Is your MF Portfolio Designed to Ride India’s Long Term Growth Story?

Posted On Thursday, Dec 15, 2022

✔ Can India’s growth story sustain?

✔ Will equity markets fall or rise further?

✔ Is India truly decoupled from the global slowdown?

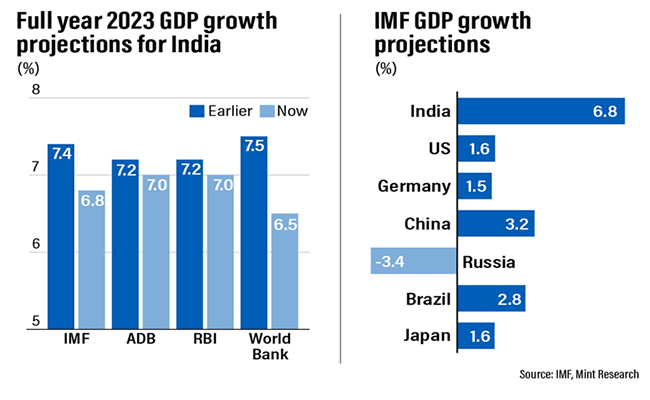

You probably have these and more questions or concerns about the future of India and its impact on your investment portfolio. However, as an investor, you can take comfort in knowing that despite RBI hiking the policy repo rate by 225 basis points to control inflation, financial markets have shown resilience.

As 2022 nears to a close, it’s a good time to look at your portfolio and evaluate whether it is designed to ride India’s growth story in the long run.

Your Growth Block – A Diversified Equity Portfolio

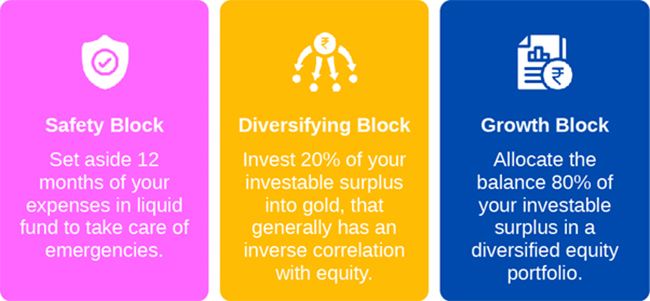

Equity forms the largest component of your portfolio. It comprises 80% of the investable surplus serving as the Growth building block of your portfolio. As we have witnessed in the past, Indian markets have bounced back after several challenging downcycles – be it during GFC (Global Financial Crisis – 2008), or the Covid-induced market crash in 2020, equity markets have stayed resilient.

India has several parameters that work in favour of its long-term growth potential:

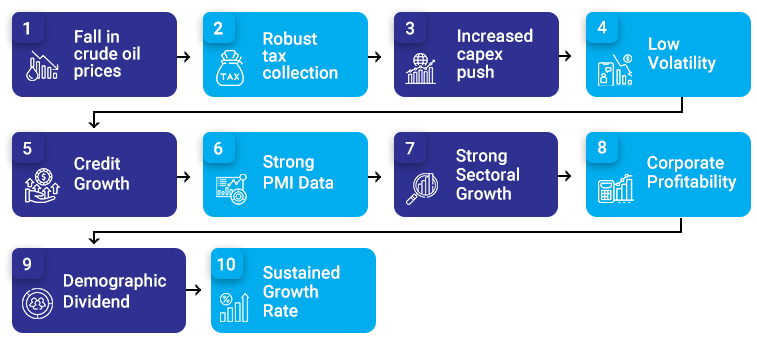

10 Factors that Indicate India’s Growth Story Remain Intact

Industry Experts believe that the positive momentum in Indian markets will continue for the following reasons:

1. Fall in crude oil prices to 10-month low1

2. Robust tax collection to the tune of Rs. 1.51 tn in October2

3. Increased CAPEX push – Government spending on capital investments jumped almost 50% of its budget in H1 FY2022-233

4. Low Volatility - 9th consecutive weekly decline in India VIX (volatility index)

5. Healthy Credit growth - Industrial credit growing at 12.6% and Retail at 19.6%4 in October.

6. Strong PMI (Purchase Managers Index) data - Manufacturing and Services stood at 55.3 and 55.1 respectively (A reading above 50 indicates expansion) in October.

7. Strong Sectoral growth in IT, oil & gas and financial services – PSU Banks record strong growth on the back of record loan growth and clean balance sheets.

8. Increased growth in Corporate Profitability

9. Demographic Dividend – 1.4 billion low-cost human capital and a median age of 275

10. Sustained Growth rate – Average GDP growth rate of 6.2% over the last 3 decades4

Source: 1Reuters, 2ibef.org, 3ICRA, 4RBI, 5Worldometer

Choose a diversified equity basket to Navigate through market ups and downs

Even within your equity basket, it is important to diversify the equity component of your portfolio across different market caps, themes, and investment styles. The impact of the market cycles is not consistent across equity investments; hence a diversified equity basket helps safeguard your investments while capturing opportunities of the broader market.

Invest in long-term opportunities in a diversified equity basket comprising of just 3 funds –

• Quantum Equity Fund of Funds (QEFOF) 70% - With just 1 Fund, you get access to a diversified basket comprising of 5-10 third party-equity funds carefully chosen after qualitative and quantitative research and a minimum 5 years track record. Investment in QEFOF reduces the hassles of making and tracking multiple investments.

• Quantum Long Term Equity Value Fund (QLTEVF) 15% - A true to label Value-oriented fund with a track record of over 16 years helps you contain losses during periods of deep or prolonged market corrections. It focuses on finding good businesses that are undervalued and have a good long-term potential.

• Quantum India ESG Fund (QESG) 15% - One of the first funds in the ESG (environmental, social, and governance factors) thematic space, Quantum India ESG Equity Fund uses in-house proprietary scoring metrics and goes beyond the desk to give a comprehensively researched portfolio. Quantum India ESG Equity Fund brings resilience to your portfolio due its focus on the triple bottom line – better People, Planet and Profits.

Now that you have Equity covered, to build a truly weather-proof portfolio, Quantum’s 12:20:80 Asset Allocation Strategy also emphasizes importance of debt and gold.

Debt particularly a liquid fund scheme offers liquidity serving as the foundation of your portfolio for emergencies. Set aside safe money equivalent to 12 months of monthly expenses.

Gold helps balance your portfolio and helps reduce downside risks during periods of macroeconomic stress, as it generally has an inverse relationship with Equities. Choose the thoughtful way to invest in Gold using efficient financial forms such as Gold ETF and mutual funds that does away with making charges or storage hassles associated with physical Gold. Allocate 20% of your investable surplus with Quantum Gold Fund or Quantum Gold Savings Fund.

Key Takeaway

India is poised for growth over the long term. It’s time to assess whether your investments are positioned to ride India’s growth with a robust equity portfolio as part of the tried and tested 12:20:80 Asset Allocation Strategy with Quantum.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Investors of Quantum Nifty 50 ETF Fund of Fund (Scheme) will bear the recurring expenses of the scheme in addition to the expenses of Quantum Nifty 50 ETF.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Is your MF Portfolio Designed to Ride India’s Long Term Growth Story?

Posted On Thursday, Dec 15, 2022

You probably have these and more questions and concerns about the future of India and its impact on your investment portfolio.

Read More