Why India Is the Market to Watch

Posted On Wednesday, Apr 30, 2025

The global economic landscape this year so far has been shaped by a mix of powerful forces that are shifting bond markets. Key drivers include changing inflation trends, diverging central bank policies, and the resurgence of trade tensions, particularly the lasting impact of U.S. tariffs from the Trump era.

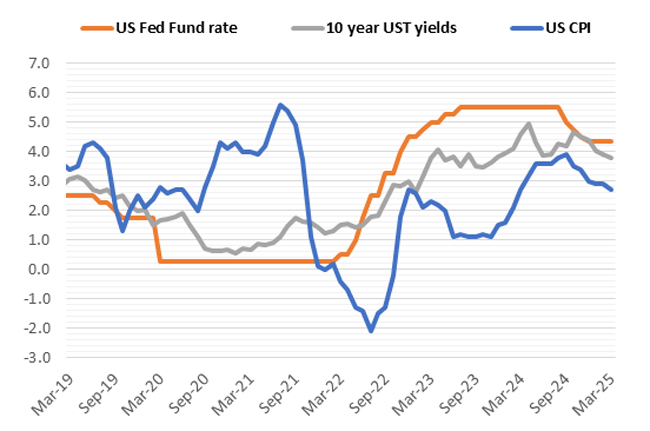

The central banks across the world are grappling with different inflationary realities and economic conditions. In the United States, inflation has eased from its peak but remains above historical norms, hovering around 3%. In response, the Federal Reserve has paused its rate hikes, signalling caution—it remains unwilling to cut rates without more convincing signs of disinflation. This strategy aligns with the Fed’s dual mandate: controlling inflation while maintaining full employment and carefully navigating the fine line between overly tightening and being too lax.

Chart – I: Fed Stays Cautious: Balancing Inflation with Growth

Source: Bloomberg. Data up to March 31, 2025

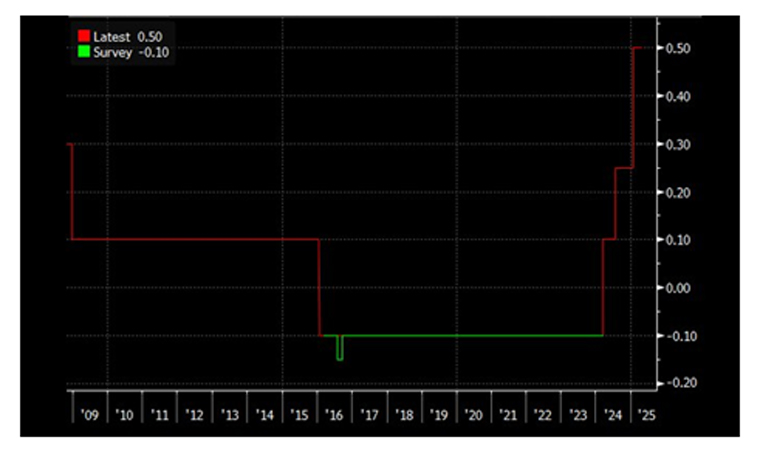

In stark contrast, the Bank of Japan (BOJ) maintains a relatively tight monetary stance, having raised its policy rate to 0.5% after years of near-zero rates. Domestic inflation is gaining momentum, with rising food prices pushing core inflation to a two-year high in April 2025. Given these pressures, the BOJ is focused on supporting Japan's fragile recovery, leaving very little room for a dovish policy outlook.

Chart – II: BOJ Signals Rate Hikes Ahead — But Only if Growth and Inflation Stay on Course

Source: Bloomberg. Data on Interest Rates in Japan. Data for the period FY 2009 to April 27, 2025

Amid this backdrop of policy divergence, India stands out with its stable macroeconomic environment, effectively balancing inflation control with steady growth.

India’s bond market is currently sitting at the intersection of three major macroeconomic events:

- The RBI’s pivot to an “accommodative” stance, signalling further support for growth.

- The pause and/or potential easing of Trump-era tariffs, reducing global trade tensions.

- Geopolitical tensions between India and Pakistan.

