Debt Monthly for October 2025

Posted On Friday, Oct 03, 2025

Key highlights of the month: |

|

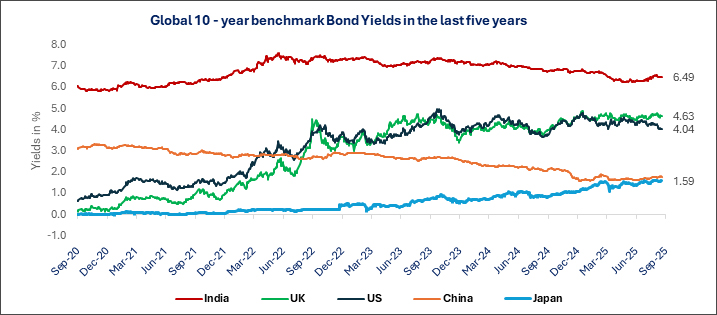

Chart I: Tracking India’s 10-Year Bond Yields Against Major Global Economies

Source: Bloomberg. Quantum AMC Graphics. Data up to September 30, 2025

September was a pivotal month for fixed income markets, both globally and domestically. The U.S. Federal Reserve (Fed) delivered its first rate cut of 2025, trimming rates by 25 basis points, and signaling the possibility of two more cuts before the year ends, setting a clear tone for the global interest rate outlook. Back home, India received a confidence boost on the credit front, with Japan’s Rating and Investment Information Inc. (R&I) - upgrading India’s long-term sovereign rating from BBB to BBB+ the third positive rating action for FY26.

On the policy side, the Indian government revised GST rates, giving a lift to domestic consumption. Adding to the positive sentiment, the G-sec borrowing calendar for the second half of the fiscal year was released with a slightly lower-than-expected bond supply. But markets remained focused on the evolving demand-supply dynamics - especially amid lingering uncertainty around GST reforms and ongoing global tariff tensions.

In the next section, we’ll dive deeper into these factors and our outlook for the rest of the year.

The Rbi’s Dovish Pause

The RBI held steady on policy rates this time, keeping the repo rate unchanged at 5.5% and maintaining a neutral stance. However, two of the external members were of the view of changing the policy stance to “accommodative” from the current “neutral” stance. The tone of the Monetary Policy Committee (MPC) was clearly dovish, with the RBI noting that the current macroeconomic conditions and outlook have created policy space to further support growth.

The decision to hold rates was unanimous. At the same time, the MPC acknowledged that the full impact of earlier rate hikes and recent fiscal measures (including front-loaded monetary actions) is still working its way through the economy. Rather than acting prematurely, the committee opted to pause and assess how these shifts play out.

Importantly, the MPC also pointed out that the recent rationalization of GST is expected to help moderate inflation while boosting consumption - giving both households and the broader economy a needed lift.

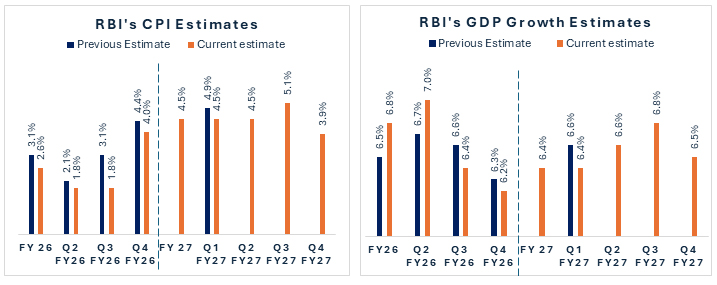

Chart II: RBI revised its CPI estimate lower and stayed optimistic on the growth front

Source: RBI Monetary Policy Statement. Quantum AMC Graphics. Data as per the Monetary Policy Statement for the October 2025 Monetary Policy.

Inflation trends continue to look favorable, with the forecast for FY26 now revised down to 2.6% (our estimates are at 2.6% with a downward bias) a significant drop from the earlier estimates of 3.7% and 3.1%. Core inflation is also expected to stay contained, which is positive for the overall outlook.

A big factor behind this softer inflation print is the recent GST rationalization, though it’s important to remember this is likely a one-off effect. Looking ahead to FY27, inflation could face a bit more pressure, though even then, estimates for Q1FY27 have been trimmed to 4.5% from 4.9%.

Broadly, inflation remains under control, which gives the RBI some flexibility to support growth without immediate concern over price stability.

