Will Gold Look Bright in 2020

Posted On Monday, Feb 24, 2020

India is the second-largest consumer of gold globally with an annual demand of approximately 800-900 tonnes. By tradition and culture, in India, gold has always been looked at as eternal wealth and is symbolic of Goddess Lakshmi.

Besides, in the heart of millions of Indians, gold has always carried high emotional value, as it is passed down to generations and strengthens family bonds.

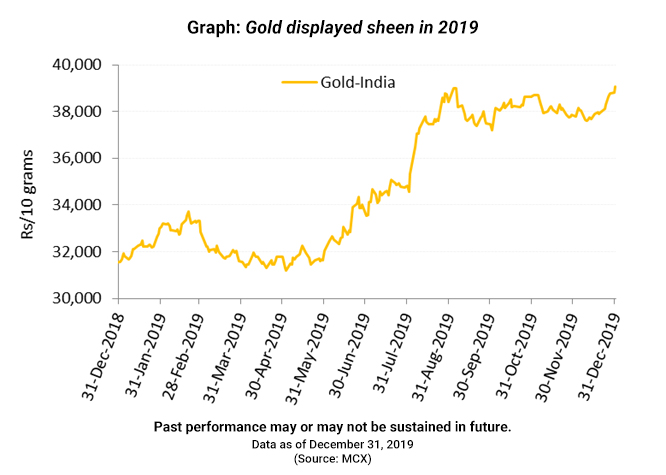

In the year 2019, gold clocked an absolute return of +24% in Indian rupee terms outperforming the returns clocked by Indian equities. Price per 10 gram of gold ended at Rs. 39,076 as of December 31, 2019.

The investment demand for gold also rose, with inflows reported by gold ETFs and folios.

Nevertheless, India’s gold imports fell to a 3-year low as elevated prices proved to be a deterrent. According to a government source speaking to the media, India’s gold imports amounted to 831 tonnes(t) in the year 2019, down from 944 tonnes a year ago. In the first half of 2019, India imported 564 tonnes of gold, while in the second half imports stood at 267 tonnes, government data showed.

In US dollar terms (on LBMA Gold AM fixing), the absolute return clocked by gold was +19%. The global uncertainty looming set the focus on the precious yellow metal.

| Region Name | Total AUM (bn) | Holdings (tonnes) | Flows (US$mn) | Flows (% AUM) |

|---|---|---|---|---|

| North America | 70.5 | 1,440.7 | 10,124.8 | 14.4% |

| Europe | 64.7 | 1,322.1 | 8,800.0 | 13.6% |

| Asia | 3.9 | 79.4 | -11.9 | -0.3% |

| Other | 1.9 | 39.0 | 311.2 | 16.3% |

| Total | 141.1 | 2,811.2 | 19,244.1 | 13.6% |

(Source: World Gold Council)

In many parts of the world as well, gold ETFs are witnessing positive participation. In the year 2019, the WGC data shows that global gold-backed ETF holdings grew 14%, reaching an all-time high of ~2,900 tonnes (t) on the heels of uncertainty surrounding most parts of the world.

Will the spotlights continue to be on gold in 2020?

Well, the following factors are expected to prove supportive for gold in the year 2020:

• Trade war induced economic slowdown in many parts of the world and fears of a recession. Trade tensions between the US and China will be a lingering headwind to global economic growth in 2020 regardless of any positive near-term developments as core issues haven’t been adequately addressed in the Phase 1 deal. These tensions can be expected to spill over to the rest of the global economy in addition to slowing down the two giants

• Easy monetary policy of lowering interest rates and expanding balance sheets has been adopted by central banks of countries that make up 70 percent of global GDP

• A vulnerable rupee against the USD since the rupee is currently overvalued by ~11% in real effective terms compared to the long term average

• A record-high global debt-to-GDP of US$ 250.9 trillion in the first half of the year 2019 (mainly led by the US and China) according to the Institute of International Finance (IIF) report released in November 2019. And the IIF estimates it to exceed US$ 255 trillion by the end of 2019

• The US President, Donald Trump has started a new trade war with Brazil and Argentina (imposing high tariffs on steel and aluminium imports attributing the move to “massive devaluation” of their currencies)

• US President, Donald Trump is facing impeachment proceedings at home, and since 2020 is an election year, it adds more uncertainty

Increased stock market volatility as a low rate environment is encouraging financial-risk taking in search of yield

• Heightened geopolitical risk such as unrest in Hong Kong, tensions in the Middle-East, outbreak of the corona virus in China

• Upside risk to food prices and international oil

• And the potential upside risk to retail inflation

The World Gold Council (WGC) points that in an environment where a whopping 90% of developed market sovereign debt is trading with negative real rates and monetary policy easing is followed; the spotlights would continue to be on gold as opportunity cost of holding the metal reduces.

