Sail through Market Cycles with a Diversified Equity Portfolio

Posted On Wednesday, Nov 22, 2023

Mutual Funds needs close observation, realistic assessment and an open mind, especially when it comes to equity funds that are primarily dependent on market conditions. Equity investments act as a vital component of investment portfolio which can pave the way for wealth creation. Markets go through phases of expansion and contraction, and each phase presents unique opportunities and challenges. Successful investing requires diversifying across different market caps and investing styles.

Now, since an equity portfolio is more volatile, it becomes important to understand the benefits of a well diversified equity portfolio.

Let’s understand the right mix of funds to design a good equity portfolio and how incorporating Quantum Small Cap Fund can help propel your portfolio to reach new heights.

Benefiting from a Diversified Equity Basket:

During the contraction phase of the market cycle, generally large cap stocks can outperform small cap stocks. This is because large cap companies are more stable and have more resources than small cap companies. They are more resilient during periods of market contraction or economic recession. Mid-caps bridge the gap, offering a balance between stability and growth, while large caps provide resilience during market downturns. While large and mid-cap funds has potential to provide stability to your portfolio, venturing into small cap funds can infuse vigor and capitalize on exciting growth prospects. During the expansion phase of the market cycle, small cap companies have potential to benefit from economic growth than large cap companies. This is because Small caps, characterized by their exposure to niche industries, offer greater potential for growth during bullish market phases.

Since asset classes and financial markets are cyclical, it makes sense to build a diversified equity portfolio to navigate through market volatility with peace of mind. By adding small cap funds in a diversified equity basket, you can gain exposure to diverse sectors or industries and take advantage of potental growth prospects.

The Small Cap Rally: Reached its peak or more Fuel Left?

While large and mid-cap stocks have had their time in the spotlight, there's a growing sentiment that the small-cap rally is far from over. As the economy recovers,industries evolve and with the government taking more initiatives to boost smaller companies, small caps are poised to benefit. There are several reasons why the small cap rally can continue.

Flexibility – Small Caps have the ability to adapt swiftly to changing market conditions and innovate making them an attractive addition to any well-rounded portfolio.

Growth prospects - The Indian economy is expected to continue growing. This growth is likely to benefit small cap companies in addition to the large cap companies due to their growth potential. This is why Small cap stocks have outperformed some of the large cap stocks in the recent times.

Valuations - Another reason why the small cap rally can continue is that valuations of small cap stocks are still relatively attractive. Small cap stocks are not as expensive as some of the large cap stocks, which makes them more attractive to investors.

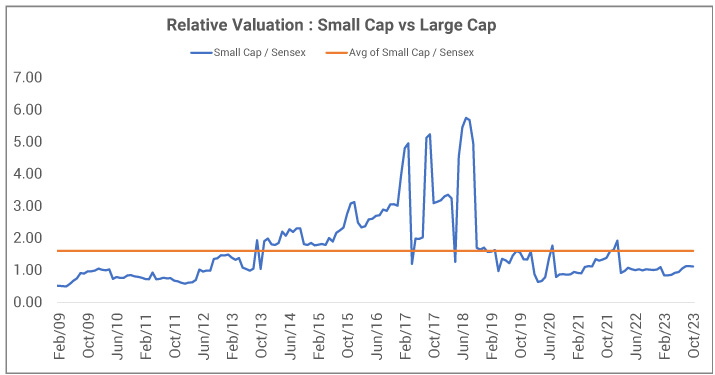

Looking at the graph below, we see relative valuations of Small caps vs. large caps close to long term averages and pockets of value exist. Small Cap Indices are currently trading below their long term valuations, indicating the possibility of growth and the potential to reach new highs.

Past performance may or may not be sustained in the future. Data as of Oct 30, 2023

Quantum Small Cap Fund

For investors seeking to invest in a true small cap fund that gives exposure to a portfolio of quality small caps, the QSCF (Quantum Small Cap Fund) scheme presents an exciting opportunity. This actively managed fund is designed to identify and invest in small-cap stocks with strong growth potential and robust fundamentals.

Watch Video from our CIO why Add Quantum Small Cap Fund to Your Portfolio

Chirag Mehta, CIO & Fund Manager, Quantum Small Cap Fund shares insights as to how Quantum Small Cap Fund can make a big difference to your portfolio

How to allocate to Quantum Small-Cap Fund to Your Diversified Portfolio using Asset Allocation Calculator:

