The Third Investment Anchor Most Investors Ignore

Posted On Tuesday, Sep 30, 2025

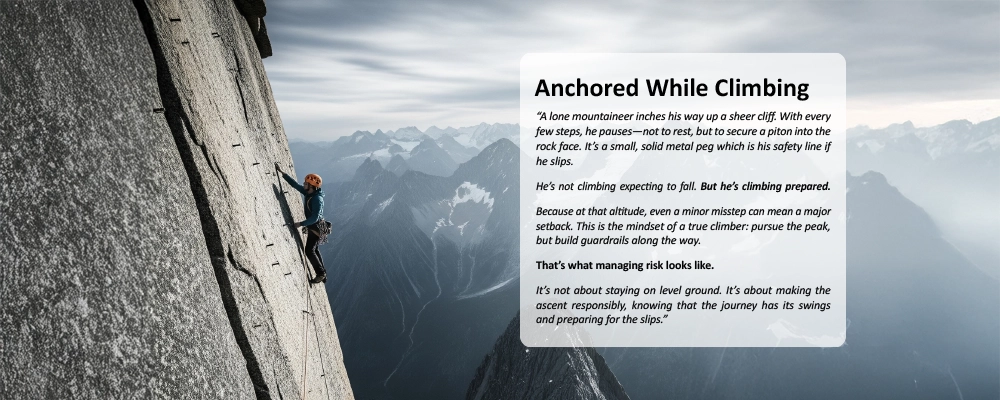

Now shift the lens to investing.

You may not always know when the drop will come. But you can equip your portfolio with an approach that can reduce the impact—without stalling your upward journey.

That’s what risk coverage in mutual funds is all about. It’s not about playing it safe.

It’s about being smart enough to stay the course—

no matter what the terrain throws at your investments.

Standard Deviation (SD) quantifies this swing movement. It tells us:

How steady or erratic the journey has been.

Whether a fund is mostly stable or tends to veer sharply in bull and bear phases.

This movement is measured by Standard Deviation, a statistical number that tells us how variability of returns has been.

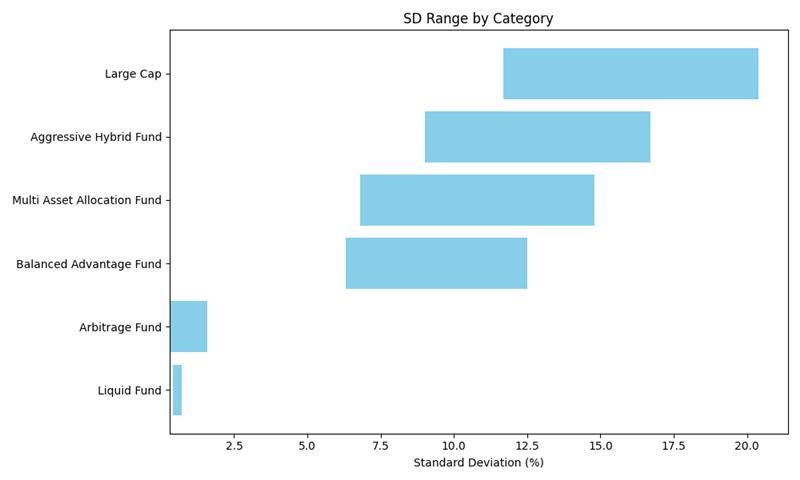

▎Every Fund Type Swings Differently—And That Matters to You

Let’s bring this to mutual funds.

Different funds come with different levels of SD — and therefore, different levels of risk. Here’s a quick map to understand where most mutual fund categories sit:

Source: ACE MF. Compiled by Quantum AMC. Standard deviation range is computed using 3-year rolling return of the respective categories. Time period for determining the range considered is from August 2020 to August 2025. Past performance may or may not be sustained in the future.

Understanding the SD band is essential. Because choosing a fund isn’t just about what it can earn — it’s also about how far it can fall in case of correction.

▎But What If Your Safety Net Isn’t So Safe?

Many investors hold both equity and debt in their portfolios — expecting debt to cushion the blow if equity markets fall. And generally, this mix has worked well across market cycles. But history shows that this isn’t always the case.

In certain periods, like the COVID-19 pandemic, equity and debt have dropped together, leaving portfolios exposed across the board.

