Quantum Dynamic Bond Fund Turns 10: Reflecting with Pride, Advancing with Purpose

Posted On Thursday, May 22, 2025

Ten years ago, when we launched the Quantum Dynamic Bond Fund (QDBF), we embarked on a journey - not merely navigating the fluctuations of interest rates, inflation, and fiscal shifts, but working towards a far more meaningful goal: earning your trust and focusing on long-term wealth stability.

As we mark the 10th anniversary of the Quantum Dynamic Bond Fund in May 2025, we don’t just look back to celebrate milestones. We reflect on how we’ve navigated a decade of shifting markets with discipline, clarity, and integrity.

We not only evaluate our performance against a specified benchmark, we also evaluate our objective, how did we prepare to meet that objective and what did we deliver to our investors.

There were moments of challenge, yes — but each one was met with reflection, learnings, and a stronger commitment to staying true to the investment objective.

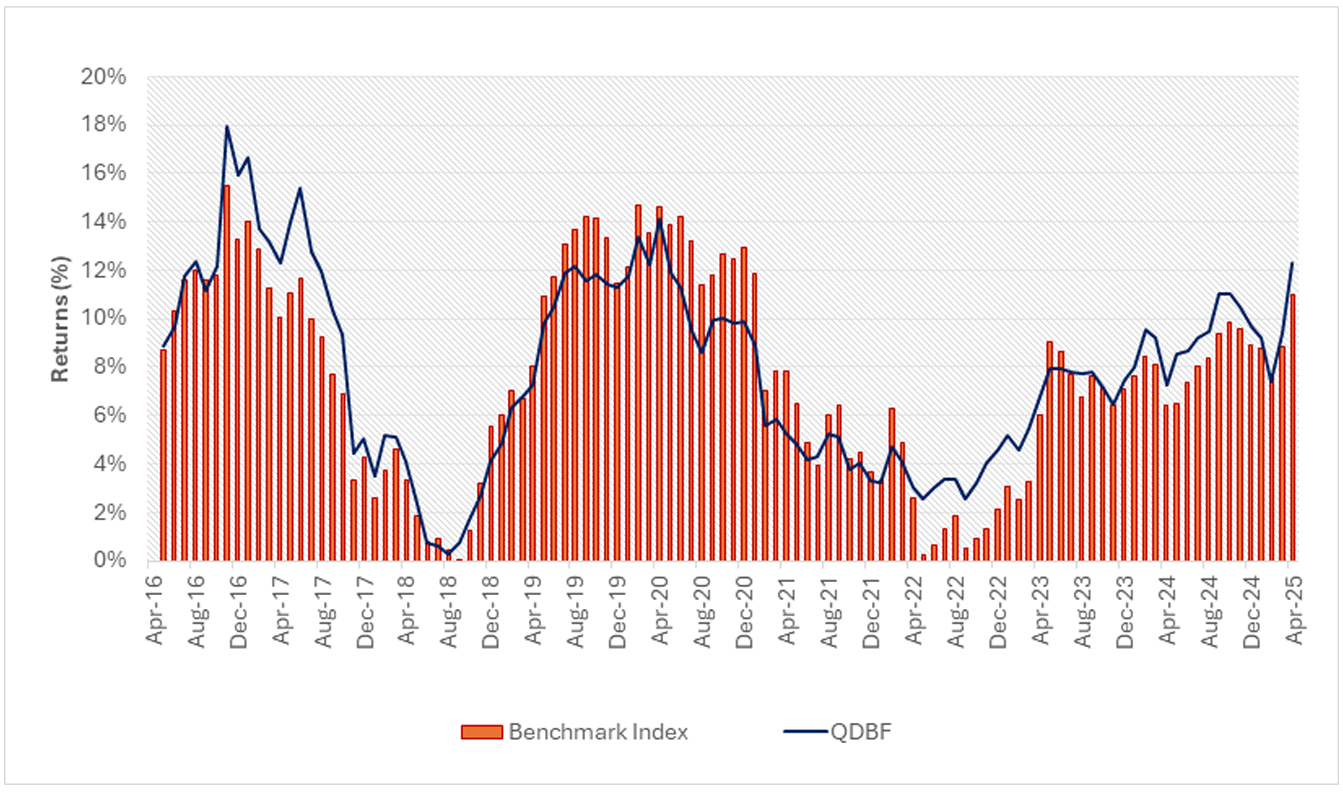

Chart – I: Long-Term Outperformance with some lags in between

Data Source: Bloomberg, AMFI. Graphics: Quantum AMC Internal Research.

Benchmark Index: CRISIL Dynamic Bond A-III Index.

Data Period: Since Inception of QDBF in May 2015 till April 30, 2025.

This is to be read in conjunction with the complete performance given at the end of the article.

Past performance may or may not be sustained in the future.

Let’s Start with the “WHY”

The Quantum Dynamic Bond Fund was built with a clear objective: To offer investors a debt fund that could adapt to changing interest rate scenarios while prioritizing safety and liquidity.

In simpler terms, our goal is to generate optimal returns while taking on interest rate risks, maintaining liquidity and keeping credit risk to a minimum. Our investments are thus restricted to Government Securities (G-Sec) and Public Sector Undertaking Bonds (PSU bonds) which are AAA Rated.

With Quantum Dynamic Bond Fund, we’ve focused on managing a single key risk—interest rate risk—while keeping credit risk to a minimum by investing in G-Sec and PSU AAA rated bonds, distinguishing our approach within the category.

Why Dynamic Bonds? And Why Government Bonds?

When we launched the Quantum Dynamic Bond Fund, we wanted it to be an all-weather solution for investors looking to grow their wealth while managing risk.

