Covid-19: Inflationary Or Deflationary?

Posted On Tuesday, Aug 04, 2020

Inflation or deflation? - The trillion dollar (pun intended) question facing the world today. Well, with a liquidity tsunami hitting the pandemic-disrupted global economy, the answer isn't straightforward.

Proponents of inflation cite the fact that the stimulus driven money supply is growing faster than the economy. Advocates of deflation point out to the weaker aggregate demand which will offset inflationary pressures.

So if you’re an investor concerned about how either of the scenarios will impact your money in the post-pandemic world, read on.

When central banks in advanced economies first rolled out quantitative easing (QE) measures in response to the 2008 global financial crisis, there was widespread fear about inflation. But these fears never came true.

Now this is leading many to conclude that the unprecedented money printing to counter the Covid-19 pandemic too will not lead to inflation.

Consider this before you make up your mind.

This time is different

The 2008 crisis was primarily a financial crisis that eventually spilled over to the real economy. By adopting an expansionary monetary policy then, the Fed was addressing the source of the crisis -– solvency woes in the financial system. Most of the liquidity created stayed trapped in the banking system and little trickled into the real economy to spur demand. As a result, it helped to support asset prices, but it did not cause a rise in consumer prices.

In Covid-19, by contrast, because of the containment measures like lockdowns and travel restrictions, the primary shock has been to the real economy with devastating consequences for businesses, workers, and the financial sector. Thus we are dealing with a real economy crisis, not a financial market one. This has led governments and central banks to roll out direct transfers and paycheck protection programs targeted at low income households and small businesses, in addition to the conventional monetary easing measures of rate cuts and bond buying. These entities tend to have a much higher velocity of money (the rate at which money is exchanged) than large institutions, which could be inflationary.

We are on shakier ground

Us national debt in 2008 was $10 trillion (Debt to GDP 67%) vs now $26 trillion (Debt to GDP 120%). These debt loads will not only impact the US economy's potential to grow but will continue to weaken the purchasing power of the world’s reserve currency - US dollar.

Easy money policy could last even longer

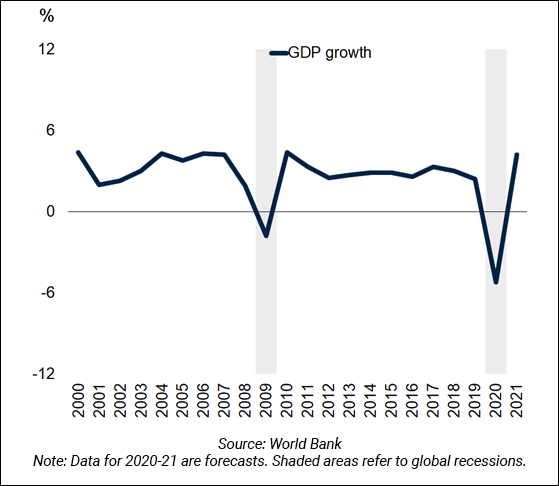

In spite of multiple rounds of QE since 2009, the world has not been able to return to the growth rates of the 2000s. According to the International Monetary Fund (IMF), the world economy is set to shrink by 4.9% in 2020 – the deepest slowdown since the Great Depression of the 1930s. Considering that Covid-19 is expected to cause greater damage to the economy than the GFC, these unprecedented policies are going to have to be sustained for even longer this time to spur economic growth and could thus eventually lead to inflation.

The current easing binge is not only more, but also faster

Consider this statistic. QE by Fed in response to the GFC of 2008 was $4.5 trillion over 6 years. QE to counter the economic damage of Covid-19 is upwards of $9 trillion over 3 months! The global measure of QE is already more than double that of the 2008 crisis! The Fed is not only purchasing Treasuries, but also agency mortgage-backed securities and, for the first time, corporate bond exchange-traded funds and junk bonds.

In addition, after announcing the largest emergency aid package in US history- $2.2 trillion or 9% of GDP since the pandemic broke out , the US congress is already considering a second stimulus relief package rumored to be of $3 trillion. The fact that 2020 is a presidential election year makes additional aid far more likely.

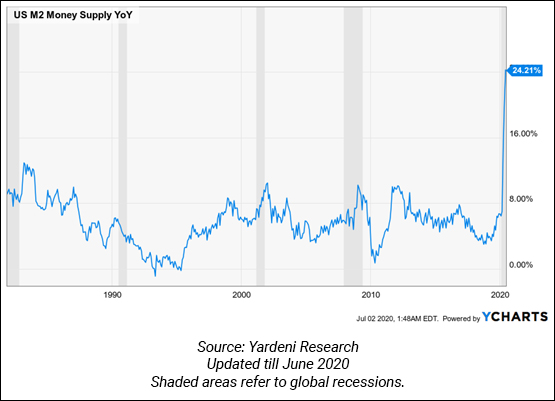

For context, M2 money supply in the US, a measure of the money actually out in the real world interacting with people and businesses (cash, checking, savings deposits, small certificates of deposit, and money-market funds) rose at a modest rate during the GFC, peaking at 10%. Today M2 is up 24% y-o-y as of June 2020. Money printing has just gone nuclear.

The Fed and the US government can’t pump this much money into the economy and not trigger inflation.

Deglobalization could be inflationary

Another consideration is that the geo-political effects of the Covid-19 crisis will see global trade being reshaped in ways that will make it more inflationary. For instance the US-China decoupling and the India-China border brawl will impact bilateral trade among these economies.

Prior to the pandemic, China was the world’s factory. Low labour cost in the country translated into lower end-product prices keeping inflation at bay. But that is now set to change.

Countries and companies are realizing that their global supply chains are a source of vulnerability. As a result, they will gradually try to bring manufacturing back to their local markets. Such a restructuring, therefore, could see inflation return.

In summary, deflation may be a concern for the foreseeable future since the pandemic has lowered aggregate demand. But inflation could eventually follow as demand rebounds without fully fixed supply chains and lots of liquidity splashing around. We will not be surprised if the world lands up in a stagflation i.e. low growth and high inflation.

Now unlike currencies, gold cannot be created or printed and is thus not susceptible to government or central bank repression. For this reason, gold has historically remained a relatively stable purchasing power while cash has gradually deteriorated. Thus it is prudent to allocate 10-15% of your investment portfolio to gold to ride out the upcoming high inflation and probably stagflationary economic scenario.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More