which has evolved through the years going through a learning curve in the ESG space.

ESG investing still warrants a detective’s lens – one cannot solely rely on Business Responsibility & Sustainability Reporting. Apart from company disclosures, at times, it becomes pivotal to move beyond desk research and go on the ground to conduct industry checks.

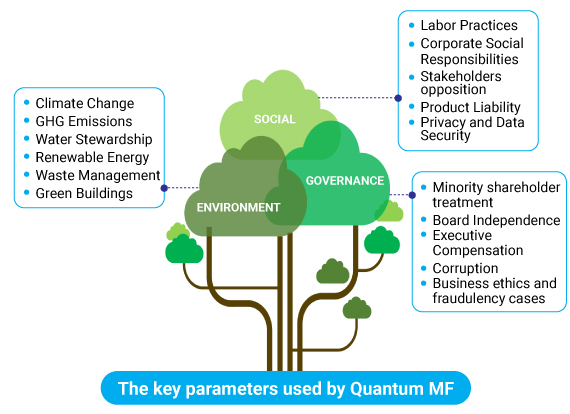

While screening companies, we subjectively evaluate more than 200 parameters across the Environment, Social and Governance domains. What investors eventually receive is the result of a 360-degree view of the companies we invest in.

Our fund portfolio is purely based on ESG parameters, irrespective of the PE ratio or any other metric. Instead, we look at the stocks ESG score to determine its weightage in our fund subject to the company meeting our financial soundness assessment and the liquidity criteria.

Low Score → Low Weight, High Score → High Weight.

Companies that score positive and are above the minimum threshold ESG score are generally included in the portfolio.

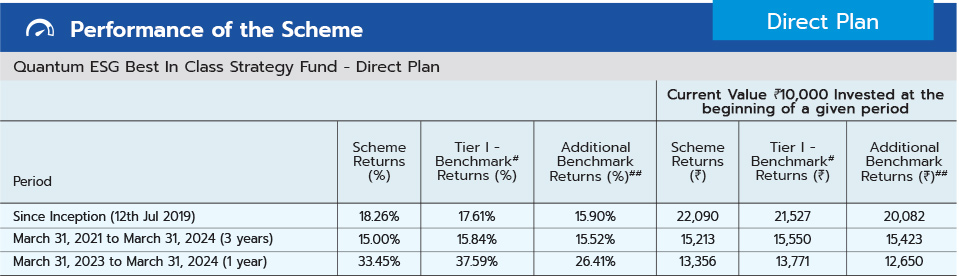

^The return is as of Mar 31, 2024. Past performance may or may not be sustained in the future. The above return should be seen in conjunction with the complete fund performance specified below.

Scheme Performance

The scheme has beat the benchmark returns since its inception as seen in the below table.

Past performance may or may not be sustained in the future. Load is not taken into consideration in Scheme returns calculation. Quantum ESG Best In Class Strategy Fund Performance as on Mar 31, 2024 Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The Fund is managed by Chirag Mehta and Sneha Joshi. Chirag Mehta is managing the fund since July 2019. Sneha Joshi is managing the fund since Jul 2019. Click here to view the performance details of other funds managed by Chirag Mehta.

By incorporating ESG principles into investment strategies, you can not only contribute to positive societal change but also mitigate various risks associated with environmental degradation, social controversies, and poor governance practices. Moreover, companies with strong ESG credentials tend to outperform their peers over the long term, indicating a correlation between sustainable practices and financial performance.

Therefore, integrating ESG considerations into your investment portfolio not only aligns with ethical values but also enhances the health and resilience of the financial portfolio by promoting sustainable growth, mitigating risks, and fostering long-term value creation.

Invest in Quantum ESG Best in Class Strategy Fund to help you achieve your financial health while making a positive impact to the planet.

|

|

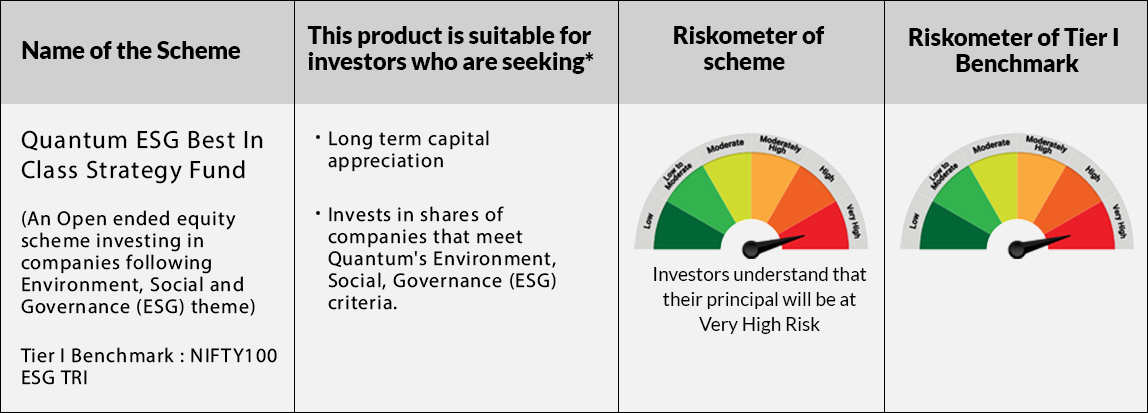

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for March 2026

Posted On Monday, Mar 02, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More