At the time, many investors relied on Fixed Deposits (FDs) for safety. While FD returns were predictable, they were also low, and tax treatment wasn’t always favourable.

So, we asked: Can we give our medium-term investors (investors with an investment horizon of 3-5 years) an investment solution that is more stable than stocks, provides better returns potential, and is more tax efficient than FDs?

Enter the Quantum Dynamic Bond Fund!

Our aim it so follow a strategy that blends investments in government securities along with carefully selected, highly rated PSU bonds, thereby aiming to outperform traditional fixed income instruments such as FDs while providing offering tax efficiency for long-term investors.

What’s the secret? Flexibility. Unlike FDs that invest your money at a fixed rate and for fixed period, Quantum Dynamic Bond Fund actively adjusts its duration in response to market conditions.

When interest rates are expected to rise, we aim to reduce the interest rate risk by keeping portfolio maturity low, thereby preserving your capital. When long-term interest rates are expected to fall, we aim to increase the portfolio maturity to earn some capital gains over and above the interest income.

In short, the Quantum Dynamic Bond Fund was designed to be a safer, more flexible investment option for FDs with the added benefit of growth potential and tax efficiency—making it a preferable option for any market cycle.

Why Thinking Long-Term Matters

We’ve always asked ourselves one simple question: “Are we striking the right balance between risk and reward, especially during periods of market volatility and uncertainty?”

Global bond markets, including our domestic market, experience notable volatility, driven by several key factors. Over the last 10 years, divergent central bank monetary policies aimed at controlling inflation and supporting growth along with the geopolitical tensions, and the recent global trade concerns related to tariffs, have impacted our economy and financial markets. Shocks like the global pandemic or demonetisation are events which have no template and requires us to respond as the situation evolves.

Key policy changes, such as the RBIs move of introducing “inflation targeting” in 2015, significantly altered the framework in which we evaluate domestic interest rates, inflation and currency, and this required us to look at cycles over the medium term.

Thus, we suggest investors to look at a dynamic bond fund allocation over a 2-3 year period.

