Debt Monthly Outlook

Posted On Thursday, Nov 12, 2020

November 12, 2020

October was another positive month for the Indian bonds. Bond yields across the curve came down by 10-20 basis points. The 10 year benchmark government bond yield declined by 14 basis points from 6.02% at September end to 5.88% in October.

Short term money market yields also witnessed similar trend as longer maturity bonds. 3 months Treasury bill yield declined by 11 basis points during the month to close at 3.16%.

The bond rally was once again triggered by the RBI. The RBI, in its bi-monthly monetary policy, was reasonably benign on the future inflation outlook and ready to look through the recent spike in headline CPI inflation. They kept the door open for future rate cuts.

Going a step further the RBI announced to remain accommodative in the current year and also in the next year.

The RBI also announced various measures to support the bond market. They doubled the size of weekly OMO purchases to Rs. 200 billion. They also announced to conduct OMOs in State Development Loans (SDL) for the first time.

RBI’s measures are favorable for the bond markets. It seems that the RBI will continue to conduct OMO purchases of government bonds and SDLs on weekly basis to support the government’s borrowing program and keep bond yields low.

At current levels we see scope bond yields to go down in near term. However we do not expect a secular bull run in the bond market and believe that the best of bond market rally is now behind us. We also need to be watchful of the inflation and fiscal risks over medium term.

Given our above view on interest rates, in the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on tactical trading opportunities within a narrow range. Quantum Dynamic Bond Fund (QDBF) takes high interest risk from time to time, but avoids credit risks and invests only in Government Securities, treasury bills and top rated PSU bonds.

We always advise investors to have a longer time frame if they invest in bond funds and should also note that the bond fund returns are not like fixed deposit and can be highly volatile or even negative in a shorter time frame.

Quantum Liquid Fund (QLF) prioritizes safety and liquidity over returns and invests only in less than 91 day maturity instruments issued by Government Securities, treasury bills and top rated PSUs.

We advise debt fund Investors to choose Safety (over Credit) and Liquidity over Returns while investing in debt funds.

Data Source: Bloomberg, RBI

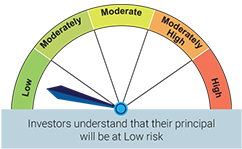

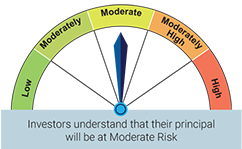

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More