Tax Saving Season with a Predictable Approach

Posted On Wednesday, Jan 17, 2024

Instead of a short-term tax-saving exercise, take a holistic approach - a new lens of building wealth alongside tax saving by knowing what you can expect from your investments. This year, choose tax saving with a fund that gives you a combination of Tax Saving + Wealth Creation with Equity exposure + Predictability of Outcomes - deliverng on its estimated NAV based on 2 year forward upside potential.

Predictability of Outcomes with Quantum - A track record of consistent performance across market cycles

Various macroeconomic events are poised to influence the investment landscape such as the general elections, annual budget, US presidential elections, potential rate cuts by the US Fed, etc.

Amidst these uncertainties, you can rely on a fund house that offers a unique capability to predict outcomes in an unpredictable world. Quantum’s stable equity approach ensures that the actual performance closely matches the portfolio’s estimated upside potential across market cycles. At Quantum, our research team analyses and estimates 2 year forward upside potential based on the scheme investment portfolio..

The Outcome of our Disciplined Research and Investment Process has a great ‘Fit’: ‘Stirred, Not Shaken’ by two massive Global Macro Events: GFC and Covid

The above graph shows the estimate of rebased GAV of Quantum Long Term Equity Value Fund – Direct Plan – Growth Option on the basis of Upside Potential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams). The performance returns are net of fees and expenses, and assuming reinvestment of all dividends and other earnings. Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2. Source: Internal Research, Bloomberg Finance L.P., As of Dec 30, 2023.

As can be seen in the graph above, the estimated upside potential has been close to the actual Net Asset Value (NAV) over the years, remaining relatively stable even in the face of two major global macro events—the Global Financial Crisis (GFC) and the COVID-19 pandemic—in the past two decades. This enduring estimation is a direct outcome of our rigorous research and investment process.

The estimate indicates that the Portfolio should have increased 9.8 times in 17 Years, 13.8% CAGR. In reality, the Portfolio NAV Increased By 10.1 times in 17 Years with a 14% CAGR.

The Quantum ELSS Tax Saver Fund

The Quantum ELSS Tax Saver Fund follows the identical value investing style and similar portfolio composition for Quantum Long Term Equity Value Fund - a fund that delivers in line with its estimated upside potential, showcasing predictable outcomes across market cycles. Similar to Quantum Long Term Equity Value Fund, this fund takes cognizance of liquidity, governance, and valuation parameters to deliver risk adjusted returns.

Wondering if it the right time to invest in ELSS amidst the high valuations in the equity markets?

Though the valuations look marginally higher, there are certain areas which have a margin of safety – certain companies that are undervalued relative to their historical averages that can be identified using our disciplined investment approach.

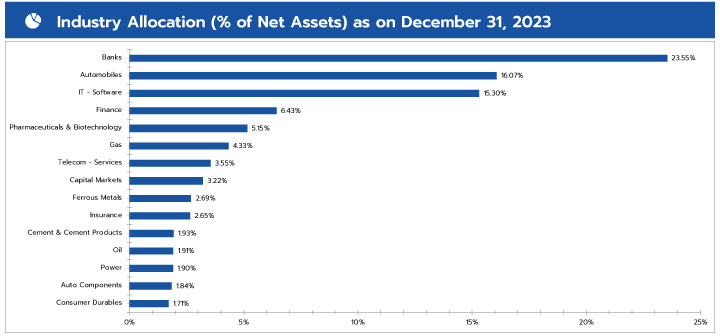

As you can see, QETSF portfolio has more exposure to banks (23%) and IT (15.30%) which we believe is yet to reach their peak.

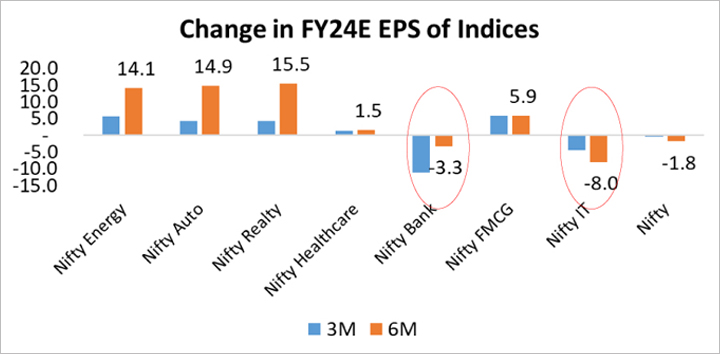

Despite having strong fundamentals, Banks haven't fully participated in the recent market rally. The positive credit cycle and a potential improvement in corporate borrowing could support the credit demand. Additionally, stable housing demand and ongoing infrastructure projects are likely to support credit demand.

While IT service companies have seen modest revenue growth, deal wins have been stable. Early indicators suggest a potential easing of the recessionary fears in the US market, which might lead to quicker revenue realization from recent deals. Although few company valuations seem reasonable, there's a chance that earnings could surpass current expectations.

IT and Banks: Muted Earnings Expectation and reasonable valuation

Source: Bloomberg; Data as of Dec 14, 2023

However, note the investment approach is sector agnostic where it follows a bottom-up stock selection focused on identifying stocks based on valuation, integrity screen, and long-term potential. Broadly, the portfolio is positioned for economic revival and limits exposure to overvalued sectors such as consumer staples, where the exposure is zero where the valuations don’t warrant an allocation.

Additional Reasons to invest in Quantum ELSS Tax Saving Fund

- Follows outcomes in line with the estimated upside potential

- Tax Saving with Equity exposure offering wealth creation opportunity

- Bottom-up stock selection process to identify fundamentally strong companies

- Low churn – holds stocks for longer indicative of our conviction with a portfolio turnover of 14.25%^

- Value oriented for lowering downside risks

^Portfolio Turnover Data as of Dec 29, 2023 for last 1 year

Key Takeaways

In conclusion, choose a tax-saving option with a fund house that provides clarity on the predictable outcome and delivers returns in line with the estimated upside potential. Create wealth and save taxes with Quantum – a reliable partner for a predictable outcome and consistent investment journey.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum ELSS Tax Saver Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Note: Name of Quantum Tax Saving Fund has been changed to Quantum ELSS Tax Saver Fund effective 1st December, 2023

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for March 2026

Posted On Monday, Mar 02, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More