What impact will the US elections have on Gold Prices? Chirag Mehta answers it all...

Posted On Tuesday, Nov 03, 2020

America is all set to vote for its next President in the midst of the COVID-19 Pandemic. We ask our Fund Manager Chirag, how will geopolitical tensions and financial uncertainty affect the yellow metal? Is it the end of the road for Gold or will its risk-reducing, return-enhancing characteristics make Gold an attractive portfolio diversifier? Read on to find out.

1. In wake of the Pandemic, the stock markets have been unstable. What percentage of an investor's portfolio should be allocated to Gold- given that Gold is a good portfolio diversifier?

Optimism about a quick economic recovery that has driven markets to record highs post March, seems to have waned. There is a good possibility that markets overpriced the rebound in the economy. To add to woes, US coronavirus cases have hit a record daily high and cases are resurging in Europe too, where the UK, Italy, France and Germany have imposed new restrictions and lockdowns.

Financial markets are unlikely to stabilize until a vaccine is developed and there is clarity of when the economy can get back to 'normal'.

With all the above forces influencing equities, and low interest rates limiting bond markets’ ability to act as a hedge against equity price volatility, gold will prove to be an attractive portfolio diversifier.

We suggest a 10-15% portfolio allocation to gold to capitalize on its risk-reducing, return-enhancing characteristics in these times of crisis and financial repression.

2. What do you think the impact of the US elections will be on the Dollar and Gold prices subsequently?

After repeatedly suggesting that the election be postponed, President Trump has indicated that he might not peacefully transfer power if he loses to Joe Biden. If that happens, it could undermine the quality of political systems and governance in the US, and raise questions about the stability of the US government and the dollar.

The potential for political chaos and uncertainty following the election will be a bigger risk for equity markets than who actually wins the vote. Investors should brace for market turbulence not just till Election Day, but for weeks after that. This will be a catalyst for gold prices to move up.

Irrespective of who wins, the stance of low real rates, further quantitative easing and government stimulus would not change given that the pandemic is still raging and the US economy is in a dire state. This will continue to weigh on the dollar and fuel gold prices for the foreseeable future.

3. How long is the bull rally in Gold expected to continue for?

It’s becoming increasingly clear that normalcy will continue to evade us and the world will be stuck in a cycle of lockdowns and openings till a successful Covid-19 vaccine is developed and distributed and the virus is defeated. Most vaccines, in the final stages of clinical trials, are expected to be publicly available only by mid-2021.

As such, sustained government relief measures and lower interest rates and quantitative easing by central banks are imperative to get the economy through this health cum economic crisis for as long as it takes.

Gold will continue to be a stable form of money with potential to store value in the midst of this global currency debasement and will appreciate in these times of low interest rates. It will thus continue to be a preferred portfolio asset generating good risk adjusted returns for its holders for the foreseeable future.

4. Which is the best way to buy Gold – Gold Saving MFs, ETFs or physical Gold and why?

Purity is always a concern when buying physical gold. In addition, the purchase of gold bars and coins comes at a premium of 5-15% above gold prices on account of wholesale and retail markups and making charges. This amount plus the 3% GST paid at time of purchase remains irrecoverable on sale.

Gold ETFs are listed on the exchanges and invest in physical gold. Each unit of the Quantum Gold ETF represents ½ gram of 24 carat physical gold. Investors in Gold ETFs do not bear any making charges or premium. Also, they don’t have to worry about purity, storage and insurance of gold. Moreover, Gold ETFs are traded on the exchange at the prevailing market price of physical gold, thus investors can buy or sell holdings at close to the market price, without paying a premium on purchase or selling at a discount. Mutual fund investors who prefer the SIP route of investing can invest in the Quantum Gold ETF via the Quantum Gold Savings fund.

5. What is a good yardstick to measure a Gold ETFs performance?

A Gold ETF invests in gold bullion and aims to passively track the domestic physical gold price. The closer the ETF’s performance to gold’s actual performance, the better an ETF is doing its job. This can be measured using the tracking error. Tracking error is the difference in the returns generated by the ETF and its benchmark i.e. gold. The lower the tracking error of the ETF, the closer is its performance to actual gold prices. Low tracking error can thus be a good way to choose a Gold ETF. Tracking error of Quantum Gold ETF since inception stands at only 0.005% and on an annualized basis it stands at 0.086% as of September 2020.

Conclusion

With the recent fall in prices, gold's risk-reward proposition now looks even more alluring. We suggest that investors may use this correction to build their allocation to this monetary asset. Because the macroeconomic realities facing the world today indicates that gold will remain a preferred strategic asset now and for years to come, powering its price to new highs.

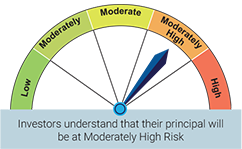

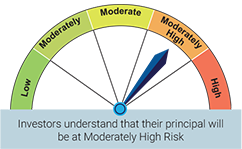

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Gold Fund (An Open Ended Scheme Replicating / Tracking Gold) | • Long term returns • Investments in physical gold |  |

| Quantum Gold Savings Fund (An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund) | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for September 2025

Posted On Tuesday, Sep 02, 2025

August 2025 saw renewed strength in gold, with international prices rising 4.79% for the month and posting a robust 37.75% year-on-year gain.

Read More