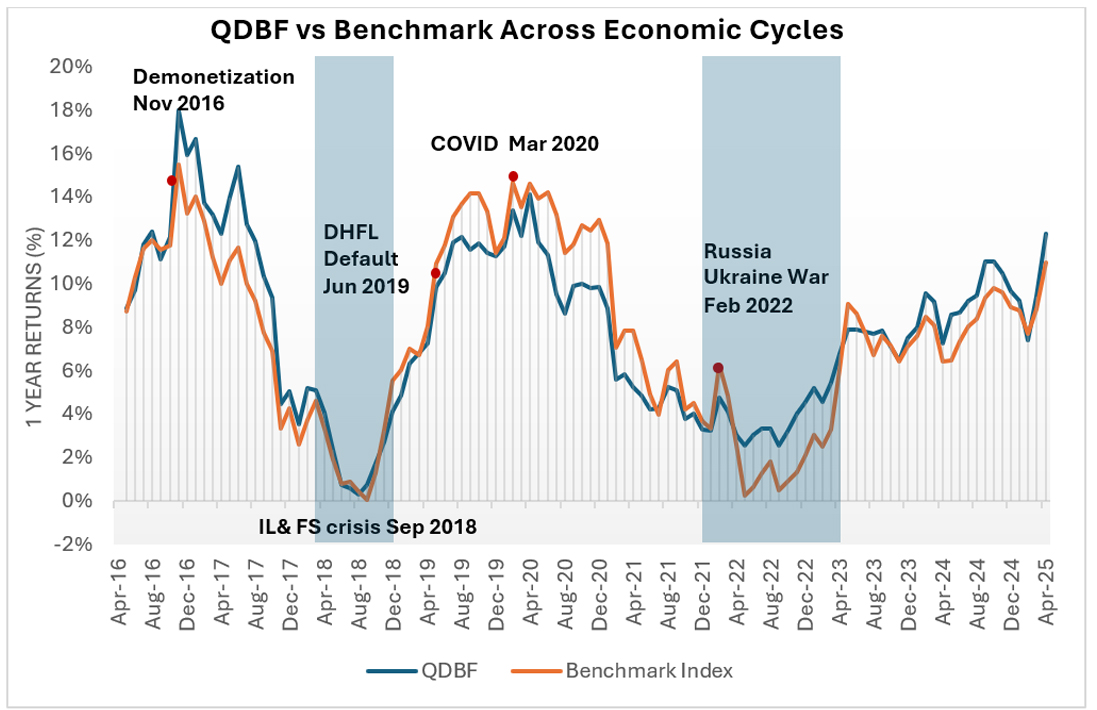

Chart II: QDBF Outperformedthe Benchmark During Challenging Times

Data Source: Bloomberg, AMFI. Graphics: Quantum AMC Internal Research.

Benchmark Index: CRISIL Dynamic Bond A-III Index.

Data Period: Since Inception of QDBF in May 2015 till April 30, 2025.

This is to be read in conjunction with the complete performance given at the end of the article.

Past performance may or may not be sustained in the future.

The above events make debt funds more volatile in the near term, but the flexibility of a Dynamic Bond Fund allows it to adjust and try and mitigate risks and manage risks during such periods.

Thus, the 1-year returns for a Dynamic Bond Fund may not represent the true picture, because short-term events like interest rate changes or inflation surprises, etc. can cause significant fluctuations in the performance that may not accurately reflect how the Fund is managed over time.

A Fund might not look good in a year when rates rise sharply, even if it was managed well. On the other hand, a sudden drop in rates could make a Fund look great.

Chart III: Through the Noise: 3-Year Returns That Prove QDBF’s Resilience

Data Source: Bloomberg. Graphics: Quantum AMC Internal Research.

Benchmark Index: CRISIL Dynamic Bond A-III Index.

Data Period: Returns data between April 2018 and April 2025.

This is to be read in conjunction with the complete performance given at the end of the article.

