Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%. BSE mid and small cap indices rose by 0.7% and 1.6% respectively. Some of the key developments during the month were:

- Global trade tensions continue to pose risk to global growth. Federal Reserve cut interest rates by 25bps.

- US administration has published rules to amend H1B process and made changes to lottery process which will result in IT hiring decisions for corporates.

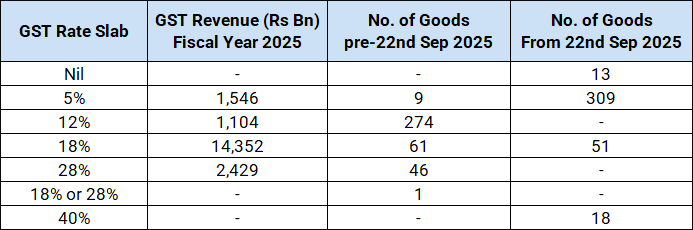

- Government implemented simplified GST rates from 22nd September; we view this as much needed simplification which can provide the much-needed consumption boost.

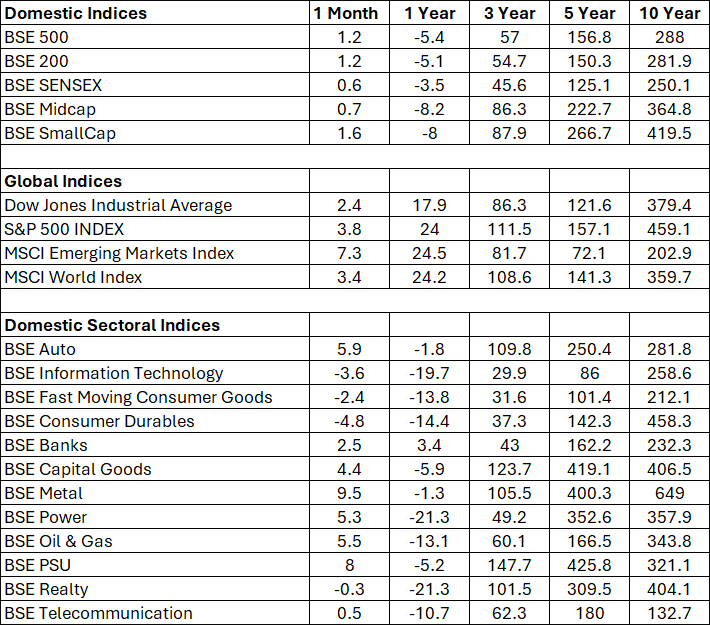

Table 1: Performance of Major Indices during the Month

Source: Bloomberg, Data as of 30 September 2025

Past performance may or may not be sustained in the future.

As shown in the table (Refer Table 1), Metals, capex focused sectors (Power, Capital Goods) and select consumption-oriented indices like Auto rallied on the back of GST rationalization. Sectors such as Consumer durables and Technology trailed the index.

On the global front, the US (S&P 500 Index) continued its rising trend driven technology and MSCI Emerging Market Index rose by 9.5% driven by China.

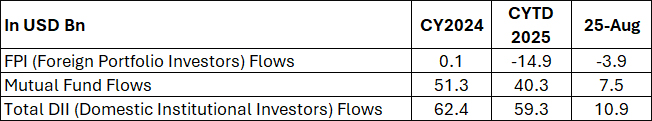

DII Flows have remained resilient:

The flows into equities remained resilient with strong DII (Domestic Institutional Investors) participation. FPI flows continued to be negative driven by valuation constraints in India and tariff uncertainty.

Table 2: Institutional Flows

Some of the Key emerging themes which will impact markets are:

