10 Years of QDBF – Navigating Debt Markets with Consistency and Caution

Posted On Monday, May 26, 2025

This May, as the Quantum Dynamic Bond Fund (QDBF) completed 10 years on May 19, 2015, we’re not just celebrating a milestone—we’re celebrating a decade of trust, discipline, and resilience. It’s a moment to pause and reflect on a journey shaped by investors unwavering belief in our investment approach.

When we launched QDBF in 2015, our objective was simple, offer an investment solution that stays steady in an ever-shifting interest rate landscape. We aimed to build a fund that could manage market volatility while focusing on capital preservation and liquidity. By maintaining a sharp focus on credit quality and a research-driven process, we sought to earn your trust—and keep it. Over time, we’ve seen how patience, discipline, and a quality-first approach can effectively navigate investments through various market cycles.

Why Dynamic Bonds? And Why Government Bonds?

At its core, the Quantum Dynamic Bond Fund seeks to balance returns with risk, prioritizing credit quality through investments in Government Securities (G-Secs) and AAA-rated PSU Bonds for stability and minimizing the credit risk.

Focus on Credit Quality: The Investment Strategy of QDBF

Over the past decade, the economy has faced many uncertainties such as the global pandemic and demonetization, along with evolving central bank policies, geopolitical tensions, and trade concerns. Domestically, shifts such as the RBI's move of introducing “inflation targeting” in 2015, have reshaped our approach to assessing inflation, interest rates, and economic factors.

These evolving changes, including liquidity policy changes, have necessitated a forward-looking approach—typically over a 2–3-year horizon —while navigating fixed income investments.

Throughout this period, we remained steadfast in our commitment to avoiding excessive credit risk by investing in AAA-rated PSU bonds and Government Securities (G-Secs) to ensure that your investments are safeguarded.

Through the Tough Times: Navigating Crises Like IL&FS and DHFL in the last decade

In the constantly changing market landscape, credit quality is not just a factor—it's the cornerstone of our investment strategy. During times of economic stress or market disruptions, the ability to weather the storm lies in the quality of the assets held within the portfolio.

Over the past decade, we've observed instances where investments in lower-rated debt instruments, initially perceived as” high yield”, later encountered challenges.

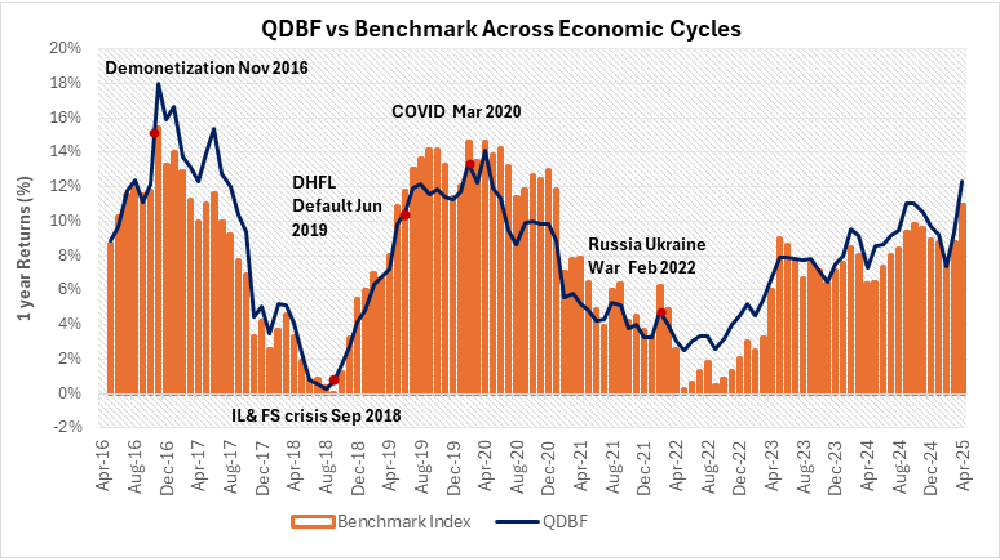

Chart I: Riding Market Cycles: QDBF Outperformed the Benchmark During Challenging Times

Data Source: Bloomberg, AMFI. Graphics: Quantum AMC Internal Research, Benchmark Index: CRISIL Dynamic Bond A-III Index. Data Period: Since Inception of QDBF in May 2015 till April 30, 2025. This is to be read in conjunction with the complete performance given at the end of the article. Past performance may or may not be sustained in the future.

To give you a sense of the tough times we’ve faced and how our disciplined approach has worked, let’s talk about a few notable examples:

- The IL&FS Crisis (2018):Infrastructure Leasing & Financial Services (IL & FS) defaulted on ₹900 billion of debt, which had a huge ripple effect across India’s debt markets. The failure was largely due to poor project execution, over-borrowing, and poor liquidity management. Many investors in high-risk bond funds were hit hard by this crisis.

- The DHFL Crisis (2019): Dewan Housing Finance Corporation Ltd. (DHFL) defaulted on over ₹1 trillion in liabilities due to mismanagement and risky lending. This caused significant turmoil, especially in the NBFC (Non-Banking Financial Company) sector.

These events reinforced the relevance of a conservative approach centered on creditworthiness and risk management.

How Maintaining Low Credit Risk Benefitted Us

By focusing on investments in AAA-rated PSU bonds and Government Securities (G-Secs), we were able to establish robust safeguards to enable the fund in navigating market volatility. This investment strategy helped us avoid the risks of credit defaults associated with higher-yield, lower-rated assets, preserving investor confidence even during market stress.