Past performance may or may not be sustained in the future.

But step back. Take a 3-year lens, and suddenly, things settle. Why?

Because - Longer timeframes help smooth out short-term volatility, capture the fund's adaptability across different market cycles, and avoid being skewed by one-off events.

These rolling returns also provide a more accurate reflection of long-term performance, highlighting consistency and alignment with an investor’s long-term goals.

What We Learned – Reflecting on Past Decisions

At Quantum, we believe in learning from both our successes and our challenges. Over the years, with Quantum Dynamic Bond Fund, we’ve stayed committed to a strategy focused on preserving capital and maintaining stability, even when the market presented high-risk opportunities.

There’s a simple truth in debt investing: Higher yields often come with hidden landmines.

We've steered clear of risky papers that later turned problematic, helping us protect our portfolio during periods of market stress.

Take the Infrastructure Leasing & Financial Services - IL&FS crisis in 2018, for example. The company defaulted in 2018 with over Rs 900 billion in debt. Poor project execution, over-borrowing, and funding long-term projects with short-term money led to a major default, triggering panic in debt markets and a liquidity crunch across NBFCs.

Similarly, DHFL (Dewan Housing Finance Corporation Ltd) defaulted in 2019 with over Rs 1 trillion in liabilities. Mismanagement, risky lending, and fund diversion led to its collapse and eventual insolvency under the IBC (Insolvency & Bankruptcy Code).

Both these cases highlighted the importance of strong credit filters and governance.

While we may have lagged our benchmark during bull markets as a result of our cautious approach, it allowed us to avoid the pitfalls of credit downgrades or defaults. We don’t see our approach as a conservative one —it's a demonstration of our efforts towards responsible investing and protecting our investors from unnecessary risk.

Of course, we didn’t always get it perfect. In February 2019, the RBI embarked on a monetary easing cycle, slashing the repo rate from 6.5% to 4% to support the economy amid the COVID-19 shock. Instead of aggressively extending duration to capture better yields, we opted for a more measured approach—gradually increasing risk only after carefully assessing the risk-reward dynamics. While this strategy aligned with our conservative philosophy, it meant we missed out on the bond market rally, as 10-year yields fell by approximately 1.5%.

Looking back, we recognize that our defensive stance was adopted a bit too early in what turned out to be a strong market rally. However, this experience was invaluable in shaping our approach. It reinforced the importance of humility, honed our research processes, and pushed us to refine our investment models.

Most importantly, it highlighted the need for clearer communication with our investors. Transparency is a core value—and we believe our investors deserve to know not just where we shine, but also where we’re adapting. We started the Debt Market Observer (DMO) to communicate our thinking, positioning and outlook.

The Secret Sauce: Weekly Portfolio Reviews and Proprietary Research

One thing we take pride in is our internal discipline. Without fail, we conduct a rigorous team-driven research and portfolio review every single week—and more frequently if needed—carefully evaluating it in light of:

- New macroeconomic data

- Changes in global and domestic yields

- RBI actions and policy signals

- Fiscal and political developments

- Market volumes, participation, and investor demand

- Spreads across the curve and credit segments

- Liquidity trends in both primary and secondary markets

- Forward-looking indicators like inflation expectations and GDP revisions

- Technical factors like supply pipelines and auction calendars

We aim to anticipate, not just react—tracking core inflation, fiscal metrics, global cues, and currency shifts.

These aren’t routine check-ins—they’re active discussions.

For many weeks, the resultant research outcome could be that we make no changes to the portfolio – (which is an ‘active’ decision). There may be months where we do not change our core portfolio positioning and there may be days where we do a month’s activity.

We aim to remain true to our research process and our conviction based on that research. We do not get swayed by near-term performance, peer- returns or deviation from benchmark.

We constrain the portfolio only to our research process.

Over the years, we’ve refined our models, added new variables, and sharpened our instincts—learning from both foresight and hindsight.