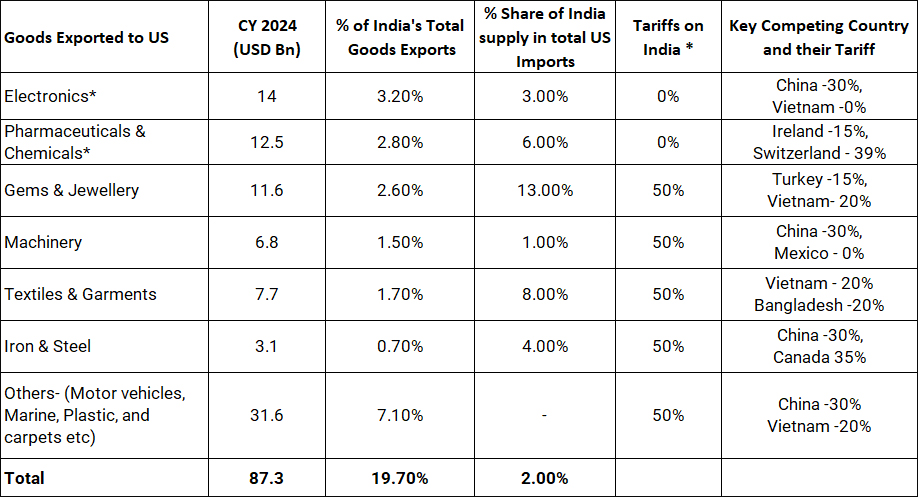

Table 3: Goods impacted by US Tariffs are 1.6% of India’s GDP

* Exempt until Sec 232** investigation completes ** Sectors are impacted and customer will look for alternatives.

Source: Quantum AMC, USITC.GOV

US tariff on goods largely remains focused on specific sectors as highlighted. Sectors like Electronics and Pharma continue to be in the exempt category; other sectors such as Gems/Jewelry, Textiles, Machinery etc. are facing adverse tariffs. If the tariff persists, the impacted sectors may face profitability hit and some of them are focusing on finding new markets for the impacted goods.

Table 4: Goods and Services Tax reforms to boost GDP growth

Source: Press information Bureau, Hindustan Times, Mint

Prime Minster announced rationalization of GST rates, that could simplify the tax system by reducing the number of GST slabs from the current multiple rates to primarily two main slabs of 5% and 18%. We view this development as continuation of reform agenda and may give one-time boost to volume growth for impacted sectors. Lower GST rates in key sectors like auto can improve affordability, especially in the mass segment; this segment has been languishing due to lower wage growth and high inflation post covid.

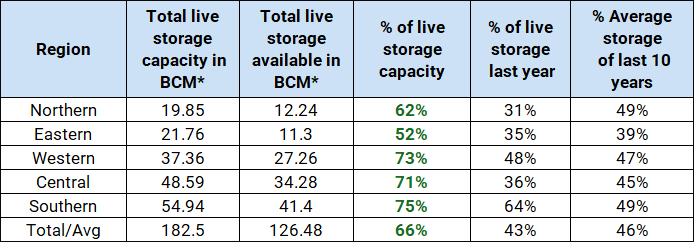

Table 5: Monsoon has been 8% above normal, augurs well for rural India

Source: Central water commission, Data as of Sep 2025

While demand environment is improving; FY26 Earnings have seen downgrades.

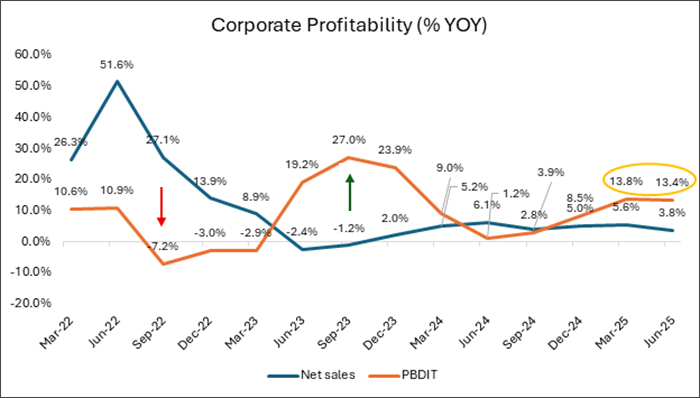

Graph 1: Trend of Corporate Profitability for Larger Listed Universe (% YOY)

Source: CMIE; Quarterly Data as of 30 June 2025; Net Sales and PBIDT (Profit Before Interest, Depreciation and Taxes) growth is considered.

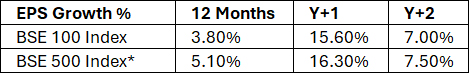

Graph 2: Aggregate Sales Growth & PBIDT Margin of BSE 500 Index

Source: Ace Equity, Data as of June 2025; PBIDT: Profit Before Interest, Depreciation and Taxes.