On the growth front, the picture is more mixed. While services continue to show resilience, overall domestic demand remains somewhat weaker than expected. External trade headwinds are also weighing momentum. That said, structural reforms like GST rationalization are helping soften the impact. Still, growth is yet to reach the levels the RBI is aiming for, a point reinforced by the Governor in his commentary.

In terms of policy direction, the RBI has opted for what we believe is a dovish pause. The central bank clearly acknowledged that it has policy space to ease further if needed.

In our view, there’s a possibility of a 25 basis point rate cut in the December policy. Timing is key here. A rate cut now in October would have been premature, while waiting until later would risk missing the window of opportunity. December seems like the most ideal time to make that move, allowing the previous cuts to be fully transmitted and making the most of the current inflationary and growth dynamics.

Bond markets reflected this cautious optimism. Ahead of the policy announcement, yields on 10-year government bonds edged slightly lower, but post-policy, there was a mild sell-off and a small upward movement in yields. This was largely driven by investor caution and thin participation leading into the event. More importantly, the full transmission of past rate cuts into the bond market still hasn’t materialized, largely due to the emerging demand-supply mismatches. Until those dynamics adjust, we may continue to see a disconnect between policy rates and market yields.

Overall, the October policy aligned with expectations – ‘a pause, but one with clear dovish undertones’. We believe the RBI has left the door open for more easing, with inflation under control and growth still needing support. For investors and businesses alike, the signal is clear: the central bank is staying flexible and responsive, but not in a hurry - waiting for the right moment to act further if the data justifies it.

Bond Demand Supply Analysis

For FY26, India's borrowing is slightly lower than the original Budget Estimate (BE). The gross borrowing for H2FY26 is set at INR 6.77 trillion, a modest 2.4% increase from the previous year, bringing the total gross borrowing for FY26 to INR 14.72 trillion - just under the initial estimate of INR 14.82 trillion. The net borrowing for H2FY26 is pegged at INR 4.88 trillion, slightly lower than the previous year's INR 4.96 trillion.

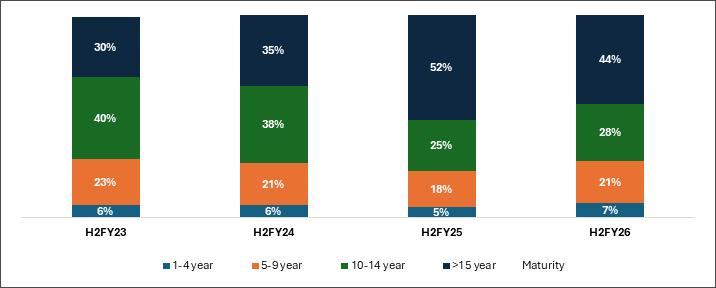

Chart III: G-sec yield curve remains steep, but the yield curve has shifted upward with yields rising amid global markets.

Source: RBI. Quantum AMC Graphics. Data for the above represents borrowing calendar by the RBI in various maturity buckets as published in September 2025.

When it comes to the tenor breakdown, there’s been a shift in focus toward shorter-duration bonds. Issuances of longer-end bonds (10 years and beyond) have decreased significantly, with the share dropping from 51.8% in H2FY25 to 43.6% in H2FY26. Notably, Sovereign Green Bonds (SGrB) will see a small issuance of INR 100 billion in the 30-year segment. Meanwhile, the 10-year bond segment gets the largest share (~28.4%, up from 24.8% last year), while the 5-year segment has also seen an increase in share to 13.3%. Shorter tenors, like the 3-year and 7-year bonds, have also gained a bit more attention.

However, this shift toward shorter bonds will be partly offset by significant G-sec maturities in H2 (~ Rs 980bn for 5-year and 10-year)

In Q1FY26, the RBI was the main buyer of Government Securities (G-secs), thanks to its OMO purchases of INR 2.45 trillion, aimed at helping monetary transmission. However, with the RBI switching to a 100bps CRR cut in Q2 and Q3 to boost liquidity, their demand will likely drop. Other big buyers like insurance companies and provident funds were active in Q1 and are expected to keep buying, but the growing focus on equity investments could start to weigh on bond markets. Banks, holding 35% of G-secs, will likely take on more of the issuances.

Foreign investments saw a dip in Q1, with an outflow of USD 4 billion, but that reversed in Q2, with inflows of USD 4.2 billion, partly due to hopes of index inclusion. Looking ahead, if liquidity tightens because of FPI outflows or higher currency demand, the RBI might step back in with OMO purchases in Q4. Overall, while the borrowing plans look positive for the bond market, the higher share of short-term bonds could cause the yield curve to flatten.

