Debt monthly view for May 2021

Posted On Tuesday, Jun 08, 2021

June 08, 2021

Fixed Income Monthly Commentary – May 2021

Bond yields remained in a narrow range throughout the month. The 10-year government bond yield hovered around the 6% mark in the month.

On month on month basis yield move was not uniform across the maturity curve. The yield curve steepened during the month as the short-term yields came down while the longer end moved up.

The 3-year Gsec yield dropped by about 7 basis points in the month to 4.70% while the 30-year bond yield moved up by 17 basis points to close at 6.94%. The 10-year G-sec yield closed flat on a month-on-month basis at 6.02%.

The spread of PSU bonds over respective Gsecs narrowed at the front end. The 3 year PSU bond yield fell by about 20 basis points from 5.35% to 5.15% during the month. Spreads on the longer end however narrowed only marginally.

Money market yields moved up by about 10 basis points across treasury bills and PSU and private debt securities. At the month-end 3 months, the Treasury bill was trading at 3.39% vs 3.30% in the previous month.

RBI interventions remain the key driver of the bond market. The RBI conducted bond purchases of Rs. 350 billion under the second tranche of GSAP 1.0. It also conducted a special OMO to purchase long-term bonds while selling short-maturity treasury bills worth Rs. 100 billion. Apart from direct market purchases, it tactically used cancellation debt auctions and devolution on primary dealers to keep yields anchored.

In the monetary policy review announced on June 4, 2021, the Monetary Policy Committee (MPC) of the RBI left the policy repo rate unchanged at 4.0% and the reverse repo rate at 3.35%. It also maintained the forward guidance to keep an ‘accommodative stance’ as long as necessary to revive and sustain growth on a durable basis, while ensuring that inflation remains within the target going forward.

The RBI noted the negative impact of the second wave of covid-19 on the economy and lowered the GDP growth forecast for the fiscal year 2021-22 to 9.5% from an earlier projection of 10.5%. The RBI reiterated the need for policy support - “at this juncture, policy support from all sides – fiscal, monetary and sectoral – is required to nurture recovery and expedite return to normalcy”.

With regard to inflation, the RBI has adopted a wait and watch approach highlighting risks emanating from rising commodity prices, logistics costs and disrupted supply chains.

The RBI made a case for supply-side measures from the Centre and State governments to soften inflationary pressures. The statement said – “Excise duties, cess and taxes imposed by the Centre and States need to be adjusted in a coordinated manner to contain input cost pressures emanating from petrol and diesel prices. Further supply-side measures are needed to soften pressures on pulses and edible oil prices.”

The headline CPI inflation forecast is pegged at 5.1% in the fiscal year 2021-22. This implies a negative real rate of 110 basis points based on the policy repo rate of 4.0%. At this juncture, low-interest rates are needed to nurture the recovery in economic activity. However, persistent low or negative real rates could weaken macroeconomic stability and make the economy vulnerable to shock.

If growth recovery gets back on track with the lowering of new covid-19 infections, the focus may shift to policy normalization. Going by the current trend, we expect the RBI to change its posturing towards the end of the year and start withdrawing excess liquidity. On policy rates, it may start with hiking the reverse repo rate first by early next year followed by a calibrated increase in repo rate.

From a bond market perspective, the biggest announcement was the extension of the RBI’s bond-buying program with GSAP 2.0. The RBI raised the size of the GSAP program and committed to conduct secondary market purchases of government bonds of Rs. 1.2 trillion in Q2 FY22 (July-September 2021).

Another significant move was to include state development loans into the GSAP ambit. It announced to split the remaining Rs. 400 billion of GSAP 1.0 auction between the centre and state government bonds. The purchase operation will be conducted on June 17, 2021.

This will help in containing the yield spread of SDLs over respective central government securities from rising sharply. This will also support the ultra-long (30-40 years maturity) Gsecs which tends to follow SDL yields.

The extension of the GSAP program should bode well for the bond market and keep yields in a narrow range near 6% in the coming months. However, the expectation of change in the monetary policy direction in the second half could weigh on the market sentiment. We expect bond yields to move higher gradually over the medium term following normalisation in liquidity conditions and policy rates.

Given the expectation of rising interest rates, it would be prudent for investors to focus on shorter-maturity funds which impact less when yields rise. Remember bond prices and debt funds’ NAV fall when market yields move up.

Conservative investors should stick to very short maturity debt categories like the liquid fund. Investors with a longer holding period and with an appetite to tolerate intermittent volatility could consider dynamic bond funds which can change the portfolio’s risk profile depending on evolving market situations.

We also suggest investors lower their return expectation from debt funds as the potential for capital gains will be limited going forward.

Source: Worldometer.info

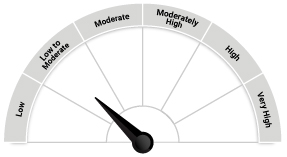

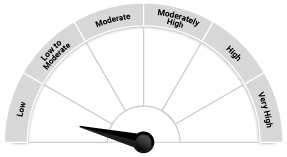

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on May 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More