Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors. Inflation is when prices keep rising and you pay more for the same products and services over a period. Inflation can also directly erode the value of your investments reducing their real returns. It tends to be more pronounced on traditional investments such as fixed deposits. Judging by the scale of increase in commodity prices in March at multi-year highs and the prolonged Russia-Ukraine crisis, RBI had to revise its CPI inflation for 2022-23 to 5.7% up from the 4.5 % projection made in the February policy. RBI has also slashed the growth forecast to 7.2% from 7.8%.

Let’s understand what this means for investors.

How inflation eats into your returns?

When looking at a typical consumption basket, the prices have grown at an average rate of 10.1% p.a. since 1990. Thus, if you were to see the real return across asset classes, it would be much lesser.

| Assets | Nominal Returns | Real Return |

| Bank deposits | 5.80% | -4.30% |

| Price of Gold / 10 grams | 9.10% | -1.00% |

| BSE Sensex | 13.91% | 3.81% |

The Consumption basket data is derived from Private Final consumption Expenditure data from CMIE using components that make a typical consumption basket and how average spending on such consumption basket has increased over time. 2021 Estimates of the consumption basket spending is derived using long term average over the 2020 data, Given that 2020-21 were pandemic period, the actual data will be different from those of estimates but that would probably normalize going forward and hence we have used long term averages for calculation purpose.

Past performance may or may not sustained in future.

Quarterly compounding and Tax rate on Fixed Deposit assumed to be 30%

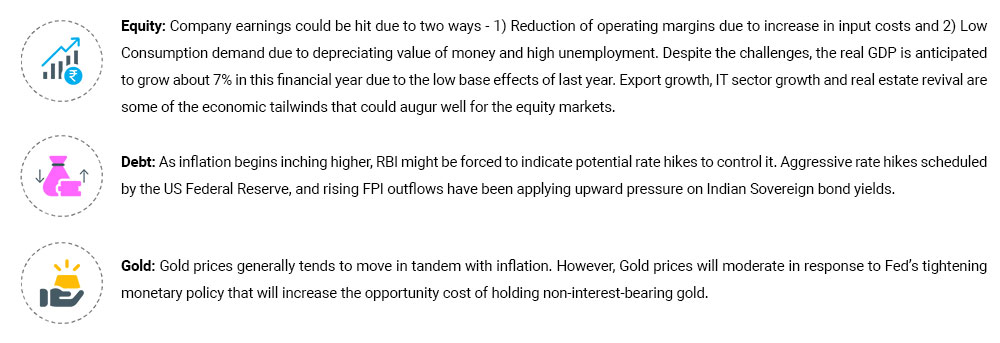

Before we understand the ways to cope, let’s understand the impact across asset classes

What are the ways to reduce the impact of inflation on your portfolio?

1. Set realistic goals: Inflation affects your savings and returns. To be better prepared for the future, make sure your goals are aligned to inflation.

2. Seek Value: Amid potential interest rate hikes and rising crude oil prices, value investing might gain over growth investing style. Companies with high valuations might be more sensitive to the increases in the cost of capital than a reasonably valued portfolio. Quantum Long Term Equity Value Fund have been adding cyclicals such as telecom, power, pharma, banks and metals at reasonable valuations and is positioned for broad-based economic growth.

3. Build an Equity Mix: The effect of inflation may not be consistent across all listed companies. While some companies could face higher margin pressures, others could gain. Thus, a diversified portfolio of different market cap and styles could be geared for better downside protection to fend off high commodity prices.

You could make use of Quantum’s Diversified Equity basket of 70-15-15 within the 12-20-80 asset allocation strategy to build your exposure to Quantum Equity Fund of Funds, Quantum India ESG Equity Fund along with Quantum Long Term Equity Value Fund.

4. Go short term with Liquid Funds: The best way to shield your fixed income portfolio is to consider funds with shorter portfolio maturity such as Quantum Liquid Fund scheme. In addition to benefiting from the rate hiking cycle, these funds also qualify as a source of emergency funds due to low interest rate and credit risks.

5. Boost gold to complement portfolio: Irrespective of the imminent interest rate hikes, gold generally has an inverse relationship with equity mutual funds and this warrants an allocation to invest in Gold for its strategic value. You could invest up to 20% of your portfolio to efficient forms such as Quantum Gold Fund ETF or Quantum Gold Savings Fund.

The start of the financial year is a good opportunity to relook at your investment goals and see whether your investments are geared to address the rising inflation and offer you a real rate of return.

| Related Articles | ||

| Interest Rate Hikes: Is your Equity Portfolio Geared for Growth? | ||

| Russia-Ukraine Crisis: Strengthen your Portfolio with Gold | ||

| Markets Crash - What Should You do With Your Investments? |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on March 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More