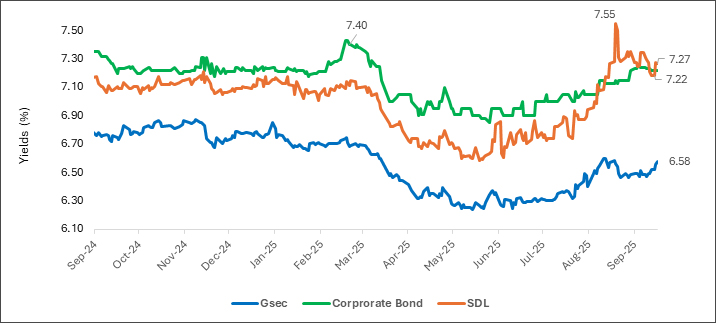

Indian Bond Yields Climb amid global market developments

On the domestic front, Indian bond yields experienced an upward movement of ~10-20 bps across the curve on a month-on-month basis.

In the first half of FY26, state government bond (SDL) issuances surged by 40% year-on-year, reaching 45% of the total borrowing estimate for the year, compared to the 3-year average of 27%. This increase was driven by weaker revenue growth and higher spending, which pushed states' fiscal deficits higher.

Additionally, states have been issuing longer-duration debt, with maturities of 15 years or more accounting for over half of their gross borrowings. However, this uptick in supply was met with subdued demand, especially from public sector banks (PSUs).

As many banks neared their internal SDL exposure limits, demand in Q2FY26 was significantly weaker, leading to PSU banks selling SDLs in the secondary market - something that hadn't been seen in the past two years.

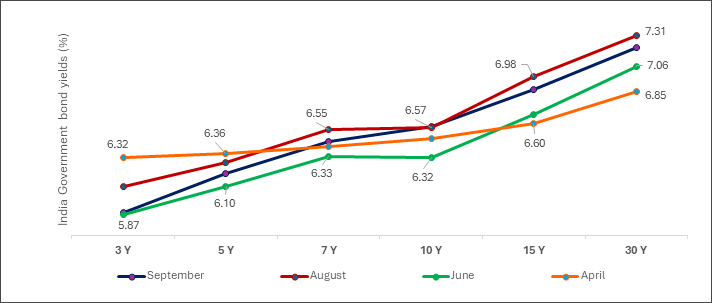

Chart IV: The G-sec yield curve shows steepening, with shorter-term yields dropping significantly.

Source: Bloomberg. Quantum AMC Graphics. Above data is for the month ended September 2025, August 2025 (1 month ago, June 2025 (3 months ago) and Date of Tariff Announcement (April 2, 2025)

As anticipated, the government's borrowing plan for the second half of FY26 reaffirms both its fiscal deficit and borrowing targets. A key change in this plan is the reduction in the duration of bond issuances, which reflects a recognition of market demand limits. The yield curve had steepened significantly recently. The overall duration of new issuances has also increased from ~12 years in FY11 to ~21 years in FY25.

This adjustment is expected to flatten the curve slightly, though the average duration of second-half issuances will remain ~16 years.

Chart V: The spreads between G-secs and SDLs, as well as G-secs and corporate bonds, have widened over the course of the month.

Source: Bloomberg. Quantum AMC Graphics. Above data is for the month ended August 2025, July 2025 (1 month ago, May 2025 (3 months ago) and Date of Tariff Announcement (April 2, 2025)

On the state government front, bond yields (SDLs) are now around 80 basis points higher than G-Sec yields, more than double the average spread seen between 2022 and 2025. This widening spread is largely due to front-loading of SDL issuances and weaker demand from banks. However, we expect both supply and demand to stabilize in the second half of the year, which should help narrow this yield gap.

GST reforms and stronger direct tax collections are anticipated to boost state revenues, and historical trends suggest that states often fall short of their fiscal deficit targets. If the actual deficit is lower than the budget estimate by 12%, state borrowings could decline by 4% year-on-year in the second half. Even with a smaller shortfall, a 7% deficit would only lead to a 3% year-on-year increase in borrowings, helping to ease supply - demand pressures in the market.