Even the IMF Global Financial Stability report highlights an increase in the level of risk among multiple global metrics and therefore the importance of owning gold in one's portfolio.

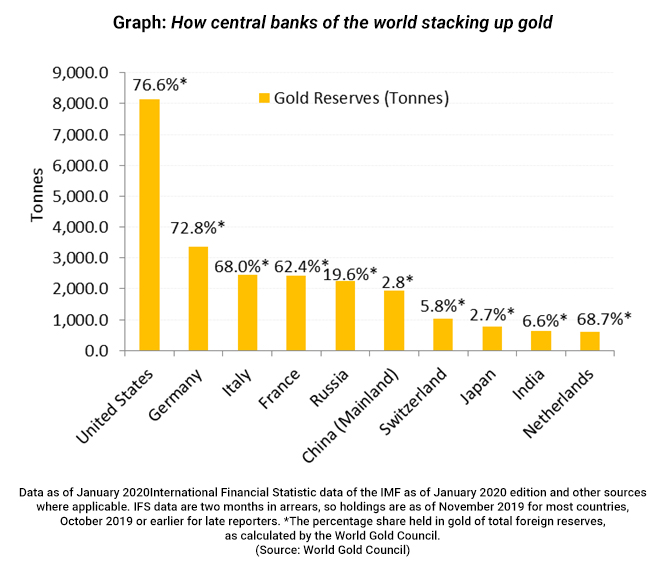

Gold plays an important role in the central bank’s reserve management. The WGC data reveals that central banks across the world aren’t taking any chance with the uncertainty looming. They are maintaining healthy gold reserves amidst times when global economic and geopolitical uncertainty has heightened.

Currently, India holds 6.6% (or 626 tonnes) of its overall foreign exchange reserves as gold. In India, the falling rupee against the US dollar, slowdown blues, sluggish consumer demand, CPI inflation ticking up, the economic growth rate deteriorating, the country entering a phase of stagflation, upward pressure on the trade deficit, and the possibility of fiscal deficit getting breached; is encouraging the RBI to add more gold to their reserves.

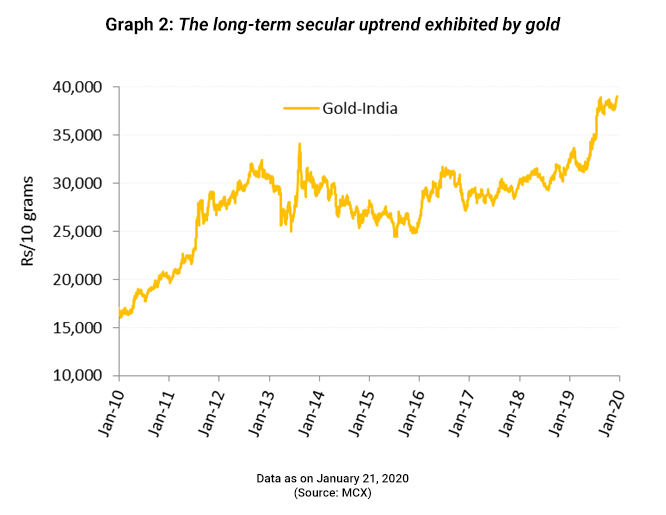

The long-term secular uptrend exhibited by gold is something that invites attention and highlights the importance of owning gold in the portfolio with a longer investment horizon.

So, buy gold strategically and be a smart investor. Gold as an asset class has a negative correlation with other assets and usually helps to protect wealth in times of geopolitical tension, depressed global economic growth, heightened volatility in financial markets and when the future looks uncertain.

The precious yellow metal as an asset class is an effective portfolio diversifier and serves as a store of value, a shield against inflation, and a lender of last resort during economic uncertainties/crisis.

That’s why allocate a small portion --- around 10-15% --- of your entire investment portfolio to gold with a long-term investment horizon. This would serve as a sensible and smart strategy. Gold Exchange Traded Funds (ETFs) and/or gold savings funds are smart ways of investing in gold.

Happy Investing!

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund ETF An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • nvestments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Debt Monthly for March 2026

Posted On Sunday, Mar 01, 2026

As FY26 draws to a close, India’s bond markets sit at the crossroads of macro stability

Read More -

Gold Monthly for March 2026

Posted On Sunday, Mar 01, 2026

Gold entered February 2026 consolidating around $4,800, after a steep fall from its late-January peak of $5,598

Read More -

Looking Beyond the 10-Year Benchmark: Decoding India’s Bond Market Signals

Posted On Thursday, Feb 26, 2026

If you glance at India’s financial headlines today, the tone feels reassuring.

Read More