While some may see our conservative approach as cautious, it has proven beneficial for the fund’s long-term stability. By prioritizing high-quality assets, we've been able to deliver risk adjusted returns, protecting investors from sudden market shocks.

Chart II: Through the Noise: 3-Year Returns That Prove QDBF’s Resilience

Data Source: Bloomberg. Graphics: Quantum AMC Internal Research. Benchmark Index: CRISIL Dynamic Bond A-III Index. Data Period: Returns data between April 2018 and April 2025. This is to be read in conjunction with the complete performance given at the end of the article. Past performance may or may not be sustained in the future.

Our Weekly Discipline: The Secret Sauce to Stay on Course

Another reason for the fund’s success lies in the discipline we’ve maintained over the years. Every week, without fail, we conduct a comprehensive portfolio review. This is not just a routine check—it's a deliberate, rigorous process where we analyze:

- Macroeconomic data (inflation, GDP, fiscal policies)

- Global and domestic bond yields

- RBI’s policy signals and actions

- Credit spread movements (difference between government and corporate bonds)

- Liquidity trends (in primary and secondary markets)

- Market participation and demand

- Political and fiscal developments... and much more.

We don’t just react to market events; we anticipate them. Over time, we’ve refined our proprietary research, developed credit models, and enhanced our internal processes to ensure that we are actively managing risk and making decisions that are in your best interest.

Looking Back, Looking Ahead: The Value of Long-Term Perspective

As we mark this 10-year milestone, it’s clear that long-term thinking has been key to the Quantum Dynamic Bond Fund’s success. Short-term volatility, whether from interest rate changes, geopolitical issues, or unexpected inflationary pressures—often makes debt funds look unpredictable.

But if you zoom out and look at the fund’s performance over 3, 5, or 10 years, the picture is much clearer. Over time, we’ve seen the benefits of our disciplined approach to interest rate risk, credit quality, and capital preservation. This long-term perspective enables us to navigate market fluctuations with resilience and focus on what truly matters—your financial goals.

In Conclusion: A Strong Foundation for the Next Decade

As we enter the next decade, we reaffirm our focus on the principles that have shaped the Quantum Dynamic Bond Fund: a disciplined investment approach, an emphasis on quality, and adaptability within a defined risk framework. We’ve built a strong foundation, enabling the fund to adapt to changing market conditions, while never compromising on our core focus—credit quality.

We are truly grateful for your trust, and as we look forward to the next decade, we remain steadfast in our commitment to safeguarding your investments and pursuing consistent, long-term growth. We thank you for your continued trust and look forward to walking this journey together.

|

Ms. Sneha Pandey is managing the scheme since April 01, 2025

| Performance of the Scheme | as on April 30, 2025 | |||||

|---|---|---|---|---|---|---|

| Quantum Dynamic Bond Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (23rd Dec 2008) | 8.17% | 7.84% | 6.87% | 21,849 | 21,206 | 19,379 |

| 7 years | 7.92% | 8.01% | 7.37% | 17,070 | 17,165 | 16,464 |

| 5 years | 6.88% | 6.73% | 5.55% | 13,947 | 13,854 | 13,103 |

| 3 years | 8.74% | 7.76% | 8.57% | 12,863 | 12,519 | 12,803 |

| 1 year | 12.32% | 10.97% | 12.58% | 11,232 | 11,097 | 11,258 |

#CRISIL Dynamic Bond A-III Index, ##CRISIL 10 Year Gilt Index. Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Ms. Sneha Pandey manages 4 schemes of the Quantum Mutual Fund. Click here for other schemes managed by the Fund Managers.

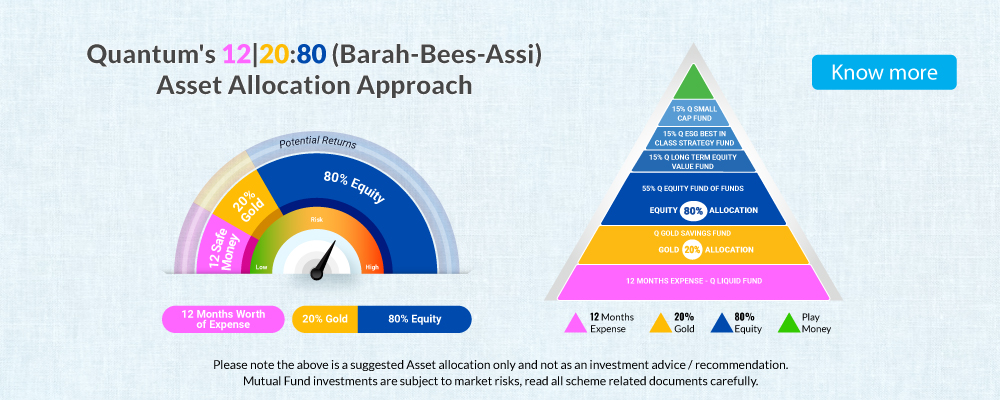

If you prefer a DIY (Do-It-Yourself) approach:

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-I Benchmark |

|---|---|---|---|

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Dynamic Bond A-III Index |

|  |  |

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More -

Debt Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Navigating 2026: India’s Bond Market in a Changing Global Landscape

Read More -

Debt Monthly for September 2025

Posted On Friday, Sep 05, 2025

August in the Indian bond market was nothing short of chaotic, with constant surprises and swings.

Read More