The NEXT 10 years and Beyond: These three themes will continue to drive our strategy

- Discipline over distraction: We’ll continue to steer clear of market fads and avoid chasing yields or short-term performance that risk capital erosion. Staying true to our core—prudence, patience, and risk-aware investing.

- Research-driven adaptability: In an era of ever-changing market dynamics like inflation, interest rates, geopolitical shifts, and unpredictable liquidity cycles, we remain committed to adapting and evolving. Our proprietary models will stay dynamic, and our research sharper—anchored in data but flexible enough to adapt to shifting conditions.

- Investor-first thinking: Our north star will always be the long-term financial well-being of our investors. Whether in calm or turbulent times, our decisions will be anchored in their best interests, not market noise.

Investing is a Journey

The Quantum Dynamic Bond Fund isn’t about chasing quick wins or beating the market every quarter. It’s about growing your investments steadily and peacefully, so you can rest easy through across market cycle.

It’s about standing by your side, through thick and thin, earning your trust with every passing year.

We’re truly grateful for the confidence and support you’ve shown us over the past 10 years. Your belief in us means everything, and it inspires us to keep improving, learning, and growing together.

Here’s to the next decade—guided by discipline, integrity, and thoughtful stewardship.

From all of us, thank you for being a part of this journey.

What’s Driving the Bond Market? Tap here for our latest Debt Market Outlook.

Source – RBI, Blomberg, Refinitiv, MOSPI, CCIL, Quantum Internal Research

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author - Sneha Pandey, Fund Manager - Fixed Income at [email protected].

For all other queries, please contact Mohit Bhatnagar - Head - Sales, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9987524548

Read our last few Debt Market Observer write-ups -

- Why India Is the Market to Watch

- Indian Bonds in a Volatile Global Landscape

| Quantum Dynamic Bond Fund | as on April 30, 2025 | |||||

|---|---|---|---|---|---|---|

| Quantum Dynamic Bond Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark## Returns (%) | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark## Returns (₹) |

| Since Inception (19th May 2015) | 8.17% | 7.84% | 6.87% | 21,849 | 21,206 | 19,379 |

| 7 years | 7.92% | 8.01% | 7.37% | 17,070 | 17,165 | 16,464 |

| 5 years | 6.88% | 6.73% | 5.55% | 13,947 | 13,854 | 13,103 |

| 3 years | 8.74% | 7.76% | 8.57% | 12,863 | 12,519 | 12,803 |

| 1 year | 12.32% | 10.97% | 12.58% | 11,232 | 11,097 | 11,258 |

# CRISIL Dynamic Bond A-III Index ## CRISIL 10 Year Gilt Index. Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). For performance of other schemes managed by the Fund Manager Click here

