Save Tax & Create Wealth with this Fund

Posted On Wednesday, Dec 01, 2021

As thoughtful Investors, avoid deferring your tax planning exercise till the last quarter of the financial year which might lead you to make investments mechanically without defining their relevance to your financial goals.

It is wise to get a head start on your tax saving needs. Through this email, understand the right way to invest your hard-earned money and use it to create wealth and save tax for you.

Save Rs.1.5 Lakh from your Taxable Income under Section 80C of the Income Tax Act

You can save up to Rs 46,800 in a year (provided you are in the highest tax bracket) by investing in ELSS Funds. Let's see how a deduction u/s 80 C can help in reducing your tax liability:

| Particulars | Tax amount after deduction of Rs. 1,50,000 | Tax amount without deduction |

| Gross Income before deductions | Rs. 15,00,000 | Rs. 15,00,000 |

| Income Tax Deductions | Rs. 1,50,000 | NIL |

| Net taxable Income | Rs. 13,50,000 | Rs. 15,00,000 |

| Tax Liability before Rebate and Cess | Rs. 2,17,500* | Rs. 2,62,500* |

*All the calculations are done based on FY 2020-21 Income Tax Slab. As seen in the above example, eligible investment/payments made can save you a tax of Rs. 46,800 (including education cess for investors under the highest bracket)

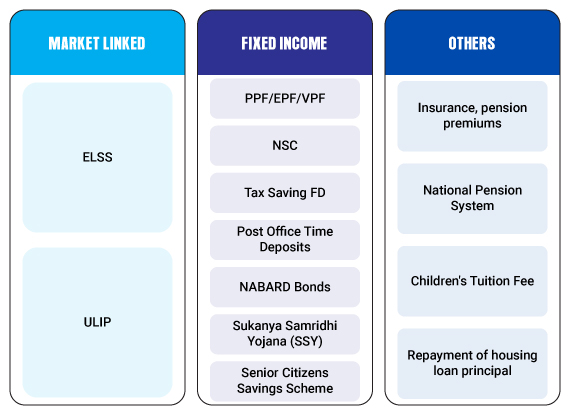

While all tax-saving investments u/s 80C provide this benefit, the similarity ends here. All tax-saving investments can be further classified as fixed income or market-linked.

Eligible investments u/s 80C

Reorient your tax saving investments to your financial goals:

As a thoughtful investor, you should look beyond tax saving investments and look at investments that build your portfolio and further help achieve your financial goals. The primary and most important financial goal for any investment is to create wealth. Saving Tax could be seen as a secondary objective or a by-product from your core investment.

An ELSS stands for Equity-Linked Saving Scheme. With ELSS, you get the dual benefit of Wealth gain + Tax Savings. An ELSS is the only mutual fund category eligible under 80C investments. Its equity component offers you the potential to further your wealth goals and provide market-linked returns over the long term when compared to other fixed-income tax-saving investments.

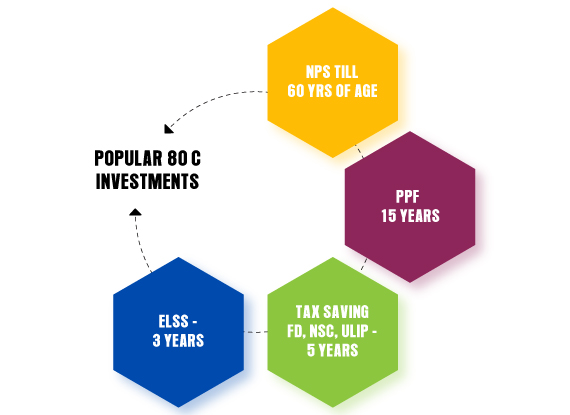

All other market-linked tax saving investments such as NPS (combination of equity and Debt) or ULIP (Combination of Life Insurance + Equity Investment) do not have the potential to generate returns for creating wealth over the long term as ELSS invests purely in equity/equity related instruments. An ELSS fund provides the potential for risk-adjusted returns over the long term, as well as the flexibility of a smaller lock-in period to liquidate your investments once the holding period of 3 years is completed.

Lock-in comparison among Popular 80 C investments

If you are looking for an opportunity to build your equity portfolio and increase your potential to earn higher risk-adjusted returns over the long term, you can add Quantum Tax Saving Fund to complement your Equity Portfolio.

Why invest in Quantum Tax Saving Fund (QTSF)

How to build your portfolio with QTSF

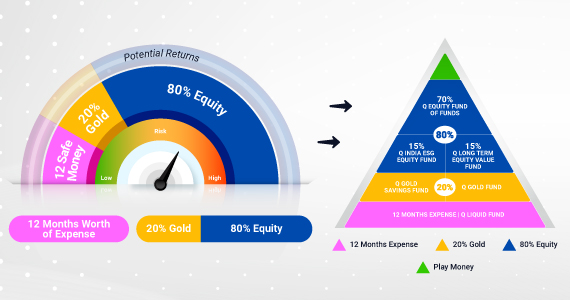

Use our tried and tested Quantum’s 12-20-80 Asset Allocation Strategy and see how QTSF fits and adds value to your portfolio. There are three asset allocation building blocks as per this strategy.

Kindly note allocation to QTSF to be generally in the similar proportion as that of QLTEVF. Please note that the above suggested fund allocation only and is not to be considered as investment advice / recommendation, please seek independent professional advice, and arrive at an informed investment decision before making any investments.

Asset Allocation Strategy Building Blocks

1. Foundation Block: Emergency funds should be at the foundation of your portfolio. Set aside safe money worth 12 months of expenses in Quantum Liquid Fund that helps you prepare for emergencies and offers you the option to liquidate (up to Rs.50K) whenever you need.

2. Risk Reducing Block: You can capitalize on Gold’s risk-reducing characteristics and allocate 20% of your portfolio to the yellow metal. Though Gold prices have corrected from the highs touched in 2020, you can use the correction to build your allocation to gold.

3. Equity Block: Diversify the balance 80% across an equity bucket that is market cap, sector, or style agnostic.

ELSS forms a crucial part of your Equity Portfolio

Since ELSS is an equity mutual fund (80% of its underlying portfolio comprises of equity and equity related investments), it forms a crucial part of your diversified equity portfolio. You can plan your equity investments and earn tax benefits in the process Quantum Tax Saving Fund follows the value style of investment. Therefore, any additional fund that you consider needs to be diversified in term of investment style or theme.

You may invest up to 15% of your equity allocation or up to Rs. 1,50,000 of your allocation to Quantum Tax Saving Fund (whichever is higher). By starting your investment ahead of schedule, you have the option of investing through an SIP or lumpsum mode of investment.

Read more on how this equity allocation forms a part of our overarching 12-20-80 Asset Allocation that incorporates assets of equity, debt and gold assets.

Get a head start to your tax saving needs with the Quantum Tax Saving Fund by investing as low as Rs 500 a month

Watch this video on ELSS, where our fund manager Sorbh Gupta shares insights on how to select an ELSS mutual fund.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Long term returns • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns •Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Long Term Equity Value Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on October 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimerto read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More