RBI’s Policy Pivot: Growth Takes Centre Stage: The RBI recently cut policy rates by another 25 basis points and shifted its stance to “accommodative,” signalling a focus on supporting growth amid rising global uncertainties. Alongside this move, it lowered its GDP growth forecast and indicated that inflation is expected to stay below target for now.

The central bank’s proactive measures have also created a liquidity surplus, with the RBI reaffirming its commitment to ensuring adequate liquidity for smooth transmission of rate cuts into market interest rates.

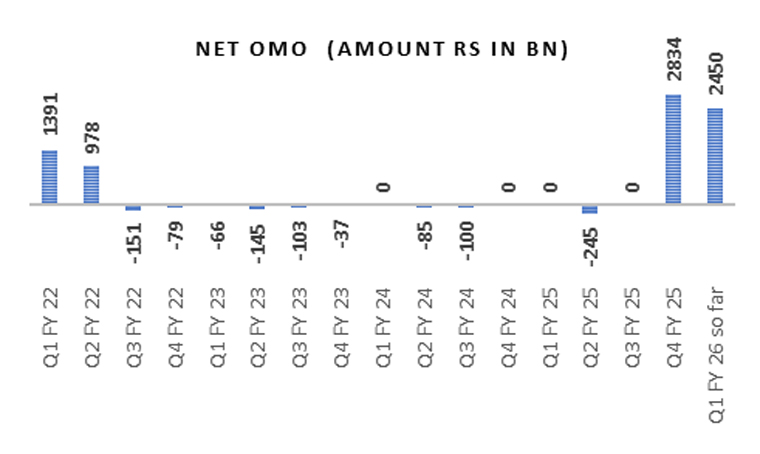

Chart – III: RBI Ramps Up Liquidity Support with OMO Purchase

Source: RBI. Data as on April 27, 2025

The RBI’s announcement of a ₹1.25 trillion Open Market Operation (OMO) purchase calendar for May 2025 marks a significant and unprecedented step in its liquidity management strategy. This move will bring total OMO purchases in calendar year 2025 so far to ₹5.3 trillion which we believe is at a slightly aggressive pace considering it took six quarters to reach ₹5 trillion in OMO purchases during the COVID-19 period.

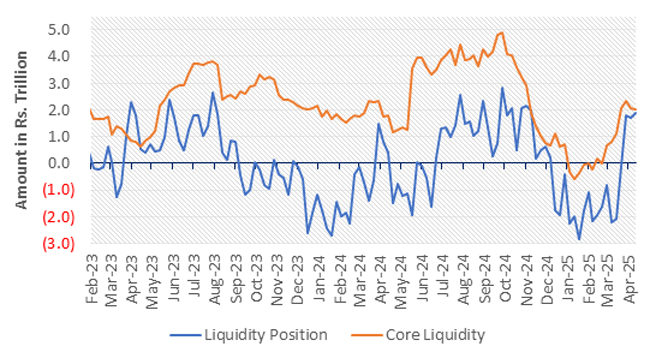

Chart –IV: Core Liquidity moving in the surplus territory

Source: RBI. Data up to week ended April 18, 2025

Despite these sizable operations, durable liquidity remains around ₹2 trillion, (less than 1% of Net Demand and Time Liabilities (NDTL)). However, with the upcoming OMOs and the anticipated RBI dividend transfer to the government, durable liquidity could potentially rise to approximately ₹4.8 trillion. This estimate, however, does not factor in the impact of any maturing short-dollar forward positions held by the RBI, which could influence overall liquidity conditions.

This suggests that the RBI aims to ensure banks have enough funds to maintain credit flow (supply side) while ensuring recent rate cuts translate into lower borrowing costs (demand side). Essentially, the RBI is leveraging liquidity not only for market stability but also to drive credit growth and support its broader easing strategy in a challenging global environment.

The bond market, especially the yield curve, is where the effects of all these moves are most evident. The yield curve has shifted downward, primarily due to the RBI's OMO purchases, which have been concentrated at the shorter end of the curve.

