The biggest financial lesson from the current crisis

Posted On Monday, May 11, 2020

Yes, 2020 has been treacherous for most investment portfolios. And yes, external factors that were beyond your control are mainly to blame. But what if we tell you that there was something you could have done better too. Don't fret. They say it's okay to make mistakes as long as you learn from them. And turns out that the biggest financial lesson from the current crisis is also the simplest: always diversify your investments. Here's why.

If you had an all-equity portfolio worth Rs 1,00,000 at the start of 2020, you're probably down a painful 28% to 72k as of March-end, which means you'll need a whopping 39% gain to recover from the recent carnage. And based on how unpredictable and bearish things are at the moment, you'd agree that those kinds of spectacular gains are pretty far out in the future. On the flip side, if your portfolio at the start of 2020 was divided between equities, debt, and gold in 40:40:20 ratio, the current value would stand at 92k requiring a much lesser 8.7% gain to be whole again. Pretty good, right? (here, Equity represents Sensex returns, Debt represents 10-year G-sec return, Gold represents domestic gold spot price returns as on 31st March 2020).

So how exactly does this diversification work? Let's take an ordinary day to day example to understand. Have you ever noticed that street vendors often sell seemingly unrelated products - such as umbrellas and sunglasses? Initially, that may seem odd. After all, when would a person buy both items at the same time? Probably never - and that's the point. Street vendors know that when it's raining, it's easier to sell umbrellas but harder to sell sunglasses. And when it's sunny, the reverse is true. By selling both items- in other words, by diversifying the product line - the vendor can reduce the risk of losing money on any given day. If that makes sense, you've got a great start on understanding asset allocation and diversification.

Now, unfortunately unlike the vendor who knows that monsoons always follow summers and summers always follow monsoons, investors don't deal with predictable economic cycles. Economies go through ups and downs and these more often than not are unforeseeable. Assets in our portfolio, due to their differing risk and return characteristics, respond differently to these ups and downs, You'd agree that equities run-up when the economy is doing well; and gold tends to shine when the economy is down in the dumps

In essence, because it is difficult to predict the future of the economy, it is also difficult to determine the resulting best-performing asset class. That's where asset allocation and diversification come handy

Asset allocation is a time-tested approach to portfolio management. It means spreading your investments among multiple asset classes such as stocks and bonds.

By including asset categories with investment returns that move up and down differently under different market conditions within a portfolio, an investor can limit significant losses. Market conditions that cause one asset category to do well often cause another asset category to have average or poor returns. By investing in more than one asset category, you'll reduce the risk that you'll lose money and your portfolio's overall investment returns will have a smoother ride. If one asset category's investment return falls, you'll be in a position to counteract your losses in that asset category with better investment returns in another asset category. The concluding point is that diversification, whilst offering no guarantees of portfolio performance or complete protection against risk, increases the possibility of an investor's portfolio withstanding the elements in a financial atmosphere experiencing both man-made and natural disasters on an almost daily basis.

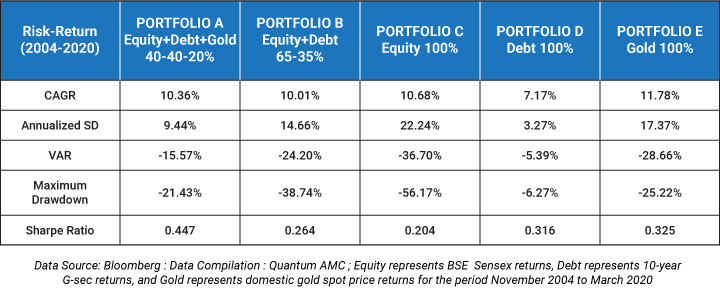

We did some number crunching to substantiate our point.

Please note that the above table is for illustrative purpose only to explain/understand the concept of Diversification / Asset Allocation”. Past performance may or may not be sustained in future.

Over the last 15 years, through the Global Financial Crisis of 2008 and the current pandemic, Portfolio A could have increased the odds of having a portion of your assets “in the right place at the right time. Not only did portfolio A with 40% equity, 40% debt, and 20% gold allocation, yield returns at par with portfolio C, a pure equity strategy, but also experienced the lowest quantum of drawdowns. Just like the vendor, portfolio A covered all bases and was prepared for any economic ups and downs. Effectively, the portfolio did not lose much money in times of crisis and also made money in the good times. Win-win

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More