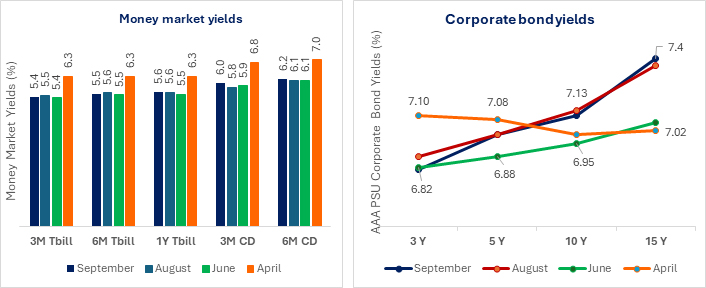

Money market yields in India remained rangebound on the back of liquidity support by the RBI. The RBI stepped in with measures to infuse liquidity in the system, holding consecutive Variable Rate Repo (VRR) auctions.

T-bill rates the remained more or less steady compared to August 2025. The 3-month AAA PSU CP/CD rates too remained steady in the 5.95%- 6.20% range on a closing basis.

The T-bill issuance schedule for Q3FY26 matches last year’s levels at INR 2.47 trillion, with the share of 91-day, 182-day, and 364-day bills split evenly at around 32-37%. However, larger than expected CIC and

Chart VI: Money Market Rates remained rangebound on the back of liquidity measures by the RBI; Corporate bond yields softened up slightly.

Source: Bloomberg. Quantum AMC Graphics Above data is for the month ended September 2025, August 2025(1 month ago), June 2025 (3 months ago) and Date of Tariff Announcement (April 2, 2025). Data on corporate bond yields is for AAA PSU corporate bonds.

The corporate bond yield curve has also moved up in line with the move in the G-sec yields, with the spread widening slightly across the curve. By end-September 2025, the spread between 10-year corporate bonds and G-secs narrowed to nearly 60-75 bps, down from nearly ~ 80 bps in July 2025. Demand for corporate bonds remains strong, supported by a steady supply pipeline.

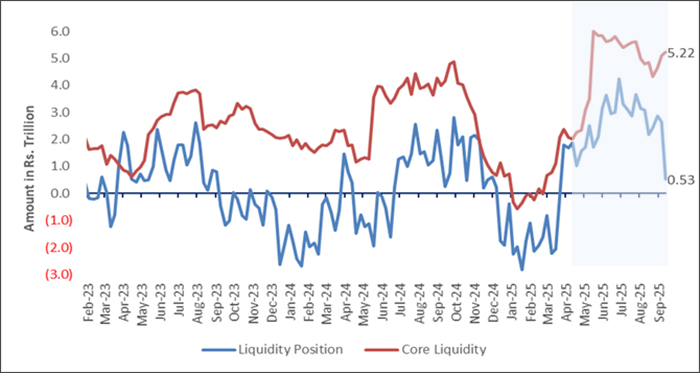

RBI Prioritizes Transmission with Steady Liquidity Support

In September, India’s liquidity conditions shifted into a mild deficit during the month, primarily due to the combined effects of GST collections and stronger-than-expected advance tax payments.

However, this was somewhat offset by the reduction in the Cash Reserve Ratio (CRR) and the month end government spending. While durable liquidity has been shrinking, CRR cuts have kept liquidity levels above 2% of Net Demand and Time Liabilities (NDTL). On top of that, demand for currency notes has been higher than usual, with deposit activity lagging behind withdrawals. As a result, overnight rates have moved closer to the policy rate, although the use of overnight Variable Rate Repos (VRRs) has somewhat moderated this effect.

Chart VII: Durable liquidity in huge surplus; Hinting at accumulation of Government Balances

Source: RBI. Quantum AMC Graphics. Data up to the week ended September 19, 2025

Looking ahead, we expect liquidity to be to surplus in the coming months, despite the seasonal drain from the festival-related increase in currency circulation. This will be supported by further CRR cuts and increased government spending.

While external risks like foreign exchange maturities and interventions may pose challenges, we anticipate that durable liquidity will remain near 2% of NDTL in the medium term. This should help stabilize overnight rates, nudging them somewhat lower between the repo and SDF rates. However, it’s important to keep an eye on the longer end of money market rates.

The more pressing concern right now seems to be slower deposit growth, which has been constrained by the higher-than-usual currency circulation and foreign exchange interventions. Even though credit growth is expected to pick up in the second half of the year, driven by stronger capital expenditure and increased investments, the sluggish growth in deposits has kept Certificates of Deposit (CDs) levels high.

While open market operations (OMOs) could help boost deposits, there’s a risk that this could create fresh savings that might eventually contribute to higher outflows, compounding the issue.

