Questions from Path To Profit. Answered

Posted On Tuesday, May 08, 2018

'Path To Profit' is an investor education & awareness initiative by Quantum Asset Management Co Pvt. Ltd. that gives us an opportunity to interact with those who wish to learn more about investing. Given below are a few more questions that we fielded at a one of the events. We will keep releasing answers to such questions in subsequent mailers, so stay posted.

Q1. How to choose other mutual fund equity schemes?

Diversification is very important when it comes to investment and more so when it comes to your equity portfolio. Every financial goal, every investor's risk appetite determines which type of fund is suitable for him/her. So assuming you have already invested in Quantum Long Term Equity Value Fund (QLTEVF), when it comes to diversifying your equity portfolio, you also need to invest money in other mutual fund schemes. However, like they say, choosing a fund is like choosing a spouse! It's a very difficult task! So for those investors who are well versed with knowledge about mutual funds and have the time to do the required research, no better way to select a fund for than the do-it-yourself way. However, for most of us it may not be easy to pay close attention to our investments or tracking our schemes on a daily basis.

At Quantum, we have Quantum Equity Fund of Funds (QEFOF) for investors who want to invest in equities but are overwhelmed by the wide array of choices to gain from the long term potential of equity investments. QEFOF has the potential to take care of your equity diversification needs.

Q2. What is the stock selection process of the Quantum Long Term Equity Value Fund?

The best person to answer this question is our Associate fund manager, Mr. Nilesh Shetty. He explains the QLTEVF stock selection process in his own words.

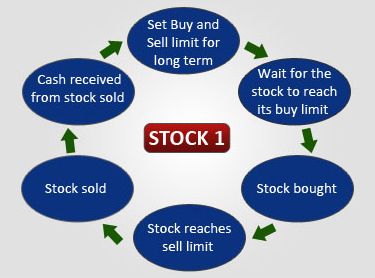

"We have a liquidity filter of at least USD 1 million (approximately INR 6.5 crores) daily trading volume in the stocks that we own; apart from that, we do not have any market capitalization or sector bias. We have a predetermined Buy and Sell limit for each stock actively covered by our research team. The limits are decided based on sustainable cash flow generating ability of a company and its long term valuation bands. Once a stock hits our buy limit, it finds its way into our portfolio and once it hits our sell limit, it exits our portfolio. Companies with weak corporate governance and a history of treating minority shareholders poorly do not come into QLTEVF portfolio."

Q3. Why is there a difference in the expense ratio of direct & regular plans?

Expense ratio is the annual fee of the fund's assets that is charged as an expense. It is expressed as the percentage of total assets that are spent to run a mutual fund. It includes management fees, operational costs, distribution fees, and marketing expenses. Direct plans have a lower expense ratio because there are no intermediaries/distributors fees involved. Regular plans have a comparatively higher expense ratio because AMC's pay intermediaries/distributors involved a commission/fee which is a part of this expense.

Q4. What is meant by mutual fund benchmark?

A scheme's benchmark is an index that is decided by its fund house to serve as a standard for the scheme's returns. Some commonly used benchmarks are the S&P BSE 30 TRI, S&P BSE 200, Nifty 50 etc. Investors are given an opportunity to compare the performance of their investments with that of the broader market. Take for instance you are investing in a diversified equity fund that is benchmarked against the S&P BSE Sensex. Its returns are thus compared with that of S&P BSE Sensex. Hence a large-cap fund's performance needs to be compared against a large-cap benchmark and vice-versa.

Q5. Why does a debt fund scheme's NAV change on a daily basis?

The Debt Mutual Funds invest in fixed income securities like government bonds, corporate bonds, Certificate of Deposits, commercial papers etc. These instruments pay a fixed or market linked interest rate (coupon) at specified frequency or issued at discount and pays the face value at the maturity. In this sense the scheme earns a pre-specified interest income which is accrued to the scheme’s NAV on daily basis.

That apart, these fixed interest instruments are also traded in the market and therefore their prices change based on market demand supply. The prices of fixed income securities are primarily driven by the interest rates prevailing in the market. The price of fixed income securities are inversely related to interest rates. When interest rates go up, bond prices go down and vice versa. The Debt Fund schemes have to mark to market their portfolio securities on daily basis.

Thus the NAV of debt schemes varies with the market price of bonds in the scheme and interest being accrued on them. Additionally, the prices of long-term securities generally fluctuate more in response to changes in interest rate than those of short-term securities. Therefore NAV of funds with longer maturity securities changes more than those of shorter maturity securities.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More