So, when everything slips at once—where’s the safety net?

And that’s when you need low-correlation assets in the mix.

Assets that don’t move in the same direction. Especially during crisis phases, they offer a different rhythm—a true counterbalance when others sync up in a fall.

▎Two Paths, One Goal: Managing Market Exposure

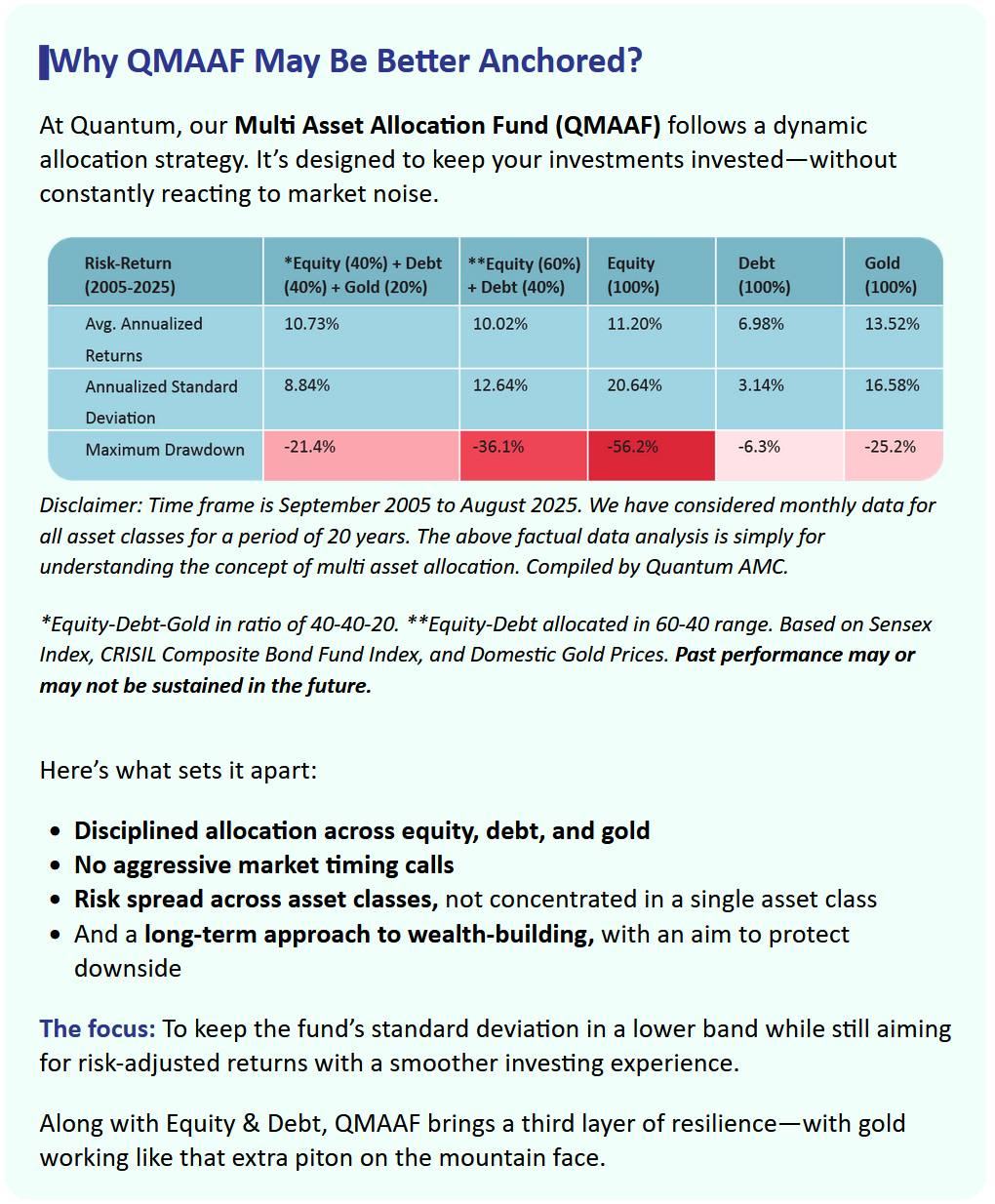

Let’s look at two categories that aim to balance return potential and risk: Hybrid / Balanced Fund category with variants and Multi Asset Allocation Funds (MAAFs).

|

|

|---|

Multi-asset allocation isn’t new to us. We’ve run this philosophy through Quantum Multi Asset Active FOF since 11th July, 2012, and, through Quantum Multi Asset Allocation Fund since 7th March, 2024.

| Explore QMAAFOF | Explore QMAAF |

Mr. Chirag Mehta is the Fund Manager effective from March 07, 2024.

