Gold Demand in India Plummets 41% in Q1 2016

Posted On Wednesday, Jun 01, 2016

Global Gold demand reached 1,290 tonnes Q1 2016, a 21% increase year-on-year, making it the second largest quarter on record.

This was mainly backed by investment led buying as investors across the globe started getting jittery about the unconventional central bank policies. The negative interest rates introduced by central banks in Europe and Japan have led to a big backlash from investors who have sought to gold as a alternative currency as investors get nervous of the impact of such policies on their economy and currencies.

In the U.S., the inability of the Fed to increase interest rates accompanied by further dovish communiqué has provided enough evidence that recovery seems not too sustainable and reduces confidence in the U.S economy and the central bank’s ability to control things.

As a result, gold exchange traded funds (ETFs) demand across the globe exploded with to 364 tonnes. Moreover Central banks remained strong buyers, purchasing 109 tonnes in the quarter.

However in India, Gold demand was down 39 percent on a year-on-year basis to 116.5 tonnes during the quarter ended March 2016. Indian jewelry demand hit a seven-year low of 88.4 tons – a 41-percent year-on-year decline. Jewellers’ strike, a sharp rise in prices and expectations of a cut in duty hit demand in the first quarter. India’s jewellery market was virtually ground to a halt in March when jewellers reacted to government tax rises with widespread strikes.

Further, Gold imports by India slumped for the third straight month in a row in April. The country, which is also the world's second-largest consumer of the yellow metal, imported gold worth $1.24 billion, down 60.47 percent from $3.13 billion in April 2015.

In a country, which is supposedly a natural buyer of gold, suddenly seems to be losing appetite. This could be on account of reduced space towards discretionary spend as the economy tries to recover from lower growth and en effect of two years of back to back drought. The lower appetite is also reflected in the Indian Gold ETFs. On the contrary, the Indian Gold ETFs continue to witness outflows with more investors seen exiting the yellow metal. This could largely be on account of investors booking profits who would have bought at lower levels around the Rs.25000 / 10 grams mark and seeing good returns in a small span of time.

Whereas, there would be many who would have bought in earlier and seen value erode as prices fell and now that prices are finally recovering, they are using this as an opportunity to exit their positions. I fail to understand the behavior of these investors as held through the tough period while their investments would have been negative. And now that the prices are recovering, they are been fearful and are trying to exit. This is a typical behavior that we have seen from most investors where they hold on to their investments when it’s time to be fearful whereas they try to run out of the door when things start looking positive. Rather, it should be contrary.

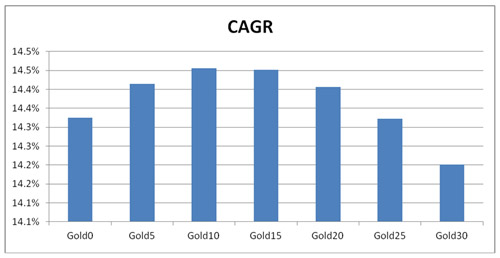

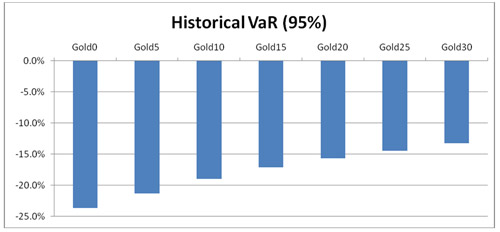

However, we strongly believe that one should always own a small allocation to gold at all times. The below given table and charts provide hard evidence that you need to own gold regardless of the outlook. As seen below, an allocation to gold has helped reduce risk significantly without impacting overall returns from the portfolio. The important point is such risk reduction enhancement for the portfolio has come without sacrificing the long term return potential.

The time period considered for the analysis has been long enough to generate a credible result. The time period considered has been from 1990 -2015 (yearly data) encompassing multiple economic cycles.

Table: Portfolio comparison – Risk and Return

| Portfolio | 100% Equity, 0% Gold | 95% Equity, 5% Gold | 90% Equity, 10% Gold | 85% Equity, 15% Gold | 80% Equity, 20% Gold | 75% Equity, 25% Gold | 70% Equity, 30% Gold |

| Returns (CAGR) | 14.3% | 14.4% | 14.5% | 14.5% | 14.4% | 14.3% | 14.2% |

| Risk (Standard Deviation) | 34.5% | 32.8% | 31.2% | 29.6% | 28.0% | 26.4% | 24.9% |

| Maximum Drawdown | 52.5% | 48.3% | 44.1% | 40.0% | 35.8% | 31.7% | 27.5% |

| Historical VaR (95%) | -23.7% | -21.3% | -18.9% | -17.1% | -15.7% | -14.4% | -13.2% |

| Historical Expected Shortfall (95%) | -38.5% | -35.1% | -31.6% | -28.7% | -26.0% | -23.4% | -20.8% |

| Annualized Sharpe Ratio (Rf=0%) | 0.42 | 0.44 | 0.46 | 0.49 | 0.51 | 0.54 | 0.57 |

For simplicity purpose, we consider only two asset classes, Equities and Gold. For equities we consider investment in Sensex (without dividends) and for Gold it would be Gold prices denominated in Indian Rupees (without any taxes, duties and levies). We compare different portfolios that are yearly rebalanced: One with 100% equity and the others with varying proportions of gold allocation like 5% Gold and 95% Equities, 10% Gold and 90% Equities, 15% Gold and 85% Equities... etc.

How much to allocate?

Generally speaking, the allocation should be somewhere between 10-20% of one’s portfolio. This is because beyond this point, the returns on the overall portfolio start diminishing and also the incremental risk reduction also starts showing a diminishing trend (refer charts given below). The 10-20% allocation to gold could be used as a thumb rule; however your financial advisor can help you identify your right allocation.

Past performance may or may not sustain in future. Source: Bloomberg, Quantum

Chart: Historical VAR ( Gold proportion in portfolio mentioned below)

*Value at risk (VaR) is a widely used risk measure of the risk of loss on a specific portfolio of financial assets.

Past performance may or may not sustain in future. Source: Bloomberg, Quantum

The hard data in the table and charts above is conclusive of the fact that an allocation to gold is indeed an excellent portfolio diversification tool even now. It has potential to reduce the risk in the portfolio without compromising the long term returns. Its important to reiterate that “No matter how dumb it may sound to many, it is important to have an allocation to gold”.

For all those who are still unconvinced, here’s our broad view on gold

Uncertainty over global central bank policies is deepening. Investors seemed to be concerned over eroding effectiveness or far reaching negative consequences of unconventional monetary experiments like quantitative easing programs and negative interest rate policies. Fundamentally, gold seems to be on a solid footing as central bankers have again hit the wall. Gold should benefit as central bankers attempt further measures through more newer, unconventional and untested approaches to revive growth.

Data Source: Bloomberg

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Looking Beyond the 10-Year Benchmark: Decoding India’s Bond Market Signals

Posted On Thursday, Feb 26, 2026

If you glance at India’s financial headlines today, the tone feels reassuring.

Read More -

From Storage to Circulation

Posted On Thursday, Feb 26, 2026

From Storage to Circulation: Can Total Return Swaps Transform India’s Corporate Bond Market?

Read More -

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More