Why Stay Invested Amidst the COVID-19 Pandemic and Beyond

Posted On Monday, May 11, 2020

The Coronavirus or COVID-19 continues to overpower every part of the globe. Confirmed cases are increasing by the day and no evident signs of containment yet. With lockdowns, travel bans, and supply chain issues, lives and livelihood have been disrupted. The economy has crippled, and many sectors, industries, businesses -- big or small – are frazzled and so are investors.

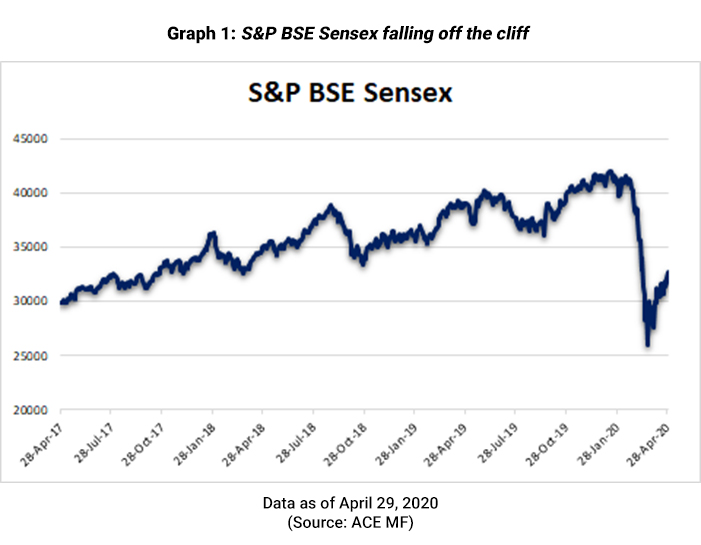

As depicted by the graph above the Indian equity market has fallen off the cliff, plunged -20.8% since the all-time of the S&P BSE Sensex (42,273.87 points made on January 20, 2020) and volatility has intensified.

Investors now are virtually on a rollercoaster – full of upturns and downturns. It could be a shrieking experience for equity investors with numerous headwinds in play. The COVID-19 pandemic may be followed with a financial crisis and the risk of a global recession too cannot be ruled out.

The credit risk has already begun to amplify, and going forward the chances of downgrades and defaults cannot be dismissed. Companies may approach the Courts to prevent default, but the capital market has abhorred this by expressing it is not the best practice.

To provide some leeway to value debt securities in light of the hardships caused by COVID-19 lockdown (and/or as an afterthought to the moratorium permitted by RBI), the capital market regulator has eased valuation norms for debt securities -- allowing rating agencies to go a bit easy on the definition of ‘default’ provided the delay in payment of interest/principal, has solely arisen due to the COVID-19 lockdown.

That said, it does not make investing in debt mutual funds very safe – particularly if the debt papers held are those of private issuers. This is because the chance of downgrade cannot be ruled out even for top-rated issuers and there have been many instances in the past where even AAA and equivalent rated papers have been downgraded by rating agencies during challenging times.

So, the wealth creation journey indubitably does not look very easy and linear in 2020. Having said, there appears a silver lining to the dark depressive clouds, and wealth creation opportunity does exist amidst adverse times.

Speaking of equities, valuation-wise the Indian equity market is looking attractive across market capitalisation. The trailing 12-month P/E of the S&P BSE Sensex and the S&P BSE large-cap index is below 20x. Likewise, the S&P BSE Mid-cap and S&P BSE Small-cap Indices are attractively placed valuation-wise -- much lower than the levels recorded in 2017 and 2018. These levels offer a relatively comfortable margin of safety.

Having said that it is important to be mindful that a further correction cannot be ruled out and the bottom is unknown. But then paying heed to the famous quote, “Be fearful when others are greedy and greedy when others are fearful,” by the legendary investor Mr Warren Buffet may reap a sweet fruit if thoughtful investments are done.

Do not give in to the short term volatility and look beyond the fear of bears running loose. Keep investing; do not apply brakes on the journey of wealth creation. In the current situation, there exist good value-buying opportunity with a decent margin of safety. But ensure investments are done in congruence with your risk profile, investment objectives, financial goals and time in hand to achieve the envisioned goals.

Also, here are five things to do:

1) Switch off from the noise and panic:

One observation we’ve seen is when the market is euphoric or under gloom, investors tend to give in to their emotions because the psyche overpowers rationality. And this is when most often things start going wrong for their investment portfolio.

In behavioural finance, ‘emotion’ is one of the fundamental aspects that deeply influence investors’ investment decisions. The way an individual deals with emotions -- anxiety, stress, fear, greed, biases, -- also following the herd, shapes up his/her investment success or failure.

So, stay away from the noise and panic. Investing is not about beating the market or anybody else, it is about building wealth with common sense, logical thinking, patience, perseverance, mental balance, emotional intelligence, and performing under stress

Therefore, learn to channelize the emotional storm and find balance. A well-trained mind is set to achieve a lot more than a fickle, short-sighted, and cynical mind. Shut out all the external noise of pessimism and free advice from friends/ family/ neighbours because investing is an individualistic exercise.