Ms. Sneha Pandey is the Fund Manager managing the scheme since April 01, 2025.

Ms. Mansi Vasa is the Associate Fund Manager managing the scheme since April 01, 2025.

| Performance of the Scheme | as on August 29, 2025 | |||||

| Quantum Multi Asset Allocation Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (07th Mar 2024) | 11.07% | 11.88% | 6.61% | 11,680 | 11,807 | 10,994 |

| 1 year | 6.49% | 8.71% | -1.95% | 10,647 | 10,868 | 9,805 |

#NIFTY 50 TRI (40%) + CRISIL Short Duration Debt A-II Index (45%) + Domestic Price of Gold (15%); ##BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Performance details of other funds managed by Mr. Chirag Mehta, Mrs. Sneha Pandey & Mrs. Mansi Vasa. Click here

Mr. Chirag Mehta is the Fund Manager managing the scheme since July 11, 2012.

Ms. Sneha Pandey is the Fund Manager managing the scheme since April 01, 2025.

Ms. Mansi Vasa is the Associate Fund Manager managing the scheme since April 01, 2025.

| Performance of the Scheme | as on August 29, 2025 | |||||

| Quantum Multi Asset Active FOF - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (11th Jul 2012) | 9.93% | 10.71% | 13.73% | 34,706 | 38,077 | 54,246 |

| 1 year | 7.74% | 8.06% | -1.95% | 10,771 | 10,804 | 9,805 |

| 3 years | 12.29% | 12.20% | 11.65% | 14,157 | 14,124 | 13,917 |

| 5 years | 11.11% | 12.14% | 17.05% | 16,931 | 17,732 | 21,958 |

| 7 years | 10.05% | 11.28% | 12.27% | 19,553 | 21,133 | 22,479 |

| 10 years | 9.87% | 10.91% | 13.14% | 25,645 | 28,170 | 34,393 |

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). #CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%). It is a customized index and it is rebalanced daily. ##BSE Sensex TRI. **The name of Quantum Multi Asset Fund of Funds has been changed to Quantum Multi Asset Active FOF effective from August 29, 2025. Performance details of other funds managed by Mr. Chirag Mehta, Mrs. Sneha Pandey & Mrs. Mansi Vasa. Click here

