Debt monthly view for March 2021

Posted On Thursday, Apr 08, 2021

The first quarter of 2021 was dominated by rising bond yields across major economies. This was backed by renewed optimism on economic recovery and fear of faster pick-up in global inflation. The US 10 year treasury yield surged from 0.91% at start of the year to 1.74% by end March.

In India also bonds sold off. The 10 year bond yield rose by 31 basis points since start of the year from 5.87% on December 31, 2020 to 6.18% on March 31, 2021. Selling was more pronounced in all other maturity segments both at long and the short end where yields went up by 30-50 basis points in the same period.

There was some breather in the month of March when yields came down by 5-15 basis points on government bonds and spread of State Development loans and PSUs compressed by about 30 basis points compared to the previous month. Notwithstanding the gains, market sentiment remained weak as government bond sale auctions faced repeated failures.

In the first monetary policy review in FY22, the MPC (Monetary Policy Committee) of the RBI maintained status quo. The policy repo rate was left unchanged at 4.0% and the reverse repo rate at 3.35%. The MPC also continued with its “accommodative” policy stance.

One significant change was in the nature of the forward guidance. In its monetary policy in October 2020, the RBI for the first time came up with a time based forward guidance stating they will remain accommodative... “at least during the current financial year and into the next financial year”. It dropped this timing element from the forward guidance and made it contingent on the growth and inflation trajectory.

Overall, the RBI maintained it priority as reviving economic growth on durable basis while keeping inflation risks in mind. It states “...to continue with the accommodative stance as long as necessary to sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward”.

The RBI raised its inflation forecast for the next year marginally and estimates the CPI to average at 5% in FY22. This suggest an implied real repo rate of -1%. Of course given that the operative rate today in 3.35% (reverse repo rate), the real rates will remain in deep negative for yet another year.

In simple terms, negative real rates discourage savings and boost consumption which may fuel more inflation and lead to even more negative real rate. It also makes domestic currency vulnerable to external shocks by making domestic assets like bonds less attractive to foreigners.

Although low interest rates are needed for the economy to revive, holding it too low for too long can have negative consequences for an emerging economy like India. Amidst resurgence of covid infections, the RBI may ignore inflationary pressures and maintain accommodative policy for some time and continue to maintain negative real rates. But, if inflationary pressures sustain, the RBI will be compelled to withdraw some of the crisis time’s measures.

They have already started with the normalization of liquidity situation by the introduction of variable rate reverse repos and reversal of CRR cut announced in the last policy.

The announcement of longer term variable reverse repo is another step towards normalization. If the tenure is for more than 3 months, we can see overnight to short term rates increasing which bodes well for returns from liquid funds. Eventually, we will see a possibility of hiking reverse repo rate towards the end of this calendar year.

Increase in inflation, removal of time based forward guidance and re-introduction of variable rate term reverse repo does indicate a hawkish bias in the monetary policy. Nevertheless, the RBI maintained the critical balance by introducing a Secondary Market G-sec Acquisition program or G-SAP. Under this program (G-SAP 1.0) the RBI will purchase government bonds worth Rs. 1 trillion in the Q1 of FY22 (April – June 2021).

This commitment to purchase pre-determined amount of government bonds should bode well for long term bonds atleast in near term.

While other factors like domestic inflation, crude oil prices and global yields will continue to influence the market, we expect long term bond yields to remain range bound. With RBI interventions short term bond yields could move higher with normalization of liquidity condition.

Over medium term, inflation and potential monetary policy normalization will play more important role in shaping the interest rate trajectory. We expect market interest rates to move higher gradually over the next 1-2 years.

Interest rate on short term fixed deposits are likely to move up. So fixed deposit investor may avoid locking long term fixed deposits at this point. They can be in short term fixed deposits or liquid funds until fixed deposit rates go up.

Given the high uncertainty over interest rate trajectory, it would be prudent for investors to be conservative in their fixed income allocation. Conservative investors should stick to very short maturity debt categories like liquid fund. With normalization in liquidity and short term rates, liquidity fund performance could improve going forward.

Investors with longer holding period and appetite to tolerate volatility could look at dynamic bond funds which can change the portfolio’s risk profile depending on the market situation.

Investors in debt funds should lower their return expectation as potential for capital gains will be limited. We advise investors to have longer holding period to ride through any intermittent turbulence in markets.

Source: RBI

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

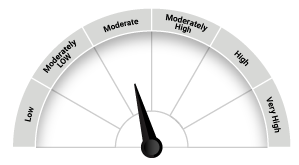

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

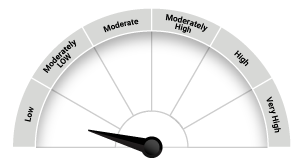

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on March 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More -

Debt Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

October 2025 in a Nutshell: Monetary Policy and Demand–Supply

Read More