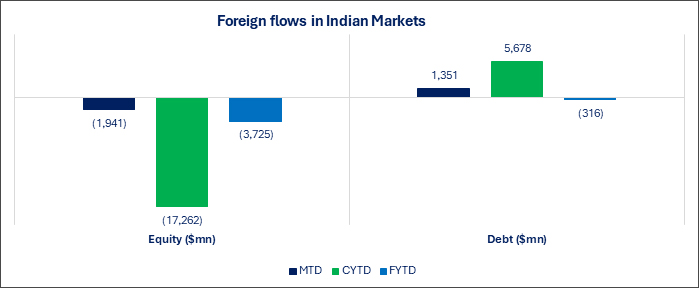

Foreign investments in (Indian Government Bond) IGBs saw significant growth in September 2025,

with the debt segment attracting $1,351 million during the month. However, this momentum could be challenged by escalating global trade tensions under the Trump administration. That said, India's three recent credit rating upgrades and affirmations are expected to boost investor confidence. Additionally, India's inclusion in the Bloomberg Emerging Market Index starting January 2026 could attract around $5 billion in inflows, driven by both passive and active investors.

Looking ahead, in the medium term, global financial markets are expected to see reduced volatility. The USD is likely to stabilize within its current range, which could trigger a reversal of the safe-haven trade, boosting capital flows into emerging markets like India.

Chart VIII: Amid Global Jitters, Indian Bonds saw inflows; August and September marks modest rebound

Source: CCIL, Bloomberg. Quantum AMC Graphics. Data up to the month ended September 2025.

Our View:

In its October 1, 2025 monetary policy meeting, the RBI opted to keep the repo rate unchanged at 5.5%, with unanimous agreement among all six MPC members. While the decision was widely anticipated as a “dovish pause,” the accompanying commentary and revised forecasts were even more dovish than expected.

Inflation has notably moderated, with the RBI lowering its FY26 inflation forecast to 2.6%, driven by falling food prices and GST cuts. However, growth remains below expectations, prompting a slight downward revision of the FY26 growth forecast to 6.3%. The RBI signaled that there’s room for further easing given the current growth-inflation mix. Additionally, two MPC members called for a shift to an accommodative stance, highlighting the RBI’s pro-growth tilt.

Despite the dovish tone, the RBI refrained from cutting rates for now, preferring to wait for the full impact of the recent GST cuts and the 50% tariff on growth. The Governor pointed out that the transmission of previous rate cuts is still in progress, suggesting more time is needed for their effects to fully materialize.

On the currency front, the RBI took a more proactive approach, signaling that it would closely monitor the Indian Rupee (INR) and take necessary actions if required. Proposals to review ECB restrictions could be aimed at boosting capital inflows, particularly if external financial conditions remain weak.

To stimulate credit growth, the RBI announced several banking reforms, including loosening regulatory limits to facilitate more lending, particularly for acquisitions and against shares. However, with nominal GDP growth remaining modest, credit growth may be limited in the short term.

Looking ahead, we are of the view that the RBI to cut rates by 25 basis points in December, lowering the repo rate to 5.25%.

Externally, while trade tensions with the US pose risks, India’s balance of payments remains resilient. Despite a possible modest widening of the current account deficit (CAD), ample FX reserves provide a buffer, and weaker domestic demand could help offset some of the export slowdown.

Foreign investors are increasingly eyeing Indian debt, particularly as long-end yields rise and rate-cut expectations gain traction. With global uncertainties still in play, India’s macro stability, deepening bond market, and real rate advantage continue to make it an attractive investment destination.

That said, we maintain a cautious near-term outlook due to persistent uncertainties, especially around the demand-supply dynamics in the bond market. And to navigate this, we’ve reduced our portfolio duration and are focusing on spread assets like SDLs and AAA-rated PSU bonds, aiming to safeguard capital and better position ourselves for the potential consolidation phase in the bond market.

What can investors do?

Given the current environment, bond yields are likely to either decline or remain range-bound. In such a volatile interest rate landscape, investors with a medium to long-term horizon may consider dynamic bond funds. These funds offer the flexibility to actively manage portfolio duration, allowing adjustments in response to evolving market conditions - making them well-suited for staying invested over longer periods.

For those with shorter investment horizons or lower risk appetite, liquid funds continue to be a more appropriate choice, offering stability and easy access to funds.

Source: Reserve Bank of India (RBI), Ministry of Statistics & Program Implementation (MOSPI), Bloomberg

|

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More