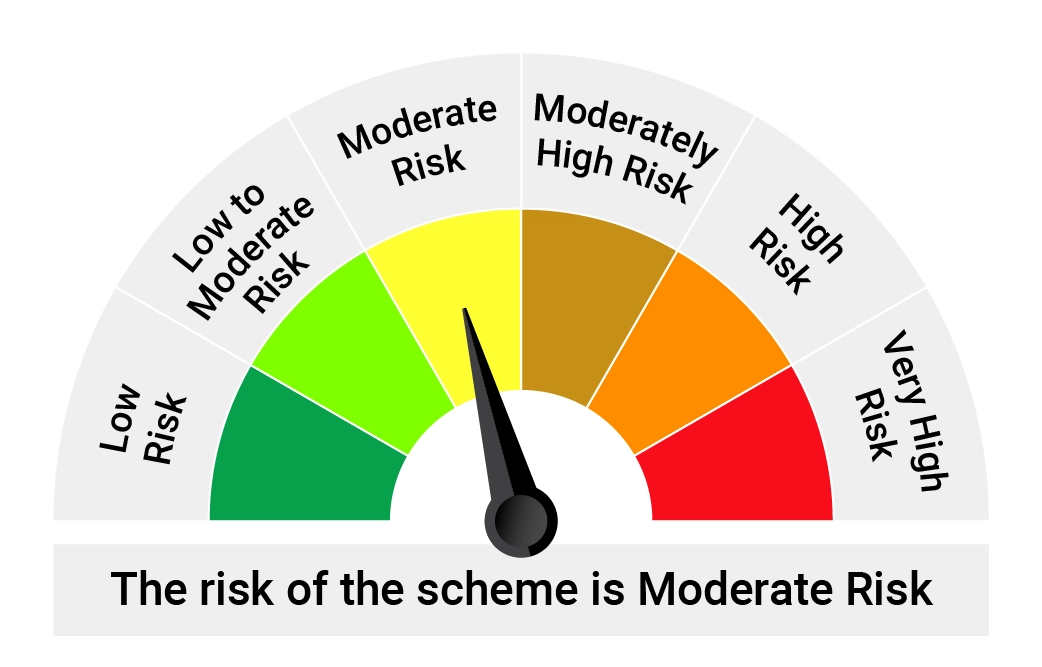

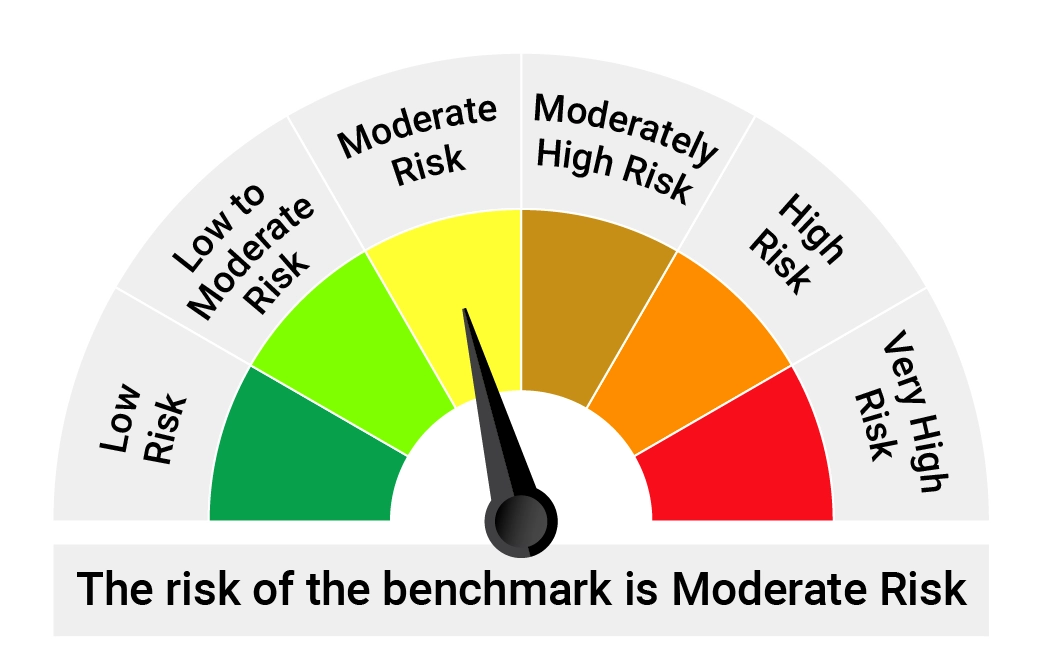

Product Labeling

Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Risk-o-meter of Tier-I Benchmark |

|---|---|---|---|

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. Tier I Benchmark : CRISIL Dynamic Bond A-III Index |

|  |  |

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Looking Beyond the 10-Year Benchmark: Decoding India’s Bond Market Signals

Posted On Thursday, Feb 26, 2026

If you glance at India’s financial headlines today, the tone feels reassuring.

Read More -

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More