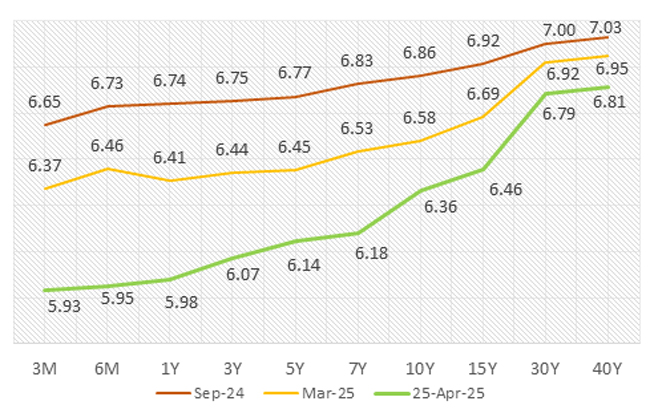

Chart –V: India Yield Curve has steeped

Source: Bloomberg. Data up to week ended April 25, 2025

Despite headwinds like heatwaves, a softening services sector, and potential tariff impacts, the economy is likely to find support from lower crude oil prices, a normal monsoon, strong Rabi crop prospects, and easing inflation.

Tariff Tensions Ease - A New Chapter in Global Trade: The temporary pause in the new U.S. tariffs, coupled with signals of a possible easing stance by the U.S. Fed and even talk of reduced tariffs on Chinese imports, gives India more policy headroom.

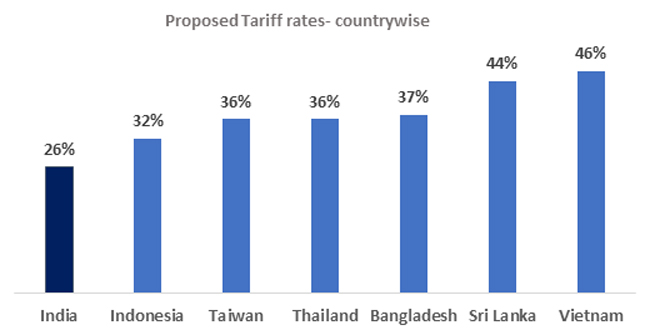

India is emerging as a relative winner in the shifting global trade environment, particularly amid the U.S.’s renewed tariff strategy. With a reciprocal tariff rate of just 26%, India enjoys a clear competitive edge over several major exporting nations. This lower tariff burden improves India’s export competitiveness—especially for U.S.bound goods—and may position it as a favourable alternative in global supply chains.

Chart –VI: India's Competitive Edge in Global Exports amid Tariffs

Source: Bloomberg. Data up to week ended April 25, 2025

But beyond tariffs, a broader set of macroeconomic and policy factors are reinforcing India's resilience and attractiveness

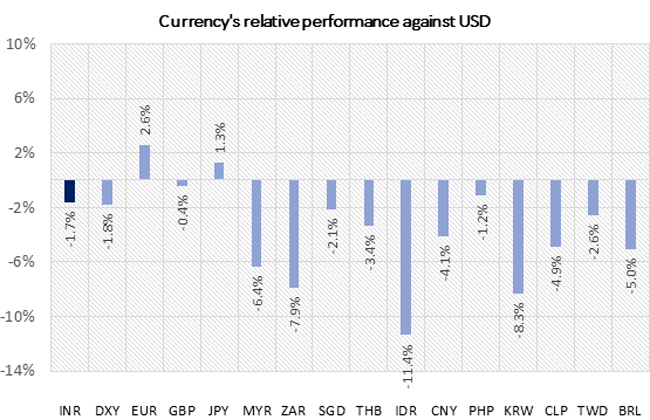

- Relatively Stable Rupee: The Indian Rupee (INR) has depreciated at a significantly lower rate compared to many other currencies against the US Dollar (USD). While most global currencies have faced substantial declines due to the stronger US Dollar, driven by persistent interest rate hikes and global economic uncertainty, the INR has shown resilience. Several factors contribute to this relative stability. The Reserve Bank of India (RBI) has actively managed the rupee through strategic interventions in the foreign exchange markets. The country’s current account deficit has also remained manageable, supported by robust services exports and a reduction in non-essential imports. These factors, coupled with India’s relatively stable economic growth outlook, have allowed the INR to withstand global currency volatility much better than other emerging and developed market currencies.

Chart – VII: The INR weakened less than other major currencies as the dollar strengthened.

