Debt monthly view for May 2020

Posted On Tuesday, Jun 09, 2020

Interest Rates at Inflection Point; what lies ahead for Debt Investors

With the start of May, the focus shifted from fighting the virus at any cost to taking stock of the resulting economic damage. Government’s both at the Centre and states were seen to be relaxing the lockdown and opening up of economic activity in the less affected areas. Several large cities and metros however continued to grapple with tight lockdown restrictions.

The economic implications have been severe. CMIE’s survey showed a spike in unemployment rates to the tune of 27% in the week ended May 3, 2020. This remained at about 24% in the following weeks. About 122 million people lost their job and income. Lack of livelihood support forced millions of migrant workers to walk hundreds of kilometers to go back to their villages.

Economic activity, as reflected by sale of automobile, consumption of petrol and diesel, electricity consumption, freight traffic, foreign trade, Industrial Production and many others, had collapsed to unprecedented levels.

Imposition of nationwide lockdown was initially expected to take away this year’s growth in real GDP but within a month and a half this forecast got lowered substantially. The GDP growth is now to tumble to a negative 5% in the current fiscal year 2020-21.

Fiscal Support – Too Late Too Little

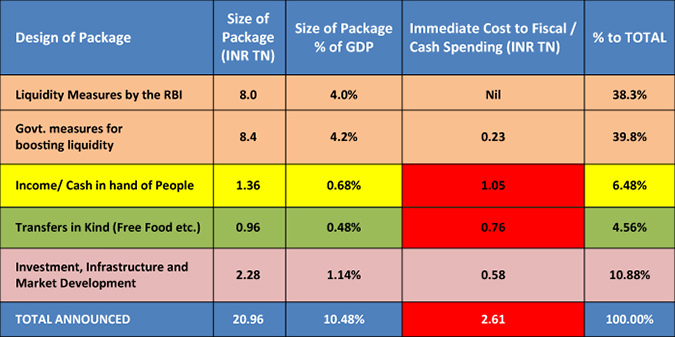

Prime Minister Modi, in his address to the nation, announced an economic package worth Rs. 20 trillion (10% of GDP). The package includes the liquidity infusion measures announced by the RBI. Even the remaining portion of the package from the government was heavy on providing liquidity relief and facilitating credit flow to various sectors. The package has very little direct support for individuals and businesses. The direct fiscal spending was limited to only 1.3% of GDP which looks grossly inadequate given the scale of the problem.

Table – I: Economic Package had too little direct support

(TN= Trillion, 1 lakh crore).

Sovereign Rating Heading towards ‘Junk’

On the question of lack of direct fiscal support, the Chief Economic Advisor KV Subramanian cautioned investors indicating that “there is no free lunch”. This was in reference to the threat of downgrade in India’s sovereign credit rating if government has to undertake a large fiscal spending.

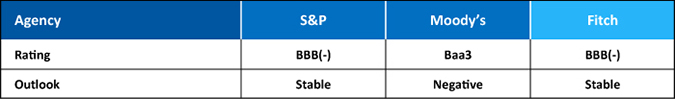

Despite the spending restraint by the government, one of the global rating agencies Moody’s decided to downgrade India’s sovereign credit rating. To recall, Moody’s had upgraded India’s credit rating back in November 2017. Thus this downgrade is just a reversal of its earlier rating action though it has maintained a negative outlook suggesting high possibility of further downgrade.

Ratings of BBB (minus) and above are considered “Investment grade”. While rating below this threshold are termed as ‘speculative grade’. More commonly in bond market parlance as ‘Junk’ category.

Table – II: After Moody’s downgrade India is rated just a notch above ‘junk’ category

Source: Rating agency websites, As at May 2020

*Baa3 is Moody’s equivalent of BBB (minus)

Having an investment grade makes it easier for the Indian government and companies to raise capital from the global markets. In other words if India get downgraded to ‘Junk’ which is just a notch down, it could seriously constrain our ability to raise foreign capital especially debt.

The main drivers for this rating action are:

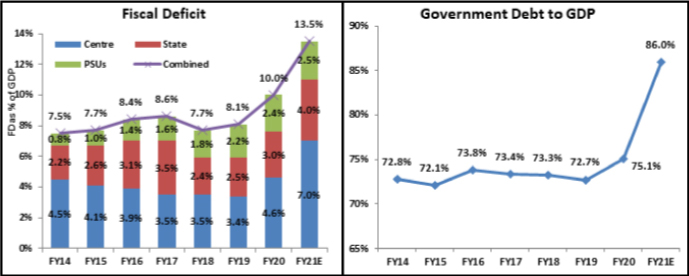

1. Deteriorating Fiscal Conditions – Fiscal Deficit (Government’s expenditure in excess of its Revenues) of Centre and state governments has widened considerably even before CoVid-19 hit us. Now with the loss in income due to the nationwide lockdown, our fiscal position will worsen even further. General government debt (Public Debt) is likely to jump past 85% of GDP by March 2021 from levels of 72%-75% of GDP in the past few years.

Chart - I & II: Fiscal Deficit and public debt to rise to historic highs

(Source – CMIE, Indiabudget.gov.in)

2. Prolonged Period of slower economic growth – On an average BBB rated countries have a Public Debt/GDP around 45%. One of the reasons why rating agencies overlook the ~30% percentage points difference between India’s public debt to GDP and other Emerging market peers with similar rating, is due to India’s track record of high growth.

