Markets Crash - What Should You do With Your Investments?

Posted On Friday, Feb 25, 2022

The Sensex saw its 10th biggest market crash in history today as geopolitical tensions intensified between Russia and Ukraine. Market levels have crashed by 2700 points in a single day and Crude oil prices has surged over 7%.

Rising crude oil prices can indirectly lead to increased inflation. Inflation may also lead to higher input costs that may lead to lags in revenue growth. This uncertainty has made the markets weary and unpredictable in the short term.

The best way to combat this uncertainty is to think long term. A long-term investment solution would mean holding different assets like equity, debt and gold mutual funds for a span of 3, 5, or 10 years based on your investment goals and risk appetite. And the best way to tackle fluctuating market cycles is through Diversification.

Over the long term, a diversified portfolio can overcome the risks of the short-term.

While no one has a crystal ball to predict the near-term market levels and the impact on your investments, what’s within your control is staying invested for the long term with a diversified portfolio using a prudent Asset Allocation.

Let us have a look at some benefits of long-term investing with an Asset Allocation Strategy.

1. Power of Compounding: If you decide to go the long-term investing way, you are most likely to gain from the power of compounding and achieve your goals.

2. Lower Risk Quotient: When you are invested for a longer tenure, your downside risks may get minimized, thereby offering you the potential for risk-adjusted return.

3. Lesser Worry About Market: Fluctuations may make a short-term investor jittery and lead him to make some poor decisions. But a long-term investor with prudent asset allocation has peace of mind during market ups and downs.

Quantum’s 12-20-80 Solution

A simple and easy solution to start with is Quantum’s tried and tested 12-20-80 Asset Allocation Strategy, where you get the potential for risk-adjusted returns over the long term.

You can use our simple tool available on your dashboard to in just a few clicks:

• Build or rebalance your portfolio

• Personalize the allocation based on your financial goals.

• View your optimised portfolio

|

|

|---|

Step 1: Enter total amount you intend to invest

First, enter the total investible corpus that you intend to invest. As a general rule, your investment should not be what is left over after your monthly expenses, but should be a fixed sum set aside with a financial goal in mind.

Step 2: Build your Emergency Block

Next, enter your monthly expenses and click on Calculate. We recommend that you set aside 12 months of your monthly expenses to help you tide over any uncertainties. The tool will calculate this as Emergency Funds that should be invested in the Quantum Liquid Fund – which prioritizes safety and liquidity over returns. If you believe that you would like to have a larger corpus, simply change the number of months, depending on your need.

Step 3: Build the portfolio diversifying block with Gold

After deducting the Emergency Corpus from your indicated investible corpus, the tool will allocate the balance into Gold and Equity in the ratio of 20-80.

The 20% allocation to Gold in the Quantum Gold Savings Fund in your portfolio helps during periods of macroeconomic uncertainty. At any point, you can change the percentage to gold if required to better suit your existing portfolio or goals.

Step 4: Build the growth block with a diversified equity portfolio

The balance of your investible corpus i.e 80% gets diversified into long-term opportunities using a diversified equity bucket. The funds get allocated across three different equity funds - Quantum Equity Fund of Funds, (70%) Quantum India ESG Equity Fund (15%) and the Quantum Long Term Equity Value Fund (15%) with varying investing styles.

Step 5: Review how your existing allocation compares to 12:20:80 allocation

Through the two tables, you get a quick snapshot of your current allocation vs the suggested allocation. The tool also calculates the portfolio since inception returns, for current portfolio which as you can see in the video is 16.35% for a 100% Equity Allocation vis a vis what return would have been if one had adopted the 12:20:80 diversified allocation, in this case 14.02%. While the return is marginally lower, the diversified bucket, assumes much lower risk, and better protection against any downturn in the market or black swan event.

A few key points to note in the calculated returns:

• The returns calculated are not the actual portfolio returns, they assume returns since inception of the respective fund.

• Quantum’s Tax Saving Fund and Multi Asset Fund of Funds have not been included in the allocation.

• Return on Investment in the Quantum Liquid Fund and Quantum Dynamic Bond Fund have not been considered as they constitute Emergency Funds.

STEP 6: Rebalance your portfolio

As you scroll down, you come to the last table which indicates whether you need to add or switch funds in each fund to rebalance your portfolio in just a few clicks.

So, login to your account today and use our easy Asset Allocation tool to build your portfolio in just a few clicks.

Let the market movements not make you anxious anymore. Just focus on an investment solution to build long term wealth that minimizes the impact of any market uncertainty.

Quantum has meticulously added each of the funds across the asset classes of Equity, Debt and Gold to create a one-stop shop to simplify your need for diversification and help you in achieving your financial objectives.

Start building your long-term portfolio with Quantum Mutual Funds.

Product Labeling

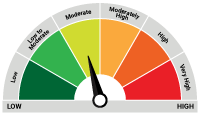

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years |  Investors understand that their principal will be at Very High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities. |  Investors understand that their principal will be at Moderate Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on January 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix - Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Received an Increment? Step-up Your SIPs

Posted On Wednesday, Jun 01, 2022

For instance, let’s assume that you have registered for a monthly SIP of Rs 5,000 for a 10-year period and later on try to step-up the SIP at an annual frequency, say by Rs 500. In the first year...

Read More -

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More