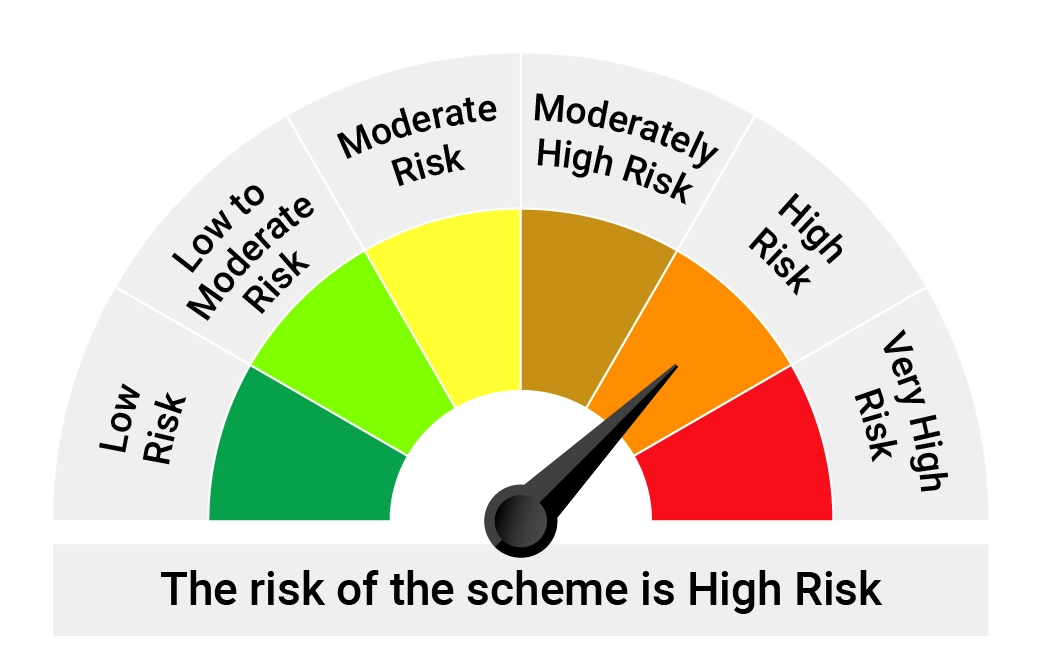

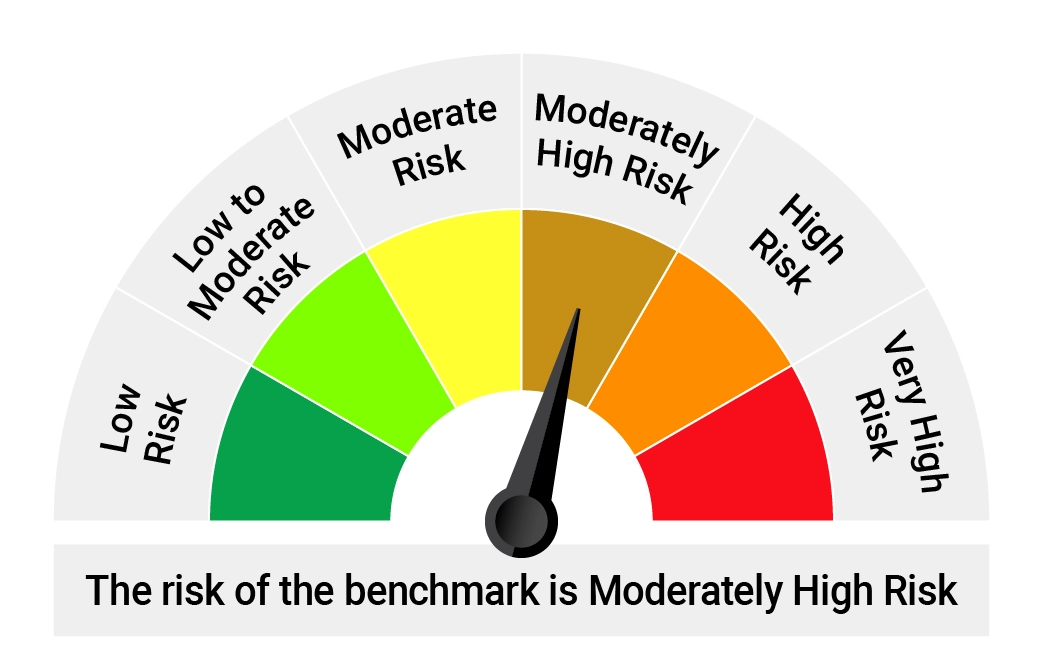

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-I Benchmark |

Quantum Multi Asset Allocation Fund An Open-Ended Scheme Investing in Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments Tier I Benchmark: NIFTY 50 TRI (40%) + CRISIL Short Term Bond Fund All Index (45%) + Domestic Price of Gold (15%) | • Long term capital appreciation and current income • Investment in a Diversified Portfolio of Equity & Equity Related Instruments, Debt & Money Market Instruments and Gold Related Instruments |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

