What Is Value Investing? Meaning Simplified

Posted On Monday, Aug 01, 2016

Virtually every investor has heard the term “value investing,” yet many investors remain confused over what it really means. Variations of the practice have been implemented successfully by investors over the years, but all share a few basic tenets that remain common throughout. With that in mind, we felt it would be worthwhile to give a simple overview of the philosophy.

The roots of value investing can be traced back to Warren Buffett’s mentor Benjamin Graham, who laid them out most accessibly nearly 70 years ago in his book The Intelligent Investor (to which Mr. Buffett has referred as “by far the best book on investing ever written”). In it, Mr. Graham advocates a philosophy of diligently buying out-of-favor stocks, which he defines using various metrics like low P/E ratio, low price-to-book ratio (“book” being shareholder equity), or high dividend yields, among others.

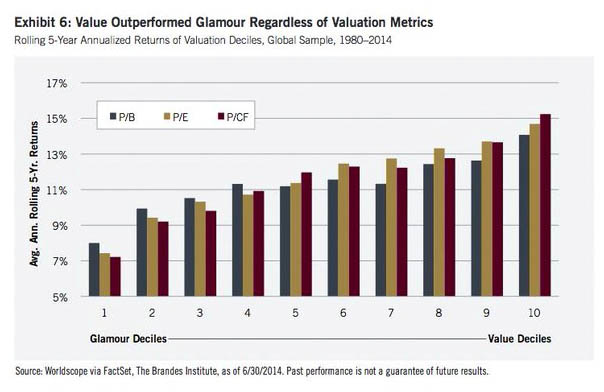

Academic studies spanning decades of data show that, despite occasional periods of underperformance, value investing has generated the best returns over the long term. This works regardless of which valuation metric one chooses, as shown by The Brandes Institute:

Past performance may or may not sustain in future

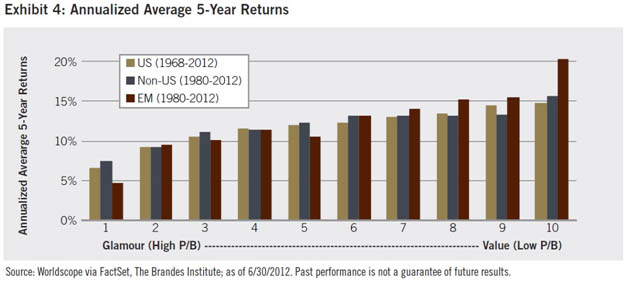

It also works regardless of country, as Brandes has shown as well:

Past performance may or may not sustain in future

Now, rather than merely buying low P/E stocks indiscriminately, however, Graham lays out a framework in which an investor must first determine a stock’s “intrinsic value” – essentially the present value of all future cash flows expected to be generated by the company. One must keep in mind that this process is an art and not a science, so different investors will have different valuations based on their own forecasts and beliefs. Once the investor has made such determination, then in a nod to our fallibility as human beings Graham preached that the investor must buy at a discount to that price, which he referred to as a “Margin of Safety.”

So why does a margin of safety even exist? Why doesn’t the stock market reflect the value of the stock? The answer lies in what we just mentioned – different investors will have different valuations on the same stock, so an investor should wait until his (or her!) own valuation is far in excess of what the market is offering him.

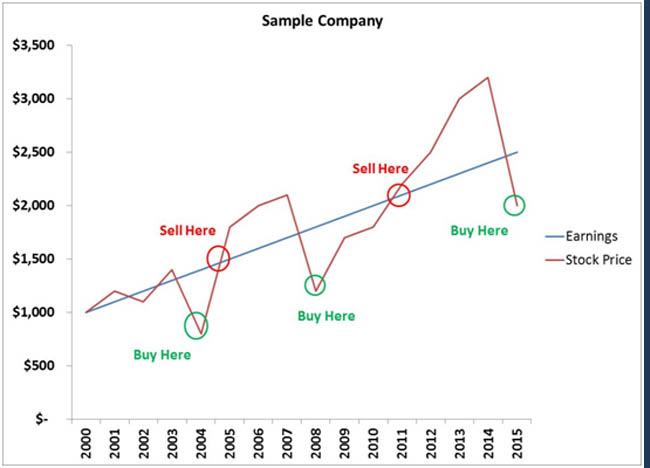

It is important to understand that the earnings of a company for the most part don’t fluctuate nearly as much as the stock, as depicted in the chart below. Graham suggested picturing the market as a temperamental human being (he called him “Mr. Market”), subject to all kinds of violent mood swings. One day Mr. Market will be in a cheerful mood and be willing to offer you $100 for a stock you own; six months later Mr. Market could be in an angry mood and only willing to offer $50. And of course, the same goes for how Mr. Market is willing to sell you the stock he owns. The goal of the value investor, then, is to take advantage of the mercurial market and pounce when the price is well under what the fundamentals justify, and let go of the stock when the price is above that mark.

The above chart is for illustration purpose only

Taking it further, Mr. Graham laid out an entire mentality towards investing that is far easier said than done. Value investing requires patience – markets can go years without reflecting the true value of a company. It requires skepticism – a willingness to ignore the hot new fad if the fundamentals are not present, such as the internet boom of the late 1990s. It requires an iron will – ignoring a mania that captures everyone around you can be gut-wrenching; we can think of no better example of the flak that value investors sometimes receive than an article from Forbes at the height of the dot-com bubble titled “Buffett: What Went Wrong?” (Buffett’s doing just fine, 16 years later!) No less importantly than the other traits, value investing requires a contrarian attitude – when everyone else has sold a stock down to lows, the value investor must be willing to ignore the herd and plumb those depths in search of value.

Typically out of favor stocks that are trading at those depths are there for a reason – perhaps a bad earnings report, a scare over some product controversy, a management departure, and so on. Where the value investor really earns his keep is investigating these situations, rationally assessing the scope of the issues, and if the stock meets his price criteria, having the iron stomach to buy it in the face of indiscriminate selling and an abundance of negative headlines hammering the stock each and every day. Rare is the day a value investor manages to bottom-tick a stock; rather, we value investors typically have further pain to endure, confident in our work which shows the true value to be much higher despite occasional setbacks.

Speaking of those setbacks, the value investor views risk much differently than academic finance teaches. We believe volatility is not a good definition of the riskiness of a stock. Rather, value investors believe risk is the likelihood of permanent loss of capital. Stocks that suddenly drop are “riskier” by the academic definition because that considers only the volatility of the stock. To value investors, if a stock has become cheaper, absent a change in fundamentals that stock is now less risky. If the company’s assets are worth $1 billion, but yesterday it was valued at $1 billion and today it’s valued at $500 million, how is it riskier to pay for those assets at a $500 million valuation?

Lastly, in the most simple and relatable terms, think of how you view a trip to the grocery store. If toothpaste or onions have gone on sale, your first instinct isn’t to run away, it’s “Wow, what a great price!” and then you add it to your basket. It’s carrying that attitude over to stocks that is the essence of value investing.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More