Debt monthly view for September 2021

Posted On Monday, Oct 11, 2021

Fixed Income Monthly Commentary – September 2021

September was an eventful month for the bond market. The expectation of a reduction in government borrowing and chatter of global bond index inclusion fueled a rally in the bond market in the first half of the month. It got further accentuated by the below expectation inflation print of 5.3% in August 2021.

The 10-year government bond yield came down from 6.22% on August 31, 2021, to 6.14% by September 20, 2021. However, the rally could not sustain for long and yields bounced back by the month-end following a sharp rise in crude oil prices and the US treasury yields. On a monthly closing basis, the 10-year Gsec yield ended flat at 6.22%.

The yield curve (yields on different time to maturities) flattened during the month as the short end (up to 3-year maturities) bond yields moved up by 15-25 basis points on a month-on-month basis while the longer maturity (15 years and above) bond yields came down by 10-15 basis points.

The central government has pegged the second half government borrowing at Rs. 5.03 trillion. This will take the full year of government borrowing to the budgeted level of Rs.12.05 trillion in FY22. However, there will be no extra borrowing on account of the GST compensation cess loan (to be provided to states).

The government had earlier estimated an additional borrowing requirement of Rs. 1.59 trillion to meet the GST shortfall in FY22. The unchanged full-year borrowing implies that G-sec issuance to fund the Centre’s fiscal deficit is actually lower.

Given the buoyant tax collections, higher RBI dividend and below trend expenditure, there is a high possibility of a full-year fiscal deficit coming lower than the budget target of 6.8% of GDP. On margins, this should be a positive for the bond market. But given the fact that the level of government borrowing is still significantly higher than the pre-pandemic level, the market would need the RBI to fill the demand-supply gap.

On demand-supply dynamics, a sigh of relief has come from the recent pick up in foreign inflows into the Indian bonds. Foreign portfolio investors (FPI) pumped in about USD 1.8 billion into Indian bonds over the last two months. Part of this could be in anticipation of India’s inclusion in the global bond indices.

Recent media reports and comments by senior government officials suggest that significant progress has been made towards the inclusion of Indian Government Securities in the global Bond Indices. This should attract foreign investors to buy Indian bonds which are grossly under-owned by FPIs at less than 2% of total stock. However, in the next few months, FPI flows will also depend on the pace of monetary policy normalization in the US as well as in India.

In the FOMC (Federal Reserve Open Market Committee) meeting last month, the US Federal Reserve maintained the status quo on rates but warned that QE (Quantitative Easing – US Fed’s bond purchase program) tapering could commence as early as November this year and could end by mid-2022. Furthermore, the ‘dot plot’ which shows the FOMC members expectation of future policy rates, indicates that the rate hike could start in 2022 itself.

US treasury yields jumped sharply after the Fed announcement. The 10-year treasury yield which was around 1.28% at August-end jumped to around 1.49% by the end of September and is currently trading around 1.59% (as of Oct 8, 2021). Apart from the FOMC outcome, a sharp surge in crude oil prices also contributed to this move-in US treasury yields.

The brent crude oil price has risen by more than 15% in the last one month and is currently hovering near USD 83/barrel (as of Oct 8, 2021), only slightly below its 2018 peak.

Given the economies are opening up globally demand for oil is expected to rise. There is an additional demand for oil emanating from the substitution effect due to sky-high natural gas prices and global coal shortage. Thus, crude oil prices may remain under pressure for some time which poses a risk for Indian bonds.

The sharp move up in the bond yields in the last two weeks is partly due to rising crude oil. While some bit is on fear of liquidity absorption measures by the RBI in the October policy.

In its bi-monthly review, the monetary policy committee (MPC) of the RBI left the policy repo rate unchanged at 4% and the reverse repo rate at 3.35%. It also kept its forward guidance “to continue with the ‘accommodative’ stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward”.

This was broadly in line with the market expectation. The biggest surprise was the complete removal of G-SAP (RBI’s bond-buying program). In the background of high oil prices and rising US treasury yields, the removal of G-SAP should lead to a rise in long term bond yields. The 10-year bond sold off by about 5 basis points after the announcement. Currently, the 10-year Gsec is trading around 6.31%, a level last seen in April 2020.

On the liquidity front, the RBI did respond to the market’s call and announced to increase the amount under 14 days Variable Rate Reverse Repo (VRRR) auctions in a staggered manner from current Rs. 4 trillion to Rs. 6 trillion by December 3, 2021. It also outlined an option of conducting 28 days VRRR, if required.

These measures should provide support to money market rates which are currently hovering around the reverse repo rate of 3.35%. However, we do not expect any notable impact on the bond curve due to VRRR for two reasons –

(1) Even with Rs. 6 trillion of VRRR, the amount under the RBI’s fixed-rate reverse repo would remain substantially higher than its pre-pandemic normal.

(2) VRRR is a temporary liquidity absorption tool. The RBI has been reluctant to absorb the excess liquidity on a durable basis. Given the gradual approach adopted by the RBI, liquidity surplus will remain high for an extended period.

We particularly like the 3-5 year segment of the government bond market which in our opinion is already pricing for some liquidity normalisation and a start of rate hiking cycle by end of this year. Given the steep bond yield curve, 3-5 year bonds offer the best roll down potential as well.

In absence of assured RBI purchases, longer-term bonds may face increased volatility and potentially lower returns going ahead.

We used the rally in the bond market in the last month to book profits from our earlier long bond positions in the Quantum Dynamic Bond Fund (QDBF). During the month, the portfolio has been rebalanced in accordance with the change in the market dynamics and the macro-outlook.

Currently, a bulk of the QDBF portfolio is positioned in the 2-5 year space which is reflective of our aforesaid view on the bond market.

In the current juncture, we believe a combination of liquid to money market funds to benefit from the increase in interest rates in the coming months; along with an allocation to short term debt funds and/or dynamic bond funds with low credit risks should remain as the core fixed income allocation.

Source: Worldometer.info

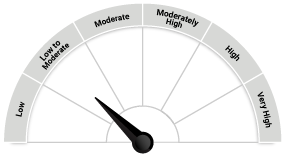

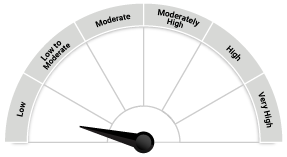

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on September 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More