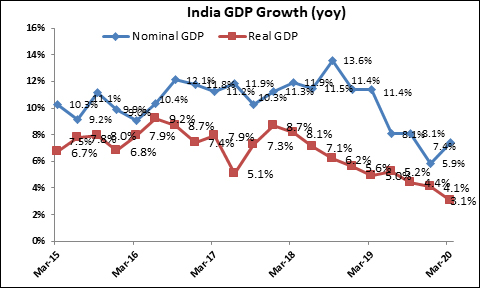

The GDP growth however has been consistently slowing down for the last 2 years. In this fiscal year, the economy is expected to contract by ~5% in real terms (GDP growth adjusted for price increases) and 1%-3% in nominal terms.

Chart – III: GDP growth was slowing even before COVID

(Source – MOSPI)

What does it mean for the Debt Market?

In the last month, the bond market stood firm against persistent negative shocks. The government breached its FY20 fiscal deficit target by Rs. 1.8 trillion (0.80% of GDP). Market borrowings for FY 2020-21 increased by over 50% (Rs. 4.2 trillion). Consequently, Moody’s downgraded the sovereign rating of India just as crude oil price jumped by over 50%.

Despite this, bond yields remained in a tight range and even declined marginally by the month end, when the RBI cut the Repo Rate by 40 basis points. The 10-year benchmark government bond (old security) yield declined by 9 basis points in the month to trade around the 6.0% mark.

Underlying macro variables have turned against the bond markets especially for the longer maturity segment. Rate cutting cycle is near to its end, government’s fiscal position has worsened considerably and there is a risk of a sovereign rating downgrade.

The combined fiscal deficit of the central and state governments is likely to widen to ~11% of GDP in FY 2020-21 compared to ~7.6% in FY 2019-20 and ~6.9% in FY 2018-19. Given the weak growth and expected slower recovery, tax revenues might remain low in years to come. This will ensure elevated levels of fiscal deficit well beyond FY21. In order to fund this increase in the fiscal deficit, government both at Centre and state levels will have to borrow a lot more from the bond markets than the usual trend. This could exert significant upward pressure on the bond yields (downward pressure on bond prices) over the medium term.

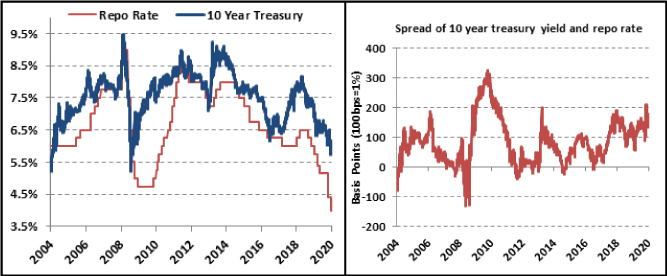

Part of this expected fiscal deterioration is already reflected in the high term premiums (long maturity bond yield over Repo rate). The difference between the 10 years government bond yield and the Repo rate is now at 175 basis points compared to its long term average of ~80 basis points.

Chart – IV & V: Indian interest rates at historic lows

(Source – Bloomberg, Quantum Fixed Income Research)

Only based on this spread, the longer maturity bonds look attractive. However, we need to remind ourselvelves that prices of longer maturity bonds are more sensitive to interest rate changes than shorter maturities. For example, with a 100 basis points increase in 10 year bond yield its price would fall by ~7.5%; while for a similar increase in yield of 3 year bond its price would fall by only 1.8%.

We now see higher probability of bond yields (market interest rates) going up than down. Additionally, there is also a risk of India’s rating downgrade below the investment grade. In our opinion risk reward is unfavorable for the longer maturity bonds. Nevertheless the shorter maturity bonds (upto 3 years) might remain supported by the easy liquidity condition.

Portfolio Recommendations and Strategy

Based on this view we have reduced the maturity profile (lowered the interest rate risk). ) of the Quantum Dynamic Bond Fund Currently, the portfolio is concentrated in upto 3 year maturity government bonds and is holding higher than usual cash which can be deployed if interest rates move up.

We understand the economy and markets are currently adjusting to an unprecedented shock. Thus any forecast is susceptible to changes arising from policy responses from the government and the RBI and changes in global markets. We will remain vigilant of these developments and review our outlook as and when new information comes. Nevertheless, it would be prudent for investors to be conservative at such times of heightened uncertainty.

We advise investors to stick to debt funds with lower maturity and good credit quality. While investing in debt funds, investors should keep the market risks in mind. Investors with low risk appetite should stick to Liquid Funds to avoid any sharp volatility in their portfolio value.

Given the excess liquidity situation, which we expect to continue, returns from overnight and liquid funds will remain muted. However in the current uncertain times, investors should live with lower returns and should prioritize safety and liquidity over returns.

Credit Crisis is not over yet – Remain Risk Averse.

The corporate debt market (for lower rated debt) has been under stress and was lacking liquidity even before this deadly virus hit us. With the economic uncertainty caused by the Covid-19 and the nationwide lockdown things got even worse.

The lockdown has significantly impaired the debt servicing capacity of many companies and individuals who have lost a significant chunk of their income. Even after the lockdown is lifted, demand for goods and services would remain below what it was pre-Covid and many of workers may remain unemployed. This could create a negative spiral in the credit markets. We see higher risk of rating downgrades and defaults in the next two years.

In this scenario it would be prudent for investors to avoid excessive credit risk in their debt exposure. Investors also need to remember that credit and liquidity risks are an inherent characteristic of debt investments albeit difficult to identify in normal times. The continuing crisis in the debt mutual fund space is a direct outcome of ignoring these risks for a very long time.

Data Source: Bloomberg, RBI

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for December 2025

Posted On Tuesday, Dec 02, 2025

As we approach the end of the calendar year, we find ourselves at a pivotal moment, with the market split on the likelihood of an upcoming rate cut.

Read More