2) Stay focused on achieving your financial goals

Remain focussed on the end goal of wealth accumulation and accomplishing financial goals using a financial plan. It is like following a road map that will prevent you from going off track. In this entire exercise of capital preservation, there is no one-size-fits-all approach. Your financial plan is unique and customised to suit your needs and wants.

Hence, stay focussed on your financial goals being cognisant of your risk profile, investment objective, and the time in hand to achieve the envisioned financial goals. Be thoughtful and refrain from investing in an ad hoc manner or calling quits.

3) Review asset allocation

Asset allocation, as you may know, is the cornerstone of investing. It refers to deploying the investible surplus into various asset classes – such as equity, debt, gold, and real estate. It is akin to putting eggs in different baskets for safety reasons.

While different assets have different moods based on the market fluctuations, a proper allocation across asset class and investment style may protect you from significant ups and downs of any single asset class and scheme in your portfolio. Every asset class has a risk-return trait suitable for a certain level of personal risk appetite, investment objectives, financial goals, and the time horizon to achieve them.

Moreover, all asset classes will not necessarily move in the same direction (up or down) always - over the long-term; some may even move in the opposite direction as what we have seen in the recent past (in the case of equities and gold).

An intelligently crafted asset allocation with the help of a SEBI-registered investment advisor or an investment counsellor will serve as an investment strategy in itself. This way you could balance risk-reward to create a robust portfolio that suits you best for your long term financial and physical wellbeing.

Amidst the COVID-19 pandemic, the fixed income instruments would shield your portfolio, address short-term liquidity needs and serve effective to build an emergency fund for they provide secure and steady returns.

Likewise, consider allocating some portion of the total investment portfolio to gold. The precious yellow metal commands a store of value, i.e. it is looked up to a lender of last resort during economic uncertainties and displayed its trait of being an effective portfolio diversifier, a hedge over the years. On a year-to-date basis, gold has gained +5.0% whereas about +30.0% in the last one year.

4) Ensure the optimal diversification within each asset class

Without a doubt, losses are painful. But with a prudently charted asset allocation and diversification of the portfolio – which are the basic tenet of investing – the risk can be mitigated and optimal returns can be clocked.

Hence, once the asset allocation is set right, care should also be taken to ensure that within every asset class as well, the portfolio is optimally diversified.

Amidst challenging times such as we are currently encountering, diversifying the portfolio across geographical regions and countries may reduce the risk and improve the potential to clock optimal returns. But in an attempt to diversify the portfolio, do not to over-diversify the investment portfolio as it often proves counterproductive: makes the portfolio overcrowded and increases the burden of managing it. Remember, "Too much of anything is good for nothing!".

5) Comprehensive Portfolio Review and Rebalancing

The performance of your overall investment portfolio weighs on the investment avenues held. In times when the returns are inconsistent over a long period of time, for equity and debt investments carry out a comprehensive portfolio review and rebalance the portfolio.

Get the professional help of a SEBI-registered investment advisor or investment counsellor to review your portfolio comprehensively. This will help you in the following ways:

? Reset asset allocation? Align the investments as per your risk profile, investment objective, the envisioned financial goals, and the time in hand to achieve those goals

? Weed out underperforming and unsuitable investment avenues

? Replace and restructure your investments astutely with deserving and suitable avenues

? And ensure that you are on track to accomplish the envisioned financial goals

A comprehensive portfolio review will keep the risk of a deadly contagion pathogen in check from spreading and detrimentally impacting your portfolio. Remember, an ounce of prevention is better than a pound of cure.

That being said, it is equally important to evaluate if the fundamentals of your investments have changed, give sufficient time for your investments to grow, and not fan out each and every investment you have made.

Approach to Investing:

Going by the WHO’s chief’s statement, the COVID-19 pandemic will be with us for long. This will have an impact on global trade (with travel bans imposed), bottlenecks in doing businesses (due to supply chain disruptions), corporate earnings, the global economy, and global growth prospects.

In such times volatility is likely to get intensified. To mitigate the volatility, making staggered lump sum investments and SIP-ping into mutual funds would be wise approach as the inherent rupee-cost averaging feature of SIPs (Systematic Investment Plans) will come to advantage in the endeavour to compound hard-earned money. So, do not commit the mistake of stopping or discontinuing SIPs.

A similar crash was witnessed during the global financial crisis of 2008. The equity market grew since then to reward long term investors handsomely for their patience. Therefore, you must hold on to your investment during this difficult phase.

According to the IMF, next year, i.e. in 2021, India is poised to see strong GDP growth of 7.4%. Having said that, much will depend on the longevity of this pandemic, its effect on economic activity, and the related stress in the financial and commodity market.

In the current scenario, it would be wise to diversify across market capitalisation while investing in equity-oriented mutual funds via a multi-cap fund, while holding some proportion of your equity allocation in a large-cap fund, mid-cap fund, as well as a value style fund. Ensure you have a high-risk appetite, investment time of at least 7-8 years, and selecting the best schemes.

Likewise with credit risk getting amplified while approaching debt & money market mutual funds it would make sense to have exposure to a pure Liquid Fund (that does not take exposure to Commercial Papers issued by private entities) and be exposed to the short-end of the maturity curve.

And do not forget to allocate 10-15% of the entire investment portfolio to gold through a Gold ETF and hold it with a long-term investment horizon. The precious yellow metal would display its lustre during uncertain times.

Happy Investing!

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More