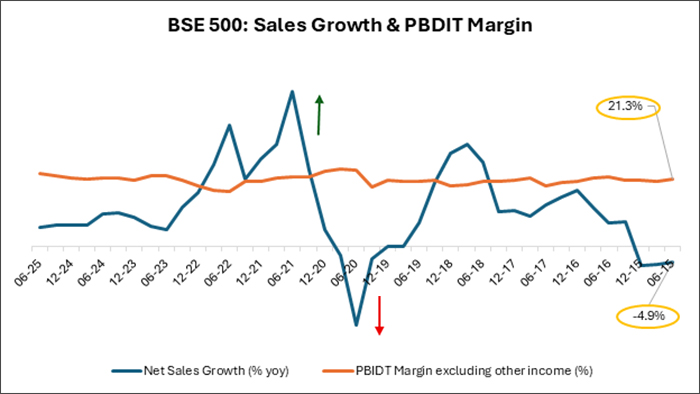

Table 6: Consensus Earnings Continues To Be Modest In The Near Term

Source: Bloomberg; Data as of 30 September 2025. *BSE 500 has limited analyst coverage due to the larger universe. Y+1 & Y+2 represents 1 year forward and 2 years forward estimates.

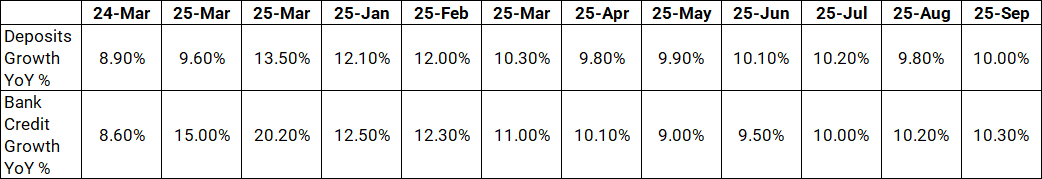

Table 7 : Credit growth has moderated, and Fresh Term Deposit Rates are coming down

Source: Reserve Bank of India, Data as of September 2025.

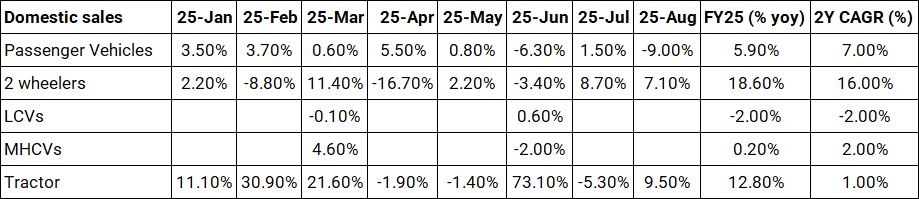

Auto:

• Due to GST changes and inventory correction PV volumes have been tepid. The tractor segment is showing an improvement on the back of a good harvest season. CV (Commercial Vehicle) remains weak, indicating subdued economic trends. GST cuts will help volume recovery in the near term.

Table 5: Domestic Auto Sales (% YOY)

Source: Society of Indian Automobile Manufacturers, Tractor and Mechanization Association; Data as of August 2025; Quarterly data is considered for LCVs (Light Commercial Vehicle) and MHCVs (Medium & Heavy Commercial Vehicles).

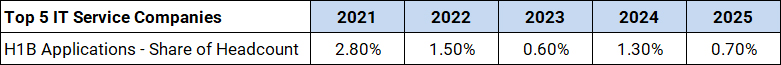

IT Services:

Table 6: Top 5 IT Service Companies

Source: LCA filings

• In a major overhaul of H1B process, US President Donald Trump on 19 Sept signed a proclamation imposing a US$100,000 visa fee for H1B visa applications. There are additional proposals to grant higher share of H1B visa to relatively higher skilled employees. These changes will be implemented from FY27. These regulations may increase the cost of doing business for Indian IT services and end-clients.

• Over the past several years, Indian IT Services have reduced the dependence on H1B (Refer Table 6). H1B share of total headcount currently is 0.7% in FY25. In our view; these changes are manageable and eventually there can be higher offshoring and nearshoring (geographies with similar time-zone and proximity to US).

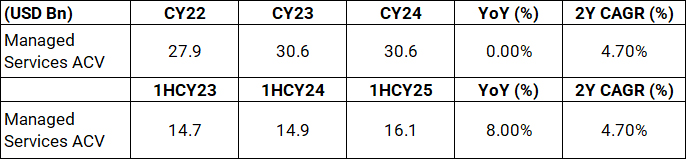

Table 6: Deal wins remain Subdued

Source: ISG (Information Services Group). Calendar Year Data as of December 2024.

