When Is the Best Time to Start an SIP

Posted On Thursday, Dec 28, 2023

Mutual funds are considered one of the best instruments for individual investors to start their investment journey. Investors frequently look for the ideal moment to invest in mutual funds as they are vulnerable to market risks. When it comes to investing in mutual funds, there isn't any 'best' or most suitable time. The right moment to invest is whenever you are prepared to do so. It is more about how and which mutual funds to invest in than when to invest.

To fulfil the unique goals of every investor, mutual funds provide a variety of simple, smart, and convenient options or modes of investment like the Systematic Investment Plan (SIP).

What is a Systematic Investment Plan (SIP)?

SIP or a Systematic Investment Plan is a mode of investment where you can gradually invest a fixed amount at specific intervals in mutual fund schemes. SIP investment is one of the best ways to invest in mutual funds, as anyone with a regular income can invest and generate decent returns in the long run. SIPs provide investors with many benefits like rupee cost averaging, power of compounding, accumulation of wealth, etc.

SIPs provide the flexibility to invest a fixed amount every week, month, quarter, or half-yearly for a definite tenure, depending on your income and financial goals. The investments are made according to pre-determined periods, wherein the mutual fund investment money is auto-debited from the investor's account.

SIPs are the best option for beginners or first-time investors as they allow them to earn returns with lower investment risk. Many investors often hesitate to invest a large sum of money in mutual funds, but SIPs don't require a large amount. You can begin with as low as Rs 500/- and gradually increase the amount.

Should you wait for the best time to start a SIP investment?

The most common question investors ask is – when is the best time to start an SIP? Well, there is no such best time to start a SIP; you can invest a small portion in mutual funds through SIP whenever you are ready to do so for your financial goals. Keep in mind, that mutual fund investments are subject to market risks, but SIPs with their inherent rupee-cost averaging feature help mitigate the risk with investments spread over a period of time. You will automatically buy more units when the market is in a correction phase, and buy less when the markets are ascending. Eventually, this strategy usually proves rewarding in the long run; it helps compound wealth.

Many investors have the misconception that one should not start a SIP when markets are highly volatile. But actually, SIP-ping makes timing the market irrelevant and helps you focus on achieving the envisioned financial goal/s. You see, what matters the most is ‘time in the market' than timing the market as long as you are SIP-ping in appropriate mutual funds.

Equity as an asset class is known to offer good returns in the long run, and equity-oriented mutual funds are an ideal way to invest, especially for those who do not possess the skills required for direct equity investing.

To get the most out of the power of compounding with SIPs, you should begin investing in worthy mutual fund schemes at an early stage in life, whereby with a sufficiently long time horizon before the envisioned goal/s befall you are able to compound wealth better. As they say, the early bird gets the worm.

Table: The benefit of starting SIP early

Investors | Monthly SIP (in Rs) | Started SIP at Age (in years) | Years until retirement | Total investment amount (Rs in lacs) | Accumulated corpus via SIP (Rs in crores) |

