Strengthen your Portfolio with Gold in Russia-Ukraine Crisis

Posted On Wednesday, Mar 09, 2022

As Russia announced a military strike against Ukraine, financial markets took a hit on Feb 24, 2022, and currently have fallen further over 1500 points since then. The Sensex took one of the 10 worst recorded intra-day falls in history. Equity markets experienced sharp selloffs and investors started taking recourse to Gold. Undoubtedly, this was also the day when Gold price had rallied to its one-year high mark, currently nearing ₹53,000 per 10 grams. This situation poses before us some very important questions like

- Is the Russia-Ukraine Crisis a wake-up call for Gold?

- How is the outlook for Gold in the near term and the long term?

Let’s look back to understand better: How gold shines during periods of crisis?

Gold prices and stock market movements are generally inversely proportional to each other. When the stock market is experiencing a downside, Gold prices generally increase and vice-versa.

Historical evidence showcases equity-gold inverse relationship. Here’s how gold prices had rallied amid equity market sell-offs at key points in history:

Past performance may or may not be sustained in the future.

Source: Bloomberg

For instance, during the 2008 Lehman collapse and the Global financial crisis, Gold prices grew by 26% while Sensex fell by 52%. The more recent example is the Covid Crisis in 2020, when gold prices rose to an all-time high of over Rs.56,000 per 10 gram while at the same time in the successive year when equity markets recovered, gold prices corrected about 20%.

What is the Outlook for Gold?

To understand the Gold outlook, we need to acknowledge the current economical and political environment that signal the near-term prospects. Let’s take a look at the key reasons for tailwinds:

1. Geopolitical tension: If the geopolitical uncertainty continues unabated and escalates, the supporting countries will resort to increased money printing to fund military actions. This can lead to a slowdown in economic growth and prove as a tailwind for gold.

2. Inflation: With sanctions on Russia disrupting global trade and supply chains, prices of raw materials and commodities are set to rise. Holding Gold can help cope with inflation as generally gold prices rise in tandem with inflation rates.

3. Crude Oil Prices: Crude oil rates has risen past the 8-year highs at $130 per Barrel amidst supply disruption from Russia, which will further fuel inflation.

4. Weaker rupee: Higher current account deficit on account of higher crude prices and flight of foreign capital from India on account of global risk aversion can put downward pressure on the Rupee. This will support domestic gold prices.

However, note that Gold prices will moderate in response to Fed’s tightening monetary policy that will increase the interest rates thereby increasing the opportunity cost of holding non-interest bearing gold.

Nevertheless, it makes sense to invest in gold for its strategic value and not a tactical play.

Gold continues as a strategic portfolio diversifier

Keep in mind that gold is not a tactical asset. You should stick to the asset allocation and allocate up to 20% of your portfolio to this strategic asset class.

Gold remains a risk-reducing portfolio diversifier due to its several properties.

• Ability to keep pace with inflation

• Long term Store of value

• Upholds value during macro-economic uncertainty

If you have already invested, you need to stay invested in balancing out the risk in your equity investments. If not, ETFs could offer a strategic way to enter the Gold market, diversify your portfolio and help offset downside risks.

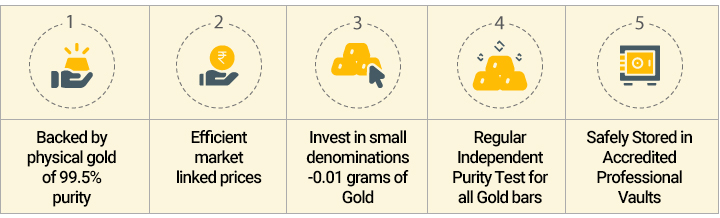

Advantages of Investing in Quantum Gold Fund:

How to allocate in Gold?

You can use our simple 12-20-80 Asset Allocation Strategy that offers the benefits of diversification and reduced downside risks.

After setting aside money equivalent to around 12 months of expenses’ in an emergency corpus with a Liquid Scheme such as the Quantum Liquid Fund, you can then consider investing 20% of your portfolio to avail the potential of risk reducing and portfolio diversifying asset of Gold with Quantum Gold Fund ETF.

It would be best if you avoid lumpsum investment at current levels. You can also take the opportunity of the lower ticket size using a monthly SIP (Systematic Investment Plan) of Rs.500 without opening a DEMAT account with the Quantum Gold Savings Fund. Quantum Gold Savings Fund has underlying investments in Gold ETFs and avail the freedom from timing the market.

Thereafter, you can invest the balance 80% in a diversified equity bucket comprising of Quantum Long Term Equity Value Fund, Quantum Equity Fund of Funds and Quantum India ESG Equity Fund.

Time and again, Gold has played a return-enhancing and risk-reducing role in investor portfolios in times of macroeconomic crisis.

Thus, while the crisis calls attention to Gold, Gold’s presence as portfolio diversifier necessitates a strategic role to enhance your portfolio risk-return trade-off.

Click on the thumbnail to watch our latest webinar where the CIO of Quantum Advisors Arvind Chari and Quantum fund managers Nilesh Shetty and Chirag Mehta helped decode the budget and shared invaluable insights.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current incomes • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity, debt / money market instruments and gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimerto read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for September 2025

Posted On Tuesday, Sep 02, 2025

August 2025 saw renewed strength in gold, with international prices rising 4.79% for the month and posting a robust 37.75% year-on-year gain.

Read More