heading

About The Fund

The Quantum ESG Best In Class Strategy Fund invests in companies that are focused on conserving the environment, on positively impacting communities that they operate in, and conducting business ethically. These sustainable businesses are not only environmentally and socially responsible but also make great sense as investments as you look to build wealth over the long term.

5 Reasons to invest in the Quantum ESG Best In Class Strategy Fund

1. Offers a solution for investing in businesses where sustainable practices drive long term performance.

2. Invests after comprehensive research on Environmental, Social and Governance or ESG factors.

3. Provides exposure to good quality sustainable companies with low volatility and downside risk.

4. Well diversified portfolio that follows a disciplined investment process.

5. Follows risk and liquidity controls on investing.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

Funds Managed:

Qualification:

- BBA.LLB (Hons.)

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum ESG Best In Class Strategy Fund

(An Open-ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy)Tier I Benchmark : NIFTY100 ESG TRI

-

This product is suitable for investors who are seeking*

- Long term capital appreciation

- Invests in shares of companies following Environment, Social and Governance (ESG) theme assessed through a Best In Class Strategy

-

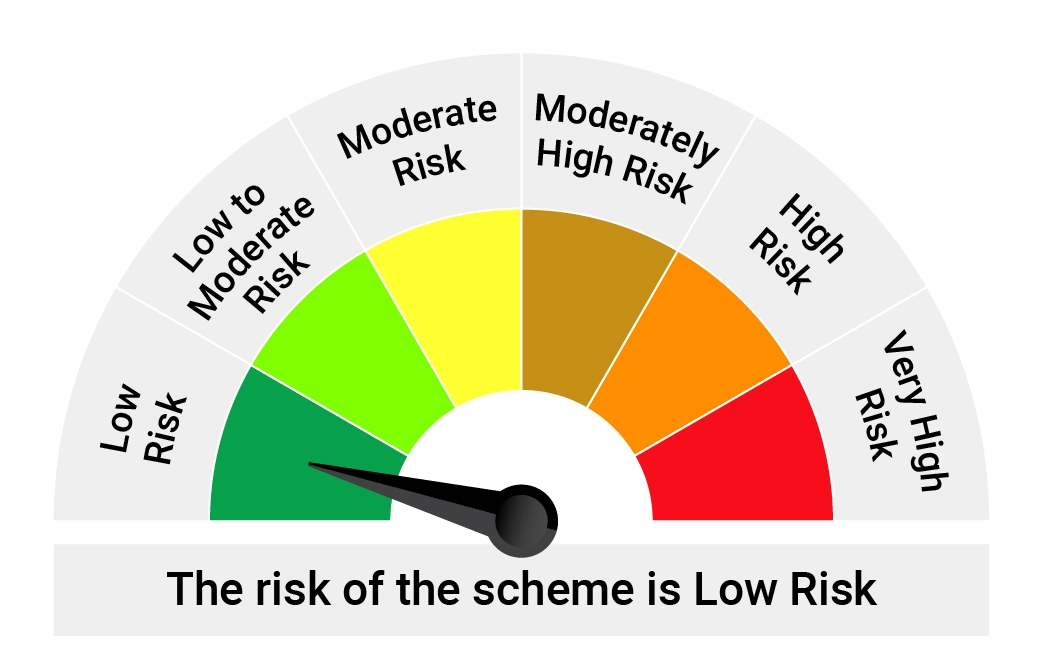

Risk-o-meter of Scheme

-

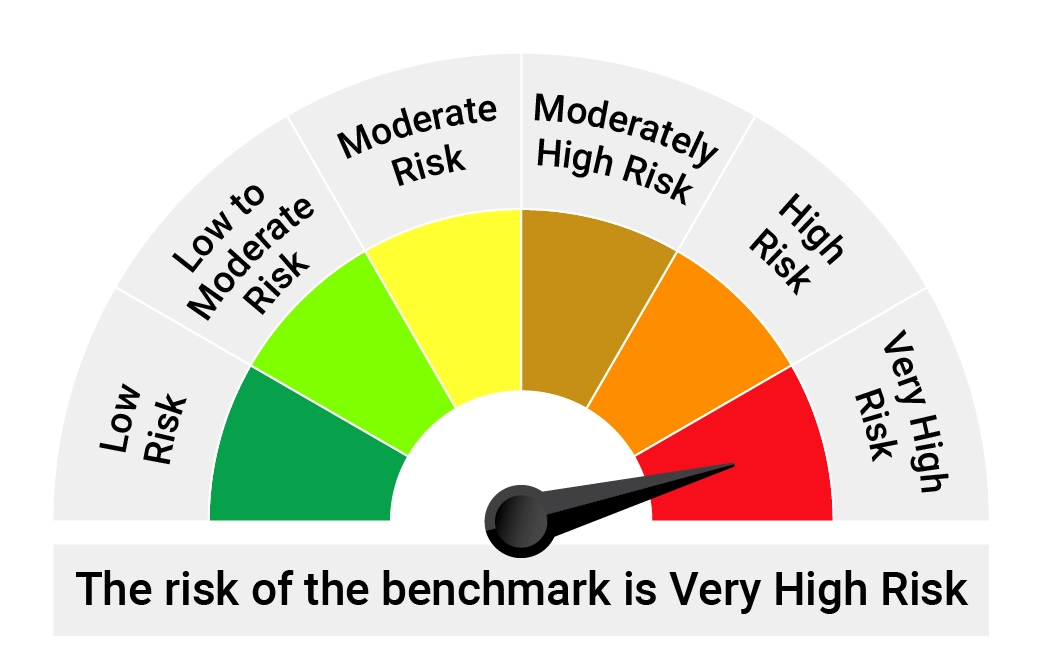

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.