Why it is imperative to have a gold allocation in 2020

Posted On Thursday, Mar 12, 2020

In an environment where financial markets are taking on the chin, gold stands tall and has helped protect value. However, after smart gains, the rally has paused a bit as the external financial environment deteriorates due to the coronavirus pandemic. If you’ve been wondering why gold has recently moved lower when it typically shines in uncertain times like these - risk assets are being shunned and equity markets are plummeting, you need to read this before you worry. Or if you’re a hands-on investor tracking global developments and wondering if it’s a good time to enter gold now, you need to keep reading too.

First, let’s understand why gold has been down. Gold is the strongest performing major asset class this year - up over +8% in INR terms vs Sensex TRI and Nifty TRI which are down ~-7% and ~-8% YTD. This may have led to some profit taking.

Also, the carnage on Wall Street (stock markets globally) could have triggered margin calls, requiring investors to raise cash by liquidating gold. A similar trend was seen in 2008 when a sharp fall in risk assets like equities triggered margin calls and gold was sold by market participants to fund their margin requirements. When there is a sharp fall in asset markets, you can only sell what is “liquid” and “profitable” and hence gold met a temporary sell off this time too. But as we have seen before, with the crisis aggravating, demand for gold is expected to dominate any selling pressures, pulling prices higher.

Lastly, sentiment in the COMEX futures market via net longs was extremely bullish and at all-time highs of 1209 tons. Extreme bullish or bearish positioning can sometimes lead to a quick short term reversal in price, which is what probably led to downward pressure on gold prices. However, given the other factors at play, the correction is expected to be temporary. Next, let us assure you that gold’s fundamentals are still intact and factors supportive of gold are overwhelmingly strong. This will only get stronger if the financial conditions further deteriorate.

Starting with the fundamentals.

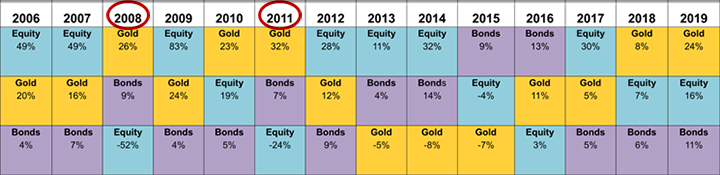

Typically, gold has an inverse relationship with paper assets like stocks and currencies and shines the brightest during extreme economic conditions, thanks to its safe haven appeal. That gives it tremendous diversification value. It has historically proven to be store of wealth in times of geopolitical or financial distress - for example during black swan events like the Global Financial Crisis in 2008-09 and Sovereign Debt Crisis in 2011. The Covid-19 pandemic is slowly shaping up to be one such event and holding gold in your investment portfolio is a wise diversify away the potential downside risks.

The chart ranks the best to worst performing indexes per calendar year from top to bottom

Past performance may or may not be sustained in future.

Indices Used: S&P BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

Moving on to the factors.

In the near to medium term:

The anxiety surrounding the coronavirus outbreak has intensified this month as the number of cases and deaths increase. The spread of the illness outside of Chinese borders to 65 countries including Europe and the Middle East raises the risk further and is threatening to majorly disrupt the already fragile global economic recovery. Markets will remain anxious till the rate of infection does not abate and incrementally continue to punish risk assets to reflect the underlying economic reality. To add to global economic woes, a brutal crude oil price war too has begun, which could have a temporary but significant impact.

And as the world economy battles with this uncertainty and a risk-off sentiment prevails, global investment demand for gold is expected to be robust. Not surprisingly, net inflows in gold ETFs in India totaled Rs 1483 crores in February taking up AUM under gold ETFs to Rs 7926 crores, up 67% from a year earlier. Similarly, global market volatility drove global gold ETF assets to new all-time highs this month, a trend that is expected to continue. What does this move mean for gold investors? It possibly indicates the beginning of increased demand for store of value like “Gold” and further pressure to push gold prices higher.

In the medium to long term:

Even if the coronavirus outbreak is quickly contained and the economic damage turns out to be short-lived, medium- and long-term macroeconomic trends that have been in place before the coronavirus outbreak, are likely to remain intact. With more and more government bonds trading with negative yields and major central banks expected to remain accommodative throughout 2020 to counter the effects of a slowdown further magnified by the virus outbreak, gold is likely to continue benefitting. Equities on the other hand are expected to remain volatile as they react to conflicting forces of central bank injected cheap liquidity and weak economic fundamentals. Similarly, underlying currents of trade wars and other geo-political tensions that have calmed for now, but threaten global growth, will also reemerge.

Thus, given the short term and long term macroeconomic picture, we believe the gold market is going to outperform in 2020, though there will be plenty of volatility along the way. Gold will thus be a useful portfolio diversification tool and augmenting one’s gold holdings would be both risk-reducing and return-enhancing. We suggest an allocation of between 10-15% of one’s portfolio. Investors could use the recent correction as an opportunity to add more gold to their portfolio And if your portfolio is already adequately diversified into gold, stay put.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More