• On the demand environment, most IT Services are witnessing weak demand trends owing to macro uncertainty in the U.S. The deal wins and growth are reflective of the same.

• Median Constant currency Revenue growth over the past 2 years for large IT services players is ~2.5% CAGR. IT services can be cyclical and clearly the current global backdrop has delayed the recovery. In our view, fundamental drivers of IT sourcing like onsite offshore cost arbitrage; efficiency play and delivery at scale still hold true. All these propositions remain relevant. Given these positives, we expect a recovery in growth for these companies.

While economic backdrop is favorable; high frequency indicators do not suggest pickup in Growth

Majority of high frequency indicators don’t suggest a material improvement from the ongoing slowdown. Near-term growth could be driven by higher rural consumption and government capex spends. Monsoon was reasonably good in the current season. Combination of this with higher MSP (Minimum Support Price) being offered by the Government should help sustain rural recovery. The lower interest rate regime is conducive for private sector capex; but uncertainty around tariff may keep the corporates on the fences.

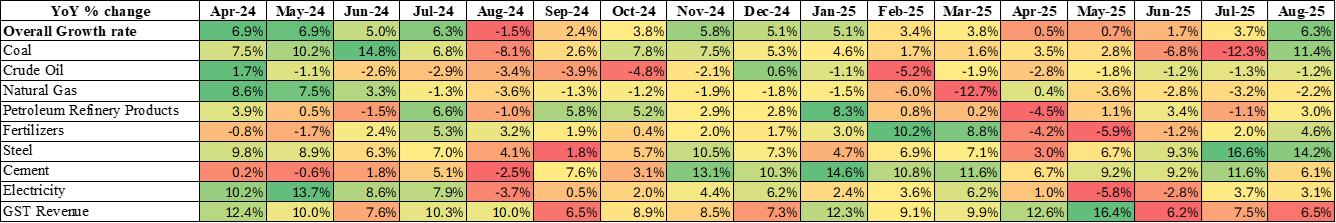

Table 7: Growth in Core Industries and GST Collection

Source: Office of Economic Advisor, Data as of August 2025

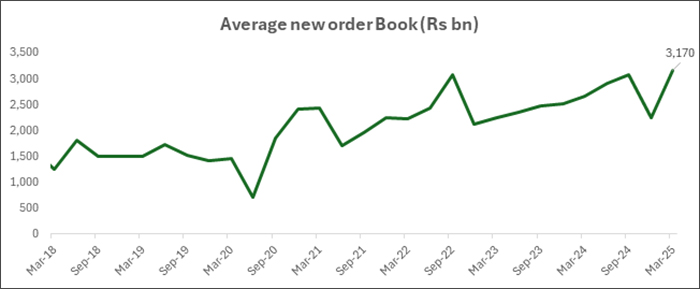

Graph 3: New order book and capacity utilization across industries suggests pick up in capex activity

Source: CMIE Economic Outlook, RBI Industrial Survey, Data Up to March 2025

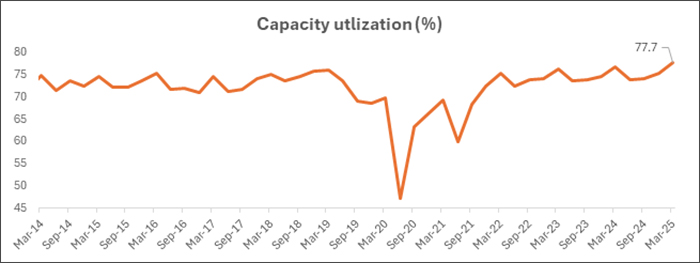

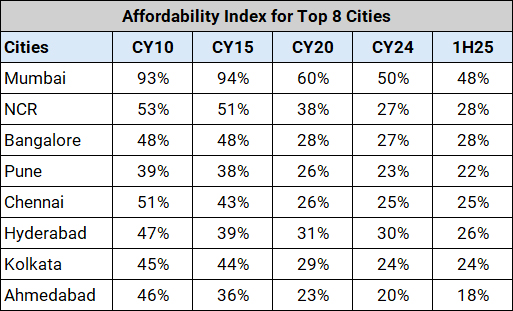

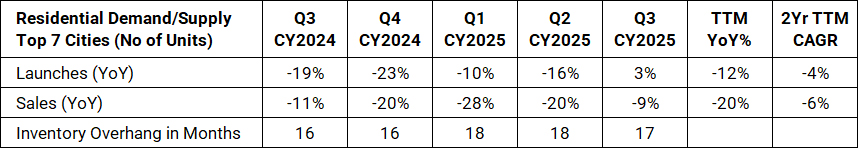

Table 8: Residential Real Estate Sales are moderating on a high base; Home affordability remains attractive

