Overcoming the equity market jitters

Posted On Tuesday, Sep 24, 2019

How many of us have lost money in the stock markets? Safe to say many of us have. And once burnt, we’ve sworn to stay away from the fire.

Ever wondered how the others managed to make money then? Well, turns out they were simply patient.

Don’t believe it? The following two data sets about the Indian saver/investor should interest you:

Average maturity profile of term deposits in all Scheduled Commercial Banks in India from calendar year 2005 to 2018

| 1 to 3 years | 51% |

| 3 to 5 years | 16% |

| 5 to 10 years | 33% |

Average holding period of Equity mutual funds at the end of March 31st 2019

| less than 1 year | 39% |

| 1 to 2 years | 29% |

| more than 2 years | 32% |

So turns out that 68% of equity mutual fund investors in India exit even before completing 2 years. In contrast, 49% of fixed deposit investors opt for a holding period of more than 3 years. Stark behavioral difference I must say.

We patiently sit on our bank deposits for years, whether or not we make real returns (returns post inflation and tax), but run out of the inflation beating equity markets at the first sign of distress, which more often than not, given the nature of the asset class, is only temporary.

Anyway, we are here to tell you that being patient is the key to successful equity investing. And we have proof. Historically, as investment horizon increased, both volatility of Sensex returns and probability of loss decreased.

| Sensex Total Return Index | |||||

| Rolling Period | 1 year | 3 years | 5 years | 7 years | 10 years |

| Number of cycles from August 1996 to March 2019 | 261 | 237 | 213 | 189 | 153 |

| Number of Cycles when returns are negative | 75 | 23 | 11 | 0 | 0 |

| Negative returns period as % of total Cycles | 29% | 10% | 5% | 0% | 0% |

| Number of Cycles when returns are below Fixed Deposit A/c (Based on SBI Fixed Deposit rates for each tenure as of September 2019) | 91 | 72 | 46 | 5 | 0 |

| Below Fixed Deposit A/c returns period as % of total Cycles | 35% | 30% | 22% | 3% | 0% |

| Average Return | 16.8% | 14.7% | 14.7% | 15.5% | 15.9% |

| Maximum Returns | 99.1% | 62.9% | 49.0% | 31.1% | 22.7% |

| Minimum Returns | -52.4% | -13.8% | -5.2% | 3.8% | 6.8% |

Data as on 31st March 2019 PAST PERFORMANCE MAY OR MAY NOT BE SUSTAINED IN FUTURE.

Data Compilation: Quantum Mutual Fund

Clearly, the stock markets aren’t as brutal as you thought. For a horizon of 7 years or more probability of making a negative return is zero, volatility of returns reduces significantly and 92% of the times your equity investments would have earned more than your pre-tax fixed deposit return. Please note, pre-tax.

And why does this happen? Emotions lead to short term volatility as investors move in and out of the markets reacting to supposedly positive and negative bits of news, but over the long term markets reflect economic fundamentals. By staying invested for a longer tenure an investor can earn close to average returns.

So next time the markets are shaky, you know what to do. Stay put.

But I bet you’re thinking, “Easier said than done”. I agree. It isn’t easy for everyone, especially investors with a low risk appetite and tolerance, to stomach the sometimes mindboggling stock market falls. But at the same time it isn’t money-wise to completely stay out of an attractive asset class like equity. Remember when it comes to investing, risk and reward are inextricably entwined - no pain, no gain.

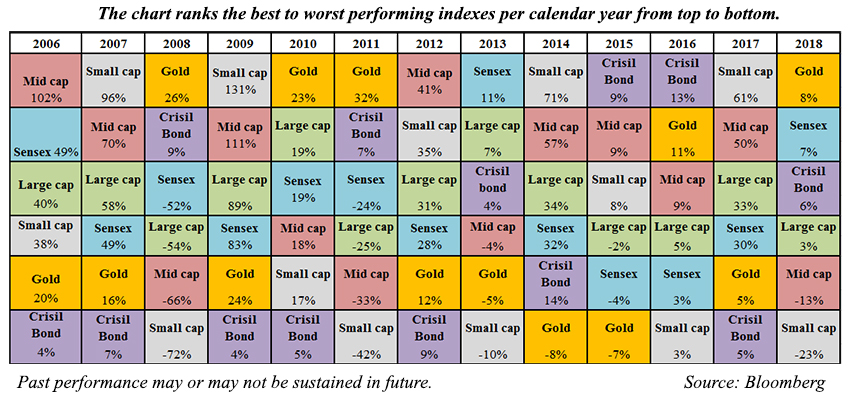

Enter asset allocation - when you divide and diversify your portfolio among various imperfectly correlated asset classes instead of concentrating investments in a single asset class. This strategy helps to lessen the effects of market volatility, manage risk and provide the potential to maximize overall returns. How it manages to do this is because historically when one asset type has average or poor returns; the other usually does well. So there will be periods when equity markets will have a brilliant run, periods when only bonds will be dependable, and periods when gold will shine the brightest, and these periods will not typically overlap.

But don’t just take our word for it. Let’s dig into the asset class returns history in India.

(Indices Used: S&P BSE Sensex Total Return Index; MCX Gold Commodity Index; CRISIL Composite Bond Fund Index; S&P BSE SmallCap Total Return Index; S&P BSE MidCap Total Return Index; S&P BSE 100 LargeCap Total Return Index)

The Hybrid: Multi Asset mutual fund category is one such avenue that employs an asset allocation strategy for investors with moderately high risk appetite. True multi asset funds enable investors to enjoy returns and minimized downside risk from the debt and gold allocations, while the timely and measured equity allocations provide a boost of higher returns.

Therefore, Investors end up with returns higher than the assured (as they are not subject to market risks) fixed deposits over long time periods while they take on some calculated risks. So it’s time you shrug your fixed deposits which have been a losing proposition to make way for multi asset allocation.

Disclaimer: Unlike Fixed Deposits there is no capital protection guarantee or assurance of any return in Mutual Funds and Investments in mutual funds are subject to market risks. Investor to take investment decision based on his risk appetite and in consultation with the investment advisors.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More