Bond Market Update & its impact on Fixed Income Funds

Posted On Saturday, Mar 21, 2020

Debt fund investors are once again alarmed by the shakeout in the corporate bond market particularly in the wake of recent incidents in the banking and telecom sectors. The corporate bond market was recovering at tepid pace from the fallout of IL&FS in Sep' 2018 and subsequent crisis in the NBFC space. As the market started stabilizing on the back of aggressive rate cuts and abundant liquidity infusion by the RBI and support from the government, the bond markets got hit from first the stress in the telecom sector, then the imposition of moratorium on Yes Bank and its impact on Perpetual Bonds and now with the growing risk-off sentiment emanating from the fears of COVID-19.

The health of Corporate India is anyways under pressure due to unprecedented slowdown in the broader economy. But the events over the last two weeks especially of the economic impact fears of COVID-19 is being witnessed in all segments of the bond market.

Foreign Investors have sold more than USD 5 billion of Government bonds in this month till date. This has resulted in a sharp spike in the yields of government bond across tenor but more pronounced in the shorter tenor segments. Short term returns of Gilt Funds reflect the impact of this sell-off.

On the back of this, yields of even good quality AAA rated PSU and Private Sector bonds have witnessed an even larger sell-off with yields of these bonds increasing by 100-150 bps (1-1.5%) across tenors. The fall in NAVs of Short Term Bond Funds, Dynamic Bond Fund in the last two weeks are testimony to this.

We have also seen a similar yield movement in yields of 1 month to 1 year money market instruments like Certificate of Deposits and Commercial Papers. Many Liquid funds, Ultra Short Duration and money market funds have posted negative returns, purely out of mark-to-market impact of these yield movement.

The Quantum Liquid Fund which invests only in Government Securities, Treasury Bills and AAA rated PSU instruments but follows full mark-to-market of all its instruments has also seen some temporary impact due to the market movements.

The announcement by the RBI to add liquidity into the banking system through Long Term Repo Operations(LTROs – RBI lending to banks at the Repo Rate for 1 yeatr and 3 year) and through Open Market Operations (OMOs) (buying government bonds) will soothe the frayed nerves and may see bond yields falling. There is also a growing expectation of the RBI to cut the Repo Rate by atleast 50 bps (0.5%) in its monetary policy meeting due on April 3rd.

Given the RBIs resolve as it mentioned today, to maintain financial stability and to ensure orderly functioning of the bond market, we expect money markets, government bonds and high quality corporate bond markets to stabilize in the coming days

March also being the fiscal year end and now with the added impact of COVID-19, money market rates have tightened despite abundant system liquidity. We expect the situation to remain tight till the fiscal year and improve going into the new year.

Given that liquidity conditions are likely to remain in surplus mode, returns from overnight and liquid funds and money market fund which do not take too much credit risks, although impacted currently, should normalize and returns should move in line with the Repo Rate.

But, we do not yet know how long this lockdown like situation will continue and what will be the economic impact of the same .

Thus investors, especially debt fund investors need to apply extra caution while choosing debt funds. We advise investors to prefer safety and liquidity over returns in this environment rather than trying to earn higher returns from liquid, money market and bond funds.

We once again like to reiterate that Quantum Liquid Fund (QLF) prioritizes safety and liquidity over returns and invests only in less than 91 day maturity instruments issued by Government Securities, treasury bills and top rated PSUs.

Quantum Dynamic Bond Fund (QDBF) takes higher interest risks, but does not take any credit risks and is invested only in Government Securities, treasury bills and top rated PSU bonds.

If you are still risk averse and do not wish to have the volatility and anxiety of market related instruments during this uncertain period, we would advise you to keep your surplus cash parked in a safe bank account.

Please also feel free to speak to your financial advisor or your relationship manager for any further queries and or advise.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

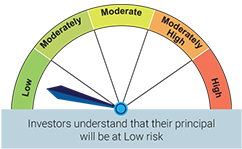

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  |

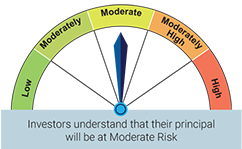

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More