Source: Knight Frank. Affordability Index indicates the proportion of income that a household requires, to fund the monthly instalment (EMI) of a housing. Data as of 30 June 2025.

Source: Anarock, Housing Sales – Top 7 Cities

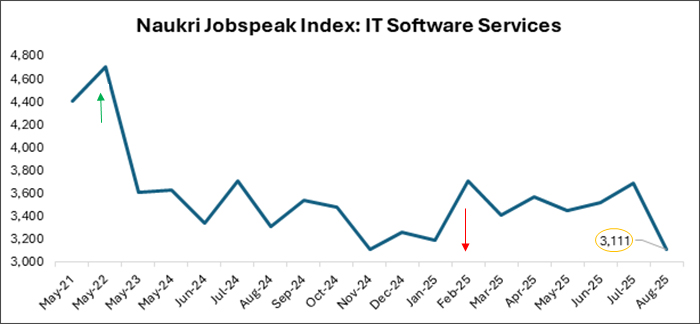

Graph 4: Naukri Jobspeak Index highlights subdued hiring environment in IT Services

Source: Naukri Jobspeak Index, Data as of 31 August 2025.

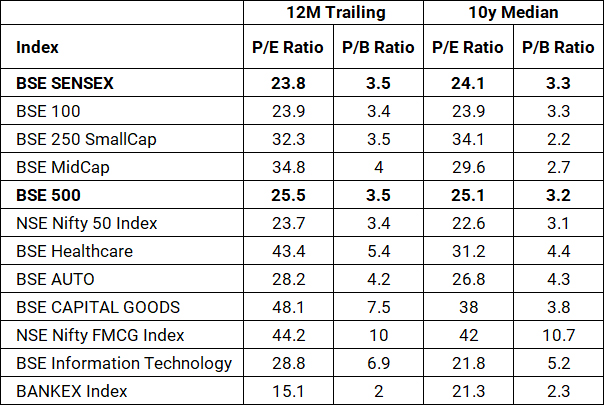

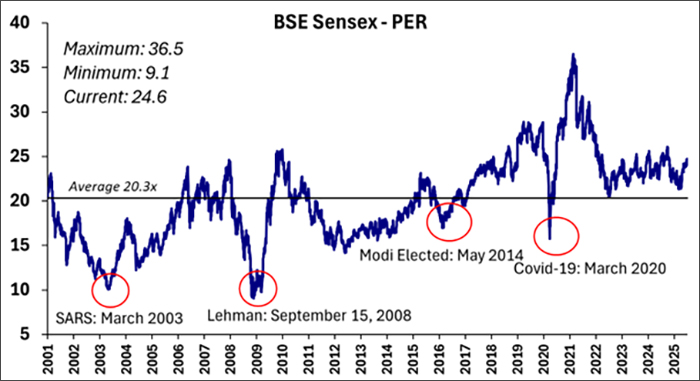

While the near-term economic trend is gradually recovering; valuations appear reasonable in pockets within the large cap space (Refer Table 9 and Graph 5). Benign inflation across food and fuel segments could keep inflation contained in the medium term. The recent interest rate cuts, benign inflation, good monsoon and potential consumption boost from tax cuts and GST rationalization augurs well for the economy over the medium term. While current valuation levels may not offer potential for super normal returns, risk reward appears reasonable for a long-term investor.

Table 9: Current Vs Historic Valuations of major indices

Source: Bloomberg; P/E: Price to Earnings; P/B: Price to Book; Data as of 30 September, 2025

Past performance may or may not be sustained in the future.

Graph 5: Long Term Valuation Chart of BSE Sensex Around Historic Average

Source: Bloomberg; Data as of 30 September 2025

Past performance may or may not be sustained in the future.

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More