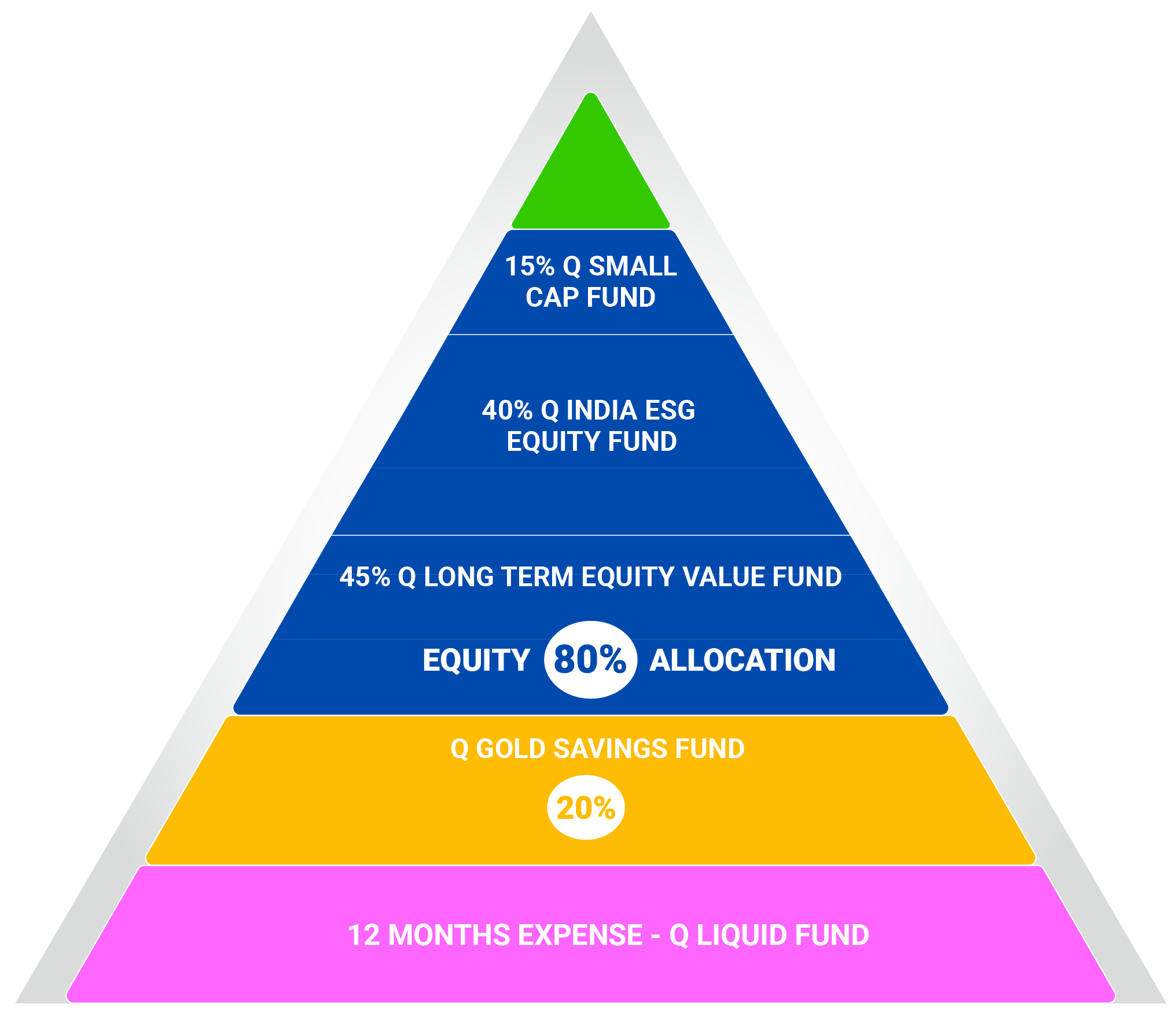

If you are looking to integrate small caps into your existing portfolio, you can make use of the 12|20:80 Asset Allocation calculator. This can be a valuable tool, ensuring a balanced and optimized portfolio. Quantum Small Cap Fund forms a crucial part of your equity portfolio, offering potential for returns commensurate with very high risk.

Investing in three funds - Quantum Long Term Equity Value Fund, Quantum India ESG Equity Fund and Quantum Small Cap Fund helps you diversify your investments and sail through different phases of market cycles while growing your wealth over the long term.

Fund | Benefit |

Quantum Long Term Equity Value Fund | Grow wealth with a diversified equity basket of undervalued stocks |

Quantum India ESG Equity Fund | Harness the power of equity investing with ESG parameters (Environmental, Social & Governance) to grow wealth & build a sustainable furture. |

Quantum Small Cap Fund | Capture the growth potential of small-cap companies with a high-conviction, adequately diversified portfolio. |

In conclusion, building a robust and resilient portfolio involves embracing diversifcation . The inclusion of quality small caps adds the necessary fuel for sustained growth. Quantum Small Cap Fund is an opportunity to diversify. Remember, successful investing requires a disciplined approach, research, and a long-term perspective.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria |  Investors understand that their principal will be at Very High Risk |

Quantum Small Cap Fund An Open-Ended Equity Scheme Predominantly Investing in Small Cap Stocks | • Long term capital appreciation • Investment in Small Cap Stock |  Investors understand that their principal will be at Very High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The investors of Quantum Gold Savings Fund will bear the scheme expenses in addition to the expenses of other schemes in which the Fund of Funds scheme makes investment (subject to regulatory limits).

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More