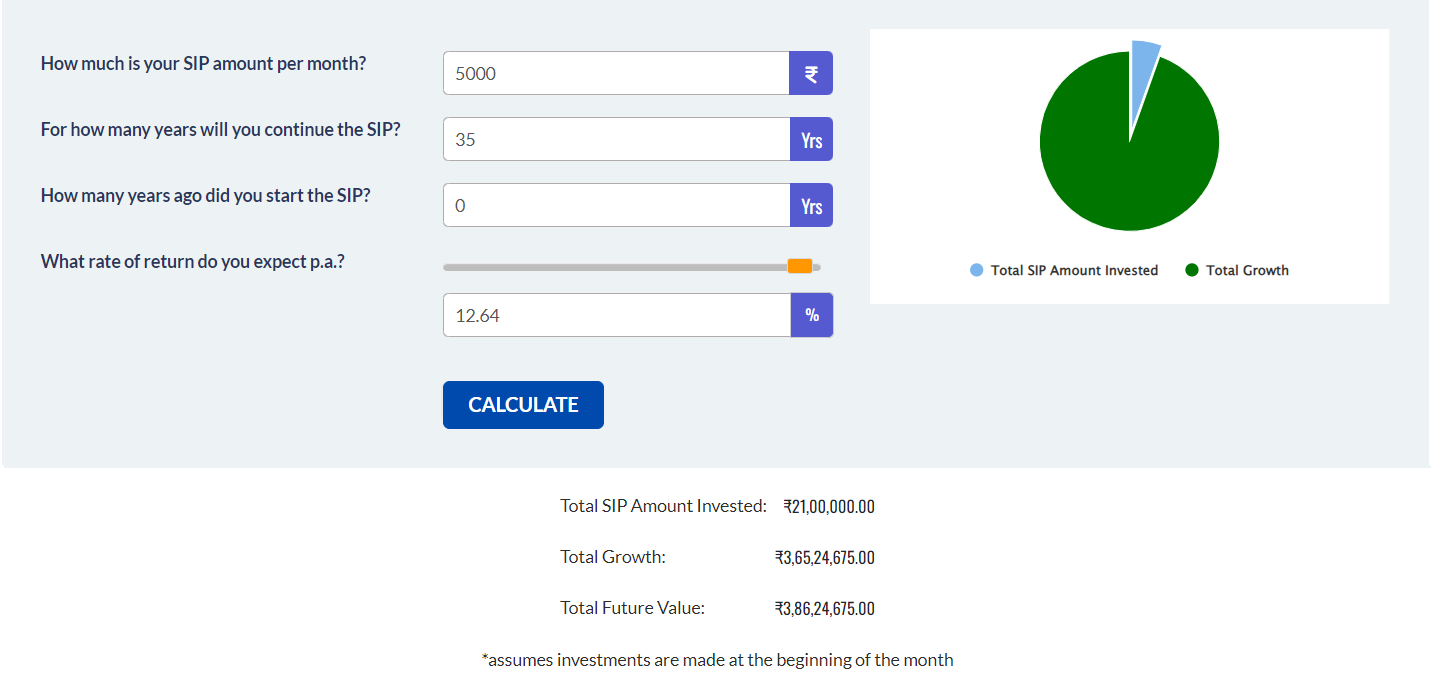

A | 5,000 | 25 | 35 | 21,00,000 | 3,86,24,675 |

B | 5,000 | 35 | 25 | 15,00,000 | 1,06,41,421 |

Investments through SIP is subject to market risk and do not assure a profit or returns or protection against a loss in a downturn market. The above calculation is for explanation purposes only. Assuming @ 12.64% CAGR in investments through SIP route in equity mutual fund. Returns calculated by taking mean of 10-year rolling returns between 01/06/13 and 30/05/23 for Equity Funds

In the above example, Investor A by starting SIPs for her retirement very early during the earning phase of her life is able to build a larger corpus. Whereas Investor B, who started SIPs for his retirement 10 years later after A, manages to accumulate a much lesser corpus than A.

Therefore, to increase your corpus and reach your desired financial goals, you should think about investing as early as possible rather than waiting for the best time to start a SIP in mutual funds.

Although SIP is a route to gradually invest in mutual funds, your regular contribution towards your financial goal should increase with an increase in your income. For example, if you are a salaried person, any additional income over and above your current income, like annual increments and bonuses, may be considered to step up your SIPs. Step-up SIP increases the potential to generate a higher corpus for your envisioned financial goal/s and even helps you fill in the gap caused by the delayed start of your SIPs. Keep in mind that even a small increase in your SIP can have a significant impact in the long run.

Furthermore, by using SIP Calculators, you can quickly calculate the amount required for your equity mutual fund SIP investments at your fingertips. You may calculate the compounded returns for your SIP investments using a free and easy-to-access online Mutual Fund SIP Calculator provided by Quantum Mutual Fund.

(Source: www.quantumamc.com)

To conclude…

Ideally, all the investments you intend to make should be aligned with your risk profile, broader investment objective, financial goals, and time in hand to achieve those goals. You must start early and invest in mutual fund schemes via SIPs to build a investments corpus.

Also, keep in mind that your SIP must be continued as long as it is among the best and most suitable mutual fund schemes for your portfolio, and a conscious effort should be made to step-up SIP with time. You may consider starting your mutual fund SIP investment journey with Quantum Long Term Equity Value Fund, Quantum Equity Fund of Funds, and Quantum India ESG Equity Fund.

Happy Investing!

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More