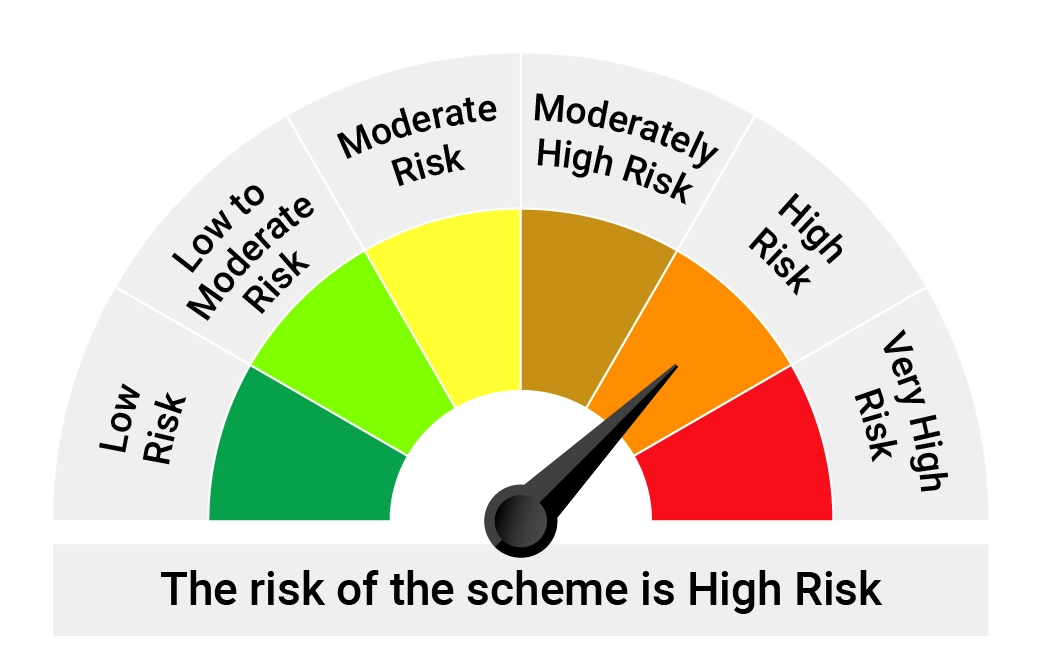

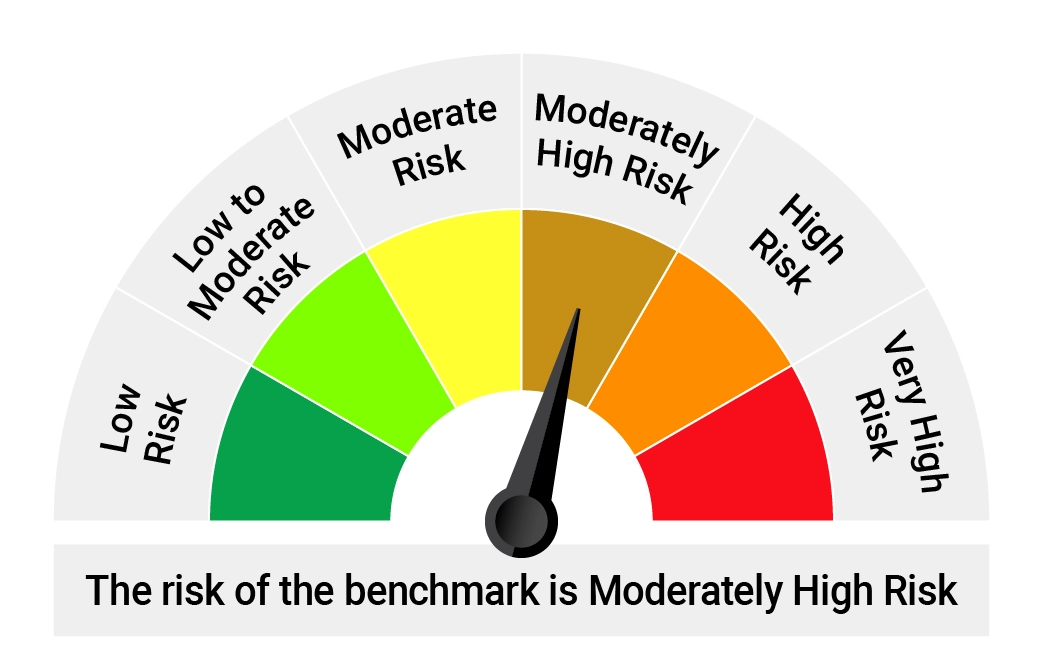

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-I Benchmark |

Quantum Multi Asset Active FOF An Open-Ended Fund of Funds scheme investing in Equity-oriented schemes, Debt oriented schemes and Gold based schemes Tier I Benchmark : CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Equity oriented Schemes, Debt oriented Schemes and Gold based Schemes of Quantum Mutual Fund |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the Underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More