Source: Bloomberg. Data up to April 22, 2025. Relative Currency performance against USD for the period September 30, 2024 - April 22, 2025

- Policy Support: Coordinated fiscal and monetary measures—like tax cuts, rate reductions, and liquidity injections—are fuelling investment and credit growth.

- Domestic Recovery: FY26 outlook shows strength in both consumption and capex, providing a stable base amid global uncertainty.

- China+1 Advantage: Lower tariffs than China open doors for India in sectors like Solar, Pharma, and the Electronics Manufacturing Services (EMS) as supply chains diversify.

- Stronger U.S. Ties: India’s stable diplomatic and trade relationship with the U.S. increases room for negotiation on tariffs.

As global investors look beyond the U.S., India’s strong macro fundamentals and stable rupee could attract more capital. This also gives the RBI more room to manage rates, while shifting trade dynamics which may open new doors for exports and investment.

OUTLOOK:

Throughout CY 2024, we maintained a positive outlook on long-term government bonds, supported by favourable demand-supply dynamics and a broader environment conducive to a bond market rally.

The inclusion of government bonds in JP Morgan indices resulted in an influx of over USD 20 billion in FPI flows. Fiscal consolidation efforts have successfully reduced the deficit from 5.4% to 4.4% of GDP, while the RBI's OMO purchases have effectively addressed the core liquidity deficit.

However, we see a more data-dependent landscape with uncertainty in the near term, influenced by:

- The upcoming rate cut cycle may be mild if growth recovers and external risks like tariffs and currency swings remain contained. But if these pressures slow down the economy, larger rate cuts could be needed.

- The extent of rate cuts remains uncertain due to unpredictable trade policies, changing inflation-growth trends, and rising geopolitical tensions between India and Pakistan.

- At the same time, the RBI may slow down its OMO purchases later in the year, while the government shifts focus from reducing the fiscal deficit to managing the debt-to-GDP ratio.

- Softening inflation and Stable Crude oil prices may turn supportive of external balances.

While near-term caution is warranted due to growth and external uncertainties, the medium-term outlook for bonds remains positive. Given expectations of a shallow rate cut cycle and surplus liquidity, we are maintaining a vigilant short-term stance.

Despite global volatility, the Indian bond market has shown impressive resilience, with yields staying within a narrow range. This stability highlights the robustness of the Indian bond market amidst broader global market fluctuations.

With fiscal balances improving and monetary policy easing, the Indian bond market's resilience is likely to persist throughout CY 2025. We maintain a positive outlook for medium to long-duration bonds, expecting further declines in bond yields over the next 12 months. However, we will remain vigilant to emerging risks and are prepared to adjust our outlook, if circumstances require it.

What should Investors do?

In our view, dynamic bond funds are an ideal choice for long-term investors who can tolerate occasional market volatility. These funds offer the flexibility to adjust portfolio positioning in response to changing market conditions.

For investors with shorter investment horizons and a low risk tolerance, liquid funds remain the more suitable option.

Portfolio Positioning

Scheme Name | Investment Approach |

|---|---|

The scheme invests in debt securities with maturity up to 91 days, issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are currently maintaining reasonably high duration in the scheme with bulk of the assets in 10–40-year maturity bucket. |

Source - RBI, Blomberg, Refinitiv, MOSPI, CCIL, Quantum Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Sneha Pandey, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian - Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- The Road Ahead for Indian Bonds

