Know Our Funds: QESG and QLTEVF - Two Mutual Funds One Solution!

Posted On Thursday, Sep 12, 2019

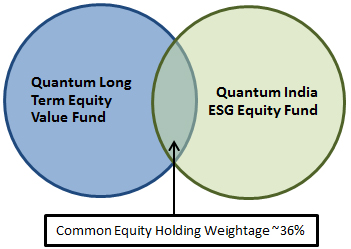

Recently, Quantum Mutual Fund launched Quantum India ESG Equity Fund (QESG), an open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme. Quantum also has its flagship open-ended equity scheme that follows a value investment strategy called as Quantum Long Term Equity Value Fund (QLTEVF).

At first instance, it might appear to a new investor or even to a seasoned investor that QESG and QLTEVF fall into the same category due to the some resemblance of investment universe for both funds. The investment universe comprises of companies that fulfill the liquidity criteria of average trading volume value of US$ 1 mn.

Given the apprehension of portfolio overlap makes investor wonder which fund to choose. Our recommendation to investors is simple and easy- You should choose both funds!

Confused? Let’s compare and contrast to understand what the investor is getting into by investing in both funds. Investment is a long term choice; hence, it is crucial that our investors - Know Our Funds.

• Before making an investment decision first step is to understand the investment strategy of the fund. QESG invests in companies that as per Quantum’s criteria rank high on Environmental, Social and Governance (ESG) scores banking on sustainability of these companies to drive long term returns. QLTEVF invests fundamentally strong stocks that are currently undervalued as compared to its future ascertained value and are likely to bounce back to its fair value over time.

• If you run a factor exposure on these strategies, QESG is quality and growth-oriented whereas, QLTEVF isquality and value-oriented.

Growth and Value exposures are complementary to each other and hence, adding both QESG and QLTEVF can add diversity to investor’s portfolio.

• The difference in strategies also leads to varied portfolio and therefore, puts investor concern about portfolio overlap at rest. Given below is the actual portfolio comparison:

Sector Exposure: as on 31st July, 2019

| Sectoral Composition | QESG | QLTEVF |

| Consumer Discretionary | 15.77% | 15.24% |

| Information Technology | 14.87% | 17.16% |

| Materials | 14.75% | 7.57% |

| Financials | 10.40% | 25.48% |

| Consumer Staples | 9.07% | NA |

| Energy | 6.07% | 5.19% |

| Utilities | 2.47% | 7.97% |

| Industrials | 2.43% | 1.33% |

| Communication Services | 2.08% | NA |

| Health Care | 0.77% | 5.27% |

| Cash | 21.32% | 14.79% |

| Total | 100% | 100% |

Top 10 of QLTEVF – How much of it is owned by QESG as on 31st July, 2019

| Top 10 Holdings | QLTEVF | QESG |

| Infosys Ltd | 8.90% | 3.20% |

| Housing Development Finance Corporation Ltd | 8.84% | NA |

| Bajaj Auto Ltd | 5.50% | 1.05% |

| State Bank of India | 5.33% | NA |

| Wipro Ltd | 4.62% | 2.72% |

| Hero MotoCorp Ltd | 4.49% | 0.95% |

| LIC Housing Finance Ltd | 3.73% | NA |

| Tata Consultancy Services Ltd | 3.64%- | 4.15% |

| ICICI Bank Ltd | 3.38% | NA |

| NTPC Ltd | 3.37% | NA |

| Total Wt. of Top 10 Holdings | 51.80% | 12.07% |

Stocks referred above are illustrative and not recommendation of Quantum Mutual Fund/AMC. The Scheme / Fund may or may not have any present or future positions in these Stocks. The above information should not be considered as research report or recommendation to buy or sell of any stocks.

Top 10 of QESG – How much of it is owned by QLTEVF? As on 31st July, 2019

| Top 10 Holdings | QESG | QTLEVF |

| Tata Consultancy Services Ltd | 4.15% | 3.64% |

| HCL Technologies Ltd | 4.05% | NA |

| HDFC Bank Ltd | 3.88% | NA |

| Shree Cement Ltd | 3.50% | NA |

| The Indian Hotels Company Ltd | 3.28% | 2.76% |

| Tata Chemicals Ltd | 3.24% | NA |

| Infosys Ltd | 3.20% | 8.90% |

| Marico Ltd | 3.16% | NA |

| TVS Motor Company Ltd | 2.72% | NA |

| Wipro Ltd | 2.72% | 4.62% |

| Total Wt. of Top 10 Holdings | 33.90% | 19.92% |

Stocks referred above are illustrative and not recommendation of Quantum Mutual Fund/AMC. The Scheme / Fund may or may not have any present or future positions in these Stocks. The above information should not be considered as research report or recommendation to buy or sell of any stocks.

Also, looking at the overall portfolio, the overlap is just 36% as on 31st July, 2019

• The benchmark for QESG is Nifty 100 ESG Total Return Index, while for QLTEVF is S&P BSE Sensex Total Return Index.

Investing in both funds gives investor the best of both strategies.

• As regards to asset allocation, QESG and QLTEVF have minimum equity allocation of 80% and 65% respectively. Comparing the portfolio holdings of both funds, the allocation to Money Market Instruments and Liquid Schemes of Mutual Funds will be at minimum for QESG while for QLTEVF, it can at times be higher if there are no opportunities from a valuation perspective available in the market. Whereas ESG will tend to run a well-diversified portfolio and will endeavor to stay invested in underlying equities to a large extent leaving little room for liquidity management.

Therefore, it is compelling to invest in both funds to efficiently diversify the portfolio across factor and style exposure and thereby enhance investors risk adjusted returns.

To sum up, investing in both QESG and QLTEVF will give investor One Mutual Fund, Two Different Style of Funds, One Long Term Investment Solution.

For quality holdings, transparent strategy and risk mitigation, suggest to invest in both QESG and QLTEVF!

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More