- Indian Bonds in a Volatile Global Landscape

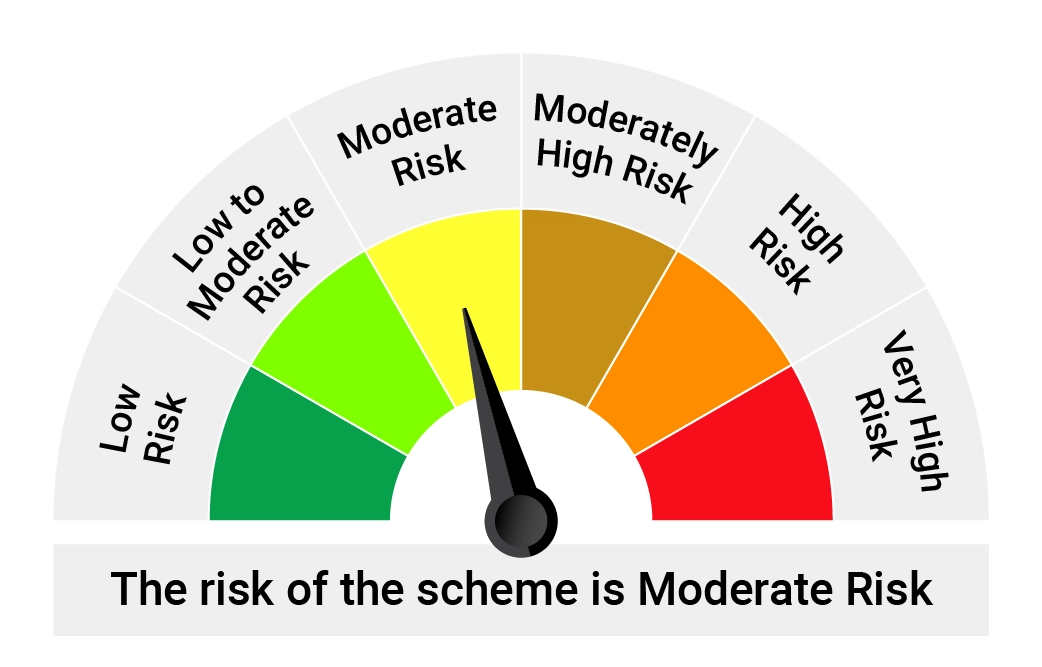

Product Labeling

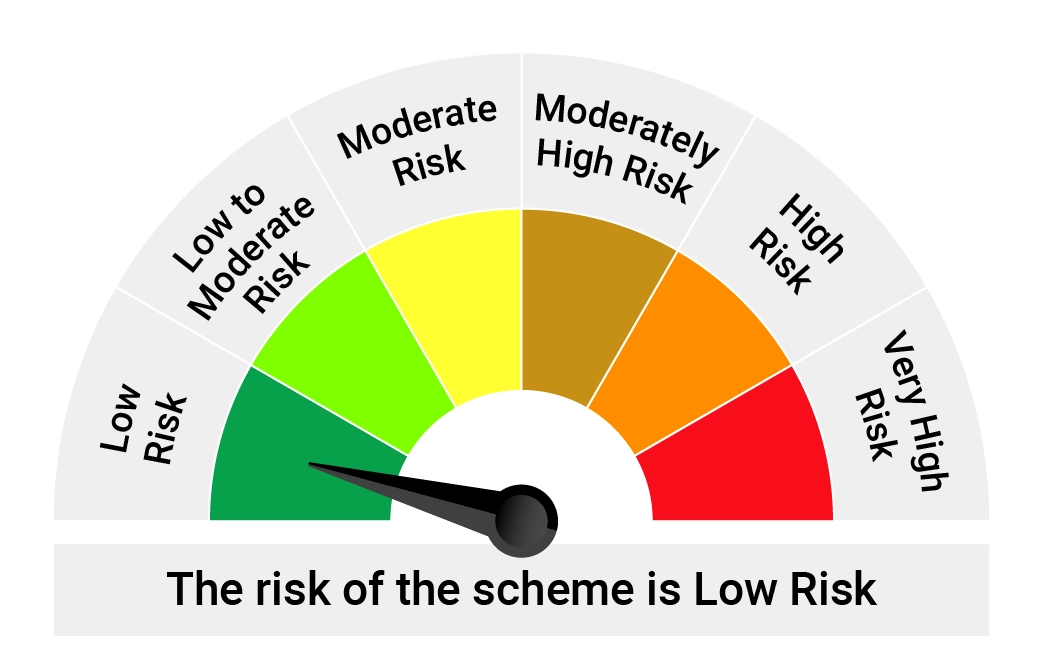

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of Scheme |

|---|---|---|

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

potential risk - quantum liquid fund

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Looking Beyond the 10-Year Benchmark: Decoding India’s Bond Market Signals

Posted On Thursday, Feb 26, 2026

If you glance at India’s financial headlines today, the tone feels reassuring.

Read More -

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More